7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 20, 2026

Want to know how your DeFi wallet is performing? Wallet profitability benchmarking helps you measure profits, losses, and ROI, so you can adjust strategies and improve results. It’s like a financial report card for your wallet.

Here’s what you need to know:

Takeaway: Benchmarking tools like Wallet Finder.ai simplify tracking wallet performance, helping you make smarter, data-driven decisions in DeFi markets.

When picking a wallet profitability benchmarking tool, certain features can make a huge difference in your success within the fast-paced world of DeFi trading. The right tools give you the edge to make smart decisions backed by accurate, up-to-the-minute data. Here’s a breakdown of the key features that can take your benchmarking to the next level.

Speed is everything in DeFi markets. Real-time profit and loss tracking gives you instant insights into how your assets are performing. With automated updates, you don’t have to worry about manual errors, and you can react quickly to price shifts, liquidity changes, or sudden volume spikes in the always-active DeFi markets. Unlike traditional finance, where updates come quarterly, DeFi operates on blockchain technology, recording every transaction publicly and providing a wealth of live data.

In these markets, even a few seconds of delay in analytics can feel like a lifetime. Rapid market movements - like flash loans or bot-driven trades - mean that outdated information could lead to costly mistakes. That’s why having real-time data isn’t just helpful; it’s essential.

Seamless integration across protocols further amplifies the value of real-time tracking.

Coverage across platforms is key. A great benchmarking tool should work smoothly with the major blockchains and DeFi protocols you use. Without proper integration, you risk missing critical data that could affect your profitability.

The best tools pull live data from major blockchains like Ethereum, BSC, Polygon, and Fantom, offering a unified view through a single dashboard. This eliminates the need to jump between platforms like Uniswap and PancakeSwap, giving you cleaner, more actionable insights without the hassle.

Cross-chain compatibility ensures you can monitor your entire DeFi portfolio in one place, no matter where your assets are located.

While integration lays the groundwork, advanced filtering tools help you make sense of all that data.

Fine-tuned control leads to smarter decisions. Advanced filtering and customization options let you dig deep into your data to uncover trends and opportunities. Filters that focus on profitability, asset types, and trading patterns give you the tools to refine your strategy.

Custom dashboards and alerts take it a step further, ensuring you never miss a critical market move. By tailoring the data to your needs, you can quickly see which strategies are paying off and where adjustments are needed. This level of detail helps serious DeFi traders stay ahead of the curve.

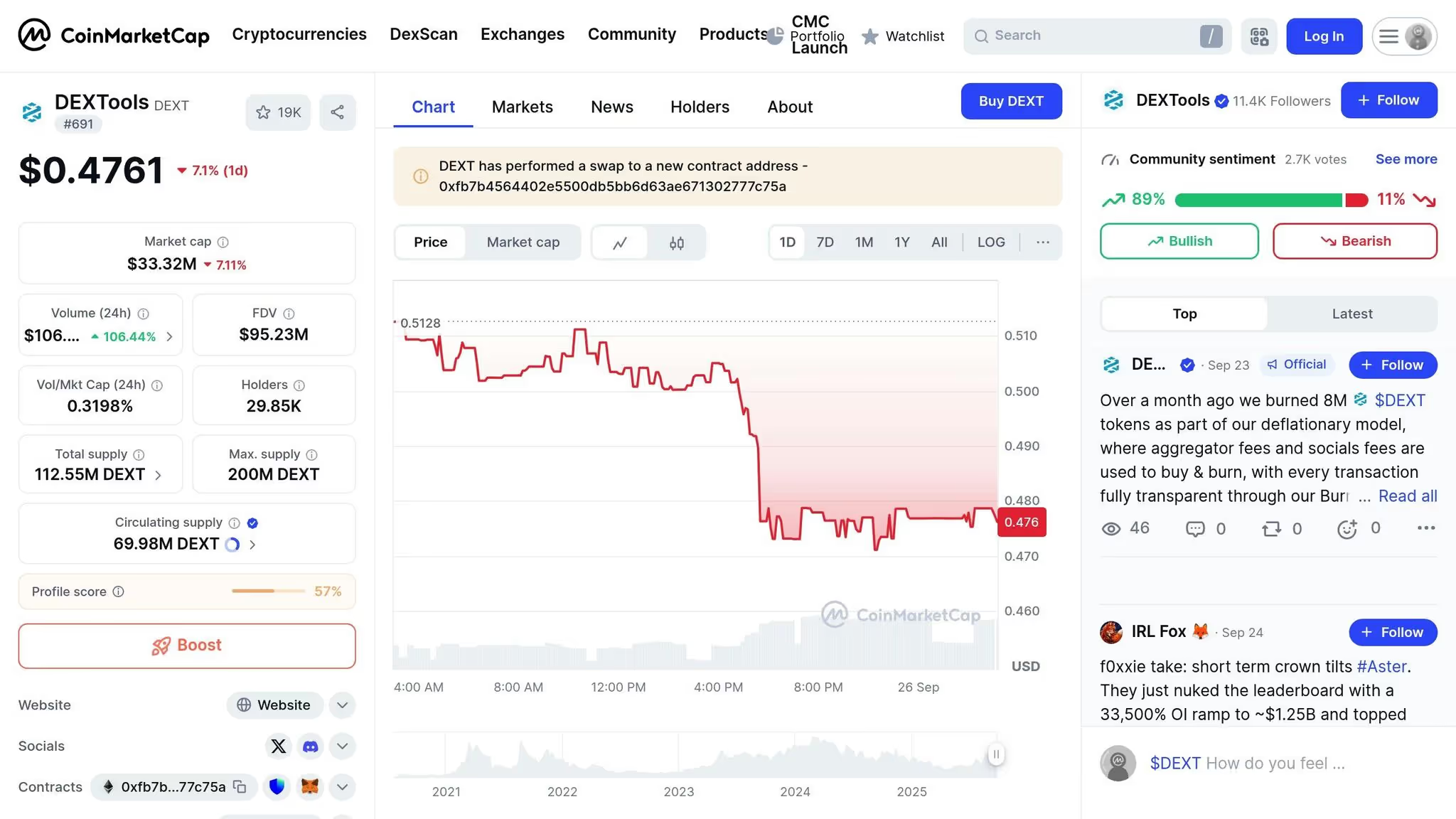

Wallet Finder.ai offers a toolset tailored for traders who want precise insights into wallet profitability. Built for serious traders, it combines analytics with an intuitive interface, making it easier to track and evaluate wallet performance.

This platform emphasizes uncovering profitable trading patterns and learning from successful wallet strategies across multiple blockchains. It addresses a much-needed gap in the DeFi space by simplifying the process of analyzing wallet activity.

With Wallet Finder.ai, you can explore top-performing crypto wallets and access detailed profit and loss statistics. This feature provides real trading data from experienced DeFi participants, giving traders practical examples of strategies that work.

Historical performance analysis is another standout feature, offering graphs that showcase wallet activity over time. These visuals allow users to study trading patterns, pinpoint effective entry and exit points, and understand how position sizing contributes to consistent profits. It’s a straightforward way to turn complex data into actionable insights.

The platform also includes advanced filters that sort wallets by profitability, win streaks, and consistency. This makes it easy to sift through thousands of wallets and focus on the ones that match your research goals.

For more in-depth analysis, Wallet Finder.ai provides a data export feature, letting users download blockchain data for offline study. This is especially useful for integrating findings into existing research workflows. Leveraging Gas Fee Analysis Tools for Crypto Traders can give you a clear view of transaction costs and help plan trades more efficiently during peak network activity.

Additionally, personal wallet connection features allow traders to compare their performance against top-performing wallets, helping to identify areas for improvement.

Wallet Finder.ai ensures you stay ahead of the game with real-time alerts. These updates, sent via Telegram, notify you of significant activities from the wallets you’re tracking.

The platform’s custom watchlist feature lets you create personalized collections of high-performing wallets. Instead of constantly checking multiple wallets, you can focus on specific ones that match your criteria, such as trading style or asset focus.

Real-time monitoring provides instant insights into how successful traders are reacting to current market conditions, keeping you informed and ready to act.

To benchmark wallet profitability effectively, you need a structured, data-driven approach that uncovers successful trading patterns.

When evaluating wallet performance, focus on key metrics that allow for meaningful comparisons across different wallets and timeframes. Start with ROI (Return on Investment), which measures the percentage gain or loss from the initial investment. Pair this with net profit to get a clearer picture of absolute gains, but always consider the initial investment size to properly assess performance.

Another important metric is win rate consistency - the percentage of profitable trades over specific periods like 30, 90, or 365 days. This helps you spot wallets that deliver steady results instead of relying on occasional lucky trades.

You should also look at average trade size compared to the total portfolio value. Wallets that consistently allocate 2-5% per trade often reflect better risk management than those taking oversized, high-risk bets.

Time-weighted returns are another valuable tool. They adjust for the timing of deposits and withdrawals, allowing you to evaluate trading skill without the noise of fluctuating capital. This is especially useful for analyzing wallets with irregular funding patterns.

These metrics form the foundation for using visual tools to better understand performance trends.

Charts can turn complex wallet data into clear, actionable insights. For example, equity curves illustrate portfolio value changes over time. Smooth, upward-trending equity curves often indicate consistent growth, while sharp spikes followed by steep declines may signal risky behavior.

Drawdown charts are equally important. They show how wallets handle losing periods by highlighting the maximum percentage loss from a peak. Generally, professional traders see drawdowns over 20-30% as a warning sign of poor risk management.

You can also use monthly or weekly performance heat maps to identify patterns. These maps help you spot wallets that thrive in certain market conditions, like bull markets, but may struggle during bearish or sideways trends.

Finally, consistent trading volumes often reflect disciplined strategies, making this another important factor to consider when reviewing wallet data.

To identify top-performing wallets, set clear criteria based on your risk tolerance and trading style. For example, you might filter by minimum returns, consistency, and acceptable drawdown levels.

Tools like Wallet Finder.ai can simplify this process by allowing you to sort wallets by profitability, win streaks, and trading frequency. Start with broad filters, then refine them as you identify patterns that align with your goals.

Time-based filtering is another useful strategy. Focus on wallets with at least six months of activity to ensure you're analyzing established performance rather than short-term luck. However, don’t overlook newer wallets if they show strong consistency metrics.

If you're interested in specific trading areas, consider asset class filtering. For example, you can focus on wallets specializing in DeFi sectors like lending protocols, DEX trading, or yield farming. This approach helps you identify strategies that match your interests.

It’s also helpful to filter by wallet size. Strategies used by $10 million portfolios may not work as well for smaller accounts due to liquidity and market impact differences.

Lastly, geographic and temporal filters can provide insights into wallets that trade during specific market hours or respond to regional market conditions. This information can guide your own trading schedule and focus areas.

Keep in mind that filtering criteria should evolve with the market. What worked during the 2023 bull run might not apply in different conditions. Regularly update your filters - about every quarter - to stay aligned with current trends and dynamics.

Figuring out wallet profitability is a must for staying competitive in the fast-paced world of DeFi trading. The right tools take the guesswork out of strategy and let you make decisions based on solid data.

With real-time analytics, you can act fast on opportunities before they disappear. Advanced filters help you zero in on wallets that match your specific goals, like ROI, win rate, or asset preferences. Plus, unified wallet integration ties everything together, giving you a complete view of performance without hopping between platforms.

Features like visual charts, customizable alerts, and export options make it easier to spot trends and react to market changes. This kind of structured approach uncovers patterns and connections that might otherwise go unnoticed.

In DeFi, speed and precision are everything. Relying on manual analysis or gut instincts just doesn’t cut it. Professional traders know that consistent success depends on a systematic strategy backed by reliable data.

Wallet Finder.ai provides the tools to make this happen. With real-time alerts, custom watchlists, and powerful filtering options, you can focus on executing your strategy rather than chasing down data.

Success in the market comes to those who act quickly and smartly. Having detailed wallet analytics and performance benchmarking tools isn’t just a nice-to-have - it’s essential for staying ahead. Start by focusing on the metrics that align with your strategy, use visual tools to track trends, and apply advanced filters to pinpoint wallets worth following. The data is there - make it work for you.

Real-time profit and loss (P&L) tracking keeps you on top of the fast-paced DeFi market. It lets you respond quickly to changes like price swings or shifts in liquidity, so you can adjust your trades promptly. This can help you boost profits while cutting down on potential losses.

By monitoring P&L as it happens, you can fine-tune your strategy on the go, improve your timing for entering or exiting trades, and make smarter decisions overall. It also strengthens your risk management, giving you the tools to better handle the ups and downs of the DeFi market.

To check how well your wallet is doing in the DeFi world, keep an eye on these key metrics:

By keeping tabs on these metrics, you’ll get a clearer picture of your wallet’s financial health and be better equipped to make smart decisions for boosting your returns.

Wallet Finder.ai offers powerful filtering and customization tools that let you dive deep into wallet data. You can zero in on specific trading metrics, performance indicators, and timeframes to analyze the information that matters most. This makes it easier to spot profitable wallets, track trading behaviors, and discover trends that might not be immediately obvious.

The platform also provides customizable charts and personalized insights, helping you turn complex data into clear visuals that fit your strategy. This means you can make smarter decisions, evaluate risks more effectively, and uncover new opportunities in the ever-changing DeFi market.

The article covers basic filtering methods but lacks rigorous statistical frameworks for determining whether observed wallet performance differences represent genuine skill versus random chance. Statistical significance testing provides the mathematical foundation to distinguish truly superior wallets from those benefiting from temporary luck or market timing.

Hypothesis testing framework establishes whether wallet performance exceeds market benchmarks through statistical rather than observational methods. Setting up null hypothesis (wallet performance equals market returns) versus alternative hypothesis (wallet demonstrates superior skill) provides structure for mathematical validation. T-tests compare individual wallet returns against market benchmarks while controlling for time periods and volatility differences.

Sample size requirements ensure statistical tests have adequate power to detect genuine performance differences. Minimum 100 trades or 6 months of activity typically provides sufficient data for meaningful analysis, though complex strategies may require longer observation periods. Insufficient sample sizes lead to false conclusions about wallet skill levels and trading effectiveness.

Confidence intervals around performance metrics provide ranges of likely true performance rather than point estimates. A wallet showing 15% monthly returns might have 95% confidence intervals of 8% to 22%, indicating significant uncertainty around the estimate. Overlapping confidence intervals suggest performance differences may not be statistically meaningful despite appearing different.

Multiple comparison corrections prevent false discoveries when analyzing many wallets simultaneously. Bonferroni corrections adjust significance thresholds when testing numerous wallets to maintain overall error rates. False Discovery Rate control provides less conservative corrections more appropriate for exploratory wallet analysis where missing true performers is costly.

Bootstrap resampling generates confidence intervals and significance tests without assuming normal return distributions. This technique repeatedly resamples observed wallet performance to estimate uncertainty and test significance. Bootstrap methods work particularly well for wallet analysis because crypto returns rarely follow normal distributions.

Non-parametric testing approaches handle situations where wallet performance data violates standard statistical assumptions.

Mann-Whitney U tests compare wallet performance rankings without assuming normal distributions. These tests work well when some wallets show extremely high or low returns that skew traditional analyses. Rank-based methods often provide more robust results for crypto wallet evaluation than parametric alternatives.

Permutation testing creates null distributions by randomly shuffling performance data across wallets and time periods. This approach tests whether observed performance patterns could arise by chance alone. If fewer than 5% of random permutations show patterns as extreme as observed data, results are statistically significant.

Time series analysis accounts for serial correlation in wallet returns that violates standard statistical test assumptions. Many successful trading strategies show momentum or mean reversion patterns that create dependencies between consecutive returns. Proper time series modeling accounts for these patterns when testing significance.

Regime-switching models recognize that wallet performance may vary significantly across different market conditions. Bull markets, bear markets, and sideways markets often favor different strategies. Regime-aware testing evaluates performance consistency across varying market environments rather than assuming uniform performance.

Monte Carlo simulation generates realistic performance distributions under null hypotheses of random trading. These simulations can incorporate realistic transaction costs, slippage, and market impact to test whether observed performance could arise from random decision-making under realistic constraints.

Statistical significance alone doesn't guarantee practical importance for investment decisions - effect size analysis measures the magnitude of performance differences.

Cohen's d calculation quantifies how many standard deviations separate high-performing wallets from benchmarks or peer groups. Effect sizes above 0.8 indicate large practical differences while values below 0.2 suggest minimal practical impact despite potential statistical significance.

Information ratio analysis measures excess returns per unit of tracking error to evaluate risk-adjusted outperformance. High information ratios indicate wallets that consistently beat benchmarks without taking excessive additional risk. Information ratios above 0.5 are generally considered good while ratios above 1.0 are exceptional.

Economic significance testing incorporates transaction costs, taxes, and implementation difficulties into performance evaluation. A statistically significant strategy that generates 2% annual excess returns may not be economically significant after accounting for implementation costs and complexity.

Power analysis determines the probability of detecting meaningful performance differences when they actually exist. Low statistical power leads to missing genuinely superior wallets while adequate power ensures reliable identification of outperformers.

Statistical significance testing requires understanding of both statistical methods and crypto market characteristics but provides objective foundation for wallet evaluation that eliminates subjective bias and marketing claims in favor of mathematically validated performance assessment.