A Trader's Guide to Timestamp in Excel

A trader's guide to mastering the timestamp in Excel. Learn static, dynamic, and automated methods to track trades, analyze data, and optimize your strategy.

February 16, 2026

Wallet Finder

November 26, 2025

.avif)

Choosing the right Layer 2 network for DeFi trading can be confusing.

With networks like Base and Arbitrum competing for users, traders need to know which suits their needs best. Both networks address Ethereum scalability, performing transactions that are frequent in nature at lower costs. Where they start to differ are factors such as transaction fees, liquidity, and user base.

This article compares Arbitrum against Base to help you decide which network would serve your DeFi trading better, with an extra reference to how Wallet Finder.ai assists you in maximizing both.

Base and Arbitrum are known for tackling scalability issues of the ETH blockchain ecosystem and stand out as popular Layer-2 (L2) networks. They simplify transaction processing than the Ethereum mainnet by delivering cheaper transaction fees and faster transaction speeds.

Now we shall go ahead to explain how these two work and their core features.

Base is a network supported by Coinbase that aims to facilitate DeFi trading.

Base, built on Optimism’s OP Stack, utilizes Optimistic Rollup technology to batch transactions off-chain, enabling high-frequency processing with minimal gas fees. With direct access to trading and user convenience, the Coinbase-backed layer-2 network is great for users looking for affordable availability.

Key Features of Base:

● Built on Optimism’s OP Stack - Uses the classic method of Optimistic Rollups for the faster processing of transactions and reduced congestion on the main Ethereum chain.

● Low gas fees - Generally 10x–50x cheaper than Ethereum mainnet (≈ $0.01–$0.15), though fees vary with congestion.

● Coinbase integration - Users on the Coinbase layer 2 network Base will be able to access DeFi directly, thereby easing the onboarding process through the Coinbase-supported Base network.

● Strong security model - Base inherits Ethereum security and consensus, thus anything useful is never compromised.

● Developer-friendly tools - Offers resources that attract a larger developer community, thus strengthening the ecosystem with more dApps being built.

Arbitrum is a leading Ethereum layer-2 network built to handle scalability issues through Optimistic Rollups. With a strong DeFi ecosystem, it attracts both retail traders and institutions. Its interoperability and support for decentralized exchanges make it a preferred platform for active DeFi participants. If you're already exploring advanced blockchain tools, you might also be interested in learning How To Track Solana Wallets – A Step-by-Step Guide, which can help you monitor wallet activity and better understand portfolio movements across another fast-growing ecosystem.

Key Features of Arbitrum:

● Optimistic Rollups technology - Processes transactions off-chain to reduce congestion and enable frequent transaction processing.

● Wide DeFi adoption - Hosts major protocols like GMX, Uniswap, SushiSwap, and Aave, boosting its market presence and liquidity depth.

● Lower gas fees - It offers average transaction fees lower than the Ethereum mainnet, making it attractive for both small and high-volume transactions.

● Multi-chain bridges - This means allowing ERC-20 assets and creating simple movement across blockchains for infrastructure governance and accessibility for end

users.

1. Arbitrum One: Focused on general dApps and decentralized finance (DeFi) projects.

2. Arbitrum Nova: Tailored for gaming and social applications, addressing different blockchain ecosystem needs.

Base and Arbitrum are important in the Layer-2 ecosystem for cost-effective solutions to improve the transaction count on Ethereum and lower the average transaction costs.

The choice, therefore, depends equally on whether you value Coinbase integration and ease of use with Base or deep liquidity and broader market volume with Arbitrum.

Base and Arbitrum use “optimistic rollups” to address Ethereum’s scalability issues.

Both aim to improve transaction counts and reduce congestion by processing frequent transactions off-chain and finalizing them on the Ethereum network. However, their approaches differ regarding user experience, speed consistency, and scalability for high-volume transactions.

Here is a table showing how they compare:

Verdict:

The base is perfect if you value Coinbase integration and want a beginner-friendly platform. The association with Coinbase-backed Ethereum layer-2 grants easy onboarding with relatively cheaper transactions.

On the other hand, if you are an advanced trader seeking a leading Ethereum layer-2 network with a proven track record in high-volume transactions and a well-established DeFi ecosystem, then Arbitrum is a better choice.

Transaction fees can make or break a trading strategy for DeFi traders.

Both Base and Arbitrum are cheaper than the Ethereum mainnet, reducing overall fees for users processing many transactions. Lower costs are significant for high-volume transactions and daily users.

Here’s how the two networks compare:

Verdict:

Both networks have low average fees, so it's suitable for DeFi trading. However, Base might be slightly cheaper in some cases since it uses Optimism’s fee structure, making it ideal for users who want the lowest transaction costs.

Security is key when handling crypto assets, and decentralization is key for governance and trust. Both Base and Arbitrum inherit Ethereum’s security, so the Ethereum mainnet’s consensus protects ERC-20 assets and transactions.

But they approach decentralization and governance differently. Let’s see in the table below:

Verdict:

Arbitrum offers a more decentralized ecosystem with community governance, which should entice users looking for independence and transparency. On the other hand, Base has a Coinbase-backed security infrastructure of the Ethereum layer-2 network, thus reassuring most safety-first users.

Liquidity is critical for really efficient DeFi trading.

A large base of users combined with high TVL and integration with the top DeFi protocols provides better markets and smoother trades. Base is still new, but it benefits from Coinbase-supported network growth compared to Arbitrum, which has positioned itself as a leader among DeFi liquidity providers.

Ease of use and accessibility are key when choosing a Layer-2 network.

Ease of use and accessibility have a lot of roles to play in choosing a Layer-2 network. Some features like fiat on-ramps, wallet integrations, and easy-to-use interfaces highly determine how easily new users can enter the crypto markets.

Verdict:

Base offers user-friendliness and accessibility, especially for those already using Coinbase. Its direct market model allows easy entry for novices. Arbitrum, while less accessible, offers advanced traders a host of chain governance options and wider market volume opportunities.

So, are you still trying to determine which network is better for DeFi trading—Arbitrum vs Base?

Both offer cheaper transactions with faster turnaround times and attempt to alleviate the Ethereum network's scalability. The best choice rests entirely on your trading style, interaction levels with the platforms, and how you'd use our behavior networks.

Let’s break it down in simple terms.

Here is why Base can be the right choice for you:

1. If you are a Coinbase user who wants easy access to DeFi.

Base should be your perfect entry. With a Coinbase-supported network, you can access DApps directly from your account with no need for complex bridges or third-party software.

2. If you prioritize low fees and fast transactions.

With Base, you can profit from some of the lowest transaction fees among the L2 Ethereum network by using Optimism's OP Stack; your average transaction fees will remain low, whether making a quick swap or sampling new tokens.

3. If you are a complete novice at DeFi and need a platform for beginners.

Base provides a user-friendly platform and removes much of the complexity through a direct fiat on-ramp via Coinbase. It is aimed at traders who are still comfortable with DeFi protocols but looking for a smooth entry into the blockchain ecosystem.

Here is why Arbitrum can be the right choice for you:

1. You want access to top DeFi portfolios and deep liquidity.

In case you want access to top protocols such as GMX, Uniswap, and Aave, you will find them on Arbitrum. With a high user base and lying close to $2B in TVL, this means that there will be better market volume, deeper liquidity, and less slippage when trading.

2. You need a more decentralized ecosystem.

Decentralization isn’t just a buzzword—it affects how secure and fair a network is. Unlike Base’s corporate network affiliation with Coinbase, Arbitrum runs on a decentralized validator network alongside community-driven governance. Thus, if you prefer a trading platform owned by numerous users instead of a single person, then you should go for Arbitrum.

3. Now, from an advanced trader's point of view, Arbitrum will provide a much broader ecosystem for development with numerous protocols, as well as lending platforms and derivative markets. Whether yield farming, liquidity provision, or other complicated transactions, Arbitrum's infrastructure supports a broader range of strategies.

No matter which network you choose—Base or Arbitrum, making informed trades is key to success in the DeFi world.

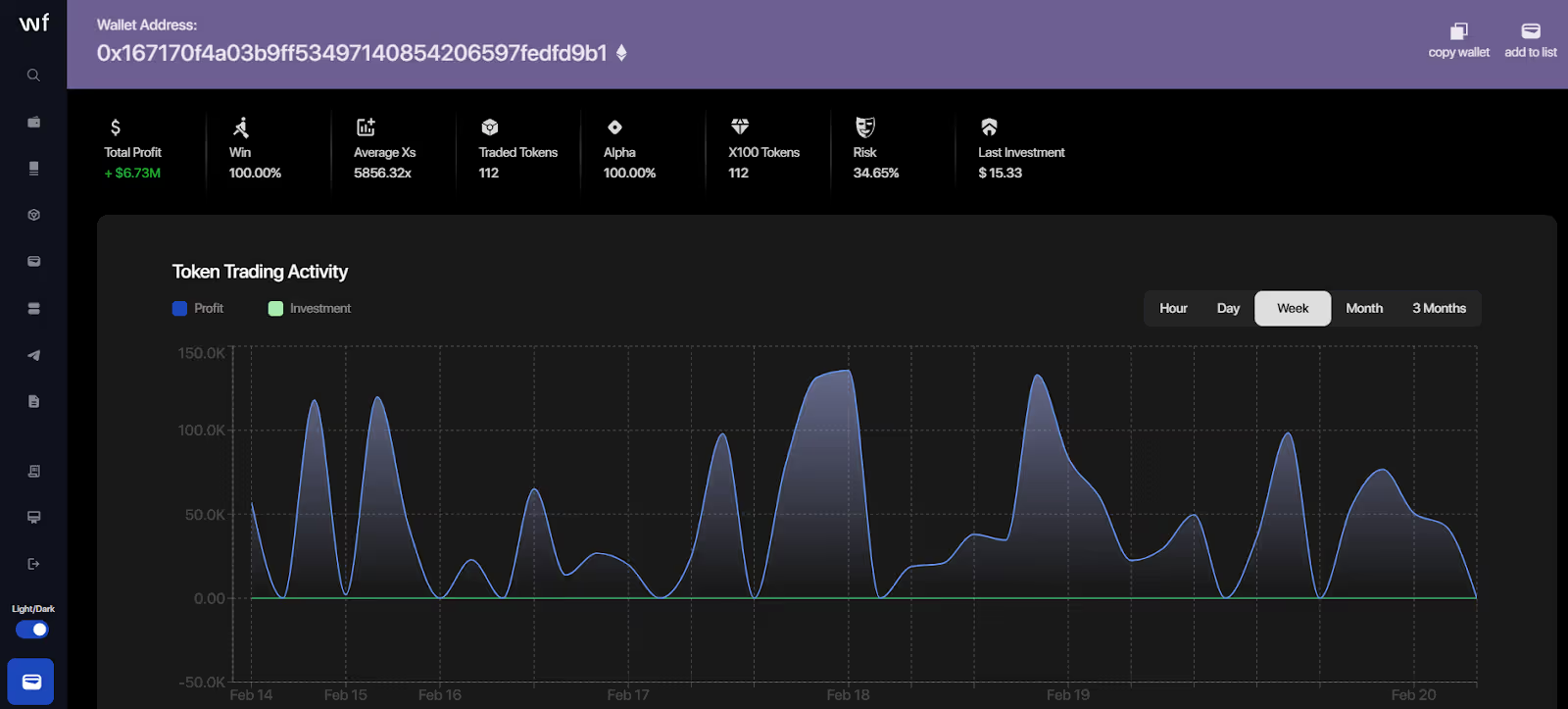

That's exactly where Wallet Finder.ai appears. Tracking profitable wallets, trading, and data analysis gives you an edge in Base. With Arbitrum support, you get extra insights to keep you ahead, no matter the market conditions and transaction fees.

Here’s how Wallet Finder.ai supports your DeFi trading on Arbitrum vs Base:

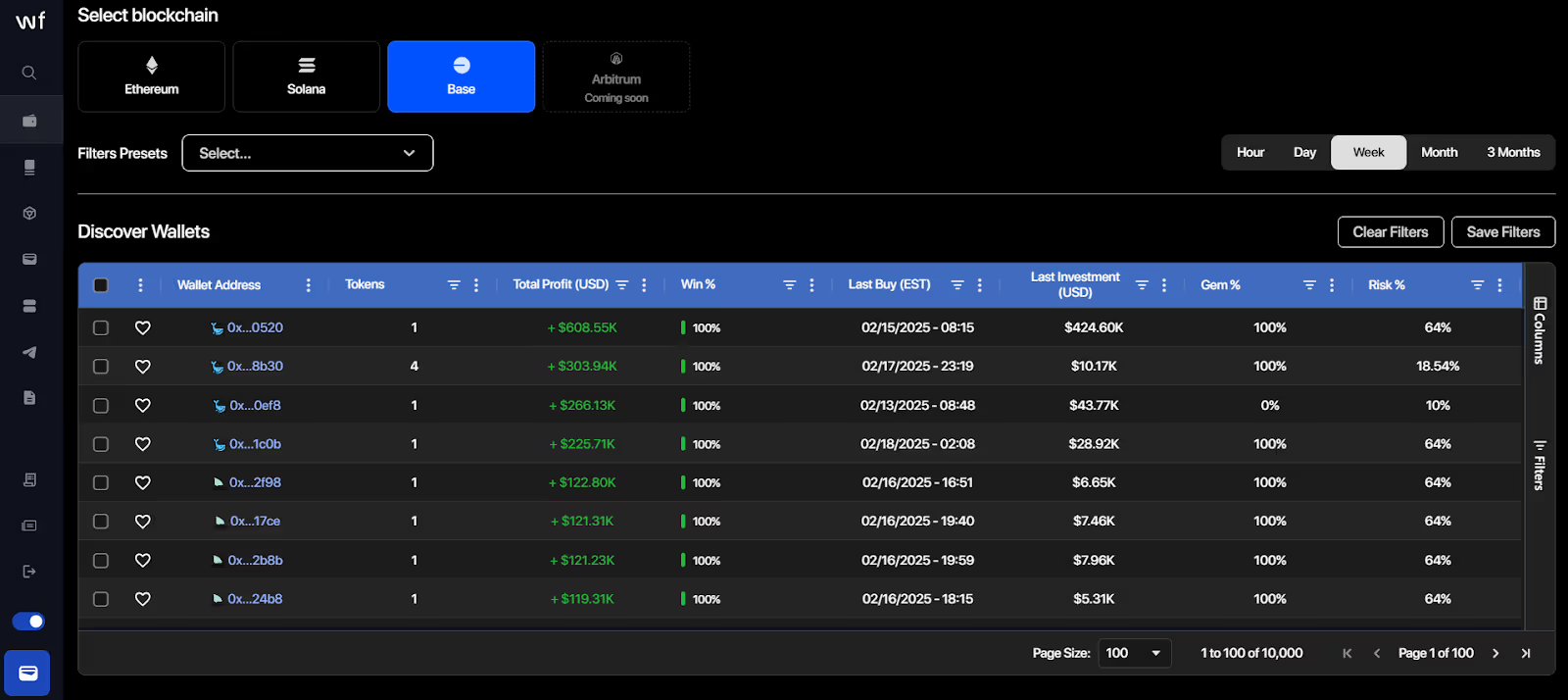

Find top-performing wallets on both networks.

Be it Coinbase-backed Ethereum layer-2 network Base or the leading Ethereum layer-2 network Arbitrum, Wallet Finder.ai connects you with traders that have proven success trading on that top most Ethereum layer-2 network in the world; thus, perfect for users aiming to keep transaction costs to a lower side while maximizing returns through increasingly frequent transaction processing.

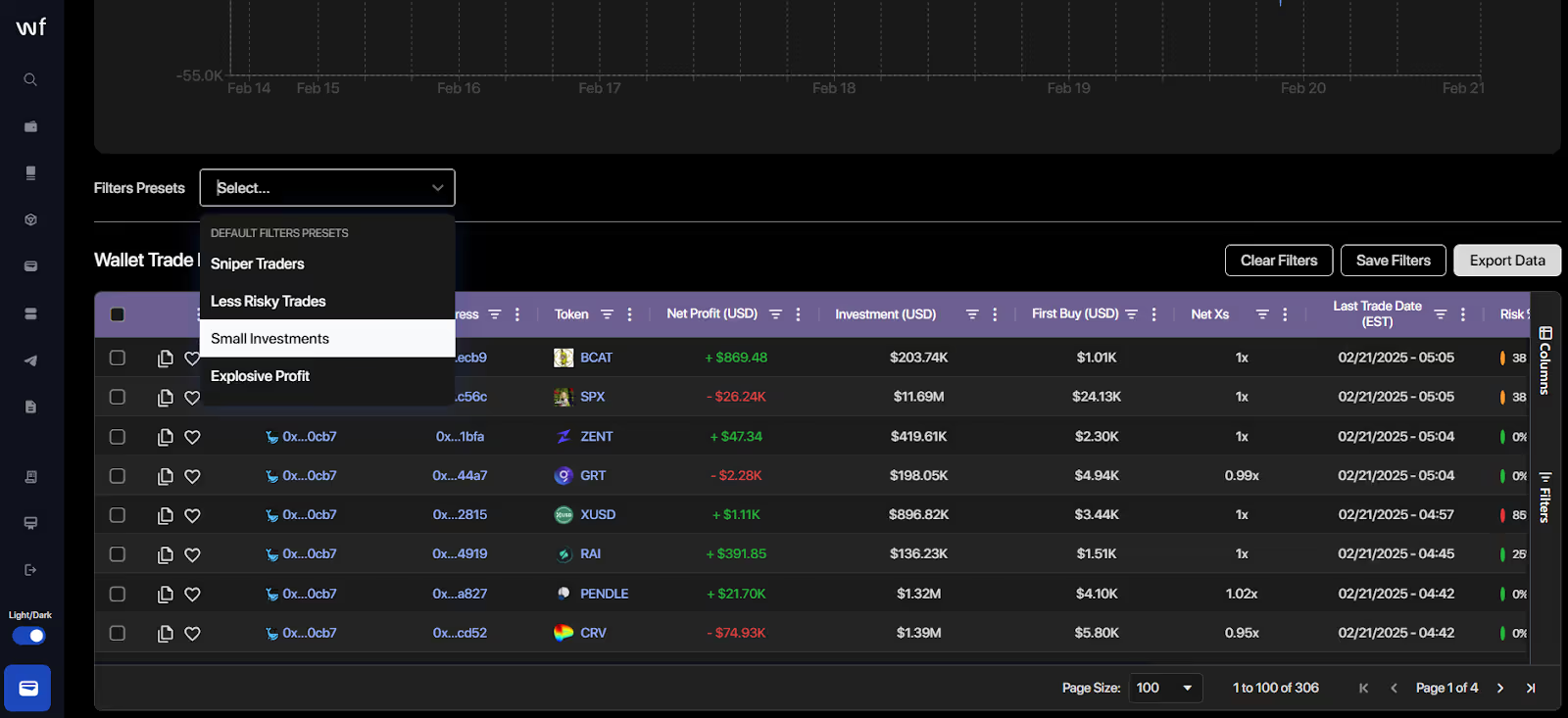

The Analytics provided by Walletfinder.ai platform help you understand transaction count, entry points, and profit margin. It also offers advanced filtering capabilities to comprehensively and easily access data from both networks to personalize your approach according to current real-time transaction trends and evolving crypto markets.

Timing matters in DeFi.

With Wallet Finder.ai, get notified whenever the top wallets trade on Base L2 Network or Arbitrum by instant alerts. Wallet Finder.ai Telegram Alerts allow you to easily follow wallet activity in real time.

Just hit the bell icon next to the wallets you want to follow from your favourite wallet lists, and you will start receiving alerts whenever the wallets perform trades or swaps. The faster you react to market changes, the better you can catch the waves of frequent transaction flows and the strategies of the top wallets on both networks.

Willing to study over time patterns?

Easily export information in Excel or CSV format for daily transaction tracking, average transaction cost evaluation, and liquidity understanding on both networks with Wallet Finder.ai. Use these insights to navigate the blockchain ecosystem and improve your decision-making confidently.

Choosing between Arbitrum vs Base for DeFi trading depends on your needs and experience level. Base would be a good option for cheaper transactions as well as an easy path into the Coinbase-supported Base network, where users could connect at the surface to the very simple user experience it provides.

On the other hand, Arbitrum would be the better choice if you need prime access to the best DeFi protocols, deeper liquidity, and a much more decentralized ecosystem.

Whichever network you eventually choose, Wallet Finder.ai enables you to make better trading decisions on both Base L2 Network and Arbitrum. You can track profitable wallets, analyze their trades, get instant alerts, and export data to improve your strategies for trading.

Sign up for free at Wallet Finder.ai and immediately start tracking profitable wallets, no credit card needed!

The key difference between Arbitrum vs. Base lies in their focus. Base is optimized for Coinbase-supported network integration with cheaper transactions and easy access for beginners, while Arbitrum offers a decentralized ecosystem with deeper liquidity and a broader DeFi protocol range.

Both networks offer low transaction costs, but Base generally provides cheaper transactions due to its use of Optimism’s OP Stack, with average transaction fees ranging from ~$0.01 to $0.10. Arbitrum fees are slightly higher, averaging ~$0.05 to $0.15.

Yes, Arbitrum is better suited for high-volume transactions thanks to its deeper liquidity, higher market volume, and established DeFi ecosystem.

Absolutely! Wallet Finder.ai lets you track profitable wallets on Base L2 Network and Arbitrum. You can analyze trades, receive instant alerts via Telegram, and export data to enhance your DeFi trading strategies.

Beginners should consider Base because of its direct Coinbase-backed Ethereum layer-2 network integration, simple interface, and lowest transaction costs, making it ideal for basic transactions and easy onboarding into the blockchain ecosystem.