7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 12, 2026

Choosing the best crypto portfolio tracker depends entirely on your needs. For manual tracking, free tools like CoinGecko and CoinMarketCap are excellent starting points. But for traders seeking deep, on-chain intelligence to mirror profitable strategies, advanced platforms like Wallet Finder.ai offer a distinct advantage.

Ultimately, the choice is between a simple financial snapshot and real-time, actionable insights that guide your next move.

Let's be honest: keeping tabs on your crypto assets can get chaotic, fast. Your holdings are probably scattered across centralized exchanges, various DeFi protocols, and a handful of blockchain wallets. Trying to get a clear, accurate picture of your total net worth in that environment isn't just a hassle—it's nearly impossible.

This is where a crypto portfolio tracker becomes less of a nice-to-have and more of an essential part of your toolkit.

Think about the alternative for a second. You'd have to manually log into Binance, check your MetaMask on Ethereum, then hop over to your Phantom wallet on Solana, all while trying to calculate your total profit and loss. It's a recipe for headaches and errors. A portfolio tracker automates this whole mess.

A portfolio tracker is your financial command center. It pulls all your scattered crypto accounts into one clean, unified dashboard. This gives you a bird's-eye view of your investments, empowering you to make smart, data-driven decisions instead of just guessing.

Getting everything in one place is just the first step. The real magic is in the clarity these tools provide, turning a flood of raw data into a genuine strategic advantage. You can finally ditch the spreadsheets and start focusing on your strategy.

For a deeper dive, check out our complete guide to crypto tracking.

Trying to track your portfolio in a spreadsheet seems like a good idea at first, but it quickly falls apart as your investments grow. You're stuck constantly updating prices by hand, and calculating complex metrics like unrealized gains or your cost basis for tax season becomes a total nightmare.

With the global crypto market cap soaring to $3.05 trillion, the complexity isn't going away. It only highlights how crucial a good tracker is for staying on top of things.

The best portfolio trackers do so much more than just list what you own. They're packed with powerful analytics that show you how your strategies are really performing.

Here’s what you gain:

Without a tool like this, you're essentially flying blind. You’re making critical decisions with incomplete information in a market that moves at the speed of light.

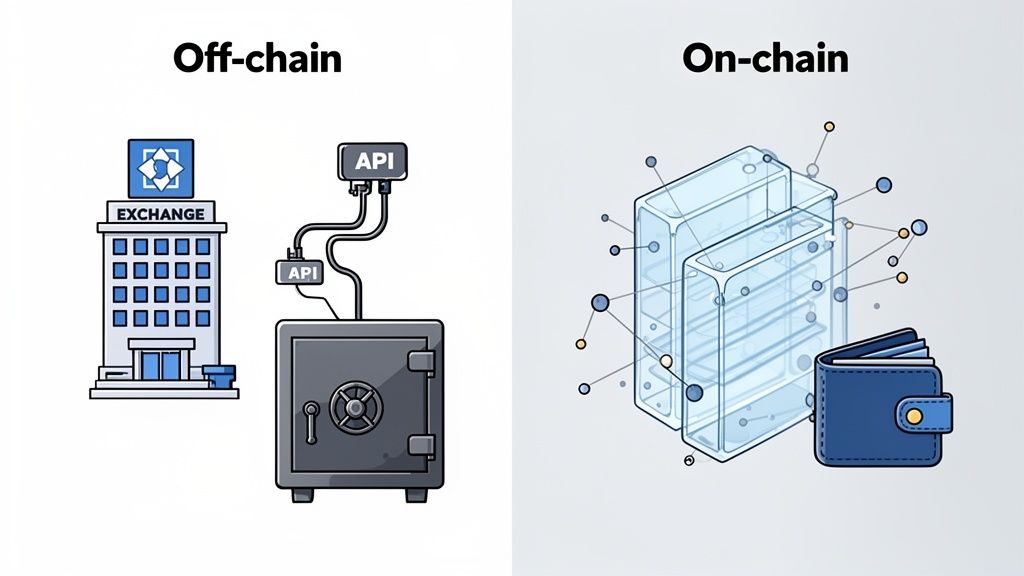

Before you can pick the right portfolio tracker, you need to know where it gets its data. It really boils down to two main sources: off-chain and on-chain. Getting this one concept right is the key to finding a tool that actually fits your trading style instead of fighting against it.

Think of an off-chain tracker as your online banking portal. It connects to centralized places—in crypto, that means exchanges like Binance or Coinbase—using a secure API key. This lets the tracker pull your balance and trade history directly from the exchange's private records.

It's a reliable method and perfect if all your activity happens on centralized platforms. The big catch? It's completely blind to anything happening outside those exchanges.

Off-chain trackers are masters of the centralized crypto world. Their main job is to pull together all your data from different exchanges and show it to you on one simple dashboard.

If you mainly buy your assets on Kraken or KuCoin and leave them there, an off-chain tool gives you a perfect, no-fuss snapshot. It's a clean, walled-garden view of your portfolio.

But what about the wild world of DeFi, NFTs, and self-custody wallets? That’s where you need to look on-chain.

An on-chain tracker, on the other hand, is like a public investigator that reads the blockchain itself. Instead of logging into a private server, it scans the decentralized, public record of every single transaction ever made.

This means it sees everything—every swap on Uniswap, every NFT you minted on OpenSea, and every token you moved between your wallets. You get a complete, unfiltered picture of all public activity on chains like Ethereum, Solana, or Base. For a deeper look at this, our guide to on-chain data analysis shows how this raw information becomes a huge strategic advantage.

On-chain trackers give you the ground truth, straight from the source. They don't need to ask a third party for permission or data, offering a level of transparency that off-chain tools just can't match for decentralized finance.

This direct-from-the-blockchain approach is non-negotiable for anyone active in DeFi. It’s the only way to accurately track what’s in your MetaMask wallet, your staked tokens, or your liquidity pool positions.

So, which one do you choose? The reality is, any serious crypto investor today needs a bit of both. The best portfolio trackers figured this out and evolved into a hybrid model.

Hybrid trackers merge the two approaches into one powerful tool. They use APIs to connect to your centralized exchange accounts and scan public blockchains for your wallet addresses. The result is a single, unified view of your entire crypto net worth, from the Bitcoin sitting on Coinbase to the meme coins you just bought on Base.

Why a Hybrid Tracker Wins

FeatureOff-Chain OnlyOn-Chain OnlyHybrid ModelCEX TradingExcellentNo visibilityExcellentDeFi & NFTsNo visibilityExcellentExcellentPortfolio ViewIncompleteIncompleteCompleteBest AudienceCEX TradersDeFi UsersAll Investors

At the end of the day, a hybrid tool makes sure no asset gets left behind. Whether you're a long-term HODLer on an exchange or a degen farmer exploring new DeFi protocols, a hybrid tracker gives you the 360-degree view you need to make smart moves.

Picking the right portfolio tracker isn’t just about finding the one with the flashiest interface. The best tools are set apart by a specific set of features that directly impact your ability to make sharp, timely decisions. Think of this as your checklist for cutting through the marketing noise to find a tool that actually fits your trading style.

Not all features are created equal for every investor. A copy trader who needs to react in seconds will care most about instant alerts, while a long-term holder might put a higher premium on rock-solid security. Understanding these core components helps you find a tracker that truly works for you.

The first question you should always ask is: "What can this tracker actually see?" Data coverage is all about the range of exchanges, wallets, and blockchains a tracker can plug into. If it can't see where your assets are, it's useless.

Without wide-ranging coverage, you’ll be stuck with a patchy, incomplete picture of your portfolio, which defeats the whole point. This is the foundation every other feature is built on.

Just knowing your portfolio's current dollar value is surface-level stuff. You need to understand how it got there. Deep profit and loss (P&L) analytics are what separate a simple balance checker from a serious trading tool. These are the metrics that show you if your strategies are actually working.

The best portfolio trackers don't just show you what you have; they show you how you got there. This includes realized gains from sold assets, unrealized profits on current holdings, and a detailed breakdown of your performance over time, net of all fees.

Look for tools that give you a complete historical P&L, showing your entry and exit points for every single trade. This is how you analyze your win rate, pinpoint your most profitable moves, and—just as importantly—learn from your mistakes.

For instance, CoinStats has become a giant in this space, with over 1 million users worldwide as of 2025, making it the #1 choice for traders with diverse assets. For DeFi copy traders and on-chain analysts, CoinStats provides advanced P&L metrics like total acquisition cost, unrealized P&L, and realized P&L, letting you get a precise read on performance. It's the kind of analysis you'd want when mirroring smart wallets on platforms like Wallet Finder.ai. You can see how top-tier trackers handle these metrics by checking out their platform insights.

The crypto market never sleeps, and it moves at lightning speed. A price swing that happens overnight can completely reshape your portfolio. This is why real-time, customizable alerts are a non-negotiable feature for any active trader.

The best tools go way beyond simple price pings. They let you set up notifications for specific on-chain events. For example, a copy trader can set an alert to get notified the second a wallet they’re tracking executes a trade. This flips the tracker from being a passive reporting tool into an active signal generator, giving you a real edge.

In crypto, security is everything. When you're looking at a portfolio tracker, the most critical security question is simple: "Does it need my private keys?" The answer should always, always be no.

A legitimate tracker will never ask for your private keys or seed phrase. Period. Here’s a quick rundown of what to look for:

Any platform that even hints at needing your private keys is a massive red flag. Walk away. Your portfolio's safety depends on keeping those keys locked down.

Finally, a great portfolio tracker shouldn’t be a walled garden. It needs to play nice with other tools. This could mean integrations with apps like Telegram for instant alerts or, crucially, the ability to export your entire transaction history as a CSV file.

Data export is especially important for two groups:

Without these options, your data is effectively held hostage by the platform, limiting what you can do with it. Choosing a tracker with solid integration and export features ensures your data stays yours.

Before we move on, let's see how some of the top tools stack up against these key criteria.

This table offers a side-by-side look at how leading portfolio trackers perform on the features we've just discussed. It's a quick way to gauge which platform might align best with your priorities, whether you're focused on data depth, security, or analytics.

FeatureWallet Finder.aiCoinStatsCoinGeckoDeltaData CoverageHigh (focus on on-chain, major EVMs & Solana)Very High (500+ exchanges, wallets, chains)High (100+ exchanges, 15+ chains)High (300+ exchanges, 20+ chains)Real-Time AlertsAdvanced (Custom on-chain events via Telegram)Advanced (Price, P&L, NFT, on-chain)Basic (Price alerts)Advanced (Price, portfolio value, market cap)P&L and AnalyticsAdvanced (Wallet-specific P&L, win rate, ATH profit)Advanced (Realized/unrealized P&L, cost basis)Basic (Overall portfolio P&L)Advanced (Realized/unrealized P&L, fee tracking)Security/PrivacyExcellent (Non-custodial, no private keys)Excellent (Read-only API, no private keys)Excellent (Read-only API, no private keys)Excellent (Read-only API, no private keys)Multi-Chain SupportStrong (Ethereum, Solana, Base, Arbitrum, etc.)Excellent (Extensive cross-chain & L2 support)Good (Major chains supported)Very Good (Broad chain and L2 support)IntegrationsGood (Telegram alerts, data export)Good (Tax software, data export)Limited (API access, no direct integrations)Good (Tax software, data export)Data ExportabilityYes (CSV/Excel for wallets and trades)Yes (CSV for tax purposes)Yes (CSV for portfolio holdings)Yes (CSV/PDF reports)

As you can see, the "best" tracker really depends on what you need. For pure breadth of exchange connections, tools like CoinStats and Delta are hard to beat. But for deep, actionable on-chain analytics and alerts, a specialized tool like Wallet Finder.ai shines. Now, let's look at how to apply these features in the real world.

Here's an uncomfortable reality nobody talks about: your portfolio tracker's numbers are probably wrong. Not catastrophically wrong in most cases, but wrong enough that your net worth display could be off by thousands of dollars, your tax calculations could trigger an IRS audit, and your trading decisions could be based on fantasy data instead of reality. Understanding where and why tracker data breaks down is essential for using these tools responsibly instead of blindly trusting whatever numbers they show you.

The core problem is that portfolio trackers sit at the messy intersection of multiple data sources—exchange APIs that sometimes lie, blockchain data that's incomplete, price feeds that lag or spike incorrectly, and DeFi protocols with positions so complex that even sophisticated trackers misinterpret them. Each of these failure points can corrupt your portfolio view, and most users never realize it's happening until they try to actually trade based on the numbers and discover they don't match reality.

The most common data accuracy failure is missing transactions that never get imported into your tracker despite happening on-chain or in your exchange account. This creates phantom gains or losses that don't exist, throwing off your entire portfolio valuation and performance tracking.

Missing transactions happen for several predictable reasons. Exchange API rate limits mean your tracker might miss rapid-fire trades if you're actively scalping—the tracker queries your exchange every few minutes, but if you made ten trades in thirty seconds during high volatility, some of those might not get caught in the snapshot. The exchange's API only shows the most recent transactions within a certain window, and older trades beyond that window never get backfilled unless you manually import them.

On-chain transactions go missing when trackers don't monitor all the addresses you actually use. Maybe you've got three different MetaMask wallets, but you only added two of them to your tracker. That third wallet's activity is invisible, creating a gap in your holdings that makes your total net worth appear lower than reality. Or you interacted with a brand new DeFi protocol that your tracker doesn't recognize yet, so the deposit transaction shows up as "Unknown Token Transfer" instead of being properly categorized as a liquidity provision.

The fix requires manual verification and hygiene. At least monthly, you should cross-check your tracker's transaction count against your actual exchange history and on-chain activity. Log into your exchange directly and verify the number of trades matches what the tracker shows. Use a blockchain explorer to manually check your wallet addresses and confirm all significant transactions are reflected in the tracker. When you find gaps—and you will—you need to manually add those missing transactions or re-sync the affected accounts.

This audit process is tedious but non-negotiable if you're using tracker data for anything important like tax reporting or performance analysis. A tracker showing you made fifteen thousand dollars in profit when you actually made twelve thousand isn't just an inconvenience—it's a tax bomb waiting to explode when the IRS compares your filing to exchange 1099 forms that show different numbers.

The second major accuracy problem is valuation errors where the tracker knows you own an asset but displays completely wrong prices or values. This is especially catastrophic for illiquid tokens, LP positions, or any asset without a clear single market price.

Low-liquidity tokens are the worst offenders. Your tracker might show that your ten thousand units of an obscure DeFi token are worth five hundred dollars based on a single tiny trade that happened on a DEX with almost no volume. In reality, if you tried to sell those ten thousand tokens, you'd get maybe fifty dollars because there's no actual liquidity to support that displayed price. The tracker is technically showing the last trade price, but that price is meaningless for your position size.

Liquidity pool positions create even weirder valuation problems. When you deposit ETH and USDC into a Uniswap pool, you receive LP tokens representing your share. Your tracker needs to calculate what those LP tokens are worth by checking the pool's reserves, computing your percentage ownership, accounting for accumulated fees, and adjusting for impermanent loss. Many trackers get this calculation wrong or skip steps, showing you a valuation that's either inflated or deflated compared to what you'd actually receive if you withdrew from the pool right now.

The most dangerous valuation errors happen during crashes or rapid price movements. Your tracker might be pulling price data from a feed that updates every sixty seconds, but in a volatile market, prices can move five to ten percent in that time window. You see your portfolio worth one hundred thousand dollars, start making decisions based on that number, then refresh five minutes later to discover it's actually ninety-two thousand because the prices were stale when you looked. That eight-thousand-dollar phantom value could have been the difference between staying in a position and cutting losses.

Defending against valuation errors requires you to independently verify prices for your largest holdings. Don't trust that your tracker's price for your biggest position is correct—go to a high-volume exchange like Binance or Coinbase and manually check the actual current price. For LP positions or complex DeFi holdings, open the protocol's actual interface and verify what it says your position is worth. Treat your tracker's valuation as a rough estimate, not gospel truth, especially during volatile markets or for illiquid assets.

The third accuracy disaster lurks in tax reporting features that many trackers offer. These tools promise to automatically generate accurate capital gains reports, but they frequently make errors that can cost you thousands in overpaid taxes or trigger audits when your filing doesn't match exchange records.

The most common tax calculation error is incorrect cost basis tracking. Your tracker needs to remember what you paid for every token you bought, but this gets messy fast when you're buying the same token across multiple exchanges at different times. If your tracker doesn't correctly match which specific tokens you sold to which purchases, it can assign the wrong cost basis using the wrong accounting method.

For example, maybe you bought one Bitcoin at thirty thousand dollars in 2022, then bought another Bitcoin at sixty thousand dollars in 2024. If you sell one Bitcoin in 2025 for seventy thousand dollars, your capital gain is either forty thousand dollars if you're using FIFO accounting (selling the first Bitcoin you bought), or ten thousand dollars if you're using LIFO accounting (selling the most recent purchase). If your tracker randomly picks the wrong Bitcoin to calculate the sale against, your tax liability is wrong by tens of thousands of dollars.

Transfer misclassification creates another nightmare scenario. When you move Bitcoin from Coinbase to your Ledger hardware wallet, that's not a taxable event—it's just a transfer between your own accounts. But if your tracker incorrectly interprets that as a sale followed by a repurchase, it shows a taxable event that never happened, artificially inflating your gains. This happens constantly because trackers see an outgoing transaction from the exchange and an incoming transaction to the wallet, and without proper pairing logic, they assume two separate events instead of recognizing it as one transfer.

The solution is never blindly filing the tax report your tracker generates. Always manually review the generated report line by line before handing it to your accountant or importing it into tax software. Cross-check that major trades are categorized correctly, that transfers between your own accounts aren't showing up as sales, and that the cost basis assignments make sense. For complex portfolios with hundreds of transactions, this review process might take hours, but it's infinitely better than the alternative of filing incorrect taxes and dealing with IRS notices or audit letters months later.

Portfolio trackers are businesses, and businesses fail. The platform you're using today might not exist a year from now, and when a tracker company shuts down or pivots away from their product, your years of carefully tracked transaction history can vanish overnight. Understanding platform abandonment risk and having a mitigation strategy isn't paranoid—it's basic digital asset hygiene that can save you from losing irreplaceable financial records.

The crypto tracker landscape is littered with dead platforms. Services that were once popular shut down without warning, leaving users scrambling to export their data before the servers go dark. Others get acquired and sunsetted by companies that wanted the user base but not the product. Still others technically stay alive but stop receiving updates, becoming gradually less useful as new blockchains and protocols emerge that the frozen tracker can't support.

Platforms rarely announce they're dying until it's too late, but there are clear warning signs you can watch for that indicate a tracker is on its last legs. Recognizing these signals early gives you time to migrate before the platform becomes completely unusable or disappears entirely.

The first warning sign is development stagnation. If the platform hasn't released a meaningful update in six months, hasn't added support for any new blockchains or protocols that emerged during that time, and doesn't have a public roadmap showing future plans, that's a red flag the company has shifted resources away from the product. Dead or dying trackers stop evolving while the crypto ecosystem races ahead, creating an ever-widening gap between what the tracker supports and where actual user activity is happening.

The second signal is degrading service quality. If the platform used to sync your data reliably but now frequently shows "sync failed" errors, if price feeds are obviously stale or wrong, if the user interface has visual bugs that aren't getting fixed, these maintenance failures indicate the company isn't investing in keeping the product running smoothly. A tracker in maintenance mode is a tracker circling the drain.

The third red flag is team changes. If the original founders leave, if the company lays off a substantial portion of its staff, if the support team stops responding to tickets within reasonable timeframes, these human signals precede product death. Companies don't maintain complex software products with skeleton crews—once staffing drops below a critical threshold, the product is effectively abandoned even if the servers stay online.

Watch for these signs with any tracker you're using. Set a recurring calendar reminder every quarter to check whether your platform released any updates, added any new features, or showed any public signs of active development. If three consecutive quarters pass with zero meaningful progress, start planning your migration immediately while the platform is still functional enough to export your data.

The single most important thing you can do to protect yourself against platform abandonment is maintaining your own independent backup of all transaction data. This means regularly exporting complete transaction histories from your tracker and storing those exports in multiple locations you control.

Most reputable trackers offer CSV or Excel export functionality that dumps your entire transaction history into a downloadable file. This file should include every single transaction the tracker has recorded—the date, the assets involved, the amounts, the exchange or wallet it happened on, the transaction type, and ideally the transaction hash for on-chain activity. Without this complete export, you're trusting that the platform will exist forever or that you'll be able to manually reconstruct years of trading history if it disappears.

The export schedule should match the frequency and value of your trading activity. If you're an active trader making dozens of transactions weekly, you should export monthly at minimum. If you're a passive holder who makes a few trades quarterly, a quarterly export is sufficient. Whatever schedule you choose, treat it as seriously as backing up family photos—this is irreplaceable financial data that you cannot recover once the platform vanishes.

Store exported files in multiple locations using the 3-2-1 backup rule: three copies of your data, on two different types of storage media, with one copy stored offsite. In practice, this might mean one copy on your computer's hard drive, one copy in cloud storage like Google Drive or Dropbox, and one copy on an external hard drive you keep physically separate from your computer. This redundancy protects against both platform failure and your own storage failures like hard drive crashes or accidental deletions.

The nuclear option for maximum data sovereignty is maintaining a parallel manual record in a spreadsheet you control. This is tedious but bulletproof—if your tracker dies, you still have a complete independent record of every transaction. Some traders use this approach for their most critical transactions while relying on tracker exports for comprehensive history. It's extra work, but it's also insurance against the catastrophic scenario where both your tracker dies and your exports are somehow corrupted or lost.

Despite your best efforts, you might find yourself forced to migrate from a dying platform to a new tracker. Having a migration strategy planned in advance turns this from a crisis into a manageable transition.

The first step when you recognize your platform is failing is identifying your migration target before you need it. Research which alternative trackers support all the features you currently use, especially if you have specific needs like multi-chain DeFi support or advanced tax reporting. Don't wait until your current platform announces shutdown to start this research—by then, you're under time pressure and might make poor choices.

Test your export files by attempting to import them into your target platform before you actually need to migrate. Most modern trackers support CSV imports of transaction data, but the format requirements vary. Your current platform's export might not map perfectly to the new platform's import format, requiring you to manually reformat columns or add missing data. Discovering this during a test run when you have time to fix it is infinitely better than discovering it during a panicked migration when your old platform's servers are being shut down in forty-eight hours.

When you do migrate, verify the data transfer completeness obsessively. After importing your transaction history into the new platform, cross-check that the total transaction count matches, that your current holdings match what the old platform showed, and that your performance metrics like total profit and loss are consistent between platforms. Don't just import and assume it worked—treat this like a surgical data migration that requires validation at every step.

The migration is also an excellent opportunity for data cleaning. As you review imported transactions, you'll likely find errors or missing categorizations that existed in your old platform. Fix these as you go, using the migration as an excuse to create the cleanest possible record in your new tracker. This extra effort pays dividends when tax season arrives and you need accurate historical data.

Knowing what a top-tier portfolio tracker can do is one thing, but using it to gain a real edge is a whole different ballgame. The true power of these tools comes alive when you apply them to a specific strategy. Let's shift from theory to practice and look at some concrete workflows for different types of crypto traders.

Each workflow shows how to turn a firehose of raw data into profitable decisions, whether you're a beginner just trying to get organized or a seasoned pro hunting for alpha. These step-by-step guides will show you exactly how to squeeze value out of a powerful tracker.

For the DeFi copy trader, speed and accuracy are everything. The goal is simple: find the "smart money" wallets, figure out their strategy, and mirror their moves before the rest of the market catches on. An on-chain tracker is your primary weapon here.

Step-by-Step Guide:

This approach turns a portfolio tracker from a passive monitoring tool into an active, real-time alpha generation engine.

Quantitative researchers and data-driven analysts need more than just a pretty dashboard. They need raw, granular data to build and backtest their models. For this crowd, the best portfolio trackers are essentially high-fidelity data pipelines.

The core job of a quant is to find patterns hidden in massive datasets. A tracker's ability to serve up clean, exportable on-chain data is the bedrock for uncovering market inefficiencies and building a unique strategic edge.

This process is less about real-time alerts and more about deep, offline analysis.

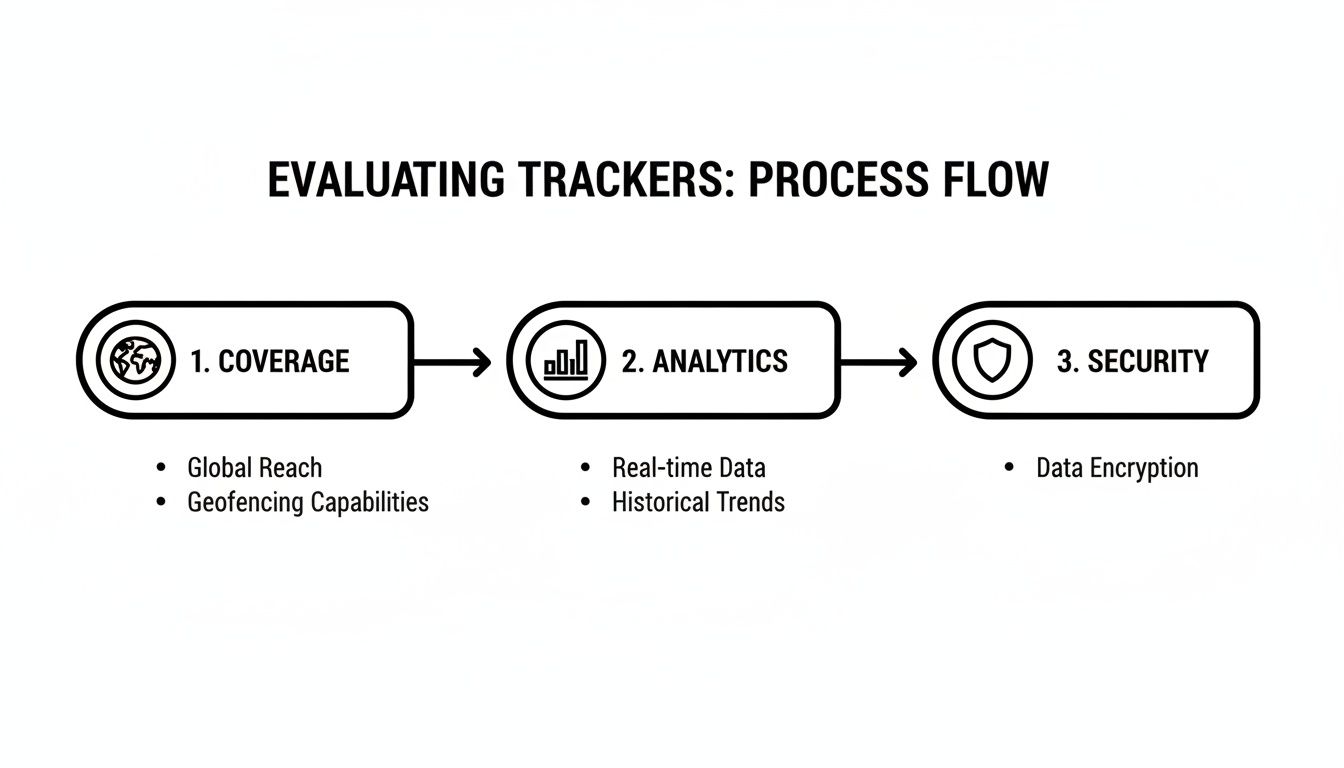

The following visual guide breaks down the core evaluation process for finding the right tool.

This infographic outlines the essential steps in evaluating the best portfolio trackers, focusing on coverage, analytics, and security.

This process flow emphasizes that a tracker's value comes from its ability to cover all your assets, provide deep analytics, and maintain top-tier security.

If you're new to crypto, the first challenge isn't finding alpha—it's just getting organized. With assets scattered across an exchange, a hot wallet like MetaMask, and maybe even a hardware wallet, just seeing your total net worth in one place is a huge win. For this, a hybrid tracker is perfect.

Getting a Unified View:

This simple workflow solves the biggest headache for new investors by creating a single source of truth for all their holdings. For more on this, you can learn more about how to track DeFi portfolios across multiple wallets and get a complete picture of your assets.

When you connect a portfolio tracker to your wallets and exchanges, you're not just getting convenient portfolio viewing—you're also creating a detailed financial surveillance record that links your real identity to your on-chain activity. Most users never think about the privacy implications of portfolio tracking, but the data you're sharing and the tracking mechanisms these platforms use can completely deanonymize your blockchain activity and expose your trading behavior to companies, governments, or hackers who breach the platform's databases.

The fundamental privacy problem is that trackers require you to associate your real identity with your wallet addresses. You create an account with your email address, you link it to payment information if you're paying for premium features, and then you hand the platform a list of every wallet address you own or control. The platform now has a master key that connects "you" to your on-chain footprint, destroying the pseudonymity that blockchains theoretically provide.

The moment you add a wallet address to a portfolio tracker, you're making a public statement: "I control this address." The tracker's database now contains a record linking your user account to that wallet. If that database ever leaks through a hack, insider breach, or government subpoena, everyone who gets access suddenly knows that your email address and identity information owns those specific wallets.

This identity linkage extends beyond just the wallets you explicitly add. Trackers with transaction analysis features can infer that you control additional addresses by following the transaction graph. If you added wallet A to your tracker, and wallet A frequently sends funds to wallet B, the tracker might automatically suggest adding wallet B as "likely yours" to complete your portfolio view. This inference creates an ever-expanding web of wallet addresses all linked to your identity in the tracker's database.

The privacy leak isn't theoretical—it's happened. Every major platform breach or data leak exposes which users owned which wallets, what their trading patterns looked like, and how much they were worth at various points in time. For high-net-worth individuals or anyone engaged in legally sensitive but legitimate activities, this exposure can be devastating. It creates identity theft risk, targeted social engineering attack risk, and regulatory scrutiny risk depending on your jurisdiction.

The defensive strategy is wallet compartmentalization where you deliberately don't add all your wallets to a single tracker. Keep your largest holdings or most sensitive trading activity in wallets that never touch any tracking platform. Use trackers only for wallets where you're comfortable with public knowledge that you control them. This limits the exposure from any single tracker breach to only the subset of your activity you've chosen to track.

Some traders go further and use different trackers for different activity categories—one tracker for legitimate exchange holdings where regulatory compliance isn't a concern, a completely separate tracker with a different email account for DeFi activity where pseudonymity matters more. This compartmentalization breaks the linkage so no single platform or breach can expose your complete financial picture.

The second privacy leak comes from the simple act of logging into your tracker. Every time you check your portfolio, you're revealing your current IP address to the platform. This creates a detailed log of where you physically were when you accessed your account, effectively building a location history that could be used to track your movements over time.

For users accessing trackers from home on residential internet connections, this IP log directly connects to their physical address through ISP records. Law enforcement or litigants with subpoena power can easily connect the dots from tracker access logs to ISP subscriber records to find exactly where someone lives. For users who travel internationally or access from different locations, the IP log creates a travel itinerary showing which countries and cities you visited and when.

Privacy-conscious users should access portfolio trackers through VPNs that mask their true IP address. This adds a layer of separation between your real location and the platform's access logs. When combined with using tracker accounts created with anonymized email addresses rather than your real name, you can maintain reasonable operational security even while using tracking platforms.

The tradeoff is that aggressive VPN use sometimes triggers security alerts on platforms that view constantly changing IP addresses as potential account compromise attempts. You might need to complete additional authentication steps like email verification or 2FA more frequently when accessing through VPNs. This minor inconvenience is worth it for the privacy gain, but it's a real usability cost to factor into your decision.

While most portfolio trackers give you a clean, historical report card of your assets, a select few are built to do something much more powerful. They don’t just show you where you've been; they give you the tools to decide where you're going next. This is exactly where Wallet Finder.ai moves beyond simple tracking to become a genuine on-chain intelligence engine.

The whole platform is built on one core idea: the most profitable moves on the blockchain always leave a trail. By analyzing the wallets of top-performing traders—what many call "smart money"—you can spot opportunities and get in before they hit the mainstream. It’s less about watching your own balance and more about finding your next big win.

The first step to finding alpha is knowing who to follow. You can't just pick a random address and hope for the best; you need to find traders with a proven, consistent track record of winning. This is what the 'Discover Wallets' feature was made for.

Instead of just feeding you a list of the biggest accounts, Wallet Finder.ai lets you slice and dice the data by the metrics that actually point to skill.

This lets you cut straight through the noise and zero in on that tiny fraction of traders who consistently beat the market. You’re not just looking for whales; you're looking for sharks.

The 'Discover Wallets' dashboard lets you filter for top-performing traders based on metrics like P&L and win rate.

This view gives you a clear, data-driven launchpad for finding wallets whose strategies are actually worth digging into.

Finding a promising wallet is just step one. The real magic happens when you vet their strategy to make sure it matches your own risk appetite and goals. A huge P&L might look amazing, but if it came from one ridiculously risky "degen" play, you probably don't want to copy that approach.

Wallet Finder.ai lays out the complete, transparent trading history for any public wallet. This lets you put on your detective hat and pick apart a trader’s every move.

You can see not just what they bought, but when they bought it, how much they paid, and when they cashed out. That granular detail is the difference between blindly following and making a truly informed decision.

This level of detail is a hallmark of advanced on-chain tools. For instance, since its launch back in October 2017, Delta.app has become a top-tier portfolio tracker by offering professional traders and quants similarly deep insights. As the crypto ETF market ballooned to an estimated $179.16 billion in assets by 2025, tools that provide exhaustive historical analysis—much like Wallet Finder.ai's trading histories—became absolutely essential for serious investors. You can learn more about how top trackers deliver detailed insights on coinledger.io.

In the breakneck world of DeFi, a few minutes can mean the difference between getting in early and buying someone else's exit pump. Once you've found and vetted a handful of top-tier wallets, you need to be able to act on their moves the second they happen. This is where instant alerts become your secret weapon.

Wallet Finder.ai hooks directly into Telegram, sending you a notification the moment a wallet on your watchlist makes a trade.

Here’s how it works in practice:

This simple workflow turns your tracker from a passive reporting tool into an active, real-time signal generator. It closes the gap between analysis and action, giving you the power to move with the same speed as the sharpest players in the market. You can see what this feels like for yourself with a no-risk, 7-day trial of Wallet Finder.ai and experience firsthand how it turns raw blockchain data into actionable opportunities.

Jumping into the world of portfolio trackers can feel a bit like drinking from a firehose. You've got questions about security, taxes, and how to actually use these things to make better moves. Getting straight answers is key to picking the right tool and making it work for you.

Let's cut through the noise and tackle the questions that come up most often. We'll cover everything from keeping your assets safe to using trackers to level up your trading game.

This is a scenario every trader using portfolio trackers needs to understand and plan for. If someone gains access to your exchange API keys—whether through a tracker platform breach, phishing attack, or any other means—the damage depends entirely on what permissions you granted when you created those keys. This is why the read-only versus full-access permission distinction is absolutely critical.

Read-only API keys can only view your account balance and transaction history. An attacker who steals a read-only key can see what you own and your trading patterns, which is a privacy violation and could enable targeted social engineering attacks, but they cannot steal your funds directly. They can't execute trades, they can't withdraw to their own addresses, and they can't change your account settings. The key is surveillance access only.

Full-access API keys that include trading or withdrawal permissions are catastrophic if compromised. An attacker with a full-access key can immediately execute trades on your behalf—often used to pump tokens they already own by market buying with your funds—and can withdraw your entire exchange balance to addresses they control. You have zero warning until you check your account and discover everything is gone.

The protective measure is simple but requires discipline: only create read-only API keys for portfolio tracker connections. Every major exchange allows you to specify exact permissions when generating API keys. Explicitly disable trading permissions, withdrawal permissions, and any other account modification capabilities. Enable only the minimum read access the tracker needs to view balances and transaction history. If a platform requires more permissions than read-only access, don't use it—the risk isn't worth the convenience.

Additionally, regularly rotate your API keys every three to six months even if you haven't detected any compromise. Delete old keys on the exchange side immediately after generating replacements. This limits the window of time any leaked key remains useful to attackers. Treat API key rotation like password changes—it's basic security hygiene that dramatically reduces your exposure to credential compromise.

Hard forks and token swap events create complicated tracking scenarios that many platforms handle poorly or incorrectly, leading to confusing portfolio displays and incorrect tax calculations. Understanding how your tracker approaches these events helps you verify the data is accurate and catch errors before they cause problems.

When a blockchain hard forks and creates a new token—like when Bitcoin Cash split from Bitcoin—you suddenly own assets on both chains. The best trackers automatically detect this event, add the forked token to your portfolio at the moment of the fork, and assign it an appropriate cost basis (typically zero for tax purposes since you received it without purchasing). Poor trackers might not recognize the fork at all, leaving the new asset invisible in your portfolio until you manually add it.

Token swaps where a project migrates to a new contract address are even messier. Maybe a DeFi protocol upgrades from V1 to V2 tokens, requiring you to swap your old tokens for new ones at a one-to-one ratio. Your tracker needs to understand this isn't a taxable sale—it's a like-kind exchange that should carry over your original cost basis to the new tokens. Trackers that don't recognize this will show it as selling V1 tokens and buying V2 tokens, creating a taxable event that never actually happened and completely distorting your portfolio performance and tax liability.

The defensive approach is manually verifying how your tracker handled any hard fork or token swap events rather than trusting it got the accounting right. After a known fork, check that the new token appeared in your holdings with the correct quantity. After a swap, verify that the transaction is categorized as a migration or exchange rather than a taxable sale. If the tracker got it wrong, you'll need to manually edit the transaction categorization or adjust the cost basis to reflect the actual tax treatment.

For complex portfolios with lots of DeFi activity, these events happen constantly as protocols upgrade and evolve. Staying on top of how your tracker interprets each one is tedious but essential for maintaining accurate records. Set a calendar reminder to audit your tracker after any major protocol migrations or chain forks you're exposed to, catching errors while they're fresh rather than discovering them months later when you're trying to file taxes.

Yes, and for traders with complex portfolios or specific analytical needs, using multiple trackers simultaneously is actually a smart strategy. Different platforms have different strengths, and combining them gives you more comprehensive coverage and cross-verification of data accuracy than relying on any single tool.

The most common multi-tracker setup is pairing a comprehensive aggregation platform like CoinStats for broad portfolio monitoring with a specialized analytics platform like Wallet Finder.ai for deep on-chain intelligence. CoinStats gives you the complete picture of everything you own across all exchanges and chains, while Wallet Finder provides the real-time alerts and performance analytics for the wallets you're actively tracking and potentially copying. This combination ensures nothing falls through the cracks while still giving you the specialized tools for advanced strategies.

Another effective approach is using one tracker for real-time monitoring and a different one specifically for tax reporting. Maybe you use Delta for daily portfolio checks because you love the interface, but at tax time you export everything into CoinTracker because its tax calculation engine is more sophisticated and integrates better with your accountant's workflow. Each tool serves a distinct purpose rather than redundantly doing the same job.

The downside of multi-tracker approaches is the maintenance overhead—you need to keep multiple platforms synced, update API keys in multiple places when you rotate them, and reconcile any discrepancies when the platforms show different numbers for the same holdings. For users with simple portfolios, this overhead isn't worth it. For users with complex DeFi positions, multiple exchanges, and serious money at stake, the cross-verification and specialized capabilities easily justify the extra effort.

When it comes to security in crypto, there's one golden rule: never, ever share your private keys. The safest portfolio trackers are built with this rule at their core. They're what we call non-custodial, meaning they never ask for your keys or control over your funds.

A secure tracker works in a "read-only" mode. Think of it like this:

The bottom line is that a trustworthy tool will give you a full picture of your portfolio without ever needing your seed phrase or private keys. If a platform asks for that stuff, it’s a massive red flag. Run, don't walk.

This "look but don't touch" approach ensures you're always the one in control of your assets, making it the only truly safe way to monitor your portfolio.

Yes, and honestly, this is one of their most valuable features. Anyone who's tried to manually calculate capital gains and losses from a year's worth of crypto trades knows it's a nightmare waiting to happen. The best trackers can turn that headache into a simple task.

Most top-tier platforms let you export your entire transaction history into a single CSV or Excel file. You can then upload this file directly into specialized crypto tax software or hand it over to your accountant. It’s that simple.

The export file contains everything needed for tax calculations:

Having this clean, organized record saves you dozens of hours and gives you the proper documentation to file your taxes correctly. It's a game-changer.

Copy trading sounds easy—just follow the smart money, right? But it's risky if you're just blindly mirroring trades without a plan. A powerful on-chain tracker like Wallet Finder.ai lets you copy trade with your brain, not just your gut. The key is to vet wallets thoroughly before you follow them.

Here’s a simple workflow to get started on the right foot:

This process transforms copy trading from a gamble into a calculated, risk-managed strategy. You're using the tracker to make informed decisions, not just to find someone to follow.

Ready to stop guessing and start making data-driven moves? Wallet Finder.ai gives you the on-chain intelligence to discover top traders, analyze their strategies, and get real-time alerts so you never miss an opportunity. Start your 7-day free trial and unlock the alpha today.