7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 14, 2026

If you're transacting on the Ethereum network, converting gwei to usd isn't just a technical exercise—it's a critical skill. This simple calculation turns a small, abstract unit into a real-world cost you can actually understand.

Think of Gwei as the "cents" to Ethereum's "dollar." It’s the unit used to price gas fees for every single action, from a basic token transfer to a complex DeFi swap. Getting a handle on this conversion is the first step to truly managing your trading costs instead of just letting them happen to you.

Gwei is the currency you use to pay for computational work on the Ethereum network. It’s a tiny fraction of one Ether (ETH), specifically one-billionth of an ETH. When you want to make a transaction happen, you bid a certain amount of Gwei for each unit of "gas"—which is just a measure of the computational effort needed. The more Gwei you're willing to pay, the faster a miner will pick up your transaction and add it to the blockchain.

For active traders, especially those using tools like Wallet Finder.ai to monitor and copy the moves of smart money, Gwei is much more than a technical term. It's a direct line item affecting your profitability.

Here are three actionable reasons Gwei is so important:

The cost of a transaction is never set in stone. In the wild world of Ethereum, the Gwei to USD rate can swing dramatically. A seemingly minor drop in ETH's price on a single day could tack on an extra $5 to a simple swap at 100 Gwei when ETH is hovering around $2,500.

During the 2021 bull run, we saw average rates spike above 200 Gwei, pushing transaction fees to over $50 for even basic actions. This forced traders to time their entries with surgical precision. You can explore more about these historical fluctuations and see just how much they impact traders' bottom lines.

Understanding the relationship between these denominations is fundamental. Just as you wouldn't confuse a penny with a dollar, knowing how Gwei relates to ETH prevents costly mistakes when setting transaction fees.

To put it all into perspective, here's a quick breakdown of how the different units of Ether relate to each other.

This table breaks down the various denominations of Ether, showing how Gwei fits into the ecosystem and its relationship to the base unit, ETH.

As you can see, Gwei sits in a convenient middle ground—small enough to price gas fees without using a ton of decimals, but large enough to be more readable than Wei, the smallest possible unit of Ether.

Ever wonder what a 20 Gwei gas fee actually costs you in dollars and cents? Let's break down the math. Calculating the real-world cost of your on-chain moves is a fundamental skill, and it's simpler than you might think.

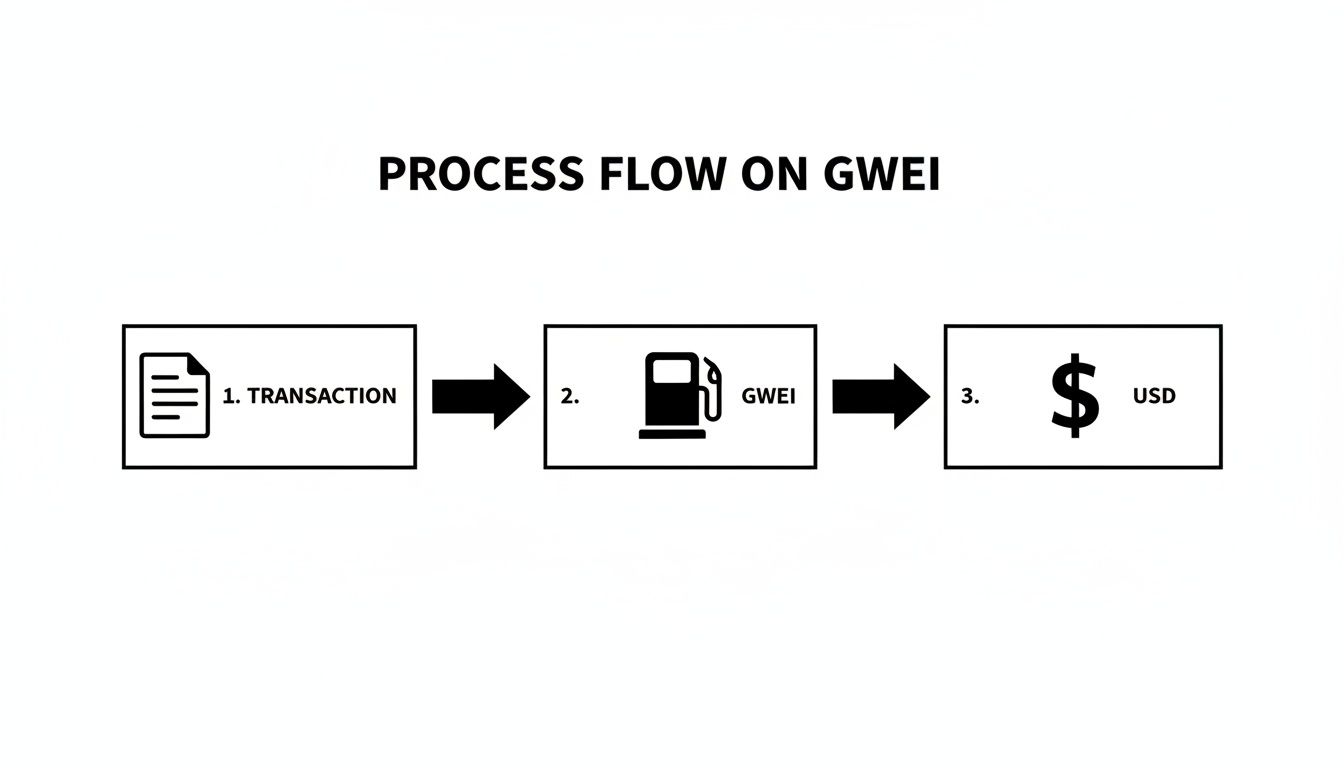

The whole point is to connect that tiny unit of Gwei to a currency we all understand, like the US dollar. It’s really just a two-part conversion: first from Gwei to ETH, and then from ETH to USD. Once you get the hang of it, you'll have a much clearer picture of what your transactions are actually costing you.

This flow chart gives you a quick visual of the path from a transaction's gas cost in Gwei to its final value in USD.

Think of Gwei as the fuel. The conversion tells you how much you're actually paying at the pump in dollars.

The calculation boils down to a simple formula you can use for any transaction. No complex math required.

Gwei to USD Formula:

(Gwei Amount / 1,000,000,000) * Current ETH Price in USD = Transaction Cost in USD

Why does this work? It’s because there are one billion Gwei in one ETH. So, dividing your Gwei amount by 1,000,000,000 converts it into its ETH equivalent. Multiply that number by the current price of ETH, and you've got your final cost in dollars.

Let’s run through a real-world scenario. You're about to make a token swap, and your wallet suggests a gas price of 45 Gwei. At the same time, the live market price for one ETH is $3,200.

Here's a step-by-step breakdown of the calculation:

45 Gwei / 1,000,000,000 = 0.000000045 ETH0.000000045 ETH * $3,200 = $0.144In this situation, your 45 Gwei gas price comes out to about 14 cents. Just remember, this is only the gas price—not the total transaction fee. The final cost also depends on the gas limit, which is a different piece of the puzzle.

Having an accurate, live ETH price is absolutely crucial for this calculation to be meaningful. For the most precise conversions, you need a data source you can trust. You can learn more about how to pull real-time data by checking out our guide on using an API for crypto prices.

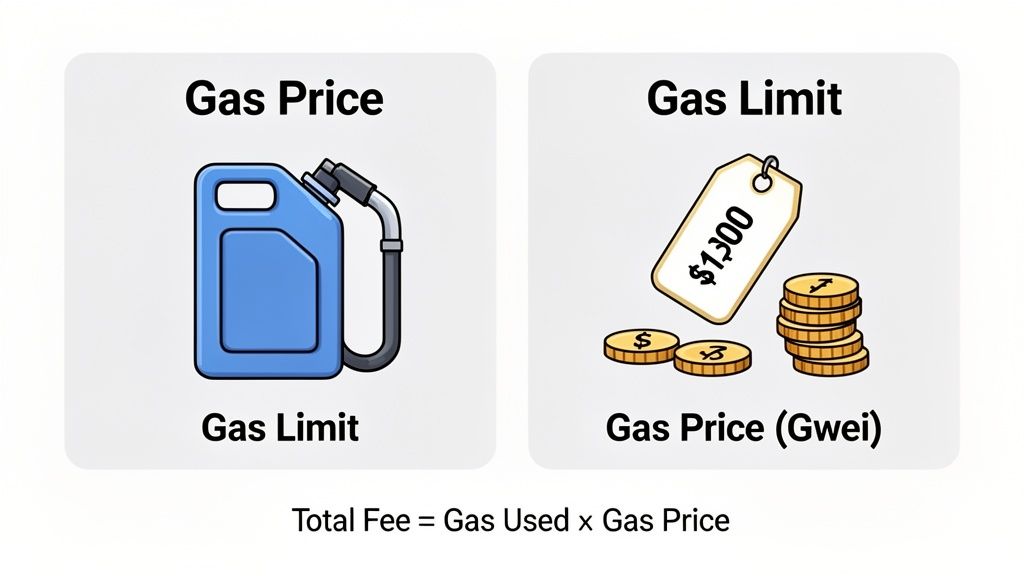

Many traders mix up Gas Price and Gas Limit, but getting this right is your secret weapon for controlling transaction costs. They work together to calculate your total fee, but they’re two very different levers you can pull. Nailing this concept is absolutely essential if you want to convert gwei to USD with any real accuracy.

A simple way to think about it is fueling up a car. The Gas Price is the cost per gallon of fuel, and the Gas Limit is the maximum number of gallons your car's tank can hold.

The final fee you pay isn't just the gas price. It's the actual gas used multiplied by the gas price you agreed to.

The more complex a transaction, the more gas it needs to run. A basic ETH transfer is like a short drive across town; it doesn't need much fuel. But executing a complex token swap on a platform like Uniswap is more like a cross-country road trip—it’s going to require a lot more gas to complete.

Here is a quick comparison of common transaction types and their typical gas usage:

Setting the right Gas Limit is crucial. Set it too low, and your transaction will run out of gas and fail, but you'll still lose the fee for the work that was done. It’s a rookie mistake that can be surprisingly costly. On the other hand, if you set it too high, don't worry—any unused gas is automatically refunded to your wallet. You only ever pay for what you actually use.

Getting this distinction right helps you sidestep two of the most common headaches in crypto: overpaying and failed transactions.

By setting a competitive gas price, you make sure your transaction gets picked up by miners in a reasonable amount of time. By setting an adequate gas limit, you ensure it has enough power to see the job through. This dual control is how experienced traders minimize their expenses and avoid the frustration of stuck or failed operations.

While running the numbers yourself is a great way to get a feel for how gas works, the reality of on-chain trading is that it moves at the speed of light. You just don't have time to manually calculate costs when a profitable move is on the line.

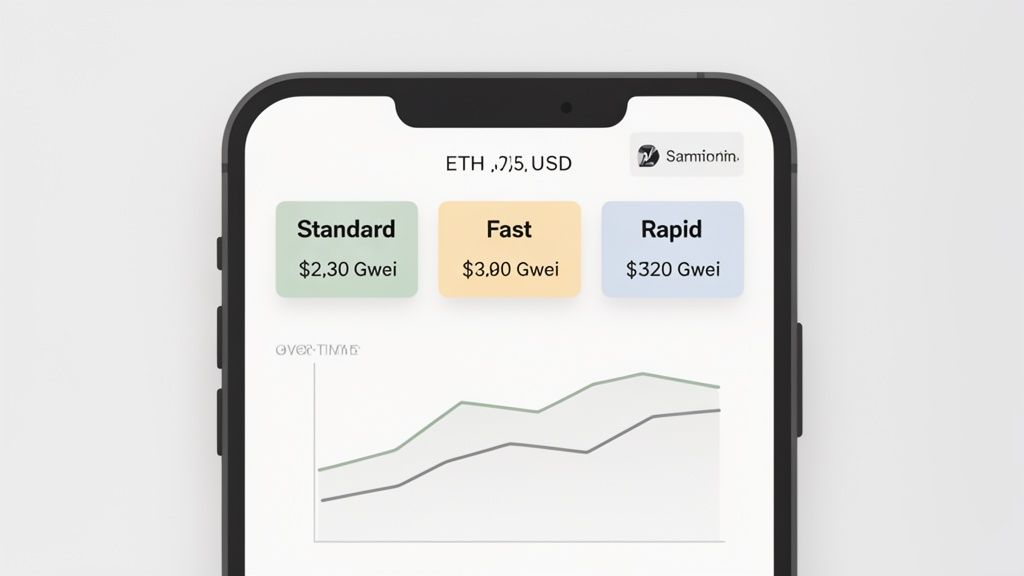

This is where live gwei to USD converters and gas trackers become your best friends. They deliver instant, accurate data, letting you make those split-second decisions that can make or break a trade.

The Etherscan Gas Tracker is an absolute staple in any trader's toolkit. It gives you a real-time snapshot of network congestion, usually broken down into a few priority tiers so you know exactly what you're paying for.

For a truly accurate gwei to USD conversion, you're juggling two constantly moving targets: the current gas price and the current ETH price. For live ETH prices, you can’t go wrong with feeds from trusted sources like CoinGecko or CoinMarketCap.

Pairing a live ETH price with a gas tracker gives you the full picture. The ETHGas (GWEI) token, which is designed to follow gas dynamics, highlights just how volatile these prices can be. Its price can differ across exchanges, with Binance showing $0.026413 while Kraken has it at $0.027. We've seen gas prices swing from -6.02% drops to 10.58% recoveries in short periods, which just hammers home the need for dependable, live data.

This real-time awareness is a game-changer for Wallet Finder.ai users. Imagine you get a Telegram alert that a wallet you're tracking just made a big move. You can instantly glance at a gas tracker to see if network fees are low enough to make copying that trade profitable at that exact moment.

By keeping these tools handy, you shift from just reacting to the market to actually anticipating its moves. You can dive deeper into our guide to the best gas fee analysis tools for crypto traders to explore more options.

Knowing how to convert Gwei to USD is one thing. Turning that knowledge into a real competitive edge is what separates amateur traders from the pros. Experienced traders don't just passively accept gas fees; they treat them as a variable cost that can be actively managed and minimized.

This discipline pays off, big time. Saving a few bucks on a single trade might not sound like much, but when you're executing hundreds of swaps, those savings compound. It's capital you can put back to work in new opportunities.

One of the simplest yet most powerful tactics is to schedule your on-chain activity around network traffic. Gas prices aren't random—they often follow predictable patterns. Here’s a quick guide to timing your transactions:

You can see this strategy in action on Wallet Finder.ai. Watch a few "smart money" wallets, and you'll notice a pattern: they often execute their biggest DEX swaps only when the base fee drops below 20 Gwei. That isn't luck. It's a deliberate, cost-saving strategy that saves them hundreds, if not thousands, of dollars over time.

Another key move is mastering your wallet's transaction settings, especially in a tool like MetaMask. During periods of high volatility, the default "fast" or "aggressive" gas suggestions can be wildly overpriced. Instead of just clicking "confirm," savvy traders set a custom max fee.

This acts as a ceiling, preventing you from overpaying in a frantic market. By setting a max fee that is reasonable but not exorbitant, you ensure your transaction still gets processed without you paying a ridiculous premium. It’s a simple but powerful defense against emotional, heat-of-the-moment overspending.

This level of discipline goes beyond just copying trades. It’s about adopting a cost-conscious mindset that truly defines profitable, sustainable on-chain activity. If you want to dive deeper into optimizing every transaction, check out our detailed guide on how to save on Ethereum gas fees.

The table below shows just how much gas prices can eat into your profits. Notice how a seemingly small change in Gwei can make a significant difference in your take-home gain from a standard $100 profit trade.

Note: Assumes an ETH price of $4,000 and a gas limit of 21,000.

As you can see, waiting for gas to drop from 60 Gwei to 30 Gwei can almost double your net profit on smaller trades. This highlights why paying attention to Gwei isn't just a technical detail—it's a critical part of your trading strategy.

When you're dealing with Ethereum transactions, a few questions always seem to pop up, usually centered around cost and speed. Getting a handle on how Gwei works is the key to transacting smarter and maybe even saving a little money. Here are some straight answers to the most common things traders ask about the gwei-to-USD conversion.

The gwei to USD price is always on the move because it's pegged to two things that never sit still: the market price of Ethereum (ETH) and the real-time demand for space on the Ethereum network.

Think of it like this: when the network gets busy—say, during a hyped-up NFT mint or a market dip that triggers a trading frenzy—everyone starts bidding up the gas price in Gwei. They're all competing to get their transactions processed first. This network traffic jam, combined with ETH's own price rollercoaster, means the actual USD cost for any given transaction is constantly changing.

Honestly, a "good" Gwei price is whatever the network says it is at that moment. It's completely relative. On a slow weekend, you might see standard transactions coasting along at less than 10 Gwei. But during peak hours or a major event, paying 50-100 Gwei could be a perfectly reasonable price for a fast confirmation.

Your best bet is to check a live gas tracker before you do anything. Etherscan has a great one that shows you the current recommended Gwei prices for 'Low', 'Average', and 'High' priority transactions. This lets you make an informed call based on how quickly you need your transaction to go through.

Not directly. Most wallets, including the popular MetaMask, require you to set your gas preferences in Gwei by adjusting the max base fee and priority fee.

However, they do give you a real-time USD estimate of your total potential fee right before you hit "confirm." This is incredibly helpful because you can see the maximum cost in a currency you actually understand, which helps you approve transactions without any nasty surprises later.

Stop guessing and start winning. Wallet Finder.ai gives you the tools to track smart money, discover profitable trades, and act on real-time data. Begin your 7-day free trial and trade smarter today.