GE price tracker: How to monitor GE stock

Learn how to use a ge price tracker to monitor GE stock in real time with apps, spreadsheets, or APIs.

March 5, 2026

Wallet Finder

February 16, 2026

A bitcoin difficulty chart is more than just a line on a graph; it's a visual readout of the network's pulse. It shows you exactly how hard miners have to work to solve the computational puzzle that adds new blocks to the Bitcoin blockchain. Think of it as the network's built-in pacemaker, constantly adjusting to keep everything running smoothly and securely.

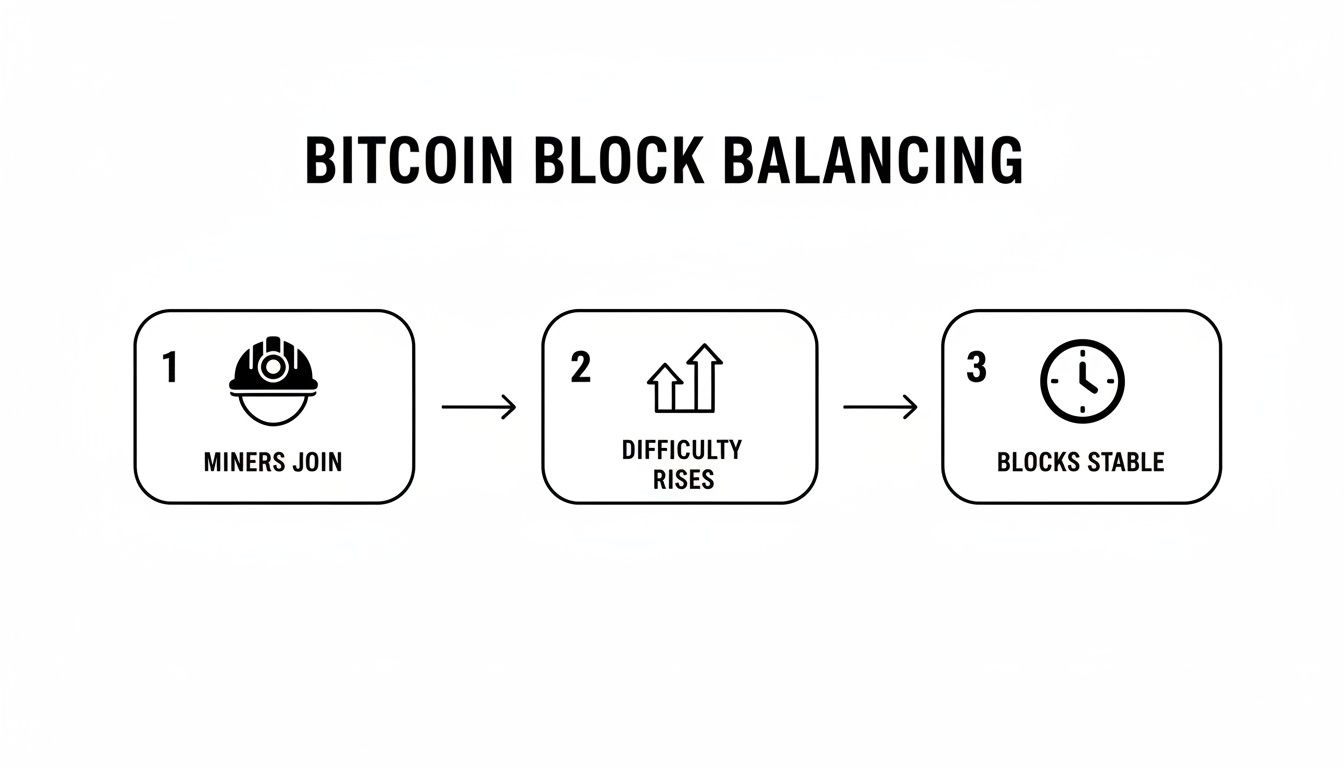

Imagine a global gold rush where, as more miners join the hunt, the gold magically becomes harder to find. That's a perfect way to understand Bitcoin's mining difficulty. This isn't just a random number—it's the network's immune system, a self-regulating mechanism that ensures new blocks are found roughly every 10 minutes, no matter how many miners are competing.

When more miners plug in powerful new hardware, the network's total computing power (or "hashrate") goes up. To keep the 10-minute block time stable, the difficulty automatically increases. On the flip side, if a large number of miners switch off their machines, the difficulty drops, making it easier for the remaining miners to find a block. This elegant balancing act is at the core of what makes Bitcoin so resilient.

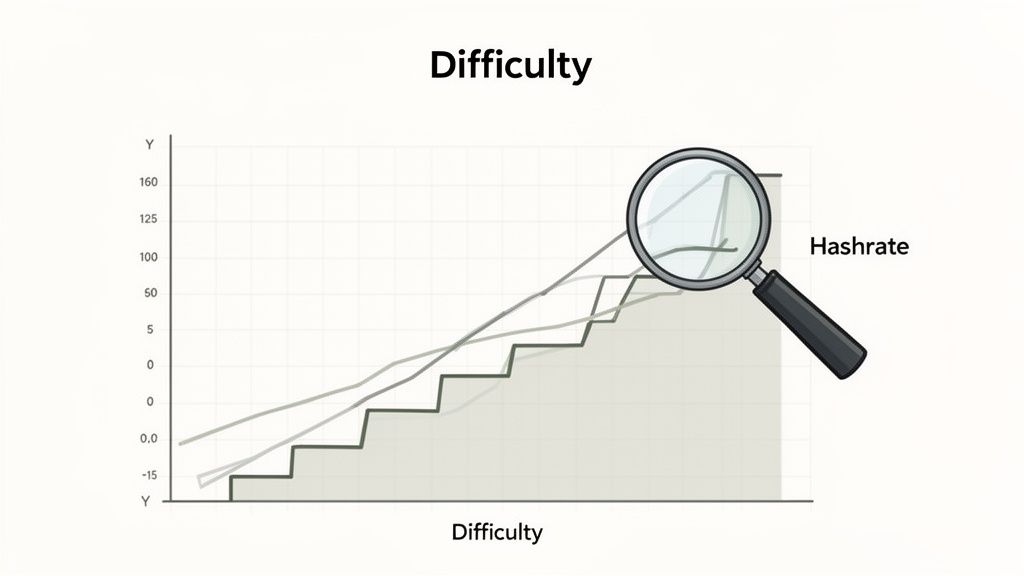

Looking at the bitcoin difficulty chart over time tells an incredible story of growth and security. In the very beginning, the challenge was trivial. The difficulty has exploded from just 1 when Satoshi Nakamoto mined the genesis block in January 2009—a level where a basic home computer could do the job—to a staggering 146.47 trillion as of block 932,898. This mind-blowing increase shows just how much the network has matured. You can explore this historical growth in detail on CoinWarz.

This exponential rise points to a massive influx of investment, hardware, and energy dedicated to securing the network. A higher difficulty means it takes an astronomical amount of computational power to try and attack the blockchain, making it one of the most secure computer networks ever created.

A rising difficulty is a direct measure of the network's health and the fierce competition among miners. It shows the network is valuable enough to attract immense resources, creating a robust and tamper-proof ledger.

For both miners and traders, this single metric is a powerhouse of information. It gives crucial context for:

Here’s a snapshot of a live bitcoin difficulty chart, which visualizes this constant adjustment and long-term growth.

Notice the chart's distinct "stair-step" pattern? That’s the difficulty adjustment in action. It happens automatically every 2,016 blocks (roughly two weeks), clearly showing how the network responds to changes in mining power. Getting comfortable with this chart is the first step toward understanding Bitcoin's fundamental mechanics on a much deeper level.

This table breaks down the core concepts of Bitcoin's mining difficulty for quick and easy understanding.

ConceptSimple ExplanationWhy It Matters for TradersDifficulty TargetAn internal network setting that determines how hard the mining puzzle is. A lower target means a higher difficulty.The target is what actually changes, affecting how much work is needed to mine. This has a direct impact on miner costs and potential selling pressure.Adjustment PeriodThe difficulty recalibrates every 2,016 blocks (about 2 weeks) to maintain a 10-minute average block time.These adjustments create predictable events. A large upcoming difficulty increase might signal strong miner confidence, while a big drop could suggest miners are capitulating.HashrateThe total combined computational power of all miners on the network.Hashrate is the input that drives difficulty changes. A rising hashrate (and thus difficulty) is often seen as a bullish, long-term sign of network health and security.

By grasping these three elements, you can start to see the difficulty chart not just as a historical record, but as a live indicator of the network's economic and security landscape.

At the very core of Bitcoin's design is a brilliant, self-regulating system: the difficulty adjustment. Think of it as the network's built-in thermostat. It works automatically to keep everything stable and predictable, no CEO or central bank required.

The network has one simple goal: to make sure a new block is found, on average, every 10 minutes. To hit this target, the protocol runs a check-up every 2,016 blocks. This works out to be almost exactly two weeks (14 days), since 10 minutes per block times 2,016 blocks is 20,160 minutes.

Every two weeks, the network essentially asks itself, "How did we do?" It measures the actual time it took to mine the last 2,016 blocks and compares that to the 20,160-minute target.

This simple check leads to one of two outcomes:

This constant back-and-forth is what creates the iconic "stair-step" pattern you see on any bitcoin difficulty chart. Each step up or down is a new adjustment, a perfect visual of the network adapting in real-time. You can actually see this happening live using tools that let you watch block data. For a deeper dive, check out our guide on what a blockchain explorer is and how it works.

This flowchart breaks down the simple, self-governing loop that keeps Bitcoin's block production on a steady rhythm.

As you can see, when more miners jump in and the hashrate climbs, the difficulty rises to compensate. This elegant balancing act is what keeps that 10-minute block time so consistent.

The 2,016-block adjustment cycle calculates difficulty based on how long the last 2,016 blocks actually took — comparing actual time to the 20,160-minute target. This creates a specific manipulation opportunity for large mining pools that control sufficient hashrate to meaningfully influence block production timing near the end of an adjustment period.

The mechanism: the adjustment formula is New Difficulty = Old Difficulty × (20,160 minutes / Actual Time). A mining pool controlling 20%+ of network hashrate can strategically reduce their mining intensity in the final blocks of a cycle to slow block production, increasing actual time above 20,160 minutes. This engineering makes the difficulty decrease on the next adjustment rather than increase — improving the pool's profitability for the entire following two-week period.

On-chain researchers have identified statistical anomalies in block timing distributions that suggest strategic behavior by large pools:

The practical impact is small for any individual adjustment — typically 1-3% manipulation of the adjustment magnitude. But compounded across many cycles and multiplied by a large pool's share of block rewards, the economic advantage is meaningful.

Difficulty adjustments that seem disproportionate to known hashrate changes deserve scrutiny:

For miners evaluating competitive economics, this means large pool membership creates compounding advantages beyond hashrate economies of scale — pools can partially engineer the difficulty environment they operate in. Independent miners and small pools cannot replicate this, widening the profitability gap beyond what aggregate difficulty numbers reveal.

The math behind the adjustment is surprisingly straightforward. While the code itself is complex, the logic is easy to grasp.

New Difficulty = Old Difficulty * (Expected Time / Actual Time)

Let's unpack that:

For instance, imagine the last cycle was completed in just 12 days (17,280 minutes). The network was running too hot. The formula would then increase the difficulty for the next cycle by about 16.6% (20,160 / 17,280). This hands-off, automatic correction is what makes Bitcoin so resilient—it can handle massive swings in global mining power without anyone needing to lift a finger.

The two-week difficulty adjustment cycle creates a systematic, predictable profitability window that sophisticated miners exploit and that traders can use as a timing signal. When a large portion of the network's hashrate suddenly goes offline — due to a price crash, regulatory action, or a competing chain's profitability spike — the difficulty doesn't adjust for up to 13 days. During that entire window, the remaining miners operate at dramatically higher profit margins because the puzzle difficulty is calibrated for a network that no longer exists at that size.

The math makes this concrete. Assume the network runs at 600 exahashes/second (EH/s) with difficulty set accordingly. A major mining facility or geographic cluster representing 150 EH/s (25% of network hashrate) suddenly goes offline. The remaining 450 EH/s still faces difficulty calibrated for 600 EH/s — meaning blocks take longer, but the key insight is that miners still operating have 25% less competition for the same block reward with no immediate difficulty increase penalizing them. Their profitability per unit of hashrate spikes proportionally.

From a trading perspective, this lag window creates a specific pattern on the hashrate chart before it appears on the difficulty chart — a leading indicator that informed traders watch:

The period between the hashrate drop and the difficulty adjustment is when smart miner capital deploys most aggressively. Tracking this lag on the difficulty chart tells you exactly when the next adjustment will occur — difficulty is only updated at the 2,016-block mark, giving you a countdown based on current block production rates. When adjustment is imminent after a sustained hashrate drop, expect a meaningful downward step that signals improved mining economics and often precedes hashrate recovery.

Historically, significant downward difficulty adjustments have often coincided with or slightly preceded Bitcoin price recoveries. The mechanism: when difficulty drops, mining becomes economical again at lower prices — stopping forced selling from miners who had been dumping BTC to cover operational costs during the unprofitable high-difficulty period. The selling pressure that depressed price partially removes itself when economics improve.

Track the difficulty adjustment countdown on any bitcoin difficulty chart tool showing blocks-until-adjustment. A large expected downward adjustment (>5%) following a sustained hashrate decline is worth monitoring as a potential short-term catalytic event.

Looking at a live Bitcoin difficulty chart is like reading the network's vital signs. It tells a story about its health, security, and the intense competition between miners. While it might just look like a line graph at first, its patterns are packed with information. For any serious miner or trader, learning to decode this chart is an essential skill.

Here's an actionable checklist to guide your analysis:

You can't get the whole story just by looking at difficulty. You have to view it alongside the hashrate chart, because the two are locked together. It’s a simple cause-and-effect relationship.

Overlay these two charts, and you'll see they move almost perfectly together. Hashrate is the more jittery, real-time metric that changes every day as miners join or leave. Difficulty is the smoother, lagging indicator that only catches up every two weeks. This relationship is the proof of the incredible, and constantly growing, computational force protecting Bitcoin.

The tight correlation between hashrate and difficulty is the visual proof of Bitcoin's self-regulating design. Hashrate is the input from miners, and difficulty is the protocol's output to maintain balance.

The difficulty ribbon is an advanced indicator derived directly from the difficulty chart that has preceded every major Bitcoin bull market cycle with remarkable consistency. It was developed by analyst Willy Woo and works by plotting multiple simple moving averages (SMAs) of mining difficulty simultaneously — typically 9 SMAs ranging from 9-day to 200-day periods — and analyzing how they compress or expand relative to each other.

Under normal conditions, the longer-period SMAs sit above the shorter-period SMAs because difficulty has been consistently rising over time. The ribbon is "wide" — the moving averages are spread apart. During miner capitulation periods, shorter-period SMAs drop below longer-period SMAs as recent difficulty falls or stagnates, causing the ribbon to compress and cross.

The ribbon compression signal works on a specific logic chain: when mining becomes unprofitable, weaker miners shut down, reducing difficulty, which causes shorter-period SMAs to drop relative to longer-period baselines. This compression and eventual ribbon inversion (short SMAs crossing below long SMAs) marks maximum miner stress — the exact moment capitulation peaks.

Historically, ribbon inversions have appeared within weeks to months before major bull runs in 2015, 2019, and 2020. The mechanism connecting ribbon compression to price: after weaker miners exit, the remaining miners operate at improved profitability, forced selling of BTC to cover operational costs decreases, selling pressure drops, and price begins recovering. The ribbon compresses as selling pressure peaks and then expands upward as conditions normalize and new miners re-enter.

Key levels to watch on the difficulty ribbon:

The difficulty ribbon is available on Glassnode (subscription) and approximated on several free platforms. Overlaying it on a bitcoin difficulty chart with price transforms a simple mining metric into a high-precision macro entry signal.

Once you can spot specific patterns on the Bitcoin difficulty chart, you can start translating that raw data into real insights about the market and what miners are thinking. Every pattern tells a unique story.

This table helps you translate common chart patterns into potential market signals and strategic insights.

Chart PatternWhat It MeansPotential Signal for TradersSteep, Consistent Upward TrendA massive influx of new miners and hardware is joining the network. This indicates strong confidence in Bitcoin's future profitability.A long-term bullish indicator of network health and security. It shows miners are willing to invest heavily, expecting future price appreciation.Sudden, Sharp Downward AdjustmentA significant number of miners have shut off their machines, likely due to unprofitability (low BTC price, high energy costs). This is often called "miner capitulation."A potential short-term bearish signal, as capitulating miners may sell their BTC holdings to cover costs, adding selling pressure to the market.Plateau or Sideways MovementThe hashrate is relatively stable. Miners are neither leaving nor joining the network en masse. This could reflect a period of market uncertainty or equilibrium.A neutral signal. It suggests the market is waiting for a catalyst, like a significant price move or a halving event, to trigger the next big shift in mining activity.Rising Difficulty in a Bear MarketDespite falling prices, hashrate continues to grow. This is a very strong signal of long-term conviction from well-capitalized miners.An extremely bullish long-term signal. It implies that the most efficient miners believe prices will recover and are using the downturn to accumulate more mining power.

Learning to read these signals gives you a powerful edge, allowing you to look past the day-to-day price noise and understand the fundamental forces driving the network.

Knowing what the Bitcoin difficulty chart is is one thing. Actually using it to make smarter decisions? That's where the real magic happens. This isn't just some abstract on-chain metric for network health; it provides concrete, actionable signals for both miners and traders.

For miners, the chart is a strategic roadmap for survival and growth. For traders, it's a peek behind the curtain, revealing the conviction of the network's most committed players. When you connect the dots between difficulty data and market behavior, you can turn chart theory into a powerful strategy.

If you're running a mining operation—whether it's a small home setup or a massive farm—the difficulty chart is one of your most important forecasting tools. It has a direct impact on your revenue and your entire operational strategy. A rising difficulty simply means your hardware earns less Bitcoin over time, relentlessly squeezing your profit margins.

Here’s an actionable checklist for miners:

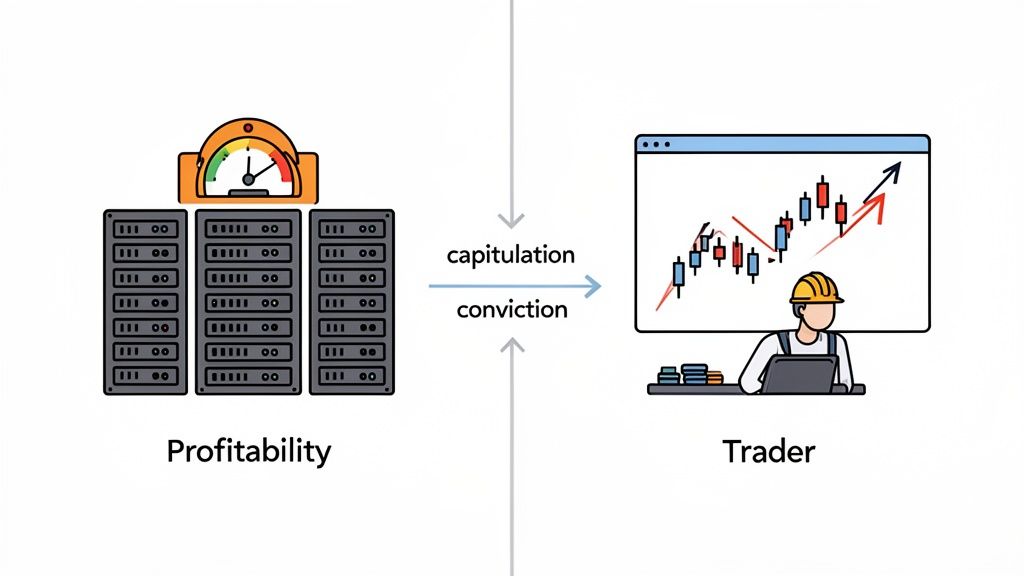

For traders, the Bitcoin difficulty chart is an on-chain indicator that cuts through the noise of daily price swings. It reflects the collective sentiment and economic reality of miners, who are often considered the "smart money" in the Bitcoin world. What they do can offer powerful clues about where the market is headed.

One of the most potent signals is miner capitulation. This is what happens when the BTC price plummets below the cost of mining for a huge chunk of the network. High difficulty plus low prices creates a perfect storm, forcing inefficient or over-leveraged miners to shut down their rigs and sell their BTC just to cover the bills.

Miner capitulation often marks the bottom of a bear market. The intense selling pressure from miners creates a final, brutal washout that clears the deck for a new accumulation phase.

This flood of selling puts immense downward pressure on the market. A sharp, sudden downward adjustment on the difficulty chart is a flashing red light that capitulation is happening. Smart traders watch for this pattern as a sign that the market might finally be scraping the bottom.

But on the flip side, the opposite scenario can be an incredibly strong bullish signal, especially when it seems to defy logic.

When the price of Bitcoin is falling or chopping sideways in a bear market, but the difficulty chart keeps climbing, you need to pay very close attention. This is one of the strongest signs of deep, long-term conviction from the network’s most seasoned players.

This divergence between price and difficulty reveals a few key things:

When you see prices falling while difficulty is rising, it suggests the most informed participants are betting big on a future recovery. For a trader, that's a signal to look past the current market fear and consider accumulating for the long haul. By learning to read these signals, you can make the bitcoin difficulty chart a core part of your market analysis toolkit.

To actually use difficulty analysis to make better decisions, you need data you can trust. A reliable bitcoin difficulty chart isn't just nice to have—it’s essential for both miners and traders who want to stay ahead of the curve.

Thankfully, there are some fantastic tools out there. Some are perfect for a quick, at-a-glance check, while others offer the deep, granular data needed for serious financial modeling. The key is finding the right one for your goals and weaving it into your daily routine.

For anyone serious about tracking the mining landscape, a few platforms are consistently the go-to resources for their accuracy and depth. These are the tools that professional on-chain analysts, miners, and traders lean on every day.

Here are some of the most trusted names in the game:

The best tool is the one that fits seamlessly into your research process. Whether you need a simple visual chart or a complex API feed, the goal is to get reliable data that helps you act with confidence.

Having access to great tools is only half the battle. The real edge comes from making this data a core part of your daily analysis. This means moving beyond just casually checking a chart and turning it into a fundamental piece of your decision-making puzzle.

For a comprehensive look at what different services offer, our guide comparing the top 10 blockchain analytics platforms is an excellent resource to check out.

Think about setting up a dedicated dashboard that pulls in multiple data points. For instance, you could create a single view showing the live BTC price, current difficulty, the next projected adjustment, and the hashrate. By watching these metrics together, you can spot divergences that often signal an upcoming shift in the market.

For active traders using a platform like Wallet Finder.ai, difficulty data adds another powerful layer of context. Let's say you get an alert that smart money wallets are accumulating Bitcoin during a bear market. If you see that happening while mining difficulty is steadily climbing, it adds serious weight to the bullish case. This fusion of on-chain metrics with real-time trading activity paints a much richer, more actionable picture of what’s really going on.

As we wrap things up, you probably have a few questions rattling around. The Bitcoin difficulty chart is a deep subject, and some of these concepts can feel a bit counterintuitive at first. Let's clear up the most common points of confusion with some straightforward answers.

Think of this as your quick-reference FAQ. Once you nail these concepts, you'll be able to read the chart like a pro and apply its insights with confidence.

Yes, absolutely—and it’s a critical part of what makes the network so resilient. While the bitcoin difficulty chart shows a clear upward trend over the long haul, downward adjustments are essential for keeping the system stable.

A downward adjustment kicks in when the network's total hashrate drops. This usually happens when a chunk of miners power down their rigs, often because a falling BTC price makes their operation unprofitable. To keep new blocks coming in close to that 10-minute target, the protocol automatically makes the mining puzzle easier for the remaining miners. This shows up as a distinct downward step on the chart.

In theory, there's no such thing as "too high." Difficulty is just a measurement of the immense computing power being thrown at the network. A rising difficulty is actually a sign of a healthy, secure, and highly competitive mining ecosystem.

The real friction happens when difficulty climbs much faster than the price of Bitcoin. This puts miners in a tough economic squeeze, leading to a few predictable outcomes:

You can think of rising difficulty as a natural selection process. It weeds out the inefficient operators, ensuring only the most robust and well-capitalized miners survive. This cycle ultimately makes the entire network stronger.

The halving event doesn't directly touch the difficulty adjustment algorithm itself. However, it sends a massive shockwave through the mining world that has a huge indirect impact on difficulty.

When a halving occurs, the block reward gets sliced in half. The April 2024 halving, for example, dropped the reward from 6.25 BTC down to 3.125 BTC. For miners, that's an instant 50% pay cut, assuming BTC price and transaction fees stay the same.

This revenue shock immediately pushes the least profitable miners out of the game. As they power down, the total hashrate falls, triggering a downward difficulty adjustment in the next cycle. This pattern is a classic post-halving signature you can spot on any historical bitcoin difficulty chart.

It really depends on who you ask.

From a network security standpoint, higher difficulty is fantastic. It's a direct measure of the real-world resources—hardware, energy, capital—being poured into securing the blockchain. This makes it incredibly expensive and practically impossible for an attacker to pull off a 51% attack to try and rewrite history. A rising difficulty is one of the strongest votes of confidence in the network's health.

For an individual miner, though, a higher difficulty is a double-edged sword. It means more competition and smaller rewards for their hash power. It's a constant pressure to find cheaper electricity and more powerful rigs just to stay profitable.

Here’s a simple way to look at it:

PerspectiveWhy It's GoodWhy It's a ChallengeNetwork SecurityMakes the blockchain virtually tamper-proof. Signals miner confidence and investment.N/AIndividual MinerShows the network is valuable and worth participating in.Ramps up competition, squeezes profits, and forces constant hardware upgrades.

The next adjustment can be predicted with remarkable accuracy because the whole process is transparent and follows a strict set of rules. The difficulty resets precisely every 2,016 blocks.

Analysts forecast the upcoming change by simply watching the current block production rate. They measure how fast the last few hundred blocks were found and project that speed forward to the end of the 2,016-block cycle.

Plenty of data sites, like BTC.com and CoinWarz, provide live estimates showing the predicted change and when it's expected to happen. These forecasts get sharper and more accurate the closer we get to the adjustment.

By getting a handle on these nuances, you can go from just looking at the bitcoin difficulty chart to actually understanding what it's telling you. This knowledge adds a powerful layer to your analysis, whether you're running a mining farm or trading the market.

Up to 13 days — the remaining time in the current 2,016-block adjustment cycle when the hashrate drop occurs. If hashrate crashes on day 1 of a new cycle, you have nearly two full weeks of the old difficulty applying to a reduced network. If it crashes on day 12, the adjustment comes within 2 days.

This lag matters for both miners and traders. Miners who remain operational during the lag period earn disproportionately higher revenue because they face less competition with difficulty unchanged. For traders, monitoring the hashrate-to-difficulty divergence on tools like Glassnode provides advance warning of an imminent large downward adjustment — historically a potential price floor signal as forced miner selling pressure decreases when economics improve.

The difficulty ribbon plots multiple simple moving averages of mining difficulty simultaneously (typically 9 SMAs from 9-day to 200-day periods). When short-term SMAs drop below long-term SMAs due to recent difficulty stagnation or decline, the ribbon compresses and inverts — signaling peak miner capitulation.

Historically, ribbon inversions have appeared within weeks to months before major bull market resumptions in 2015, 2019, and 2020. The logic: inversion marks maximum forced selling from unprofitable miners, after which selling pressure structurally decreases as weak miners exit and economics normalize for survivors. The ribbon re-expanding after inversion (short SMAs recovering above long SMAs) is the confirmation signal that capitulation is complete.

Yes — in one specific way. The difficulty chart shows aggregate global hashrate, but not its geographic distribution. High aggregate difficulty combined with heavily concentrated hashrate (one country controlling 60%+) presents a hidden vulnerability: a single government action, power policy, or conflict could eliminate enough hashrate to temporarily reduce difficulty to levels where well-resourced attackers might find a 51% attack feasible during the adjustment lag.

China's 2021 mining ban caused a -28% single-period difficulty drop — the largest in Bitcoin's history — demonstrating this risk. Supplement difficulty chart analysis with geographic hashrate data from the Cambridge Centre for Alternative Finance and mining pool distribution data on mempool.space to assess whether difficulty reflects genuinely distributed security or concentrated fragility.

To get an even sharper edge, try pairing these on-chain insights with real-time wallet tracking. A tool like Wallet Finder.ai helps you see what smart money is doing, turning raw network data into signals you can act on. See how top traders use these tools to get ahead by visiting https://www.walletfinder.ai.