7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

December 29, 2025

Wondering how some people make their crypto work for them, earning passive income while they sleep? They’re likely using a yield farming platform, a decentralized finance (DeFi) engine that puts your crypto assets to work.

Think of it as a supercharged savings account. Instead of a bank, these platforms run on automated programs called smart contracts. You provide your crypto, help others trade or borrow, and earn rewards for your contribution. It's a powerful way to generate yield on your assets.

At its core, a yield farming platform is a system that allows you to lend your crypto to provide liquidity for DeFi protocols. Participants, known as liquidity providers, lock up their funds to power services like decentralized exchanges and lending platforms.

Imagine a busy marketplace. For it to run smoothly, it needs a constant supply of goods. In DeFi, those "goods" are crypto tokens, and you’re the supplier. By contributing your assets, you keep the market liquid, and you get paid for it. The scale is massive—the total value locked (TVL) in DeFi protocols was hovering around $107 billion as of early 2025. That’s a lot of crypto being put to work.

To truly understand what’s happening, you need to know the three key components. These parts work in concert to generate the returns you're looking for.

These three components create a powerful, self-sustaining financial ecosystem. If you want to get into the details, you can learn more about how crypto liquidity pools work and why they’re the backbone of DeFi.

A great way to think about it is like an automated financial co-op. Members (you) pool their resources (crypto), and the co-op (the platform) uses them to offer services like currency swaps or loans. In return, every member who chipped in gets a cut of the profits.

So, why should you care about these technical details? Because these moving parts directly impact your potential profits and your risks.

The size of a liquidity pool, the efficiency of the AMM, and the staking rewards all combine to determine your farming success. A platform with deep liquidity and high trading volume usually offers steady, reliable returns from fees. Conversely, a new platform might offer sky-high staking rewards to attract users, but this often comes with higher risk.

To make it even clearer, here’s a quick-reference table breaking down the essential parts of any yield farming ecosystem.

Once you understand how these pieces fit together, you’re in a much better position to spot good opportunities and start building your own yield farming strategies.

As you explore any yield farming platform, you'll immediately encounter two metrics that look similar but have vastly different implications for your earnings: APR and APY. Understanding the difference is crucial for accurately projecting your returns.

Think of APR (Annual Percentage Rate) as the simple interest rate. It’s the flat return you’d earn on your initial investment over one year, without reinvesting any of your earnings. It’s a straightforward number but doesn't tell the whole story.

Then there’s APY (Annual Percentage Yield). This is where the magic of compounding comes into play. Compounding means your earnings start generating their own earnings.

It’s just like a high-yield savings account. The APR tells you the base interest rate. The APY, however, shows the actual return once you factor in the effect of reinvesting your interest payments.

This is what makes yield farming so potent. The difference between a 20% APR and a 20% APY can become enormous, especially when compounding occurs frequently—daily, hourly, or even more often.

The core difference is reinvestment. APR is a static, one-year snapshot of returns on your principal. APY is a dynamic measure that reflects the exponential growth that occurs when your earnings start earning for themselves.

Many platforms simplify this with "auto-compounding" vaults. These smart contracts automatically harvest your rewards and reinvest them into your position, maximizing your APY without manual intervention. To better forecast your potential gains, see how a DeFi yield estimator can help model different scenarios.

When comparing farming pools, a higher APY is almost always preferable, assuming similar risks. A platform might display a high APR, but if you must manually claim and restake rewards—paying gas fees each time—your effective return could be significantly lower.

Here's a quick breakdown:

Always investigate how often the yield compounds. Is it daily, weekly, or do you have to do it yourself? A high APY on a reliable yield farming platform with frequent, automated compounding is the key to accelerating your portfolio’s growth.

Once you’ve grasped how a yield farming platform works, it's time to explore strategies. These range from simple, low-risk approaches for beginners to complex plays for seasoned DeFi veterans. Your ideal strategy depends on your risk tolerance and financial goals.

For those just starting, these strategies offer a clear and lower-risk path to earning yield.

Once you're comfortable, you can explore advanced strategies that offer higher potential returns but come with increased risk.

The DeFi space is crowded, but a few platforms stand out due to their security, user experience, and consistent returns. Protocols like Beefy Finance and PancakeSwap are heavy hitters, often delivering APYs from 8% to 40% across more than 30 blockchains.

This growth is built on crypto-collateralized lending. Industry data shows this sector exploded by $20.46 billion in just one quarter of 2025—a massive 38.5% leap to an all-time high of $73.59 billion. The broader DeFi market itself was valued at USD 26.94 billion in 2025 and is projected to hit USD 231.19 billion by 2030. You can dive deeper and find some of the top yield farming platforms in the market.

Choosing a platform is a critical step, as each offers different strategies and risk levels. This table breaks down a few popular options.

Ultimately, picking the right yield farming platform is about matching its strengths to your personal strategy. Whether you want the "set it and forget it" simplicity of Beefy or the hands-on opportunities of PancakeSwap, there's a platform for you.

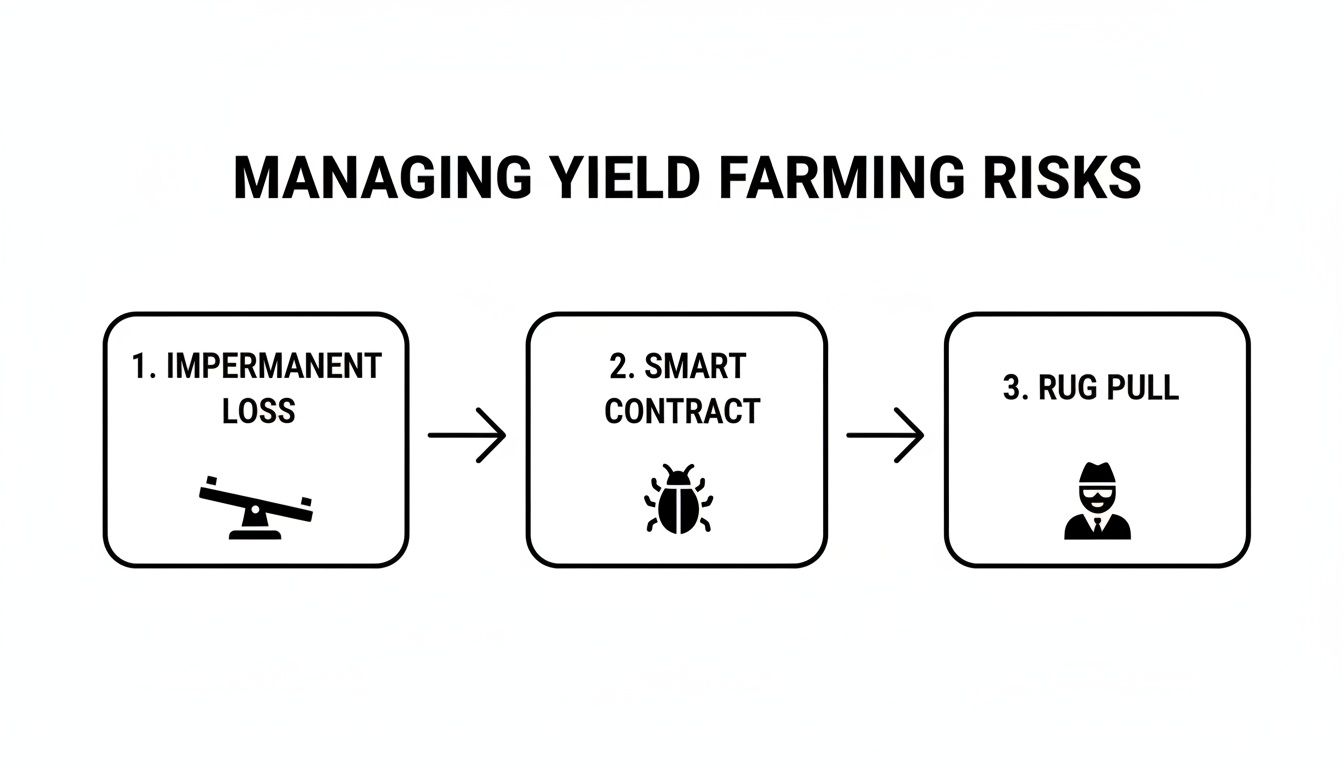

High yields always come with risk. The promise of eye-watering returns can be tempting, but it's crucial to understand the dangers before you commit capital. The most successful farmers aren't just yield chasers; they are masters of risk management.

Navigating this space requires a clear view of what can go wrong. The risks range from temporary losses to outright theft, but they are manageable if you know what to look for. Let's break down the three biggest dangers.

One of the trickiest concepts is impermanent loss. This occurs when you provide liquidity to a two-token pool, and the price of one token changes significantly relative to the other.

Imagine a balanced see-saw with ETH on one side and USDC on the other. If the price of ETH skyrockets, the automated market maker (AMM) rebalances the pool by selling some of the more valuable ETH for USDC. If you withdraw your funds at that moment, you'll receive less ETH and more USDC than you initially deposited.

This gap between the value of your assets in the pool versus what they would have been worth if you'd just held them is impermanent loss. It only becomes permanent if you withdraw your assets while prices are imbalanced.

Often, the trading fees you earn can offset minor impermanent loss. However, a major price swing can leave you with less total value than you started with, even after fees.

Every DeFi protocol is built on smart contracts. If the code has a bug or security flaw, hackers can exploit it and drain the protocol of its funds. This isn't a theoretical risk—DeFi platforms lost over $2.3 billion to hacks in 2023 alone.

So, how do you stay safe? Look for signs of a security-conscious project.

No platform is 100% immune, but due diligence can dramatically lower your risk.

The most malicious danger is the rug pull. This is an exit scam where anonymous developers abandon the project and abscond with investors' funds. These scams prey on the hype surrounding new tokens.

To avoid being rugged, develop a healthy skepticism and learn to spot the red flags.

Red Flags of a Potential Rug Pull

Ultimately, selecting a safe yield farming platform comes down to solid research. By understanding these core risks, you can make smarter decisions and farm with more confidence.

Let's move from theory to practice. This actionable guide will walk you through setting up your first farm, from creating a wallet to earning rewards.

The core process involves four simple stages: getting your gear (wallet), loading it with supplies (crypto), finding a good location (platform), and planting your seeds (providing liquidity).

First, you need a non-custodial Web3 wallet. This is your digital passport to the DeFi world. You are in complete control.

With a funded wallet, you’re ready to connect to a platform. For beginners, it's best to stick with battle-tested names like Aave, Curve, or PancakeSwap.

Now it’s time to pick a pool. Look for a section labeled "Pools," "Farms," or "Liquidity."

Once confirmed, you will receive Liquidity Provider (LP) tokens. These act as a receipt, representing your share of the pool.

As you get comfortable, remember the main threats you're managing.

This image nails the big three: impermanent loss, sneaky smart contract bugs, and outright rug pulls. Always keep these in the back of your mind.

You're almost there. Holding LP tokens isn't enough; you must stake them to start earning.

That's it! Your LP tokens are now staked, and you will begin earning rewards. With DeFi's total value locked at $192 billion, it's clear there's huge demand for these yields. Pros use tools like Wallet Finder.ai to see how top wallets are farming Curve's massive $34.60 billion in quarterly volume. You can dig deeper into how the top yield farming platforms are generating daily returns.

Now, monitor your position. Check your earnings, watch for APY changes, and have a plan for taking profits.

The most successful yield farmers don't just chase high APYs—they follow the data. To gain a real edge, you must look past the advertised numbers and see what profitable traders are actually doing. This is where on-chain analysis becomes your secret weapon.

Instead of guessing, you can mirror the moves of top-performing wallets. The blockchain is a public ledger, and by identifying these "smart money" addresses, you get a direct look at proven, profitable strategies. You're turning transparency into a source of powerful, actionable signals.

First, you need to find these profitable wallets. Using a tool like Wallet Finder.ai, you can filter addresses by their track record of high returns in DeFi. This is about spotting consistent success, not luck.

You can get highly specific. For example, if you're interested in a particular yield farming platform like PancakeSwap, you can filter to see only wallets active in that ecosystem. This reveals how the best traders are navigating that exact platform.

The screenshot below shows the 'Discover Wallets' feature, where you can sort and filter wallets by key performance metrics like Profit & Loss (PnL).

By analyzing these top wallets, you can uncover their entry and exit points for different liquidity pools, revealing which farms they prefer and when they decide to move on.

Once you've identified promising wallets, the real magic is monitoring their activity in real-time. Manual tracking is impossible in this fast-paced environment, which is why real-time alerts are a game-changer.

Here’s a simple playbook to put this into practice:

This process transforms raw on-chain data into a significant advantage. For a deeper dive into these techniques, check out our complete guide to on-chain analysis.

The goal is to stop chasing yesterday's returns and start anticipating tomorrow's opportunities. By following smart money, you're essentially getting a front-row seat to strategies that are actively generating profit.

In 2025, the DeFi space is booming. The global decentralized finance market is valued at USD 87.11 billion and projected to reach USD 954.59 billion by 2035, growing at a 27.02% CAGR. With institutional money pouring in, mirroring whale strategies with on-chain trackers is how you cut through the noise. Learn more about these trends in crypto yield farming platforms.

Jumping into DeFi and yield farming is exciting, but it's natural to have questions. Let's tackle some of the most common ones.

There's no minimum investment, but the practical starting amount depends on the blockchain you use.

It's better described as actively managed passive income. Once staked, your assets earn rewards automatically (the passive part). However, successful farmers don't just "set it and forget it." They constantly monitor their positions, hunt for better yields, and manage risks like impermanent loss (the active part).

Think of it like being a landlord. The rent check is passive income, but managing the property and tenants requires active work.

Yes, you can absolutely lose your entire investment. The high returns in yield farming are compensation for taking on significant risks.

Here are the primary ways you can lose money:

Because these dangers are real, it’s crucial to use well-known, audited platforms and adhere to the golden rule of crypto: never invest more than you can afford to lose.

Ready to stop guessing and start following the pros? With Wallet Finder.ai, you can discover the top-performing wallets, analyze their strategies, and get real-time alerts on their every move. Start your 7-day trial today and turn on-chain data into your competitive advantage.