How to Take Profits in Crypto: A Guide

Learn how to take profits in crypto with proven strategies. This guide covers exit plans, on-chain analysis, and tax tips to secure your gains.

March 2, 2026

Wallet Finder

January 16, 2026

A basic bitcoin price alert—a notification when the price hits a certain number—is a good start, but it's just that: a start. On its own, a simple price trigger doesn't give you the full story, which can lead traders to jump on false signals or, even worse, miss the boat on a real opportunity.

An effective alert system needs to be much smarter than just a price ticker.

In a market that moves as fast as crypto, relying only on simple price pings is like trying to navigate a hurricane with just a compass. You’re missing most of the critical data.

Think about it: an alert that Bitcoin just hit $70,000 doesn't tell you how or why. Was it a low-volume drift upward that could easily reverse? Or was it a massive surge backed by billions in trading activity? The difference between those two scenarios is everything when your money is on the line.

This guide will walk you through a more robust, multi-layered approach. Instead of reacting to a single data point, we’ll combine price levels with other key metrics to build a powerful signaling system that helps you get ahead of market moves, confirm trends, and sidestep those frustrating fakeouts.

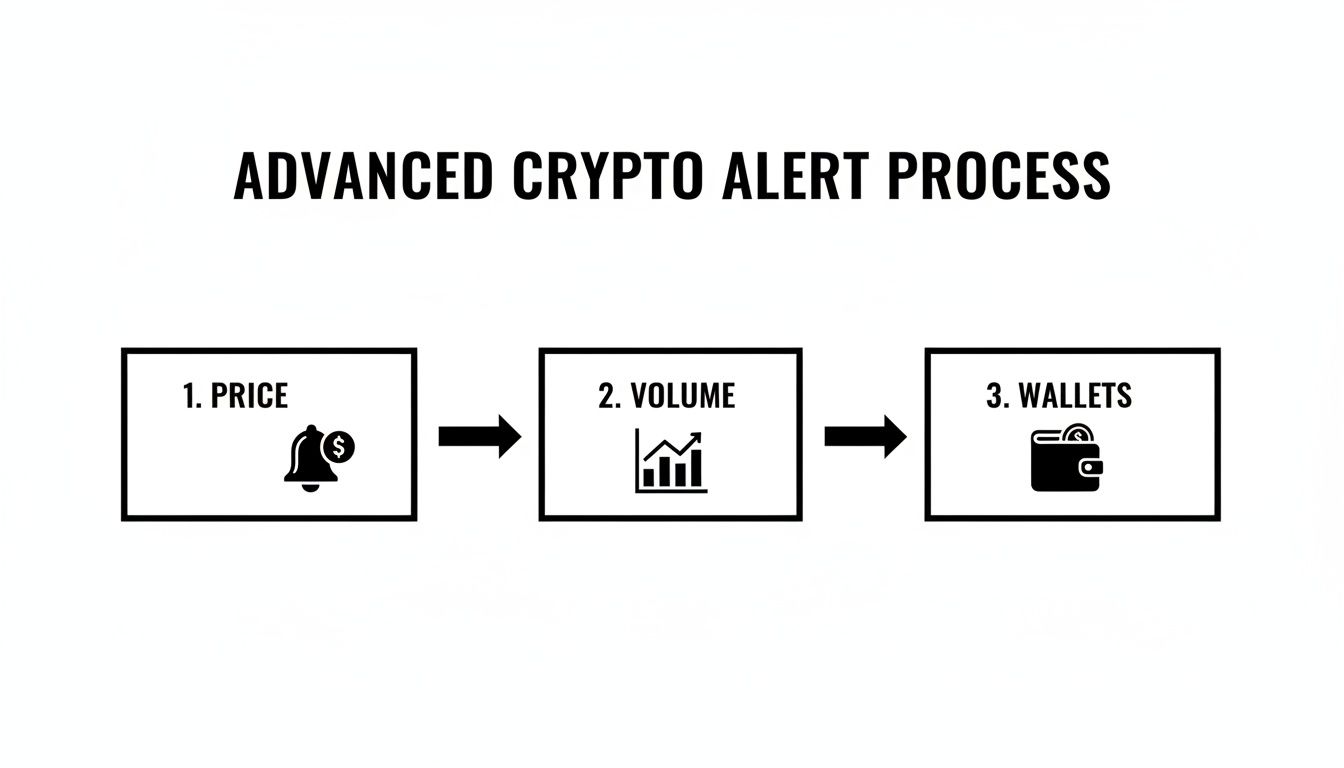

A truly sophisticated alert system pulls in several data streams at once to paint a complete picture of what's happening. This approach transforms your trading from being reactive to proactive. The best systems are built on three core pillars:

This flow shows how you can layer price, volume, and on-chain wallet data to create much smarter, more reliable crypto alerts.

As you can see, layering data like this takes you from a basic signal to a high-conviction trading setup. Of course, you need the right platform to build a system like this. For a full breakdown, check out our guide on the best crypto alerts app to find a tool that matches your strategy.

With a tool like Wallet Finder.ai, you can get instant notifications the moment top wallets make a move, giving you a serious edge. This approach ensures you're not just watching the market—you're actually understanding it.

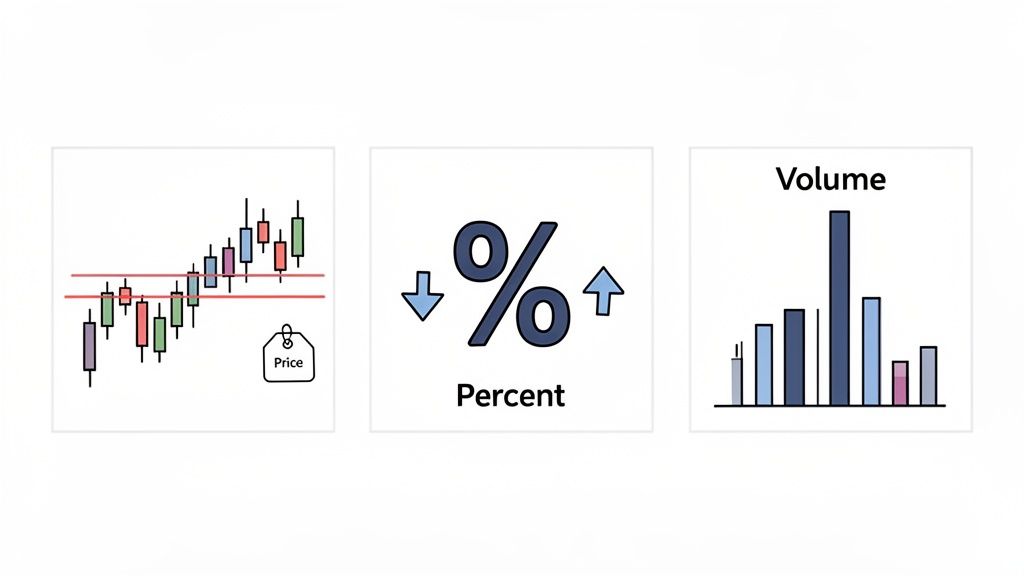

Crafting a powerful Bitcoin price alert system begins with one crucial choice: the trigger. This is more than just picking a random number. It's about defining the exact market action that matters to your strategy. To get real signals instead of just noise, you need to look beyond simple price points and incorporate percentage shifts and volume spikes.

The most straightforward trigger, and the one most people start with, is a specific price level. These are typically set at key technical zones—think historical support and resistance, all-time highs, or big psychological numbers like $70,000. An alert at one of these levels is your early warning that a major market decision is happening, giving you time to prepare for a breakout or breakdown.

Actionable price levels to watch:

Price levels are great for static targets, but the market is anything but static. That's where percentage-based alerts shine. These triggers ping you when Bitcoin's price moves by a specific percentage in a set timeframe—like a 5% drop in one hour or a 10% jump in 24 hours.

This type of alert is fantastic for catching sudden changes in momentum or volatility. It's less concerned with a specific price and more about the speed and size of the move. A sharp, fast drop could signal panic selling, while a rapid surge might point to a FOMO rally. Both are actionable events you don't want to miss.

Key Takeaway: Percentage alerts catch what price-level alerts often can't. They act as your eyes and ears for unexpected market velocity, giving you a head start to react to breaking trends or sudden reversals.

A price move on its own can be a trap. That's why volume-based triggers are so essential—they confirm the strength behind a move. A Bitcoin price alert that only goes off when the price crosses a key level and trading volume surges is infinitely more reliable.

High volume means more people are participating, which suggests the move has real conviction. For instance, a breakout above resistance on weak volume is sketchy and has a high chance of failing. But if that same breakout happens on volume that’s 50% higher than the daily average? That screams strong buying pressure and makes the trade much more likely to succeed. This metric is so important that we wrote a whole guide on how to master crypto volume analysis.

To make it easier, here's a quick comparison of the different trigger types. This table should help you figure out which one aligns best with your goals, so you can build an alert system that actually works for you.

Ultimately, the most effective traders don't just pick one type of trigger; they combine them. Layering price, percentage, and volume alerts creates a robust system that weeds out false signals and highlights the high-probability opportunities worth your time and capital.

A perfectly timed trigger is worthless if the alert arrives a second too late. The delivery channel you choose can be the difference between catching a profitable move and watching it from the sidelines. Picking the right channel for your bitcoin price alert is all about getting critical information to you instantly, in a way that you can actually act on.

Your trading style should dictate the channel. An intraday trader glued to the charts needs real-time pings for every move. A long-term HODLer, on the other hand, might just want a daily summary. The goal is to match the notification method to your strategy so you're not overwhelmed by noise or left in the dark during a market-shaking event.

Different channels are built for different jobs. Push notifications are all about speed, blasting alerts directly to your phone’s lock screen for at-a-glance info. This is perfect for time-sensitive triggers, like a breakout above a key resistance level where every second counts.

Email, however, is better for less urgent, more detailed updates. You could set it up to send a daily digest of price movements or a weekly summary of interesting on-chain activity. This helps you stay in the loop without constant interruptions, making it a great tool for macro analysis.

Telegram has become the go-to for active DeFi traders. Its bot integrations allow for instant, customizable alerts that you can even share in private groups or channels. It creates a collaborative trading hub right on your phone. Platforms like Wallet Finder.ai use this to send instant Telegram alerts on smart money movements.

To help you decide, here’s a quick breakdown of the most common alert channels and where they shine.

For more advanced traders, webhooks are the ultimate power tool. Think of a webhook as an automated message that one app sends to another when something specific happens. In our case, a bitcoin price alert trigger could automatically send a command to a trading bot.

For example, you could set up a webhook to fire off a buy order the second Bitcoin breaks a major resistance level and volume spikes. This takes emotion and manual fumbling completely out of the equation, letting you execute your strategy with machinelike precision.

This usually involves connecting your alert platform to a trading bot through an API. If you're curious about the technical side, you can learn more about how to use an API for crypto prices to build your own custom solutions. This approach turns a simple notification into a fully automated trading action.

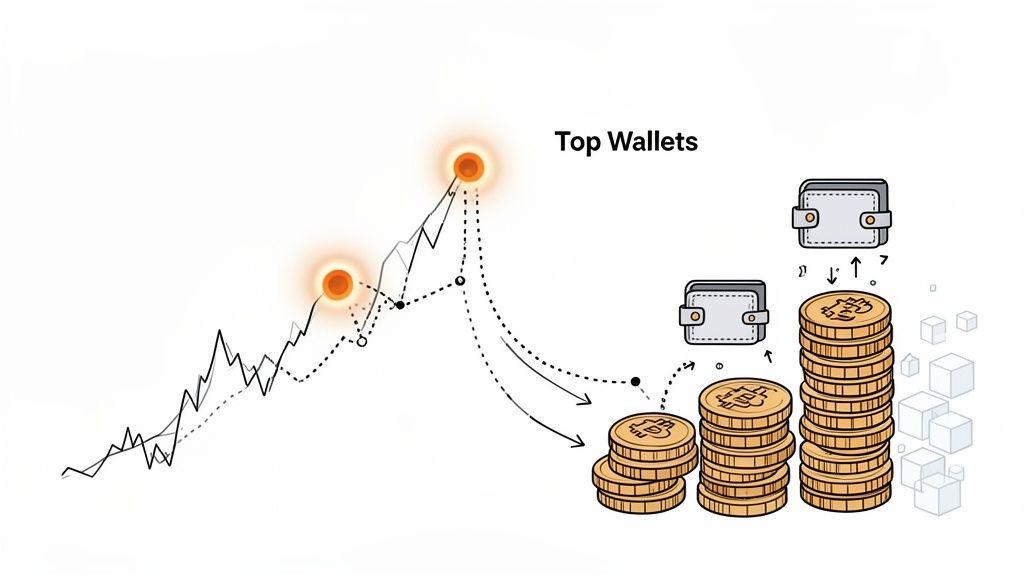

While price and volume triggers are essential, the real edge comes from layering on-chain activity into your alerts. This is what separates the pros from the crowd. It transforms a simple bitcoin price alert into a high-fidelity signal, giving you a peek at what the most successful players are doing right now.

Picture this: Bitcoin takes a dive and hits a key support level. Your basic price alert goes off, but you're stuck. Is this a genuine chance to buy the dip, or is it the start of a much deeper crash?

Now, imagine a second alert pops up just moments later. It shows that several top-performing wallets—what many call "smart money"—have just begun accumulating millions of dollars in Bitcoin at that exact price. That changes everything, doesn't it?

That's the advantage of mixing on-chain analysis with your alerts. It adds a layer of confirmation that price and volume alone can't provide. You’re no longer just reacting to a number on a screen; you're seeing the conviction of traders with a proven track record.

The whole idea behind a "smart money alert" is to watch the blockchain for moves made by highly profitable wallets, often called whales or expert traders. We're talking about addresses with a history of high PnL (Profit and Loss), which signals they know how to play the game.

When their activity lines up with your own technical levels, you get an incredibly potent signal.

Here’s how you can start building these more advanced alerts:

The strategy here is all about finding patterns where whale movements come before major price action. A standard bitcoin price alert tells you what happened. A smart money alert helps you understand why it might be happening.

By tracking wallets with a demonstrated history of profitability, you can essentially look over the shoulder of the market's best performers. Their actions can provide the conviction needed to act on a price signal with confidence.

Let's make this practical. The market is in a full-blown panic, and prices are in a freefall. Fear is everywhere, and your basic price alerts are firing off constantly, creating more noise than clarity.

But you’ve already set up a smart money alert using a tool like Wallet Finder.ai. In the middle of the chaos, you get one, single, high-priority notification:

"Bitcoin has dropped to $58,500 (weekly support), and 3 of your tracked high-PnL wallets have just collectively bought $10 million in the last hour."

This one piece of information cuts straight through the noise. It shows that while the retail crowd is panic-selling, some of the most successful traders are confidently buying the dip. This isn't just a price alert anymore—it's actionable market intelligence. It’s a powerful confirmation signal that helps you make a far more informed and less emotional decision.

An endless stream of notifications is just noise, not a signal. When every minor fluctuation triggers a bitcoin price alert, you quickly hit "alert fatigue"—that point where you start ignoring everything, potentially missing the one notification that truly matters. The whole point is to build a smarter system where every single ping is meaningful and actionable.

This means you have to move beyond setting simple price points and start creating more intelligent, conditional alerts. Instead of getting buzzed every time Bitcoin moves $500, you build a rule that only fires when several conditions are met at once. This approach filters out the market's daily chatter and focuses your attention squarely on high-probability events.

For example, a far more powerful alert would be: Price > $75,000 AND 24h Volume > $40B. This setup ensures you're only notified when a significant price breakout is actually supported by strong market participation, which drastically cuts down on false alarms.

Not all market events carry the same weight. A potential breakout above an all-time high is more critical than a minor dip to a local support level. That’s why it’s so important to tier your alerts, assigning different notification channels or sounds based on how urgent they are.

Here’s a simple tiered system you can implement:

This tiered system keeps you responsive to major opportunities without burning you out on routine market movements.

Your perfect alert setup depends entirely on your trading strategy. A memecoin degen needs completely different signals than a long-term, patient investor. Here are a few practical examples to get you started.

Key Insight: The best alerts are tailored to a specific strategy. A generic

bitcoin price alertserves everyone poorly, but a customized one can become a trader's most valuable tool for staying ahead of the curve.

Here’s how a few different trader profiles might structure their alerts:

1. The High-Volatility Memecoin TraderThis trader thrives on chaos. They need to know the second market sentiment is shifting, since Bitcoin often leads the entire altcoin market.

BTC price change > 5% in 1 hour OR BTC Dominance drops by 2% in 24 hours.2. The Long-Term InvestorThis person is focused on accumulating during periods of fear and couldn't care less about minor price swings. Their game is patience.

BTC price enters predefined 'accumulation zone' ($50k-$55k) AND on-chain data shows wallets > 1,000 BTC are buying.Bitcoin's price has delivered some jaw-dropping returns over the years, making these accumulation zones incredibly important. From 2010 on, annual returns were all over the place: a staggering 30,203% in 2010, 5,870% in 2013, and 1,338% in 2017. You can dig into more of this data on Bitcoin's historical price performance on Bankrate.com.

This volatility is pure gold for DeFi copy traders using tools like Wallet Finder.ai—spotting wallets that mirrored smart money entries around key dips could multiply gains. By building a thoughtful alert system, you can turn this volatility into an opportunity instead of a source of anxiety.

Theory is great, but let's talk about what really matters: how a solid alert system performs in the wild. A well-tuned bitcoin price alert setup isn't just about saving you time; it’s about turning hindsight into foresight, giving you the chance to act on historic market moves instead of just reading about them later.

We’re going to walk through a couple of major market turning points to see exactly how a multi-layered alert strategy would have played out. Think of these as a practical blueprint for setting up your own system to spot the next big opportunity.

Remember the "COVID crash"? It was a moment of absolute panic in the streets—and a legendary buying opportunity for those who were prepared. On March 12, 2020, Bitcoin plummeted nearly 40% down to $3,850 in just a few hours.

A basic price-level alert would have been your first ping.

Price < $4,000But to act with real conviction, you needed more. An advanced alert combining price with on-chain data would have shown that while retail was panic-selling, huge wallets were quietly buying up all the cheap coins they could get. That's the kind of confirmation that helps you pull the trigger. You can relive the drama on these interactive Bitcoin charts on Bitbo.io.

Catching tops is every bit as important as nailing the bottoms. Bitcoin's run in 2021 was incredible, but as it pushed to new all-time highs, the rally started looking tired. The key tell? Smart money wallets began offloading their holdings, a classic warning sign that a deep correction was on the horizon.

A price alert alone might have kept you dangerously bullish. But an alert tied to on-chain distribution would have been an unmistakable signal to take profits and protect your capital before the subsequent 50%+ crash.

Here’s how a smarter alert could have gotten you out near the peak:

Price > $65,000 AND Tracked 'Smart Money' Wallets begin net selling.These examples make it crystal clear. A proactive, multi-layered alert system is a non-negotiable tool for any serious trader. It helps you cut through the noise and focus on what the biggest players in the market are actually doing.

Jumping into crypto alerts always brings up a few questions. The goal is to build a system you can actually trust, one that cuts through the noise and gives you a real edge. Let's tackle some of the most common things traders ask when setting up their first bitcoin price alert.

The "best" app comes down to your needs. Here's a quick guide:

This is a big one. To avoid "alert fatigue," you have to shift your mindset from quantity to quality. Forget setting alerts for every minor price flicker. Instead, focus on the levels that actually matter.

A few practical ways to do this:

Absolutely. Think of Bitcoin as the market's weather vane. Its price action is the tide that either lifts all the other crypto boats or sinks them. Many pro traders set alerts on Bitcoin not to trade BTC itself, but as a sentiment indicator for their altcoin bags.

Here are two actionable strategies:

5% in 1 hour). When it triggers, immediately tighten stop-losses on your altcoin positions.Ready to stop reacting and start anticipating the market? With Wallet Finder.ai, you can create a multi-layered alert system that combines price, volume, and smart money movements. Discover profitable wallets and get instant notifications when they make a move. Start your 7-day trial today and see what the pros are trading.