What does SOL stand for? A Quick Guide

Discover what sol stands for in Solana, with a clear, beginner-friendly breakdown of terms, uses, and key concepts.

March 4, 2026

Wallet Finder

February 16, 2026

Ever heard of a token presale? It's a fundraising event where a new crypto project sells its tokens to early investors before it's available to the general public. Think of it like getting VIP early-access tickets to a concert, often at a discount. It's a classic high-risk, high-reward chance to get in on a project's ground floor.

This strategy is designed to be a win-win. New projects get the capital they desperately need for development, and investors get a shot at a potentially massive return on their investment.

A token presale is the crypto world's version of an early-stage venture capital round for a tech startup. It's the first real opportunity for a project to raise money, build a dedicated community, and get the ball rolling. For you, the investor, it's a chance to buy in before the project hits the mainstream market, often at the absolute lowest price you'll ever see.

But this early access comes with a major catch. While the potential for huge returns is real, so is the risk. The crypto space is littered with the ghosts of projects that never delivered on their promises, and let's be honest, plenty of presales are just straight-up scams. That's why doing your homework isn't just a good idea—it's absolutely essential for survival.

The biggest draw for joining token presales is, without a doubt, the potential for explosive growth. Early investors are buying tokens at a serious discount compared to the price they might list at on a public exchange. If that project takes off, these early backers can see returns that are orders of magnitude greater than those who buy in after the public launch.

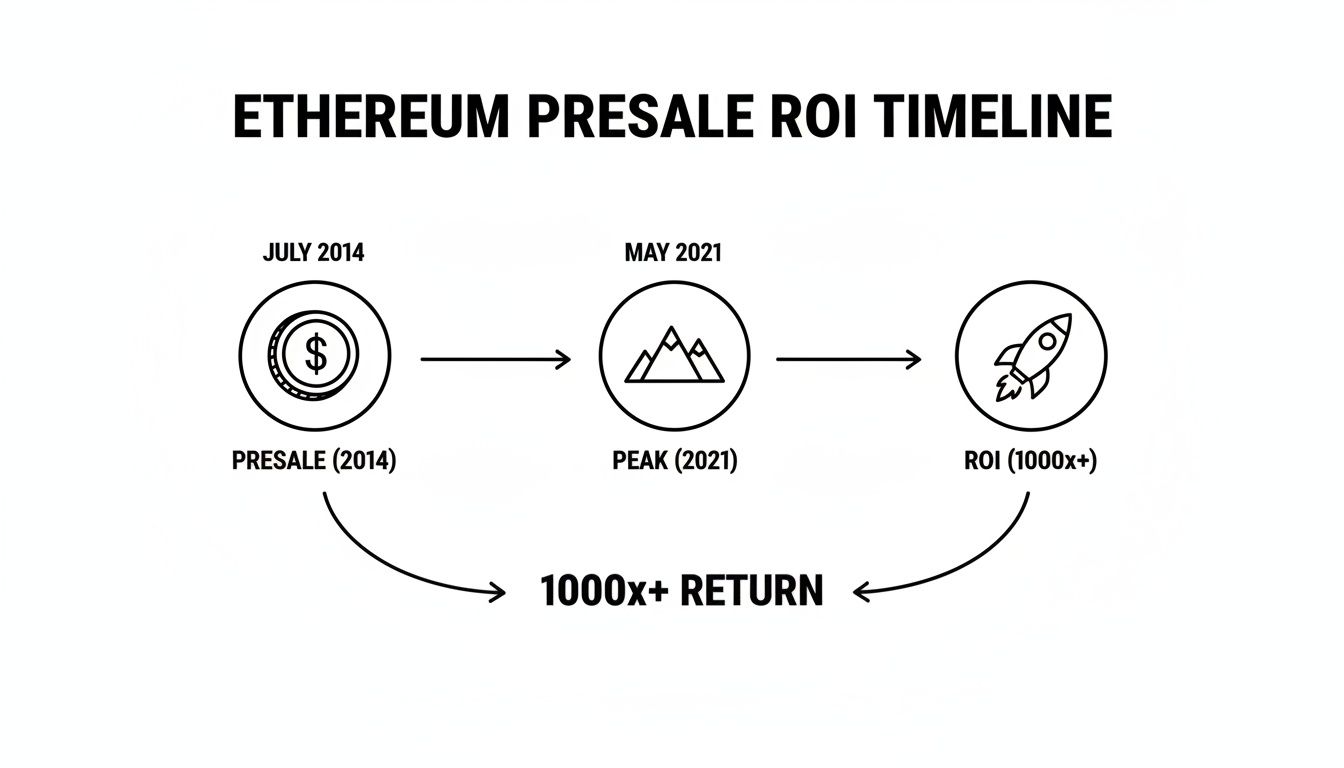

The legendary example everyone points to is Ethereum's 2014 presale. They offered ETH for about $0.31 per token. For the diamond-handed investors who held on until its peak, that translated to an almost unbelievable 1,400,000% return. We're talking about turning small, speculative investments into life-changing fortunes. You can find plenty of historical data on early crypto fundraising events to see just how impactful these initial offerings can be.

When you get in early, you're not just buying a token. You're funding the development of something new and becoming a founding member of that project's community.

While the success stories are incredibly tempting, the hard truth is that most presales are a gamble. It's a largely unregulated landscape, making it tough to tell a future unicorn from a project destined to fail. This is why you need a structured, almost skeptical, approach.

To succeed, you must learn to critically evaluate key project elements. Here's your initial actionable checklist:

This guide is here to arm you with the knowledge and tools you need to navigate this tricky environment. We'll walk you through how to conduct proper due diligence, spot the most critical red flags, and use on-chain data to give yourself an edge. Your ability to analyze these factors is what will separate a winning bet from a costly mistake.

To really get a handle on token pre sales, you have to stop thinking of them as one-off events. It’s more like a journey with multiple stages. I like to think of it as a rocket launch sequence—every phase serves a specific purpose, involves different people, and carries its own level of risk. The earliest stages are super exclusive and risky; later, the doors open to a wider crowd as the project picks up steam.

A project’s funding journey usually flows from private, strategic money to a broader public sale. Knowing which stage a presale is in tells you a ton about how mature the project is, the potential discount you're getting, and just how much risk you’re taking on. Early birds get the best prices but have to stomach a lot more uncertainty. Later participants pay a higher price but for a project that's already got some momentum.

This timeline of Ethereum’s presale really drives home the mind-blowing potential of getting in on the ground floor. It’s a perfect example of the kind of returns early believers can see.

What this shows is how a tiny investment during the presale could have ballooned into life-changing money by the time the asset hit its peak. That right there is the core appeal of these early funding rounds.

The very beginning of a token’s life starts with the Seed and Private sales. These rounds are behind closed doors, usually only open to venture capital (VC) firms, angel investors, and key strategic partners. At this point, the project might be nothing more than an idea on a whitepaper, making it the riskiest phase of all.

Investors in these rounds inject the first critical cash in exchange for tokens at rock-bottom prices. But there’s a catch: their tokens almost always come with long vesting schedules. This means their tokens are locked up and released slowly over several years, preventing these whales from dumping on the market right after the public launch and crashing the price.

After a project has locked in its initial funding and maybe built out a basic product or a community, it’s time for a Public Pre Sale. This is often the first real chance for the average crypto investor to get involved. These sales are way more accessible and are usually run on specialized platforms.

The token price here is higher than what the seed investors paid, but it's still expected to be a discount compared to the price when it finally lists on an exchange. Vesting schedules for public buyers are typically much shorter, and sometimes there are no lockups at all. This stage is all about spreading the token ownership out and building a bigger army of supporters before the big launch.

The way projects run these public presales has changed a lot over the years. Getting the difference between these models is crucial for figuring out how safe and easy it is to participate. Each one offers a different balance of centralization, security, and user-friendliness.

Sale TypePlatformKey CharacteristicMain BenefitMain DrawbackICOProject's WebsiteDirect sale from the project to investors.Full control for the project team.High risk of scams; minimal vetting.IEOCentralized ExchangeSale hosted and vetted by an exchange (e.g., Binance).Increased trust and security; easy access for users.Highly centralized; limited project selection.IDODecentralized ExchangeSale conducted on a DEX launchpad (e.g., Raydium).Permissionless and accessible; immediate liquidity.Can be complex; risk of smart contract bugs.

An Initial Coin Offering (ICO) was the wild west original. The lack of oversight led to a ton of scams, which paved the way for Initial Exchange Offerings (IEOs) and Initial DEX Offerings (IDOs). These newer models bring in third-party platforms for more security and vetting. Which one is best for you really comes down to your risk tolerance and how comfortable you are with the tech.

Think of tokenomics as the economic engine of a crypto project. It's the complete set of rules that dictates how a token is created, who gets it, and how many are available. This blueprint is one of the single most important factors in a project's long-term survival. You can have the most brilliant technology in the world, but if the tokenomics are garbage, the project is likely doomed to fail under a mountain of sell pressure.

Getting a real read on a project's tokenomics means going way deeper than just looking up the total supply. You have to roll up your sleeves and figure out who gets what, and more importantly, when they get it. This is your number one defense against projects that are secretly designed to make the founders rich while leaving the community holding the bag.

The first place you should look is the token allocation chart. You can usually find this in the project's whitepaper or on a dedicated tokenomics page on their website. This pie chart breaks down how the total supply is split between different groups—the team, private investors, the public sale, ecosystem funds, and marketing budgets.

A healthy allocation feels balanced and clearly puts the community and future development first.

You need to be extremely cautious of projects where the team and private investors control a massive slice of the pie. If insiders are holding over 50% of the total supply, that's a huge red flag for centralization. It means they could easily team up, dump their tokens on the market, and completely tank the price, leaving all the public presale buyers with worthless tokens.

A project's token allocation tells you everything you need to know about their priorities. If the team and their VC buddies own most of the tokens, their priority is probably lining their own pockets—not building a healthy, decentralized network.

A healthy token allocation usually includes:

To get an even clearer picture, you can use specialized tools to see how tokens are actually spread across different wallets. You can learn more about using a token distribution analyzer to spot wallets with huge holdings that could pose a major sell-off risk.

That token allocation chart doesn't mean a thing if you don't also look at the vesting schedules. Vesting is simply the act of locking up tokens for a set amount of time and then releasing them slowly. It’s the most important tool for preventing the team and early investors from immediately dumping their cheap tokens on the public.

Just imagine a project gives the team 20% of the total supply, but it's all unlocked on the first day of trading. What's stopping them from selling it all, pocketing millions, and walking away? Nothing. A proper vesting schedule forces them to have skin in the game for the long haul.

Look for vesting schedules that last for at least a year, but the best projects often have them for four years or even longer. A standard practice is the "cliff," which is an initial lock-up period (like six months or a year) where no tokens are released. After the cliff, the tokens start unlocking gradually, usually month by month. This staggered approach prevents huge amounts of new supply from suddenly hitting the market and causing a price crash.

To give you a practical framework, this table breaks down common token allocations and vesting schedules. Use it to quickly spot the difference between a project with a healthy, sustainable model and one that's a ticking time bomb.

Stakeholder GroupTypical Allocation %Common Vesting ScheduleWhat It MeansTeam & Advisors10-20%12-month cliff, then linear release over 2-4 yearsShows long-term commitment. The team can't just cash out and abandon the project.Private/Seed Investors5-15%6-12 month cliff, then linear release over 1-2 yearsAligns early backers with the project's long-term success, preventing instant dumps.Public Sale (Presale)15-30%Partial unlock at TGE (Token Generation Event), then linear release over 6-12 monthsEnsures fair distribution while managing initial sell pressure from public buyers.Ecosystem & Treasury20-40%Gradual release over 3-5 years, controlled by DAO/FoundationA healthy fund for future development, grants, and partnerships signals a long-term vision.Liquidity & Marketing10-20%Mostly unlocked at TGE or released as neededEssential funds for ensuring deep liquidity on exchanges and promoting the project.

Seeing allocations and schedules like these should give you confidence that the project is structured for sustainable growth. Deviations aren't always bad, but they demand closer scrutiny.

At the end of the day, tokenomics and vesting schedules reveal the true character of a project's founders. By taking the time to analyze these economic details, you can easily filter out the weak or predatory projects and zero in on the ones that are actually built to last.

Vesting schedules exist to prevent early investors from dumping tokens on retail buyers. The loophole that undermines the entire system: vesting locks on-chain token transfers, not off-chain economic agreements. Venture capital firms with locked presale allocations regularly execute structured OTC (over-the-counter) deals that transfer the economic rights to their tokens — including all upside and price exposure — without moving a single token on-chain.

Here's exactly how it works: Seed investor holds 10 million tokens locked for 12 months. Within weeks of the public launch, they find a willing counterparty (another fund, a market maker, a high-net-worth buyer) and sign a private OTC agreement: "I'll transfer you the economic rights to my 10 million tokens for $X today. When they unlock on-chain in 11 months, I'll send them to your wallet." The tokens never moved. The vesting contract shows everything locked. But the economic pressure from that position has already been monetized.

The consequences become visible on-chain at cliff unlock dates. The counterparty who bought the economic rights wants immediate liquidity when tokens finally transfer — they paid a discount to the locked-token holder specifically to get below-market tokens, and their business model is selling quickly. This creates coordinated multi-wallet selling at cliff dates from parties who weren't even the original vesting beneficiaries.

Watch for these on-chain signals that suggest OTC pre-selling occurred:

Genuine long-term alignment leaves different on-chain traces. Investors who actually intend to hold through vesting typically:

The strongest signal of genuine commitment: team wallets that had full on-chain access to tokens pre-vesting but demonstrably didn't touch them. Checking whether wallets could have transacted but chose not to is the real vesting quality test.

Jumping into token pre sales without a solid game plan is like trying to cross a minefield blindfolded. The crypto space is packed with incredible opportunities, but it's just as full of projects designed to fail and outright scams. A systematic due diligence process isn't just a good idea—it's your best defense.

This battle-tested framework gives you a repeatable checklist to methodically pick apart any presale that catches your eye. By splitting your analysis into two key areas—Off-Chain and On-Chain—you can slice through the marketing hype and focus on the signals that actually matter. Think of this process as your personal filter for spotting red flags and protecting your capital.

Before you even glance at a smart contract, your investigation begins with the people and the plan behind the project. This is where you dig into the vision, the team, and the community—the true foundation of any legitimate venture. Here is your actionable checklist:

A project's greatest asset is its team. If the founders aren't willing to put their reputations on the line by being public, you have to ask yourself why you should be willing to put your money on the line.

The article correctly flags the absence of a smart contract audit as a red flag. The more dangerous opposite: a prominently displayed audit from a recognizable firm that the project paid to produce, designed to pass rather than find problems. Paid audits create a veneer of security that attracts capital while leaving critical vulnerabilities intact.

Audit theater works because most retail investors can't evaluate audit quality — they see a badge from a known firm and assume safety. Projects exploit this by selecting auditors with reputations for fast, affordable, approval-oriented reviews; providing auditors only the code they want reviewed while keeping privileged backdoor functions out of scope; rushing audits on tight timelines where auditors can't conduct thorough manual review; and immediately displaying audit badges in marketing materials before the full report is even published.

The result: multiple high-profile DeFi protocols were hacked through vulnerabilities that existed in audited code. The audit firms technically reviewed the contracts, technically produced reports, and technically found some issues. The critical vulnerabilities escaped review due to scope limitations, time pressure, or inadequate depth.

What makes an audit credible:

The strongest signal: audit reports available in full detail, not just summary badges. Projects with genuine security commitment publish complete audit reports including all findings, severity classifications, and remediation proofs. Projects hiding behind badges while not publishing reports are failing the transparency test.

Once a project passes the off-chain sniff test, it's time to get on-chain to verify the technical and financial guts of the operation. This is where you confirm that what they say they're doing matches what's actually coded into the blockchain. This step is absolutely non-negotiable for avoiding rug pulls and technical exploits. Follow this checklist:

By systematically working through this two-part checklist, you build a powerful filter. The off-chain analysis vets the people and the plan, while the on-chain analysis verifies the code and the capital. Together, they give you the complete picture you need before putting any money on the line.

Public presales on major launchpads (Polkastarter, DAO Maker, Seedify, Fjord Foundry) advertise open participation. The reality: coordinated whitelist farming groups systematically game allocation systems, capturing the majority of every desirable presale while retail investors wait in queues and receive minimum allocations — or nothing.

Whitelist farming is a full-time operation for sophisticated participants. They accumulate launchpad native tokens (POLS, DAO, SFUND) across dozens of wallets to reach the highest allocation tiers, complete every KYC-linked task simultaneously across multiple identities where possible, and leverage network connections with launchpad operators for guaranteed allocations in exchange for market-making or promotional services. A single coordinated group might control 40-60% of total whitelist spots in a "public" presale.

Most launchpads use tiered allocation systems where larger holders of the native launchpad token receive proportionally larger presale allocations. This sounds fair until you see how it concentrates access:

Retail investors who buy launchpad tokens specifically to access presales often pay premium prices for those tokens during hype periods, only to discover their tier allocation is negligibly small. They paid to participate in a system that was designed to funnel allocation toward the largest existing participants.

The presale structures that actually give retail a fair shot share specific characteristics:

Before committing to a launchpad's process, check historical allocation data for their previous presales. If the top 10% of participants consistently received 60%+ of allocations, the system is structurally biased. If allocation distribution shows broad participation across hundreds of unique winners, the design is genuinely fair.

Reading a whitepaper and checking out the team is a good start, but that’s just static due diligence—a snapshot in time. To get a real edge in finding the best token pre sales, you need to look at what’s happening on-chain, right now. This means tracking the moves of "smart money," which are the wallets of experienced, consistently profitable investors whose actions are often a leading indicator of a project's future success.

When you follow the on-chain footprints of these top-tier wallets, you’re basically piggybacking on all their hard work and deep research. If a wallet with a proven history of picking winners invests in a new presale, that’s a massive signal that the project is worth a closer look. It’s a data-driven approach that helps you move beyond pure speculation and make decisions based on real evidence.

First thing’s first: you have to find these high-performing wallets. On-chain analysis platforms are built for this. They let you sift through millions of transactions and wallets to find the needles in the haystack. Instead of just guessing, you can use concrete data to pinpoint investors who have a history of nailing it with early-stage projects.

Your main goal is to build a watchlist of wallets that meet some pretty strict criteria. You're looking for skill, not just a one-time lucky bet.

Tools like Wallet Finder.ai are designed to make this whole process much smoother, letting you apply these filters and surface the wallets that fit your exact criteria. The platform's dashboard gives you a clean way to spot wallets with a proven edge.

This view lets you see key stats like realized P&L and win rate at a glance, making it incredibly simple to identify and start tracking true smart money.

Okay, so you’ve found a handful of elite wallets. Just watching them isn’t enough. The presale world moves at lightning speed; opportunities can appear and vanish in a matter of hours. To actually act on their insights, you need real-time notifications the second they make a move.

This is where setting up alerts becomes a game-changer. It transforms your passive research into an active signal-generation machine. You can get notifications sent straight to you on platforms like Telegram or as browser push notifications.

By setting up alerts, you're essentially creating a personalized "presale radar." When a top wallet invests, your radar pings, giving you an immediate heads-up to start your own final due diligence.

These alerts give you a massive time advantage. You can be one of the very first to know when a well-vetted project is picking up steam with serious investors, giving you a chance to investigate and get in before the wider market even knows what's happening. To dive deeper into this strategy, check out our guide on how to build a smart money tracker to automate this whole process.

Tracking wallets isn’t about blindly copying trades. It’s about understanding the why behind their decisions. An investor's entire transaction history is out there on the blockchain—a completely transparent ledger of their strategy. By digging into their past trades, you can start to see patterns in how they operate.

Ask yourself these kinds of questions when you're reviewing a wallet's history:

Analyzing these patterns gives you invaluable context. It helps you understand their risk appetite and investment thesis, which allows you to find and follow investors whose strategies align with your own goals. This deeper level of analysis takes you from simple copy-trading to genuine strategic intelligence, giving you a powerful and repeatable method for finding and validating high-potential presales.

You’ve done the hard work, vetted a project, and decided it's worth a shot. Now for the final, and arguably most critical, step: execution. Safely participating in token presales isn't just about clicking a button; it requires a specific set of security habits to shield your funds from the swarms of scammers and technical traps laid for eager investors. Nailing this part is just as important as all the research that got you here.

First things first: use a dedicated "burner" wallet. This is a brand-new, completely separate wallet that you fund with only the exact amount of crypto you plan to invest. Never, ever connect your main wallet—the one holding the bulk of your assets—to a new presale website or smart contract. This one simple move isolates your risk, meaning that even if the project turns out to be a complete rug pull, your primary portfolio stays untouched.

With your burner wallet locked and loaded, you'll typically join the presale through a launchpad or the project's official site. This is a high-stakes moment where paranoia is your best friend. Scammers are masters of disguise, creating pixel-perfect fake websites and social media profiles to lure you in.

Always triple-check the URL. Get the official link directly from the project's verified Discord or Telegram announcements. Never, ever click on a link someone sends you in a direct message, even if it looks like it’s from a team member.

Here’s a step-by-step guide to the technical process:

Beyond fake websites, be on high alert for scammers impersonating team admins in community chats. They'll slide into your DMs offering "special deals" or "private sale access." Let's be clear: a real project team will never DM you first to ask for money. Any message like that is a 100% guaranteed scam.

Your final layer of defense is understanding what you're interacting with on-chain. The more you know about the fundamentals of smart contract security, the better you'll get at spotting potential risks before you connect your wallet. By mixing careful operational security with a healthy dose of skepticism, you can confidently navigate the process and protect your capital.

Let's tackle some of the most frequent questions that come up when people are thinking about jumping into a token presale.

It's easy to get these two mixed up. An Initial Coin Offering (ICO) is a specific kind of public sale event. The term "presale" is much bigger; it's an umbrella that covers the entire fundraising journey.

This journey includes multiple stages:

Think of an ICO as just one possible stop on the much longer presale road.

Here's the honest answer: only invest what you are completely, 100% willing to lose. No exceptions.

Even projects that look like a sure thing can go sideways, making token presales incredibly high-risk. A smart approach is to carve out a very small slice of your total crypto portfolio for these kinds of speculative plays. That way, you limit your downside while still getting a ticket to potential high rewards.

Here's the golden rule for any high-risk investment: if the thought of it dropping to zero will cost you sleep, you’ve put in too much. Your number one job is always capital preservation.

In almost every case, yes. A public, transparent team with a history you can actually verify is one of the biggest trust signals you can get. It creates real-world accountability.

Sure, some corners of the crypto world have a culture that's okay with anonymous founders, but it massively cranks up the risk of a rug pull or the team simply vanishing. For most investors, making it a rule to avoid anonymous teams is a simple, powerful way to protect your capital.

Vesting contracts are on-chain and verifiable — use a block explorer to find the vesting contract address (usually published in the project's tokenomics documentation), check unlock dates and claimable amounts, and monitor whether team/investor wallets are moving tokens to exchanges immediately after cliff dates.

The deeper issue is OTC pre-selling — vesting locks on-chain transfers but not private economic agreements. Watch for unusual multi-wallet selling at cliff dates from addresses with no prior history, which indicates OTC delivery rather than original vesting beneficiaries selling. Genuine commitment shows as staking or LP deployment of vested tokens rather than immediate exchange deposits.

Yes — significantly. Audit quality varies enormously and paid audits can be designed to pass rather than find vulnerabilities. Multiple DeFi protocols with published audit badges were subsequently exploited through vulnerabilities in audited code.

Evaluate audit quality, not just existence: look for multiple independent auditors reviewing the same codebase, full scope disclosure showing nothing was excluded from review, high-severity findings that were demonstrably fixed, and the auditing firm's historical track record of subsequent exploits in their audited projects. The strongest signal is a full published report — not just a badge — showing real findings and their resolutions.

Healthy TGE price action shows gradual price discovery with broad participation, proportional liquidity depth relative to presale size (a $10M raise should have $1M+ initial liquidity, not $200K), diverse wallet addresses providing liquidity, and team wallets that demonstrably don't transact in the first 48-72 hours despite full access.

Manipulation signals: thin initial liquidity pool enabling dramatic price moves on small volume, sharp synchronized pumps from a small number of wallets within the first hours, initial LP addresses removing liquidity within days of launch, and 300-500%+ gains in the first 4 hours on low volume. That kind of chart pattern reflects engineered thin-market manipulation designed to attract FOMO retail buyers into team and VC distribution — not genuine demand.

Ready to stop guessing and start tracking the experts? Wallet Finder.ai gives you the on-chain intelligence to see where smart money is moving in real time. Discover top-performing wallets, get instant trade alerts, and leverage data-driven insights to find your next crypto gem before the crowd. Start your 7-day trial and gain a critical edge at https://www.walletfinder.ai.