Is Coinbase Safe? A Guide To Its Security

Is Coinbase safe to use? This guide explores its security, insurance, and regulations. Learn how to protect your assets and decide if it's right for you.

February 17, 2026

Wallet Finder

February 12, 2026

When you hear traders discuss a blockchain, one of the first specs they mention is transactions per second (TPS). What is it? Think of it as the network's raw processing power—how many transactions it can handle every single second.

For a DeFi trader, this isn't just a technical detail; it's the engine driving your profitability. A higher TPS translates directly to faster trade execution and fewer missed opportunities. It’s the difference between a quiet country road and a ten-lane superhighway. One gets you there eventually, while the other gets you there now.

We've all been there. You spot a whale making a monster buy on a token that’s about to pop. You quickly move to copy the trade, but the network is clogged. By the time your transaction finally confirms, the price has already pumped, and your potential profit is gone.

This guide pulls TPS out of the technical weeds and shows you what it really is: a core metric that can make or break your trades. We’ll dig into why a network’s speed can be the deciding factor between a huge win and a painful loss.

In the DeFi arena, speed isn't a suggestion; it's a requirement. A slow network does more than just make you wait. It actively works against your trading strategy, turning a golden opportunity into a costly mistake when the chain gets congested.

These delays aren't just minor hiccups. They create a window for bots and other traders to jump ahead of you, exploiting the very market movement you were trying to capture. This is a huge hidden risk, and you can learn more about it by analyzing latency in crypto trading patterns.

In DeFi, speed isn't a luxury—it's a fundamental component of execution. A network's TPS directly influences your ability to enter and exit positions at your desired price, making it a crucial element of any successful trading plan.

Getting a handle on TPS is your first step toward gaining a real edge. By focusing on networks with high and, just as importantly, stable transactions per second, you can stack the odds in your favor.

Here’s what a fast network actually lets you do:

This guide will break down how a chain’s speed impacts your trading, compare how the big blockchains really perform under pressure, and give you strategies you can use today. The goal is simple: to help you turn network speed into your personal advantage.

Let's cut through the noise. When you hear about a blockchain's transactions per second (TPS), it’s easy to get lost in the technical weeds. Think of it like this: a blockchain is a massive highway, and every transaction—a swap, a transfer, a DeFi trade—is a car trying to get through.

TPS is a simple measure of how many cars can pass a single point on that highway each second. A network with high TPS feels like a wide-open superhighway. One with low TPS is a single-lane country road at 5 PM on a Friday. For a trader, knowing which road you’re driving on is everything.

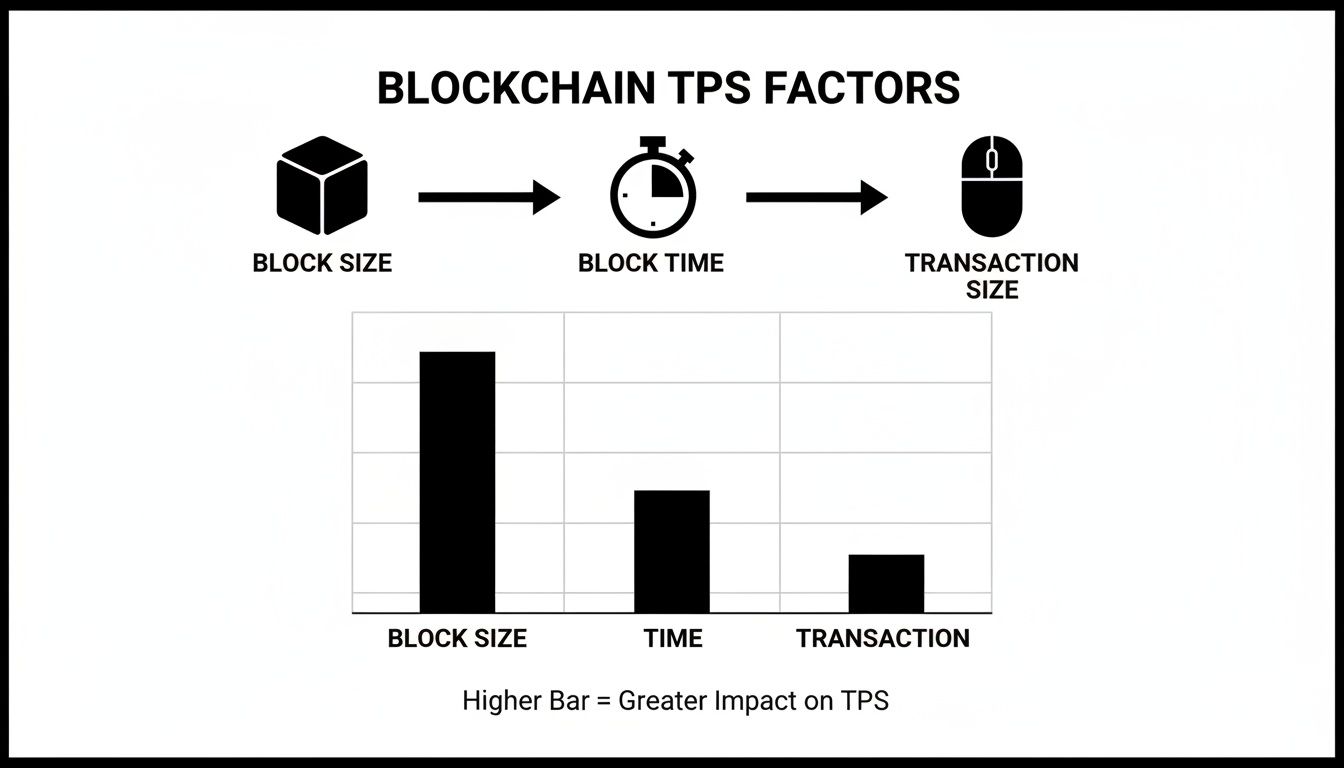

So, what determines if you’re on a superhighway or a dirt road? It all boils down to a few core design choices made by the blockchain's engineers. These factors are locked in at a foundational level and dictate how fast your trades get processed.

There are three main parts to this puzzle:

A network's real-world performance is a constant tug-of-war between these three elements. You could have a highway with tons of lanes (huge blocks), but if the traffic light stays red for ages (slow block time), your actual throughput is going to suffer.

You’ve probably seen flashy headlines from blockchains claiming absurd TPS numbers—tens of thousands, even hundreds of thousands. Take those with a grain of salt. That's peak TPS, a theoretical maximum achieved in a sterile lab environment using only the simplest, smallest transactions. It's like measuring a highway's capacity at 3 AM with only tiny smart cars on the road.

As a trader, the only number you should care about is sustained TPS. This is the network’s actual, real-world average throughput during normal conditions, with a messy mix of simple transfers and those giant DeFi "trucks" jamming up the lanes. Sustained TPS tells you how the network performs when you actually need it.

This isn't just semantics; it's critical. Peak TPS is a marketing gimmick, but sustained TPS is a real performance metric. Relying on inflated peak numbers can get you wrecked, as the network could grind to a halt right when you need to execute a time-sensitive trade during a big market event.

The good news is that this real-world capacity has exploded. Over the last five years, the total transaction throughput across major blockchains has shot up more than 100x. We've gone from fewer than 25 TPS in 2020 to a solid 3,400 TPS today. You can see the data for yourself in the State of Crypto Report 2025. This isn't just an incremental improvement; it's a massive leap that puts blockchain infrastructure on par with serious traditional financial systems.

Let's cut through the noise. When you see a blockchain boasting about its theoretical max transactions per second (TPS), it’s mostly just marketing. For a DeFi trader, that number means nothing when the market is pumping and you need your transaction to go through right now.

What really counts is the sustained, real-world TPS a network can handle under pressure. This is where the top DeFi blockchains show their true colors, and understanding these differences is key to picking the right chain for your trading style.

This table gives you a practical, data-driven look at how the major chains perform day-to-day. We're focusing on the numbers that actually impact your trading—sustained speed, typical costs, and the best use case for each network.

BlockchainTheoretical TPS (Peak)Sustained TPS (Real-World Average)Average Transaction FeePrimary Use Case for TradersSolana65,000+~3,000< $0.01High-frequency copy trading, memecoins, fast DEX swapsEthereum~10015-30$5 - $50+High-value settlement, NFT mints, major protocol governanceBase (L2)10,000+~150-500$0.01 - $0.10Emerging DeFi applications, social finance (SocialFi)Arbitrum (L2)40,000~100-400$0.05 - $0.25Established DeFi protocols, yield farming, complex swaps

This isn't about finding the "best" blockchain, but the right one for the job. A high-value settlement on Ethereum has different needs than a rapid-fire memecoin trade on Solana.

Solana has built its entire reputation on speed, making it the undisputed king for high-frequency trading, copy trading, and chasing the latest memecoin. Its Proof-of-History consensus mechanism is engineered for raw velocity.

While Solana's theoretical peak is an eye-watering 710,000 TPS, its real-world performance hovers around a consistent 3,000 TPS. That might sound like a big drop, but it absolutely smokes Bitcoin’s 7 TPS and Ethereum’s 15-30 TPS. This makes it the perfect playground for strategies where every millisecond gives you an edge.

This chart breaks down the core components that dictate any blockchain's transaction speed.

As you can see, factors like block size and block time are the fundamental levers that determine a network's final throughput.

Ethereum plays a different game. It deliberately sacrifices raw speed on its mainnet for maximum decentralization and iron-clad security. Think of it less as a high-speed highway and more as the ultimate, immutable settlement layer for the entire crypto world.

For traders, this means Ethereum's mainnet is reserved for high-value transactions where security is non-negotiable. Its slow, methodical pace is a feature, not a bug—it ensures every transaction is validated by a massive, decentralized network, making it incredibly tough to attack.

But that doesn't mean traders are left in the slow lane. Ethereum's true power today comes from its Layer-2 ecosystem.

Networks like Base, Arbitrum, and Optimism are the answer to Ethereum's scalability puzzle. These Layer-2s operate like express lanes, processing thousands of transactions quickly and cheaply on a separate chain. They then bundle these transactions up and settle them as a single, verified batch on the Ethereum mainnet.

This clever setup gives you:

For most DeFi traders, Layer-2s are where the action is. They offer the speed you need for day-to-day trading without ever compromising the security that makes Ethereum the foundation of DeFi. To dive deeper, check out our complete Ethereum Layer-2 guide for traders.

Chasing the highest transactions per second (TPS) without understanding the cost can be a recipe for disaster. While speed is a massive advantage in DeFi, it rarely exists in a vacuum. The fastest networks often make some serious compromises that can introduce new, unexpected risks for traders.

This delicate balancing act is famously known as the blockchain trilemma. It's a simple framework that describes the constant battle between three core properties every blockchain has to juggle.

The trilemma basically says you can't have it all. It’s extremely difficult for a blockchain to max out all three areas at once. Pushing hard on one usually means you have to give something up on another.

Some networks hit those eye-popping TPS numbers by cutting corners on decentralization. They might rely on a small, fixed group of incredibly powerful validators to process every transaction. It's like having just a few hyper-efficient checkout clerks at a massive supermarket—things move fast, but you've also created a huge single point of failure.

This kind of centralization can expose you to some serious risks. What happens if a few of those key validators team up, get hacked, or are shut down? The whole network could grind to a halt or even start censoring transactions, leaving your funds stuck in limbo. A truly decentralized network might be a bit slower, but it spreads trust so widely that it becomes incredibly tough to attack or censor.

For a trader, decentralization isn't just some philosophical ideal—it's your insurance policy. It's the guarantee that the network rules are fair for everyone and that no single entity can just decide to freeze your assets or block your trades.

Beyond the trilemma, there's another crucial metric that often gets lost in the hype around TPS: time to finality. This is the real measure of how long it takes for your transaction to be permanently locked in and irreversible on the blockchain.

Think of it this way: high TPS with slow finality is like getting an instant email receipt for an online purchase, but your payment hasn't actually cleared the bank yet. The initial confirmation feels good, but the deal isn't truly done until it's final.

A network might "confirm" a transaction in less than a second, but it could take a full minute to actually achieve finality. During that gap, there's a small but very real risk that the transaction could be reversed in what’s called a "chain reorganization." For any trader, especially one moving serious size, that window of uncertainty is a major liability.

To protect your capital, you have to look past the flashy marketing numbers. A healthy, reliable network is about so much more than raw speed. Before you park your funds on a new blockchain, run through this checklist to get a sense of its true strength.

Metric to EvaluateWhat to Look ForWhy It Matters for TradersValidator Count & DistributionA high number of globally distributed, independent validators.More validators mean greater decentralization and security, reducing your risk of being censored or seeing the network halt.Sustained Real-World TPSConsistent performance on a block explorer during busy periods, not just the theoretical maximum from a whitepaper.This tells you the real speed you'll get when you need it most, which directly impacts slippage and your exposure to front-running.Time to FinalityHow many seconds or minutes it takes for transactions to become irreversible. Look for this data on explorers or in official docs.The faster the finality, the sooner your funds are truly secure. This cuts down on the risk of reversed transactions and trade uncertainty.Transaction Fee StabilityPredictable fees that don't skyrocket the moment the network gets a little busy.If you’re copy trading or scalping, you need stable, low fees for your strategies to even be profitable.

Using a framework like this helps you make much smarter decisions. You can cut through the hype and judge a blockchain on the metrics that actually impact your security, your profits, and your peace of mind as a trader.

Knowing the technicals of transactions per second is one thing. Connecting it to your P&L is where the real edge is. A network's speed isn't just some abstract number; it's a force that actively shapes the outcome of every single trade you make. Slow chains can silently bleed your profits through sneaky mechanisms that punish even the slightest delay.

Let's break down the critical ways a blockchain's TPS can make or break your trading success. These aren't just hypotheticals—they're the daily realities that separate traders in the green from those constantly getting wrecked.

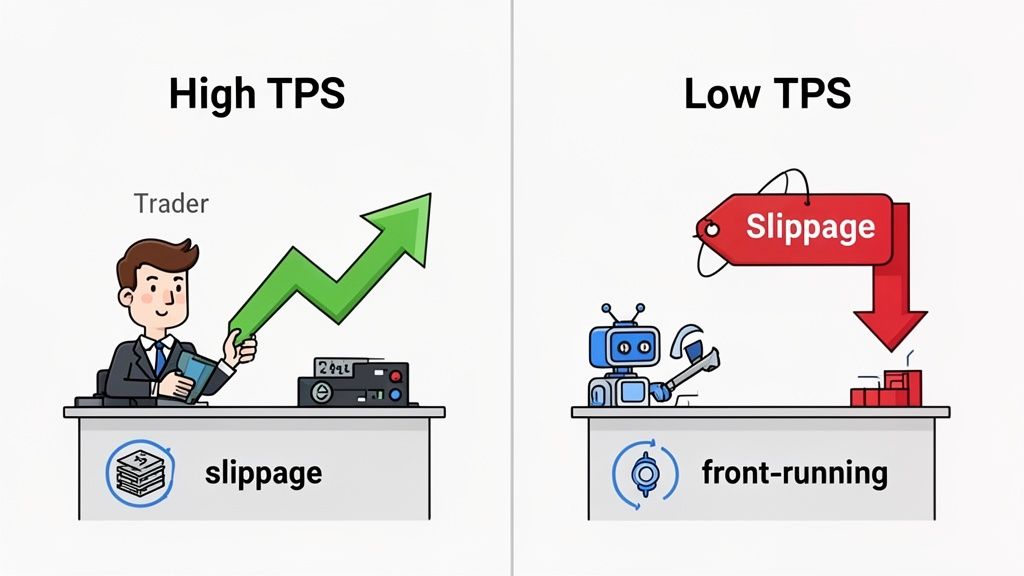

Slippage is the frustrating gap between the price you think you're paying and the price you actually pay. On a slow, low-TPS network, the time between clicking "swap" and your transaction getting confirmed is a danger zone where prices can swing wildly against you.

Picture this: you're trying to ape into a hot new token on Ethereum during peak mania. Your transaction gets stuck in the queue for several seconds, maybe even a minute. In that time, hundreds of other trades jump ahead of you, driving the price up. By the time your order finally executes, you could be paying 3-5% more than you planned, instantly putting you underwater. A high-TPS chain crushes this delay, shrinking the window for price moves and getting you a fill much closer to what you saw on screen.

Slow networks are a playground for predatory bots designed to pick your pocket. These bots are constantly scanning the mempool—the public waiting room for pending transactions—looking for juicy trades to exploit. This is the dark art of Maximal Extractable Value (MEV).

Here's the classic play-by-play:

High-TPS networks throw a massive wrench in this scheme. By processing transactions almost instantly, they give these bots a razor-thin window to spot and hijack your trades, protecting your entry price. Of course, managing your own fees is just as vital; our guide on how to track gas fees for high-frequency DeFi trades can help you master that side of the equation.

If you’re using a platform like Wallet Finder.ai, the success of your copy trading rides entirely on the network's ability to mirror a trade instantly. The moment you get an alert that a smart money wallet just made a move, you're in a race against the entire market.

A delay of just a few seconds is the difference between catching a profitable entry and buying the top of a pump. On a lightning-fast network like Solana, your copy trade can get confirmed in under a second, giving you the best possible shot at replicating an expert's success. On a slower chain, that same alert is often worthless by the time your transaction finally gets through.

The value of a real-time trading alert is directly proportional to the speed of the underlying network. An instant alert on a slow chain is a recipe for frustration and financial loss.

Finally, low TPS contaminates the very data that fuels your trading tools. On-chain data platforms depend on information being confirmed and added to the blockchain. When the network gets clogged, this entire process grinds to a halt, meaning the data feeding your wallet tracker or alert system is stale.

This leads to a cascade of problems:

Even a network like Bitcoin, prized for security over speed, proves this point. Bitcoin's 7 TPS is rock-solid for settling value but far too slow for time-sensitive trading. Real-time charts show its mempool traffic hovering between 3-10 TPS, which is fine for its purpose but a deal-breaker for DeFi. You can see more historical Bitcoin transaction rates on Blockchain.com. High-TPS networks ensure the data feeding your tools is fresh, giving you an accurate picture of the market you can actually act on.

Understanding average TPS is useful, but knowing how a network behaves during congestion is what separates profitable traders from those constantly fighting with stuck transactions. Every blockchain has predictable stress patterns that emerge during high-activity periods, and learning to read these signals gives you a massive edge in timing your trades and avoiding costly delays.

Network congestion doesn't appear randomly—it follows patterns triggered by specific events and market conditions. If you can recognize these patterns forming, you can either execute your trade before the congestion hits or wait for the storm to pass, avoiding the worst possible execution conditions.

Congestion happens when transaction demand exceeds the network's sustained processing capacity. Think of it like a highway where rush hour traffic overwhelms the available lanes. On a blockchain, this creates a mempool backlog—a growing queue of pending transactions competing for limited block space.

The mempool is essentially the waiting room for unconfirmed transactions. When demand is normal, transactions flow through the mempool and into blocks within seconds. During congestion, the mempool swells as thousands of transactions pile up, creating a bidding war where users compete by offering higher gas fees to get priority processing. For traders, a bloated mempool is a red flag that your transaction might take minutes or even hours to confirm unless you're willing to pay significantly inflated fees.

Predictable Congestion Triggers

Certain events trigger congestion with clockwork regularity, and monitoring for these patterns lets you anticipate problems before they impact your trades.

The first major trigger is new token launches and NFT mints. When a hyped project goes live, thousands of wallets simultaneously attempt to mint or purchase at the exact same moment. This creates an instant spike in transaction volume that can overwhelm even high-TPS networks. Ethereum has seen gas fees spike from five dollars to two hundred dollars or more during major NFT drops, and Solana has experienced complete network outages when demand exceeded its processing capacity during high-profile launches.

The second trigger is market volatility and liquidation cascades. When the market makes a violent move in either direction, leveraged positions start getting liquidated, triggering automated trades across thousands of accounts simultaneously. This creates a feedback loop where liquidations cause more liquidations, each one adding more transactions to the mempool. During these events, DeFi platforms become nearly unusable as traders scramble to adjust positions, close loans, or rush for the exits. If you're running leveraged strategies, you need to factor in the very real possibility that network congestion during a crash could prevent you from closing positions before they get liquidated.

The third trigger is protocol governance votes and time-sensitive events. Many protocols have voting windows or claim periods with hard deadlines. As these deadlines approach, users rush to participate, creating predictable congestion spikes. Similarly, airdrops with limited claim windows generate massive transaction spikes as users compete to claim free tokens before they expire.

Real-Time Mempool Monitoring for Execution Timing

Smart traders don't just check current TPS—they monitor the mempool to understand what's coming. The mempool's size and composition tell you whether the network is about to get congested or if conditions are clearing up.

Most blockchain explorers provide mempool visualizations showing how many transactions are pending and what gas fees are being offered. Ethereum's mempool can be monitored through sites like Etherscan's Gas Tracker, which shows pending transaction count and current gas prices in real time. Solana's mempool can be checked through Solscan, which displays current transaction load and any backlog building up.

When the mempool is empty or near-empty, you're in a green zone—transactions will confirm quickly at minimal cost. When the mempool starts filling up and you see pending transactions climbing into the thousands, you're entering a yellow zone where delays are likely and fees will increase. If the mempool is massively bloated with tens of thousands of pending transactions and gas prices have spiked five to ten times normal levels, you're in a red zone where execution is unreliable and costs are prohibitive unless the trade is absolutely critical.

Strategic Transaction Timing Based on Network Load

Using this mempool intelligence, you can make tactical decisions about when to execute. If you're planning a large DeFi trade that isn't time-critical, checking the mempool first can save you hundreds of dollars in gas fees. Executing the same trade during off-peak hours when the network is quiet might cost five dollars instead of fifty dollars, with faster confirmation to boot.

For time-sensitive trades where you can't afford to wait, understanding current network conditions helps you set appropriate gas fees. If the mempool is starting to fill but hasn't reached critical levels, setting your gas fee at the seventy-fifth percentile of pending transactions ensures you'll get processed in the next few blocks without grossly overpaying. If the network is in full red-zone congestion, you need to either pay premium gas fees to guarantee inclusion or accept that your transaction might fail or get stuck for an extended period.

The key is building this check into your trading routine. Before executing any significant trade, spend ten seconds glancing at the mempool. This tiny habit prevents countless frustrating experiences where your transaction gets stuck, you miss your entry, or you wildly overpay for gas because you executed blind during a congestion spike.

Transaction speed becomes critical when you're trading with leverage because liquidations happen automatically based on price movements, and network congestion can prevent you from closing or adjusting positions before you get liquidated. When the market makes a violent move against your leveraged position, you typically have a narrow window to add collateral or close the position to avoid forced liquidation. On a slow network during peak congestion, your transaction to save the position might get stuck in the mempool while the liquidation bot's transaction gets processed first because it paid higher gas fees.

This creates a devastating scenario where you attempted to close your position in time, but the network's TPS limitations and congestion made execution impossible before the automated liquidation triggered. During the March 2020 crypto crash, Ethereum's network became severely congested as thousands of leveraged positions hit liquidation simultaneously. Many traders tried to close positions or add collateral but their transactions took twenty to thirty minutes to confirm—far too late to prevent liquidation. The lesson is clear: if you're using leverage on a slower network, you must maintain larger safety margins and avoid positions that leave you vulnerable to liquidation during predictable congestion events like major economic announcements or protocol governance votes.

Yes, with practice and the right monitoring tools, you can develop a strong sense of when congestion is likely to spike. Network congestion follows predictable patterns triggered by scheduled events and market conditions. Major NFT drops, token launches with announced times, governance vote deadlines, and airdrop claim windows all create foreseeable transaction surges that will congest the network.

The best traders maintain a calendar of high-impact events on the chains they actively use. If you know a hyped NFT mint is scheduled for three p.m. Eastern on Ethereum, you can expect network congestion to spike fifteen to thirty minutes before the event as bots begin positioning and continue for thirty minutes to an hour after as demand overwhelms supply. You can either execute your unrelated trades well before this window or wait until the congestion clears. Additionally, monitoring tools like Etherscan's Gas Tracker or Solana Beach show real-time transaction loads and pending mempool sizes. If you check these before executing and see the mempool starting to fill with pending transactions climbing rapidly, that's your signal that congestion is building and you should either execute immediately before it worsens or wait for conditions to normalize.

While theoretical TPS is determined by block size and block time, real-world sustained TPS is heavily influenced by the number and geographic distribution of validators. A network with only fifty validators concentrated in one data center can process transactions quickly under ideal conditions but becomes extremely vulnerable to outages, attacks, or censorship. If that data center loses power or internet connectivity, the entire network halts regardless of its theoretical capacity.

Networks with thousands of geographically distributed validators like Ethereum achieve much greater resilience but pay a coordination cost that can reduce sustained TPS during stress conditions. Each validator must communicate with peers, verify blocks, and reach consensus, and this coordination overhead grows with validator count. However, this trade-off is usually worth it because a well-distributed validator set ensures the network continues operating even during regional outages, government interference, or targeted attacks. For traders, the practical takeaway is to check a network's validator count and distribution before committing significant capital. A network claiming high TPS with only a handful of validators controlled by the same entity is a red flag—that speed is fragile and could disappear the moment those few validators face any disruption.

Let's clear up some of the most frequent questions traders have about network speed and how it really impacts their strategies. Think of this as the practical takeaway section, reinforcing the key ideas we've covered.

Picture it this way: TPS is how fast you get a "payment received" email after buying something online. Time to finality is when the money is actually, irreversibly, gone from your bank account.

So, TPS measures throughput (how many transactions can be processed), while finality measures when a transaction is set in stone and can't be reversed. A blockchain can have a high transactions per second but take a while to reach finality, meaning your trade might look complete instantly but isn't truly secure for several minutes.

Layer-2 networks like Base and Arbitrum are like adding express toll lanes to a jammed highway. They handle thousands of transactions off the main Ethereum blockchain, making them incredibly fast and cheap.

After processing all these trades, they bundle them into one neat package and submit it back to the main chain for security. This whole process massively boosts the effective TPS for you, the trader, making these networks a go-to for any strategy where speed and low costs are paramount.

Absolutely. A network's TPS isn't some fixed number you see on a website—it's a living metric. It goes up and down constantly depending on network traffic, the complexity of the transactions being run, and any updates the developers are rolling out.

This is exactly why smart traders don't rely on theoretical stats. You have to check the network's real-time performance. A chain that's blazing fast on a quiet Monday morning could feel sluggish during a chaotic Tuesday afternoon airdrop.

Pretty much every major blockchain has a dedicated network explorer that gives you a live look under the hood. For Solana, you can use Solscan, and for Ethereum, you’d use Etherscan.

These sites are your dashboard for what's happening right now. They show you the current transactions per second, how congested the network is, and what you can expect to pay in gas fees. Checking these explorers before a trading session should be part of your routine.

Ready to turn on-chain data into your trading advantage? Wallet Finder.ai gives you the real-time alerts and deep wallet insights you need to act faster than the market. Start your 7-day free trial today.