7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 18, 2026

Imagine snagging a 100x gain right as it’s taking off, all from a single ping on your phone. That’s the kind of power a modern crypto app alert puts in your pocket. These aren't just notifications; they're real-time signals that can give you a serious edge in DeFi, shifting your entire trading game from reactive to predictive.

In the fast-paced world of crypto, the speed at which you get information often draws the line between a monster profit and a painfully missed opportunity. This is exactly where crypto app alerts become a non-negotiable tool.

We're not talking about basic price pings that tell you when Bitcoin hits a certain number. Today's advanced alerts are a sophisticated intelligence feed, scanning the blockchain 24/7 for the events that really matter. This is how you see what the market is doing before it shows up on the charts.

The real advantage isn't just knowing when a price moves—it's understanding why it's about to move. A price alert for a token crossing a resistance level is useful, but it’s a lagging indicator; the price has already moved. The best traders hunt for leading indicators—the on-chain actions that cause those price spikes.

Modern alert systems like Wallet Finder.ai change the game by focusing on critical on-chain activity:

By tracking the moves of top-performing wallets, you're essentially looking over the shoulder of a professional trader. You gain insight into market trends before they hit the mainstream.

The need for these alerts is only getting more critical as the crypto space explodes. The global crypto wallet market was valued at USD 10.51 billion in 2024 and is expected to rocket to USD 77.17 billion by 2033, driven by a user base of over 560 million people worldwide.

In an environment this crowded and fast, trying to catch everything manually is impossible. An automated system that delivers high-signal alerts isn't just a nice-to-have; it's a fundamental tool for survival and success. You can learn more about the crypto wallet market growth projections to see just how fast things are moving.

A powerful crypto app alert system flips your entire strategy. You stop chasing pumps and start anticipating them. This proactive approach, fueled by real-time, actionable data, is what separates hobbyists from professional traders who consistently find and keep their edge.

Not all crypto alerts are the same. A pilot needs different instruments for altitude, speed, and direction; a trader needs a varied toolkit of alerts to get a clear picture of the market. Knowing what each alert does is the first step to building a data-driven trading strategy.

Let's break down the essential alert types every serious trader should use.

These are your non-negotiable basics for monitoring market movements and your own activity.

This is where the real competitive edge is found. On-chain alerts provide leading indicators by tracking the actions of key market participants before they impact the price.

The diagram below shows how these alert categories form a complete monitoring system.

As you can see, a solid system connects price action, smart money moves, and liquidity events to give you the full story. Platforms like Wallet Finder.ai specialize in these advanced on-chain alerts.

Together, these alerts form a safety net. They let you monitor not just opportunities but also the risks hiding in plain sight. They are the market's pulse, delivered right to your device.

The demand for this detailed monitoring is exploding. In a market where timing is everything, crypto alerts are a lifeline. For traders tracking wallets on hot networks like Base or Solana, these real-time signals are indispensable. Check out our guide on mastering crypto price alerts to dial in your basic setup.

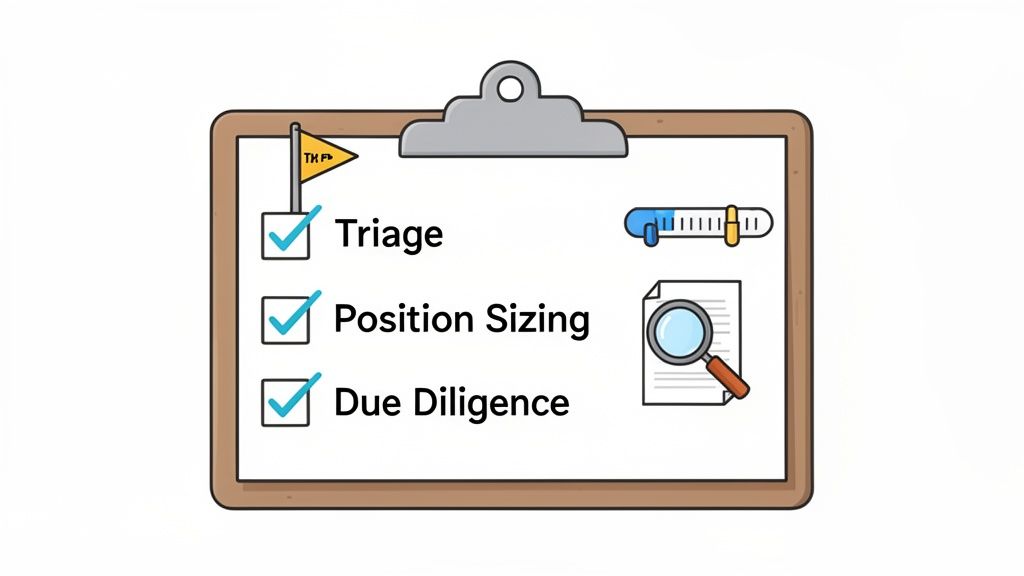

Getting dozens of crypto app alerts is easy. Turning that firehose of information into consistent profit is the real skill. Professional traders build a disciplined workflow around their alerts, letting them cut through the noise, validate opportunities, and trade with confidence.

Here’s a step-by-step framework you can follow:

Think like a medic on a battlefield—you can't waste time on minor scrapes when there are critical injuries. Elite traders instantly sort incoming alerts to zero in on high-signal events.

This strategic filtering prevents burnout and ensures you spend your mental energy on what actually matters.

Once a high-priority alert hits, don't blindly copy the trade. Use it as a starting point to quickly build or confirm a trading thesis. A platform like Wallet Finder.ai, packed with rich contextual data, is essential here.

Let’s walk through a typical workflow:

This process hammers home a critical principle: alerts are for discovery and validation, not blind execution. The goal is to move from raw information to an informed decision, quickly but methodically.

Beyond copy trading, alerts are a game-changer for timing your own entries and exits. By tracking the flow of smart money, you can often see major market moves brewing before they appear on a price chart.

For instance, setting an alert for when several top-performing wallets start buying the same asset can be a massive tell that a trend is forming. This adds a powerful layer of confirmation to your technical analysis. A bullish chart pattern looks much better when it’s backed by alerts showing the smartest wallets are also going long.

Ultimately, using alerts this way transforms trading from a reactive gamble into a strategic, data-driven discipline.

The right tool can make or break your trading strategy. With so many options, you need a clear way to pick a crypto app alert system that delivers a real edge. This is about moving past simple price dings to find a tool that provides actionable intel.

Your evaluation should boil down to four critical areas. These pillars separate basic, noisy tools from the professional-grade platforms that successful traders use.

An alert without context is a distraction. An alert with context—showing a wallet's profitability, past trades, and win rate—is a high-probability trading signal.

The difference is like night and day. One tells you it's raining; the other tells you a storm is coming. Here’s a breakdown of how they stack up against our four pillars.

While a basic price alert has its place, it’s a relic in today's market. To compete, you need the deep, contextual intelligence that only an advanced on-chain crypto app alert system can deliver.

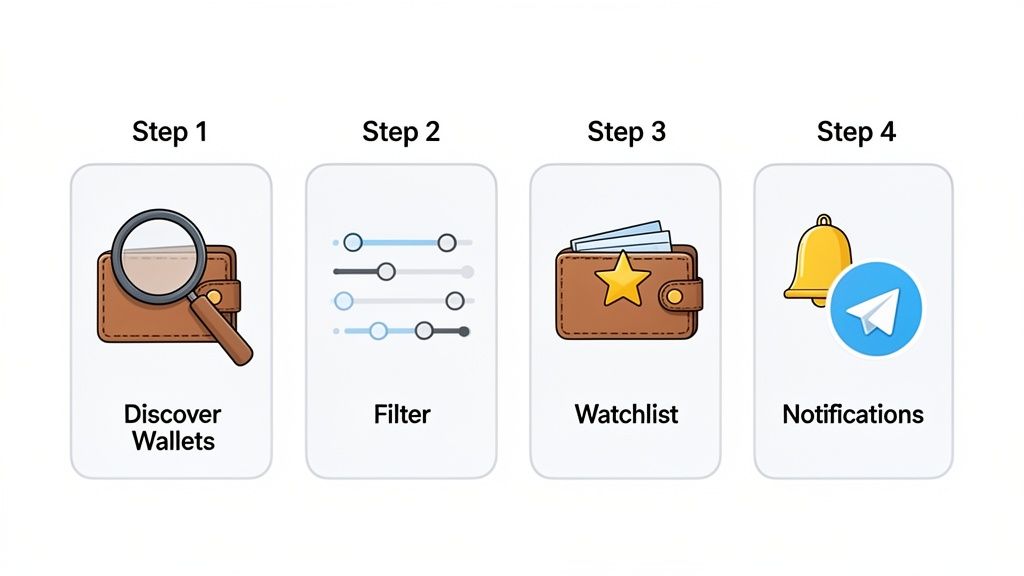

Theory is great, but let's get practical. Setting up your first high-quality crypto app alert is simple. This guide will walk you through the process using Wallet Finder.ai, turning raw on-chain data into actionable trading signals sent right to your phone.

The goal is to get the right notifications by homing in on smart money, so you can monitor the pros instead of passively watching the market.

First, you need to find wallets that are consistently making money.

> $1M> 75%This ensures you’re tracking elite traders, not the average Joe.

Once you've found a promising wallet, add it to a watchlist and turn on alerts.

Pro Tip: Don't just track one superstar. Build a watchlist of 5-10 top-performing wallets in a niche you care about. When you get alerts that multiple of these wallets are buying the same token, that's a much stronger signal.

By following these simple steps, you've just built a powerful, personalized smart money alert system. You're no longer a spectator; you're monitoring the key players who move the market.

Getting powerful crypto app alerts is only half the battle. A disciplined workflow is what turns that data into a real strategic edge. Here are three essential best practices.

Not every ping deserves your immediate attention. You must have a system to instantly sort high-signal alerts from market noise.

This prioritization helps you focus your energy where it counts and avoid alert fatigue.

Once you’ve flagged a high-priority alert, do not blindly copy the trade. A good alert is a signal to start your due diligence. A platform like Wallet Finder.ai provides the data to validate the signal.

An alert tells you what happened. A deep dive into the wallet's history tells you why it matters. Use the full trading history, PnL, and win rate to confirm if the new trade aligns with a consistently winning pattern.

This simple check is your best defense against acting on a fluke and adds a crucial layer of confirmation to your decisions.

Not every signal carries the same weight, so your trade size shouldn't either. It must reflect the strength of your conviction.

This measured approach to sizing is a cornerstone of professional risk management. In a market projected to hit USD 100.77 billion by 2033 with over 560 million users, these disciplined practices are what separate profitable traders from the crowd. You can learn more about the growth of the crypto wallet market to see just how big this space has become.

Once you start using alerts, a few common questions always pop up. Let's tackle them head-on to help you get past the initial learning curve.

This is the number one concern, and the solution is to make your alerts smarter, not just turn them off.

They play a different, more strategic role. A price alert is a lagging indicator—it tells you what has already happened. An on-chain wallet alert is a leading indicator—it shows you what influential traders are doing right now, often just before a major price move.

Think of it this way: A price alert tells you the final score of the game. An on-chain alert is like having a seat on the team's bench, giving you a huge clue about the next play.

When you track actions instead of just prices, you shift from being reactive to proactive.

Bluntly, no. Blindly mirroring every trade you see is a fantastic way to lose money. Alerts are incredible for finding opportunities, but they are not a magic "buy now" button.

Here’s the right way to approach it:

Crypto alerts are an amazing tool for finding opportunities you’d otherwise miss, but they work best when combined with your own research and disciplined trading habits.

Ready to stop reacting to the market and start anticipating it? Wallet Finder.ai gives you the on-chain intelligence and real-time alerts you need to trade like a pro. Start your free trial today and see what the smart money is doing.