GE price tracker: How to monitor GE stock

Learn how to use a ge price tracker to monitor GE stock in real time with apps, spreadsheets, or APIs.

March 5, 2026

Wallet Finder

February 16, 2026

A cryptocurrency price API is an application programming interface that gives developers programmatic access to real-time and historical crypto price data. Think of it as a data pipeline connecting your application directly to market information from a whole universe of exchanges. It's how you integrate pricing, volume, and market cap data right into your software.

At its heart, a cryptocurrency price API is the engine powering countless applications in the digital asset space. Instead of having your code manually scrape prices across dozens of exchanges—a messy and unreliable process—you can make a simple call to an API endpoint to get structured, clean data. This is fundamental for building any tool that needs up-to-the-minute market info.

You can think of it as a universal translator. It takes the complex, fragmented data from all these different market sources and does the heavy lifting of aggregating, cleaning, and standardizing it. Then, it delivers everything to your app in a predictable format like JSON.

The demand for accurate, timely crypto data isn't just growing; it's exploding. The global cryptocurrency market is on track to hit USD 18.26 billion by 2033, growing at a compound annual rate of 14.5%. This rapid expansion shines a spotlight on the critical need for dependable API providers that can supply the data backbone for sophisticated market intelligence tools. If you want to dig into the numbers, the full market analysis from Grand View Research is worth a read.

This growth is fueled by everyone from retail traders to huge institutions, all of whom rely on this data for critical functions:

Without a robust cryptocurrency price API, these applications would be slow, unreliable, and simply unable to compete. APIs form the foundational data layer for a massive slice of the crypto economy, giving developers the power to create valuable tools that help us all make better financial decisions.

Choosing the right crypto price API is the bedrock of your entire project. Get this wrong, and you're looking at failed trades, wonky portfolio tracking, and a user experience that sends people running for the exit. That's why it's critical to vet any potential provider against a solid set of benchmarks.

Think of it like picking the engine for a race car. You wouldn't just grab one off the shelf. You’d dig into its horsepower, reliability stats, and efficiency numbers. We need to apply that same level of rigor here. The API's data accuracy, latency, asset coverage, and uptime will directly define how well your application performs in the real world.

First up, and arguably the most important, is data accuracy. Your API has to pull its information from reputable, high-volume exchanges to give you a true market price. An API that scrapes data from low-liquidity sources is serving up poison—skewed prices that can wreck any financial application.

Just as critical is latency, which is simply how fast the API delivers fresh price updates. For anything like trading bots or real-time arbitrage finders, milliseconds matter. A low-latency feed, usually powered by WebSockets, is completely non-negotiable for these time-sensitive jobs. High latency means you're trading on old news, and that’s a fast track to losing money.

Next, you need to look at the breadth of its asset coverage. Does the API even support the specific cryptocurrencies, tokens, and exchanges you need? A service with spotty coverage will hamstring your app's usefulness from day one, forcing you to patch in multiple APIs and adding a ton of complexity and cost.

Reliability, measured as uptime, is another deal-breaker. A serious API provider will offer a Service Level Agreement (SLA) that guarantees a specific uptime, which should be 99.9% or higher. Constant downtime makes your application useless and shatters user trust. Before you even think about committing, check the provider's historical uptime records and their public status page.

Key Takeaway: Your application's reliability is a direct mirror of your API's reliability. Choosing a provider with documented high uptime and a clear SLA is essential for building a professional-grade product that people can actually depend on.

Finally, don't forget how external factors can move the needle on price data. You can learn more about how social media sentiment predicts crypto prices in our guide on the topic.

The article correctly identifies data accuracy as the most important evaluation criterion. The specific problem most developers don't discover until it causes application failures: the same token can show meaningfully different prices across different API providers at the same moment, not due to data delay but due to fundamental differences in how each provider calculates an aggregate price from multiple exchange feeds.

The divergence sources run deep. CoinGecko calculates its global average price using a volume-weighted formula across all exchanges it tracks, including smaller venues. CoinMarketCap uses its own proprietary price calculation that excludes exchanges it classifies as having suspicious volume, using a different exchange quality scoring methodology. Kaiko and Amberdata use only institutional-grade exchange feeds with strict wash trade filtering. The same BTC/USD pair at the exact same millisecond can legitimately show prices ranging $50-$200 apart across these providers during normal market conditions — and $500-$2,000 apart during high-volatility events when exchange prices briefly decouple.

For a portfolio tracker, this divergence is a display aesthetic issue. For an algorithmic trading bot executing against a specific exchange, it becomes a critical problem: your bot's logic uses API price X to determine entry, but the exchange it's actually trading on is priced at X + $150. The strategy's edge calculation is based on false premises.

Different applications need different aggregation approaches:

Before committing to any API for price-sensitive applications, run a parallel comparison test for at least 24 hours during a volatile market session: log prices from your shortlisted APIs at identical timestamps and measure divergence magnitude and frequency. This tells you the real-world accuracy gap before it manifests in production.

To make this process easier, use this checklist to score potential API providers against the most important technical and business requirements. It helps standardize your evaluation and ensures you don't overlook a critical detail.

CriteriaDescriptionWhy It MattersData AccuracyAre the prices sourced from high-volume, reputable exchanges?Low-quality sources lead to inaccurate prices and bad trades.LatencyHow fast are new data points delivered (in milliseconds)?Low latency is crucial for real-time applications like trading bots.Asset CoverageDoes it support all the coins, tokens, and chains you need?Incomplete coverage limits your application's utility.Reliability (Uptime)What is the provider's guaranteed uptime (SLA)? Look for 99.9%+.Frequent downtime makes your product unreliable for users.Documentation QualityIs the documentation clear, complete, and full of code examples?Good docs save hundreds of hours in development time.Scalability & Rate LimitsCan the API handle your projected request volume as you grow?Hitting rate limits can break your app; high costs can kill your business.Connection TypesDoes it offer both REST API and WebSockets for real-time streams?WebSockets are essential for low-latency, real-time data feeds.Pricing ModelIs the pricing clear, predictable, and aligned with your business model?Unexpected costs can make your project financially unviable.

This checklist isn't exhaustive, but it covers the non-negotiables. Running each potential provider through this gauntlet will quickly separate the serious contenders from the ones that will only cause headaches down the road.

Never underestimate the power of great developer documentation. It can literally save you hundreds of hours during the integration phase. The docs should be crystal clear, comprehensive, and packed with practical code examples you can actually use. Before you subscribe to anything, spend some time in their developer portal to see if the documentation is easy to follow.

Lastly, think about the API’s scalability and rate limits from day one. Rate limits dictate how many requests you can make over a certain period. Make sure the free or entry-level plan gives you enough room to build and test, and that the paid tiers can handle your app's growth without costing a fortune. Planning for scale now prevents a painful and expensive migration later.

The article correctly flags rate limits as a scalability concern. What it misses — and what destroys production applications — is that exceeding rate limits doesn't always produce obvious error responses that your application can catch and handle. Many cryptocurrency price API providers respond to rate limit violations with stale cached data rather than clean error codes, silently serving your application outdated prices while appearing to function normally.

The failure mode is insidious. Your trading bot requests ETH price at 14:23:07. The API is at rate limit capacity. Instead of returning a 429 "Too Many Requests" error your code can handle, the provider returns the last cached price from 14:21:43 — 84 seconds stale — with a 200 OK status code. Your application has no indication anything went wrong. The bot executes a trade based on a price that's 84 seconds old during a volatile period. That's not a data quality problem; it's a silent failure mode creating real financial losses.

Testing for this failure mode requires deliberate rate limit abuse in a staging environment:

timestamp or last_updated field in the response against the actual current timeProviders with clean rate limit behavior return clear 429 error codes consistently, allowing your application to implement exponential backoff and retry logic. Providers with silent caching behavior require you to implement your own timestamp freshness validation on every response.

Regardless of your API provider's behavior, implement these safeguards:

last_updated is more than 15-30 seconds stale (adjust threshold based on your application's latency tolerance)Now that we have a solid set of evaluation criteria, it's time to put the leading cryptocurrency price API providers under the microscope. The market is packed with options, but a few key players have risen to the top through a combination of reliability, deep data coverage, and developer-friendly tools.

Choosing the right one really boils down to your specific use case. Are you building a high-frequency trading bot, a simple portfolio tracker, or a sprawling market research platform? The answer will steer you toward the perfect fit.

This head-to-head comparison will focus on the providers you see time and again in developer toolkits, like CoinGecko, CoinMarketCap, and CryptoCompare. We’ll size them up based on the factors we’ve already established—data types, asset coverage, real-time capabilities, and of course, what you can get with their free tiers. This is about cutting through the marketing hype to give you a clear, functional overview.

The world of crypto data is largely built on the backs of a few established names. These services have become the foundational infrastructure for the digital asset market, tracking thousands of cryptocurrencies in real-time by aggregating data from countless exchanges. For professional traders and researchers, especially those in the copy-trading space, this access to accurate, real-time API data is the absolute backbone of any informed strategy. For a deeper dive into how top traders leverage this data, check out TokenMetrics' blog.

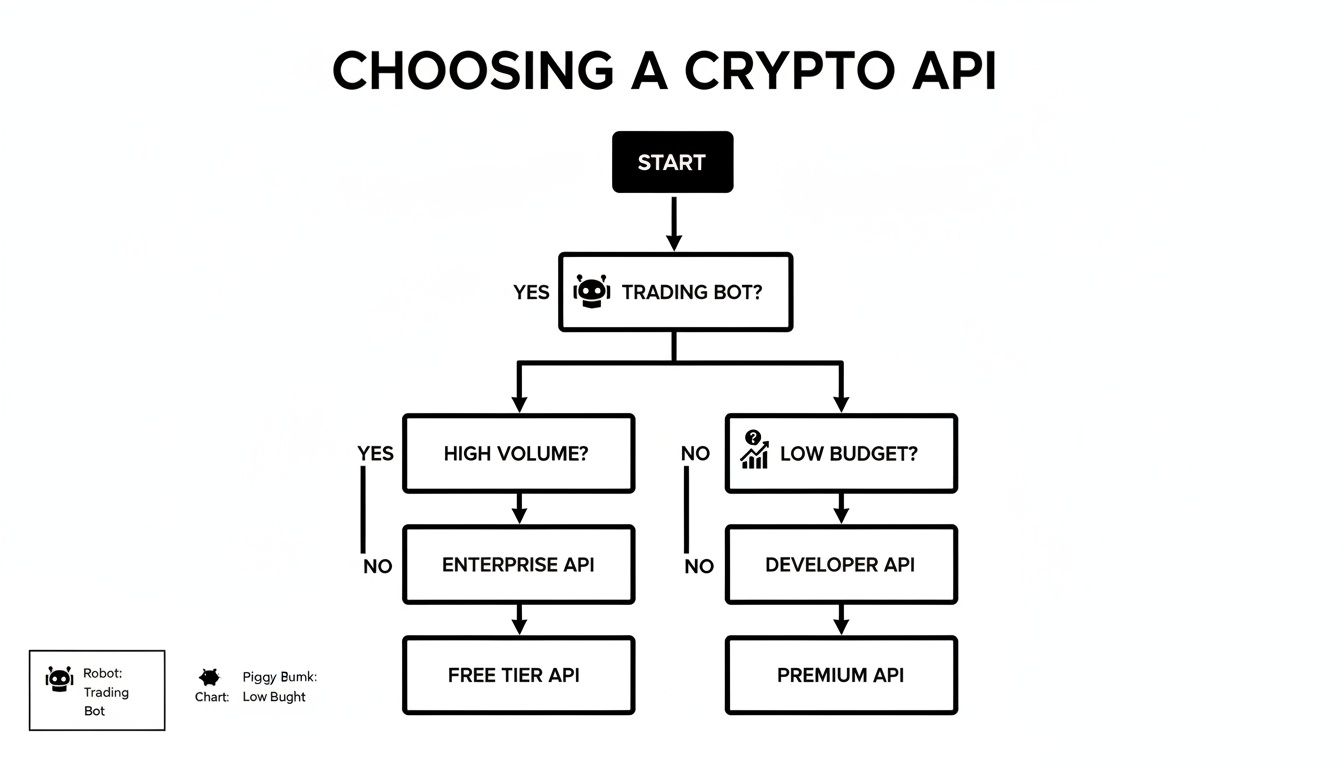

This flowchart offers a simple decision tree to help guide your choice based on your project's main needs, whether that’s trading automation, data volume, or pure budget constraints.

As the chart shows, a hobbyist on a shoestring budget and a high-volume institutional trader have wildly different API needs. This can help point you toward the right category of provider from the get-go.

Most developer evaluations test API quality on free tier access, then assume the data quality scales with the plan price. The undocumented reality: several major cryptocurrency price API providers serve demonstrably lower-quality data on free tiers through deliberate technical decisions — not just lower rate limits.

The specific mechanisms used to differentiate free from paid data quality:

Update frequency throttling: free tier endpoints on some providers update their price data every 60 seconds regardless of market movement. Paid tier endpoints update every 10-30 seconds or in real-time. During volatile sessions, the free tier's 60-second-old prices are functionally useless for any time-sensitive application — but this update frequency difference is buried in technical documentation rather than prominently featured in pricing pages.

Exchange source exclusion: some providers exclude high-volume, institutional-grade exchange data from free tier responses, including only a subset of their exchange coverage. The "aggregate price" from the free tier reflects fewer sources and can diverge meaningfully from the paid tier's broader aggregation, especially for altcoins where volume is concentrated on specific exchanges.

Historical data truncation: free tiers typically limit historical data access to 365 days or less. For backtesting trading strategies, this restriction makes free tier data essentially unusable for any meaningful analysis requiring multi-year historical context.

Before assuming your free tier evaluation reflects production performance:

last_updated timestamps — persistent gaps indicate update frequency throttlingFor any application where data quality directly affects financial decisions, budget for at least the first paid tier from day one of production deployment. The free tier is genuinely suitable for UI mockups, learning, and low-stakes portfolio display — not for trading logic or price-critical calculations.

To make your research a bit easier, the table below gives you a side-by-side look at the most popular cryptocurrency price APIs. It breaks down their core features, from the type of data they specialize in to the limits you'll hit on their free plans. This format is perfect for a quick assessment of which service aligns best with your technical needs and budget.

ProviderPrimary Data TypeAsset CoverageReal-Time Data (WebSocket)Free Tier Rate LimitBest ForCoinGeckoMarket Data (Price, Volume)14,000+ coins across 1,000+ exchangesNo (REST API only)10-30 calls/minuteHobbyist projects and broad market analysis.CoinMarketCapMarket Data & Aggregated Stats20,000+ coins across 600+ exchangesNo (REST API only)333 credits/day (~60 calls)Portfolio trackers and general market data.CryptoCompareMarket & On-Chain Data5,300+ coins & 240,000+ pairsYes100,000 calls/monthInstitutional use and real-time trading.CoinAPIMarket & Order Book Data18,000+ assets from 400+ exchangesYes100 requests/dayAlgorithmic trading and detailed market depth analysis.

This comparison quickly reveals a clear trade-off. For instance, while CoinGecko offers an extremely generous free tier that’s perfect for getting started, it lacks the real-time WebSocket feeds that are mission-critical for serious trading applications.

On the other hand, providers like CryptoCompare and CoinAPI cater to more professional needs with lower-latency data streams, but their plans are naturally more restrictive or costly. Their tiered pricing structures allow developers to start free for development and then scale into paid plans as their application’s user base and data demands grow.

Expert Insight: Choosing a cryptocurrency price API is a strategic decision. For rapid prototyping or a personal project, a free API from CoinGecko is often more than enough. However, for any commercial application—especially one involving trading—investing in a paid plan with WebSocket support and a high uptime SLA isn't just a good idea, it's a necessary cost of doing business.

Alright, let's get our hands dirty. Connecting to a cryptocurrency price API is where theory meets practice. It's the moment you stop just looking at data and start turning that raw market feed into something useful, like a real-time portfolio value or a slick price chart.

While it might sound overly technical, the process is pretty straightforward once you get the hang of making a request and handling what the API sends back. We'll walk through a practical example using Python, which is a go-to for this kind of work because of its simplicity and fantastic libraries. Our goal will be fetching the current prices of Bitcoin and Ethereum, showing you the whole workflow from scratch.

Before you can write a single line of code, you need to set up your environment. The first move is installing the requests library. Think of it as the standard toolkit for making HTTP requests in Python. If it's not already on your system, you can add it with one quick command in your terminal.

This little library makes the whole process of talking to a cryptocurrency price API and getting data back incredibly simple. Once that's installed, you’re ready to start pulling down some data.

pip install requests

With your setup complete, it's time to make your first real API call. This just means sending an HTTP GET request to a specific URL—the "endpoint"—that your API provider gives you. Most APIs will require an API key to authenticate your request, which you'll typically pass along in the request headers or as a parameter in the URL.

Let's imagine we're using a hypothetical API endpoint to get the latest prices for Bitcoin (BTC) and Ethereum (ETH).

https://api.example.com/v1/pricesids=bitcoin,ethereum and currency=usd.Here’s a Python script that builds the request, sends it off, and prints whatever comes back.

import requestsimport json# Define the API endpoint and parametersAPI_URL = "https://api.example.com/v1/prices"params = {'ids': 'bitcoin,ethereum','currency': 'usd'}# Make the API requesttry:response = requests.get(API_URL, params=params)response.raise_for_status() # This will raise an exception for bad status codes (4xx or 5xx)# Parse the JSON responsedata = response.json()# Print the formatted data so it's easy to readprint(json.dumps(data, indent=4))except requests.exceptions.RequestException as e:print(f"An error occurred: {e}")

If everything went smoothly, the API server will send back data, almost always in JSON format. JSON (JavaScript Object Notation) is a lightweight, human-readable format that's also a breeze for machines to parse. Your application's next job is to pick out the specific pieces of information it needs from this response.

For our example, the data coming back from our hypothetical API might look something like this:

{"bitcoin": {"usd": 68500.75},"ethereum": {"usd": 3550.21}}

To actually use this information, you just need to access the nested values. For instance, to grab Bitcoin's price, your code would reference data['bitcoin']['usd']. This is the fundamental logic you'd use to power something like a portfolio tracker; you'd loop through your list of assets, fetch their current prices, and calculate their total value in real time.

This same data is perfect for creating dynamic visuals. For DeFi traders looking to build their own dashboards, we have an in-depth guide covering real-time visualization techniques.

Important Takeaway: Always, always build in solid error handling. APIs go down, network connections fail, and keys can be invalid. Your code needs to anticipate these hiccups and handle them gracefully. Otherwise, you risk crashing your app and frustrating your users.

Before you write a single line of code, you need to get a handle on the financial and technical constraints of any crypto price API. This stuff—pricing models and rate limits—directly impacts your app's scalability and how much you'll end up paying. Picking the wrong plan can lead to surprise service outages or a bill that completely sinks your budget.

Most API providers use one of three pricing structures. Each one is built for a different kind of user, from a hobbyist tinkering on a small project to a high-frequency trading operation. The key is to match your choice to how you actually expect to use the API.

The most common starting point is the freemium model. It gives you a basic level of access for free, which is perfect for development, testing, or apps with low traffic. While these free tiers are a great way to get your feet wet, they always come with tight rate limits and usually don't include premium data endpoints.

If your project has traffic that’s hard to predict, a pay-as-you-go model is incredibly flexible. You only pay for the API calls you actually make, so you’re not shelling out cash for capacity you don't use. The catch? You have to monitor your usage closely to avoid a monster bill if your app suddenly gets popular.

Finally, tiered subscriptions are the standard for any serious commercial application. You pay a fixed monthly fee for a set number of calls and features, with different tiers available as you grow.

A classic mistake I see developers make is underestimating their call volume. Always project what you’ll need down the road and pick a plan with a comfortable buffer. You don't want to hit your limits right when your app starts gaining traction.

Think of rate limits as the non-negotiable rules of the road for any API. They put a hard cap on how many requests you can make in a given time, like 30 calls per minute or 100,000 calls per month. Providers need these limits to keep their service stable for everyone and prevent one app from hogging all the resources. If you ignore them, your requests will get blocked, and parts of your app will simply break.

The only way to operate efficiently is to design your application with these limits in mind from day one. It’s a proactive approach that saves you from performance headaches later and ensures your users have a smooth experience.

Here are a few solid strategies to keep your API usage in check:

When you integrate a cryptocurrency price API, you get a unique API key. Think of this key as the master credential for your data subscription—it's not just a random string of characters. You have to treat it with the same seriousness as a password. It's not just a best practice; it's absolutely essential for protecting your application and the integrity of your data.

A leaked API key can cause real trouble. A malicious actor could easily exhaust your rate limit, disrupting your service. Even worse, if the key unlocks paid data tiers, you could be looking at a serious financial hit. The first and most important rule is simple: never hardcode your API keys directly into your source code. Doing so makes them visible to anyone who can get their hands on your repository.

Instead of hardcoding, you should always store your keys as environment variables. This simple step separates your credentials from your codebase, making things significantly more secure. Your app can then just read the key from the server's environment when it runs, keeping it out of sight.

Another great security layer to add is IP whitelisting, a feature many API providers offer. You can specify exactly which IP addresses are allowed to make requests with your key, effectively blocking any unauthorized attempts coming from unknown servers.

Finally, you need to make sure your data is confidential while it's in transit.

Crucial Tip: Only make API calls over HTTPS. Using an unencrypted HTTP connection sends your API key and all the data you receive in plain text. That makes it trivial for an attacker on the same network to intercept everything.

Sticking to these core principles—storing keys securely, restricting access, and encrypting communications—is the foundation of a solid security posture for any app using a crypto price API. For projects dealing with sensitive financial information, a comprehensive strategy is non-negotiable. You can learn more about beefing up your project's defenses in our guide on the benefits of a blockchain security audit service.

Jumping into the world of crypto data APIs brings up a ton of questions, especially when you're trying to pick the right tools for a new project. Let's cut through the noise and get you direct answers to the most common questions we see.

The real difference comes down to how your application gets the data.

A REST API works on a simple request-response model. Think of it like knocking on a door to ask for the time; you have to initiate the request every single time you need an update. This makes it a great fit for pulling historical data or for apps where you only need to check prices every now and then.

On the other hand, a WebSocket API opens up a persistent, two-way communication channel. Once that connection is live, the server can push new data to your app the second it's available—no new requests needed. If you're building anything that needs real-time info, like a trading bot or a live price chart, WebSocket is the only way to go for speed and efficiency.

Generally, no. A standard crypto price API, like the ones from CoinGecko or CoinMarketCap, is built to aggregate market data. This means they pull information like price, trading volume, and market cap from a mix of centralized and decentralized exchanges.

To get your hands on true on-chain data—we're talking specific wallet transactions, token movements, or smart contract events—you'll need a dedicated blockchain data API from a provider like Alchemy or Moralis. Most serious applications actually use both: a price API for the big-picture market context and a blockchain API to see the granular, on-chain action. It's a powerful combo.

Key Insight: Price APIs tell you what the market is doing, while on-chain APIs tell you how and why it's happening at the ground level. Using both gives you a massive analytical advantage.

When you're looking at free crypto price APIs, your main focus should be on providers with a solid reputation, crystal-clear documentation, and transparent rate limits. Big names like CoinGecko and CoinMarketCap offer really dependable free tiers that are perfect for getting a project off the ground, testing ideas, or running low-traffic apps.

Before you build your whole project around a free API, run these quick checks:

Price aggregation methodology divergence — each provider calculates its aggregate price differently. CoinGecko uses volume-weighted averaging across all tracked exchanges. CoinMarketCap excludes exchanges it classifies as having suspicious volume using its own scoring system. Kaiko and Amberdata use only institutional-grade exchanges with strict wash trade filtering. The same BTC/USD pair can legitimately show $50-$200 divergence across providers during normal conditions and $500-$2,000 during volatile periods.

For portfolio display, use any reputable aggregator — the "consensus" price is accurate enough. For trading bot logic, use the direct API of the exchange your bot actually trades on rather than an aggregator, or choose an aggregator explicitly confirmed to include and heavily weight your target exchange. Run a 24-hour parallel comparison test during a volatile session before committing to any API for price-sensitive applications.

Yes — this is a documented failure mode. Some providers respond to rate limit violations with stale cached data and a 200 OK status code rather than a clean 429 error. Your application receives what appears to be a valid response but the price is 60-90+ seconds old. During volatile markets, a trading bot executing on stale prices creates direct financial losses with no visible error to debug.

Test for this in staging: burst your requests 3-5x above the stated limit and check the last_updated timestamp in responses against current time. Any gap exceeding 30 seconds during rate limit conditions confirms silent caching. Add timestamp freshness validation to every response in your application code — reject any price data more than 15-30 seconds old and implement a circuit breaker that halts trading after 3 consecutive stale responses.

Not safely for any protocol handling significant value. Off-chain price APIs are designed for analytics and display — they're not built for the manipulation resistance required by on-chain financial logic. Flash loan attacks can manipulate prices on specific exchanges your oracle reads from within a single block, then exploit the manipulated price on your protocol before the oracle updates.

Use decentralized oracle networks (Chainlink, Pyth Network) for any on-chain price feeds — these use cryptographic aggregation and TWAP mechanisms specifically designed to make single-block manipulation economically impractical. Implement circuit breakers pausing operations on price movements exceeding 10-15% per block. Keep standard price APIs in your analytics and UI stack where they belong, and use purpose-built oracle infrastructure for smart contract logic.

Discovering profitable trading strategies requires more than just price data. Wallet Finder.ai helps you track the on-chain movements of top traders, providing actionable signals before the market moves. Find your edge by analyzing winning wallets and mirroring their success in real time. Start your 7-day trial at https://www.walletfinder.ai.