7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

November 7, 2025

The crypto funding rate is a small, periodic payment that traders exchange in perpetual futures markets. Its entire job is to keep the futures contract price tightly tethered to the actual spot price of a cryptocurrency.

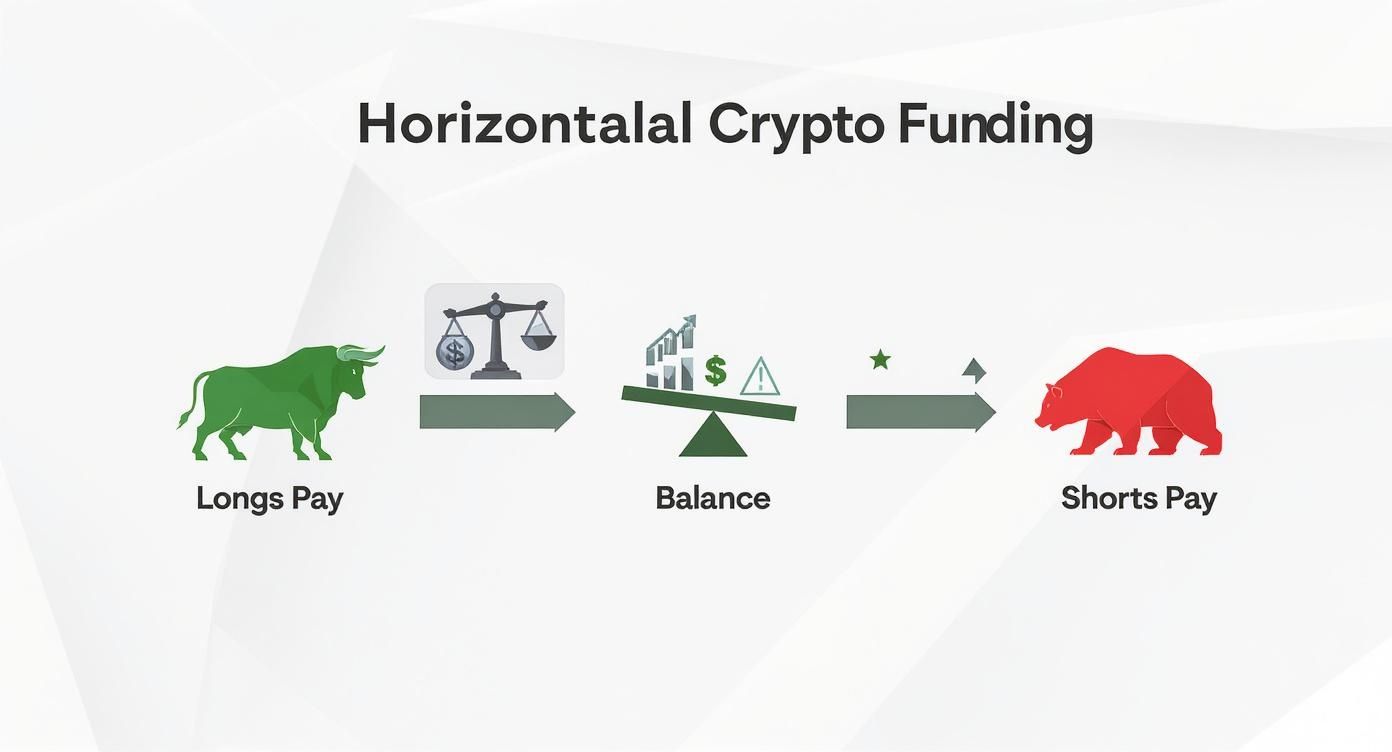

Crucially, this is not a fee you pay to the exchange. It's a direct payment between traders holding long (buy) positions and those holding short (sell) positions.

Think of a perpetual futures contract like a satellite that must maintain a perfect orbit around its planet—the crypto's spot price. The funding rate is the invisible force making constant, tiny adjustments to pull that satellite back into alignment whenever it drifts. Without it, the contract price could float off into space, becoming completely detached from the asset's real-world value.

This balancing act happens directly between traders. Picture a playground seesaw. If a crowd of traders jumps on one side (going long, betting the price will rise), that side gets heavy. To bring things back into balance, you need to entice some people to move to the other side. The funding rate is that incentive: the people on the heavy (long) side pay a small fee to those on the light (short) side.

At its core, the funding rate is a vital sign of the derivatives market. It serves two main purposes:

It's important not to confuse funding rates with standard trading fees. Trading fees go to the exchange for processing your order. The funding rate, on the other hand, is a peer-to-peer payment that reflects the real-time balance of bullish versus bearish pressure. For a deeper look into market dynamics, our guide on on-chain analysis offers signals that perfectly complement what funding rates tell you.

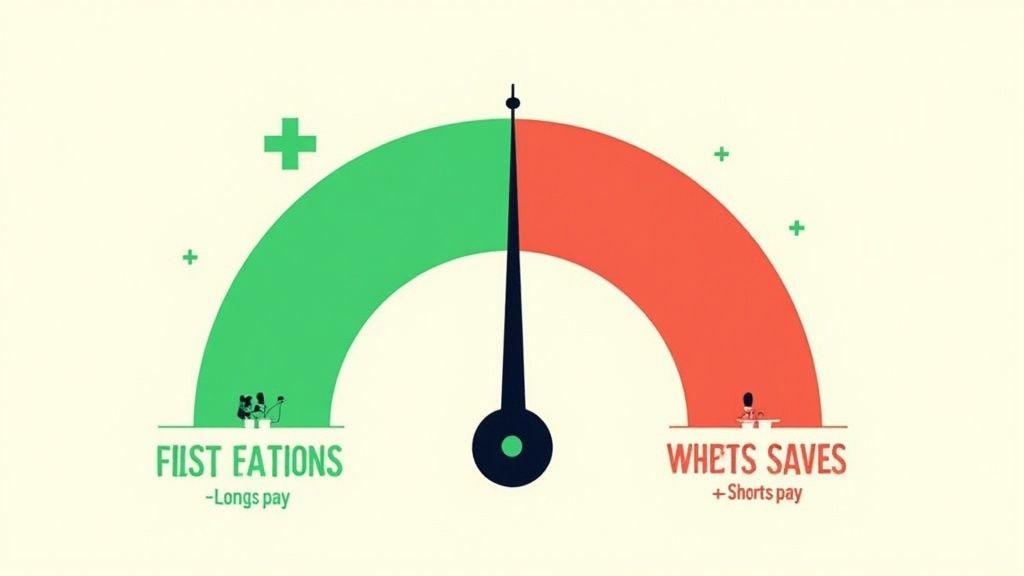

The direction of the payment instantly reveals a story about market sentiment. This makes it one of the most direct ways to gauge the collective mood of leveraged traders.

The crypto funding rate is a real-time sentiment gauge. A positive rate signals bullish optimism, while a negative rate points to bearish pessimism, offering a clear window into the market's collective psychology.

To break it down, here’s a quick reference table to help you understand what each funding rate scenario means for your trades.

In short, the sign of the funding rate—positive or negative—gives you a powerful clue about whether the market is feeling overly greedy or fearful.

To really get what's going on with the crypto funding rate, you have to look under the hood. Think of it like a recipe with two main ingredients. When they're mixed, you get the final rate that traders see on their screens. It’s not some arbitrary number; it’s a carefully calculated figure meant to mirror what’s happening in the market right now.

At its core, the funding rate formula is surprisingly simple. It’s basically the sum of the Interest Rate Component and the Premium Index. Each one has a specific job in keeping the perpetual contract price tethered to the actual spot price.

First up is the Interest Rate Component. This part is usually fixed and simply accounts for the difference in borrowing costs between the two assets in a trading pair. For a BTC/USD contract, it reflects the gap between the interest for borrowing Bitcoin versus borrowing US dollars. It’s part of the official formula, but it rarely has the biggest say in the final rate.

The second, and far more influential, ingredient is the Premium Index. This is the dynamic piece of the puzzle. It measures the price difference—or spread—between the perpetual contract and the asset's spot price. When the contract is trading at a premium (higher than spot), this index goes positive, pushing the funding rate up. If it's trading at a discount (lower than spot), the index turns negative, dragging the rate down with it.

The Core Formula: Funding Rate = Premium Index + clamp(Interest Rate - Premium Index, 0.05%, -0.05%)

This formula is set up so that the premium index is always the main driver. The interest rate just provides a baseline, and that "clamp" function is there to stop the rate from getting too wild in either direction. The result is a number that gives you a clean read on the tug-of-war between buyers and sellers.

Let's walk through a quick, hypothetical scenario to see how this all clicks together.

Picture this market setup for a BTC/USD perpetual contract:

Because the rate is positive, traders holding long positions will pay a small fee to those holding short positions. It’s the market’s way of nudging things back toward balance. This infographic gives a great visual of how those payments flow depending on market sentiment.

As you can see, payments shift from longs to shorts when the market is bullish and from shorts to longs when it's bearish, all to keep things in equilibrium.

Most major exchanges, like Binance and Bybit, calculate and settle these funding payments every eight hours. This creates a predictable rhythm that traders can plan around, anticipating the costs or earnings tied to their open positions.

Think of the crypto funding rate as a real-time barometer for market sentiment. It's more than just a fee mechanism; it’s a powerful window into the collective mindset of traders, offering clues about what the market might do next. Learning to read it is like learning to read the weather before a storm.

When the funding rate is consistently positive, it means traders with long positions are paying those with short positions. This is a dead giveaway for bullish sentiment. Demand for leveraged long positions is high, and traders are willing to pay a premium to bet on prices going up.

On the flip side, a negative funding rate tells the opposite story. When shorts pay longs, it’s a clear sign of dominant bearish sentiment. The market is flooded with sellers who believe prices will fall, and they're paying to keep their short positions open.

Interpreting these signals correctly can give you a serious edge. For example, a persistently high positive funding rate often crops up right before a market top. It’s a classic sign of greed, showing that too many traders are piling into leveraged longs. This makes the market extremely fragile and vulnerable to a sharp correction or a cascade of liquidations.

We break down exactly how those events unfold in our detailed guide on crypto market liquidations.

Conversely, a deeply negative funding rate can be a powerful contrarian indicator. This usually happens after a major price crash when fear is peaking. It can signal that sellers are exhausted—a moment known as market capitulation—which often creates the perfect setup for a price reversal or a relief rally.

A crypto funding rate isn't just a number; it's the collective voice of the market whispering its next potential move. High positive rates often scream "greed," while deeply negative rates whisper "fear."

To get the full story, it's best to look at aggregated data, not just a single exchange. The open interest-weighted funding rate for Bitcoin gives you a global snapshot of what everyone is thinking. You can find this data on platforms like CoinGlass.

Historically, the average 8-hour funding rate for BTC perpetuals hovers between 0.01% and 0.03% in calm markets. But during the crazy run-up to Bitcoin's all-time high near $69,000 in November 2021, rates shot above 0.05% as traders went all-in on leverage. During the 2022 bear market, rates were mostly negative or flat, reflecting widespread caution. The open interest-weighted metric is key because it gives more weight to giants like Binance and Bybit, helping you spot when the market is overheated or scraping the bottom.

To help you quickly interpret these signals, here’s a handy reference table.

This table breaks down different funding rate scenarios and what they likely mean for market behavior.

Using this table can help you make quicker, more informed decisions instead of just reacting to price movements.

Looking back at past market cycles shows just how predictive these rates can be.

By studying these historical patterns, you can get a much better feel for market psychology and start making moves based on sentiment, not just price charts.

Knowing what the funding rate means is one thing, but actually turning that knowledge into profitable trades is a whole different ballgame. Let's move from theory to practice and break down two powerful strategies that use funding rate signals to find opportunities you might otherwise miss.

The first is a market-neutral approach that’s all about capturing small inefficiencies. The second is a psychological play, betting against moments of extreme market emotion. Both demand discipline and a solid game plan.

Funding rate arbitrage is a classic market-neutral strategy that profits from the difference in funding rates for the same contract across different exchanges. Because every exchange has its own unique mix of traders, the balance between longs and shorts—and therefore the funding rate—can drift apart. That drift is where the opportunity lies.

The core idea is simple: collect funding payments while sidestepping the asset's price volatility entirely.

Here’s how you can execute this strategy, step-by-step:

This strategy is a favorite among crypto hedge funds. For instance, on any given day, Kraken's BTC perpetual funding rate might be 0.0148% per 8 hours while Binance is sitting at 0.0100%. This creates a spread of 0.0048% per funding interval, which firms exploit by going long on Binance and short on Kraken to pocket the difference.

Contrarian trading is all about using extreme funding rates as a sign of market hysteria—and then betting against the crowd. The philosophy here is that when sentiment hits a fever pitch, whether it’s irrational greed or blind panic, the market is stretched thin and ready for a reversal.

An extremely high funding rate is the market screaming that it's overleveraged and euphoric. A deeply negative rate is a cry of capitulation. A contrarian trader listens for these signals to enter when others are most emotional.

This approach requires patience and a bit of a strong stomach, as you’re deliberately stepping in front of a moving train.

By mastering these strategies, you can turn the crypto funding rate from a simple data point into a core pillar of your trading toolkit.

Funding rates can be a great source of trading ideas, but ignoring the risks is a fast way to drain your account. Think of a high positive funding rate as a hidden tax on your long positions. It slowly bleeds your capital with every eight-hour payment cycle.

Managing this risk isn't just about playing defense; it's a crucial part of trading perpetuals with any real confidence.

Smart traders always factor these payments into their game plan. This means you need to calculate your cost of carry—the total expense of keeping a position open over time. If a funding rate is sky-high, you have to ask yourself: will my potential profits from the price move even cover these recurring fees?

To get a handle on this, you have to treat funding payments like a business expense and build them directly into your profit and loss (P&L) projections.

Here’s a quick and dirty way to estimate the cost:

That 0.45% is the minimum profit you need just to break even on funding costs. If your total profit target is only 1%, a 0.45% fee completely changes your risk-to-reward calculation.

For a deeper look at managing your money in these fast-moving markets, check out our complete guide on position sizing for high-volatility trades.

Not all big funding rates are what they seem. Sometimes, a juicy rate is actually a funding rate trap, hiding nasty surprises like poor liquidity or extreme market risk. A massive positive rate might signal that the market is dangerously greedy, making your long position a prime target for a sudden, brutal reversal.

Be skeptical of unusually high funding rates. They often scream market instability, not sustainable opportunity. What looks like an easy arbitrage play could just be a trap set by low liquidity or incoming volatility.

Crypto funding rates are famous for their wild swings. During the 2020 bull run, Bitcoin funding rates on some exchanges regularly spiked past 0.1% every 8 hours as bulls levered up. But those rates were a flashing red light for an overheated market.

When the price eventually crashed by over 30% in May 2021, rates flipped hard into the negative, hitting lows like -0.15% as panicked traders rushed for the exits. You can see more of this history on Bitcoin funding rate history on Coinalyze.net.

To keep your capital safe, make these habits part of your routine:

We’ve pulled back the curtain on crypto funding rates, showing you they’re much more than a simple fee. Think of them as a powerful, multi-dimensional tool for smarter trading. When you move beyond just looking at price charts, you start to see the market's hidden currents, which is where the real opportunities are.

Everything we've covered gives you a serious leg up on traders who are only reacting to price action. You now understand how this mechanism keeps perpetual contract prices from flying off into their own orbit, away from an asset’s true value. More importantly, you can see it for what it is: a real-time barometer of market sentiment, pointing out moments of extreme greed or fear.

Knowing what the funding rate is is one thing; using it is another. The real power comes from turning this data into actionable strategies. We've walked through two key approaches that do just that:

Weaving these strategies into your routine is what takes your analysis from basic to truly strategic.

The ultimate edge in trading doesn't come from a crystal ball. It comes from deeply understanding the market's psychology right now. The crypto funding rate is one of your clearest windows into that collective mindset, flashing signals that price charts simply can't show you.

The takeaway here is simple: use this knowledge. Use it to get a better read on market moves, manage your risk like a pro, and trade with more confidence. By mastering the crypto funding rate, you’re not just a passenger in the market; you're actively interpreting its behavior. That deeper understanding is what builds a lasting edge, helping you navigate the wild world of crypto derivatives with skill.

Diving into perpetual futures always brings up questions, especially around a mechanism as unique as the funding rate. Let's clear up some of the most common ones traders ask so you can trade with more confidence.

The standard rhythm for funding payments is every 8 hours, which means three times a day. You'll find this schedule on most of the big exchanges like Binance, Bybit, and OKX, creating a predictable cycle for traders.

But don't take that as a hard and fast rule. During wild market swings, some exchanges might shorten the interval to help pull the contract price back in line with the spot price. Always give the funding interval a quick check on whatever exchange you're using.

Yes, absolutely. This is a trap that catches a lot of traders off guard. If you're holding a leveraged long position while the funding rate is consistently positive and high, the cost can seriously chip away at your profits.

Think about it this way: say your trade is up 2%, but you've been holding it for a few days while paying a 0.05% funding fee every eight hours. Those payments add up fast and can easily eat up a big chunk of your gains. If your trade is only slightly in the green, high funding costs could even push it into a loss.

Nope, not at all. Every exchange is its own little ecosystem with its own mix of traders, liquidity, and sentiment. Since the funding rate is just a reflection of the long vs. short pressure on that specific platform, the rates will naturally differ.

This is exactly what opens the door for strategies like funding rate arbitrage. A trader can spot a big difference in rates, go long on one exchange and short on another, and pocket the spread while staying neutral on the asset's price.

A key takeaway for every perpetuals trader: never assume the funding rate is uniform across the market. The differences between exchanges are not just noise; they are actionable signals and potential trading opportunities.

There's no single "good" funding rate because it all depends on your strategy. What’s great for one trader is a huge cost for another.

Let's put it into context:

In the end, a good funding rate is one that fits your market thesis and helps you execute your strategy.

Mastering the crypto funding rate is a powerful step, but it's just one piece of the puzzle. To truly get ahead, you need to see what the most successful traders are doing in real time. Wallet Finder.ai gives you that edge by tracking smart money movements on-chain, letting you discover and mirror the strategies of top-performing wallets before the market catches on. Start your 7-day trial and turn on-chain data into your next profitable trade.