7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 17, 2026

Let's get your crypto gains into your bank account where you can actually spend them. The whole point of investing, right?

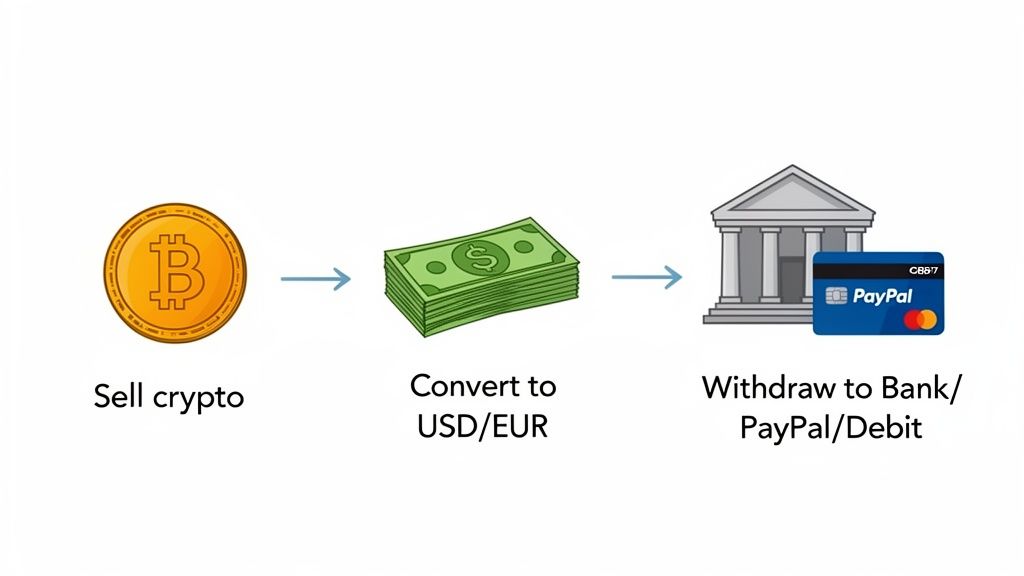

Before you can cash out from Coinbase, you must take one crucial first step: selling your cryptocurrency for a fiat currency like U.S. Dollars or Euros. Once that sale is done, the cash sits in your Coinbase account, ready for withdrawal. From there, you can send it directly to a linked bank account, PayPal, or a debit card.

Turning digital gains into real-world cash is a fundamental part of the crypto journey. While Coinbase makes the process simple, knowing your options ahead of time can save you a headache and money on fees.

You can't just send Bitcoin directly to your bank—it doesn't work that way. The "sell" button on Coinbase is your friend here. It handles the conversion for you, turning your crypto into a cash balance that’s all set for the final step: the withdrawal.

So, how do you actually get the money out? The best way to cash out from Coinbase really boils down to what you need most: speed, low fees, or moving a large amount. Each option strikes a different balance.

For example, a standard ACH bank transfer is usually the cheapest way to go, but you'll be waiting a few business days for the funds to clear. On the flip side, an instant cashout to your debit card gets the money in your hands in minutes, but you'll pay a bit more for that convenience.

A smart move for most people is to have two methods linked: a primary bank account for regular, low-cost ACH transfers and a debit card for those times you need cash right now. This gives you the best of both worlds—cost savings and flexibility.

To make the choice easier, let's break down the most common ways to pull your cash out.

This table offers a direct comparison of common ways to cash out, highlighting key differences to help you choose the best option for your needs.

MethodTypical SpeedFee StructureBest ForACH Bank Transfer3-5 Business DaysGenerally FreeStandard, low-cost withdrawalsWire Transfer1 Business DayHigher Fee (~$25)Large-volume withdrawalsPayPalWithin a few hoursFree (from Coinbase)Fast and convenient cash outsInstant Card CashoutWithin 30 minutesPercentage-based feeUrgent, immediate access to funds

Ultimately, the right withdrawal method depends on your specific situation. Weigh the speed against the cost to find the perfect fit for your cash-out strategy.

The published withdrawal limits in the comparison table reflect standard verified account limits. Coinbase operates additional limit tiers above these published figures that are not documented publicly, and accessing them requires specific steps most users do not know exist. For anyone planning a cash-out above $50,000, understanding how the limit escalation system works is the difference between a smooth single transfer and a frustrating multi-week process of moving funds in batches.

Coinbase's standard verified account allows ACH withdrawals up to $50,000 per day and wire transfers up to $250,000 per day for most users. Above these thresholds, a separate tier exists that Coinbase refers to informally as institutional or high-volume limits, accessible to both individual and business accounts. These elevated limits can reach $1 million or more per transaction for wire transfers, but accessing them requires a different process than standard verification.

The trigger for limit escalation review is a direct request through Coinbase Support, not an automatic upgrade based on account history. Contact support through the in-app chat or help center and explicitly state that you are planning a withdrawal above your current daily limit and request a limit review. Have the following information ready before that conversation: the approximate dollar amount you intend to withdraw, the timeframe, and the source of the funds if they originated from a large sale or external transfer rather than gradual accumulation on the platform.

For withdrawals above $100,000 from a personal account, Coinbase's compliance team typically requires a brief verification of the source of funds before processing or increasing limits. This is a regulatory requirement under their Bank Secrecy Act obligations and is not optional. Source of funds documentation can include brokerage statements showing the original crypto purchase, tax returns showing the income used to acquire the assets, or wallet transfer records demonstrating the funds came from your own external wallets rather than a third party. Having these documents organized before initiating the request reduces the review timeline from days to hours.

For single wire transfer requests above approximately $50,000 from accounts without prior large-withdrawal history, Coinbase's fraud prevention system is configured to flag the transaction for manual review before processing rather than blocking it outright. In practice, this means a Coinbase compliance representative may call the phone number on file for your account before releasing the funds. This is a fraud prevention step rather than a regulatory hold, and cooperating with the call is the fastest path through it.

The call typically involves confirming your identity, the destination account details, and the purpose of the withdrawal. "Profit-taking after a market run" and "consolidating to a personal bank account" are both acceptable answers. The call is not an interrogation and it is not a signal that your account is under investigation. It is a standard verification step for large first-time withdrawals that takes five to ten minutes.

If you want to avoid the interruption of an unscheduled call, the workaround is to proactively alert Coinbase support in writing before initiating the withdrawal. Send a support message stating the amount, destination, and timeframe. This creates a record that the withdrawal was expected, which often routes it through standard processing rather than the manual review queue. For any withdrawal above $75,000, this advance notice step is worth the five minutes it takes.

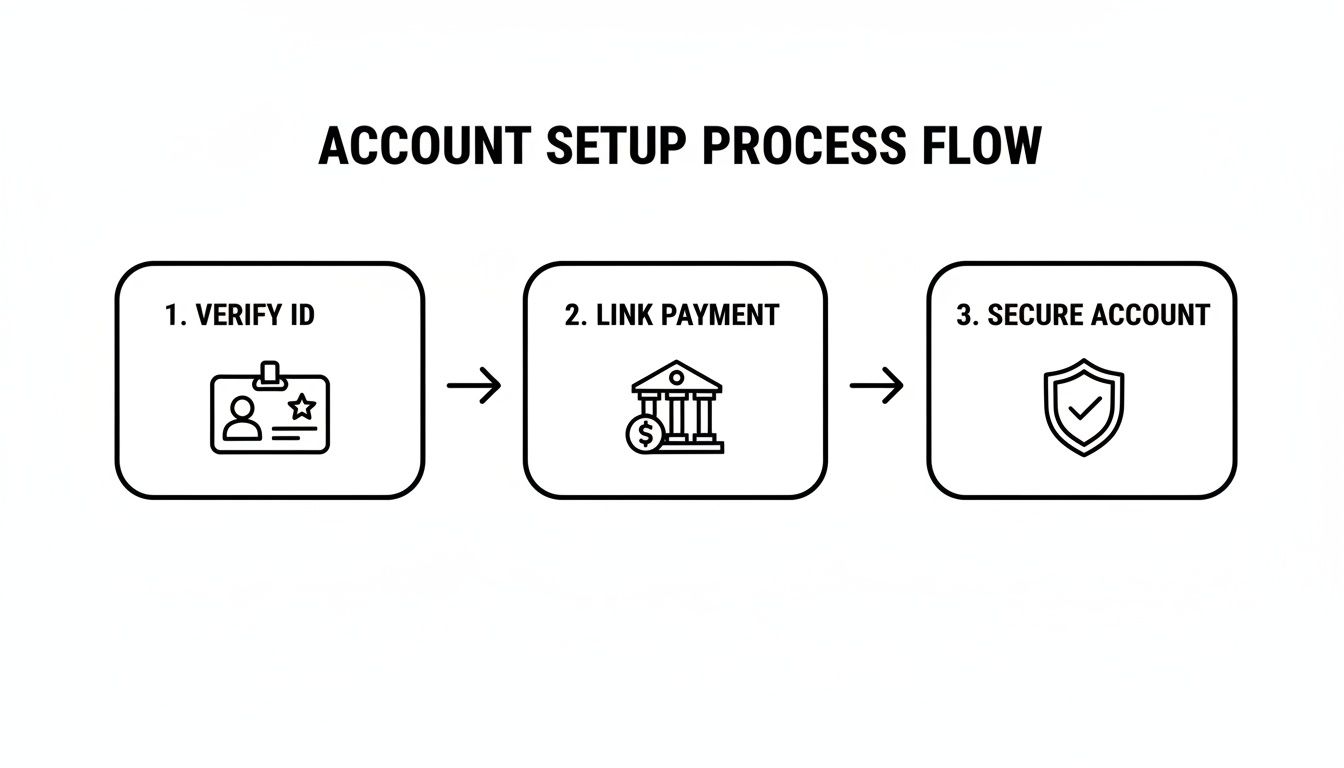

Before you can cash out your crypto on Coinbase, a little prep work goes a long way in preventing headaches and delays. Think of it like getting your passport ready before an international trip—having everything in order upfront makes for a much smoother journey. The process boils down to verifying who you are and securely linking where you want the money to go.

The first, and most critical, step is completing the Know Your Customer (KYC) verification. This is a non-negotiable regulatory requirement for any legitimate exchange, put in place to stamp out fraud and money laundering. Simply put, without a verified identity, you can't withdraw your funds.

To get through KYC, you'll need to provide some personal details and documents. The process is straightforward but absolutely essential for unlocking your account's full potential, including higher withdrawal limits.

Actionable Checklist for KYC Verification:

Once you submit everything, verification is usually pretty quick, often taking just a few minutes. Getting this out of the way early means it won't be a last-minute roadblock when you're ready to move your cash.

After your identity is confirmed, it's time to connect the account where you want your cash to land. Coinbase gives you a few secure options, and it’s a good idea to link at least one primary method right away.

Many people use Plaid to connect their bank account. It’s a popular and secure service that links your accounts using your bank login credentials without ever sharing them directly with Coinbase. You can also link a debit card for instant withdrawals or a PayPal account for quick, convenient transfers. If you’re planning on moving larger sums, setting up your wire transfer details is another solid option.

Security is everything at this stage. You absolutely should have Two-Factor Authentication (2FA) enabled on your Coinbase account, preferably using an authenticator app like Google Authenticator or Authy. While SMS-based 2FA is better than nothing, authenticator apps offer a much stronger defense against someone trying to gain unauthorized access.

Making sure your account is locked down is a foundational step. To get a better handle on the platform's security features, take a look at our full guide on how secure the Coinbase Wallet is.

Alright, your account is verified and a payment method is locked in. Now for the part you’ve been waiting for: moving your funds out of Coinbase and into your pocket.

Cashing out is always a two-step dance. First, you sell your crypto for cash. Then, you withdraw that cash to your bank, PayPal, or debit card. It’s an important distinction because you can’t just send Bitcoin directly to your checking account—you have to convert it into dollars (or your local currency) first.

Let's get into the specifics of how this works on the platform.

Before you can make a move, you need a solid foundation. This means getting your identity verified, linking your payment methods, and securing your account—essentials for both compliance and your own peace of mind.

The first move is always to place a sell order. This is where you swap an asset like Ethereum or Solana for a fiat currency like USD, EUR, or GBP. Once you do, the cash sits in your Coinbase fiat wallet, ready for you to withdraw.

To get started, head over to the "Buy & Sell" or "Trade" section of the Coinbase app or website. From there, just hit the "Sell" tab.

Here’s the play-by-play:

With fiat currency now sitting in your wallet, it’s time to send it home. The process is straightforward, but the method you choose has a big impact on speed and cost. You'll navigate to your portfolio, click on your cash balance (e.g., your USD Wallet), and select the "Withdraw" or "Cash out" option.

From there, Coinbase will ask where you want the money to go, pulling up the payment methods you linked earlier.

Here's a breakdown of your options:

Quick tip from experience: Always, always double-check the details on that final withdrawal confirmation screen. Make sure you’ve selected the right bank account or card and that you see the fee and estimated arrival time. A simple typo here can lead to frustrating delays.

A smart plan to cash out from Coinbase is all about knowing the fine print. The withdrawal method you pick will directly affect how much you pay in fees, how much you can move at once, and how fast you’ll actually see the money in your account. A lot of people overlook these details and end up with surprise delays or higher costs than they expected.

Every cash-out option has its own trade-off between speed, cost, and capacity. For example, an instant debit card withdrawal is incredibly fast, but it comes with a higher fee. On the other hand, a standard bank transfer is cheap (often free) but takes several business days. These aren't just small differences—they should shape your entire withdrawal strategy.

The numbers really tell the story here. A wire transfer might look pricey with its flat $25 fee, but if you're pulling out a large amount, that fee is a tiny percentage compared to what you'd pay for an instant cash out. Conversely, paying a 1.5% fee to get $100 immediately is often way more practical than waiting days just to save a couple of bucks.

This is the classic speed-versus-cost dilemma, and it’s especially important when you need to get your funds out of Coinbase efficiently. Market conditions can also force your hand. If the market is pumping and you want to take profits now, a faster, more expensive option is often the smarter move.

Your account's verification level plays a huge role in your withdrawal limits. A brand-new, partially verified account will have much lower daily limits than a fully verified account that's been around for a while. Always check your personal limits in your account settings before you plan a big withdrawal.

To see exactly how these options stack up, let's break them down side-by-side.

Thinking through your withdrawal strategy ahead of time can save you from a lot of headaches. This table gives you a clear comparison of the most common cash-out methods on Coinbase, so you can pick the one that best fits your needs.

Withdrawal MethodCoinbase FeeProcessing TimeDaily Limit (Example)Use CaseACH Bank TransferGenerally Free3-5 Business Days$50,000Best for standard, low-cost withdrawals where speed isn't a priority.Wire Transfer~$251 Business Day$250,000+Ideal for moving large sums of money quickly and securely.PayPalFree (from Coinbase)Within a few hours$25,000A great middle-ground for fast, convenient withdrawals without high fees.Instant Card Cashout1.5% (min fee applies)Within 30 minutes$25,000Perfect for urgent situations when you need immediate access to your funds.

Understanding how and when people pull money off major exchanges gives you some valuable context. Coinbase Exchange, which handles billions in daily volume, always sees a huge spike in cash-out activity during market rallies. For instance, after one major Ethereum price surge, users pulled a net $8.5 billion off the exchange in a single quarter—a clear sign of widespread profit-taking.

This behavior shows just how much market sentiment drives withdrawal volumes. By planning your exit and choosing the right method before you need the cash, you can execute your strategy smoothly, no matter what the market is doing.

For an active trader, cashing out of Coinbase isn't just about taking profits—it's a calculated move. It's a part of the bigger strategy, and if you know what to look for, a large-scale cash-out event can tell you a lot about where the market is headed.

The key is learning to distinguish between retail panic and smart money strategically taking chips off the table. When markets get choppy, retail traders often dump their entire bags. Experienced investors, on the other hand, might only cash out a small percentage of their gains, rotating the rest into what they see as the next big opportunity. Reading that difference helps you make informed decisions instead of just reacting to the noise.

One of the sharpest tools in your shed for anticipating major sell-offs is on-chain data. When huge wallets—the "whales"—start moving significant amounts of crypto from their private cold storage to a Coinbase address, it’s a massive red flag. More often than not, they're getting ready to sell.

This flood of new supply hitting the exchange can put serious downward pressure on prices. A number of on-chain analysis tools let you track these whale movements in real-time, giving you a critical heads-up before a potential dip. It really highlights why understanding the difference between holding assets on an exchange versus a private wallet is so crucial; you can dive deeper into that in our guide on crypto exchange vs a wallet.

The data reveals some fascinating habits. Since it launched in 2012, Coinbase has seen over $1.5 trillion in cumulative cash-outs. These moments often line up with market dips. For instance, withdrawals tend to spike on Fridays, often aligning with 15% drops in BTC's price. On-chain analysis from sources like Coinbase data patterns shows that the top 1% of wallets cash out only about 12% of their gains on Coinbase. They redeploy the other 88% back into DeFi, while retail traders make full exits 65% of the time.

Let's be clear: cashing out is a taxable event. Every single time you sell crypto for fiat, you're triggering a capital gain or loss. Blowing this off is a surefire way to get hit with penalties and a massive headache from the IRS later on.

Think of your tax reporting as just another part of your trading strategy. By meticulously tracking your cost basis and sale prices, you can find opportunities for tax-loss harvesting. That means selling some assets at a loss to offset gains from your winners, which can seriously lower your overall tax bill.

Coinbase gives you the raw materials you need to get started. Here's your action plan:

By staying organized and thinking ahead, you can transform what feels like a chore into a smart financial move that protects more of the profits you worked so hard for.

The tax section of this article correctly flags that cashing out is a taxable event and recommends downloading your transaction history. What it does not cover is the fundamental shift in IRS reporting that took effect starting with the 2025 tax year, which means cashing out of Coinbase now generates automatic government reporting that previously did not exist. Understanding exactly what gets reported, to whom, and when is not optional information for anyone cashing out more than a minimal amount.

Starting with transactions in the 2025 tax year, Coinbase is classified as a broker under IRS regulations finalized in 2024, specifically under Treasury Regulation 1.6045 as amended. This classification requires Coinbase to file Form 1099-DA (Digital Asset Proceeds from Broker Transactions) for every customer who sells or exchanges digital assets on the platform, regardless of the amount. The 1099-DA reports your gross proceeds from each sale to the IRS and to you simultaneously, the same way a stock brokerage reports equity sales.

The specific threshold change from prior years is significant. Before 2025, Coinbase only issued Form 1099-MISC to users who received more than $600 in crypto rewards, staking income, or referral bonuses. Standard buy-sell-withdraw transactions below certain volume thresholds were not automatically reported. The new 1099-DA framework eliminates those volume thresholds entirely. If you sold $50 of Bitcoin in 2025 and withdrew the proceeds, that transaction is now reportable to the IRS.

The 1099-DA does not yet include cost basis reporting for most transactions, because the IRS phased in the new requirements with a delayed start for cost basis reporting. Coinbase will report your gross proceeds but not your purchase price in the first year of the new framework. This means the IRS sees your total cash-out amount but not the profit component, which creates a specific risk: if you do not file your own accurate cost basis on your tax return, the IRS may assess taxes on your entire gross proceeds rather than just your net gain. Users who cashed out $10,000 in crypto that they originally purchased for $8,000 have a $2,000 gain, but if they fail to report cost basis, the IRS could treat the full $10,000 as taxable income.

While the 1099-DA covers all sales regardless of amount, the original $600 threshold still applies to a different category: miscellaneous income from Coinbase products. If you received more than $600 in staking rewards, Coinbase Learning rewards, Coinbase One cashback, or referral bonuses during the tax year, Coinbase sends a 1099-MISC for that income to both you and the IRS. This income is taxed as ordinary income at your marginal rate, not at capital gains rates, regardless of whether you cash it out or leave it on the platform.

The practical compliance action for any user cashing out in 2025 or later is to download your complete annual transaction statement from Coinbase's Tax Center (found under Account Settings) no later than January 31 of the following year, when Coinbase is required to make tax documents available. Compare the gross proceeds on your 1099-DA to your own records. If they match, file accordingly. If there are discrepancies, address them before filing rather than after, because a mismatch between your return and the 1099-DA the IRS received is a common audit trigger.

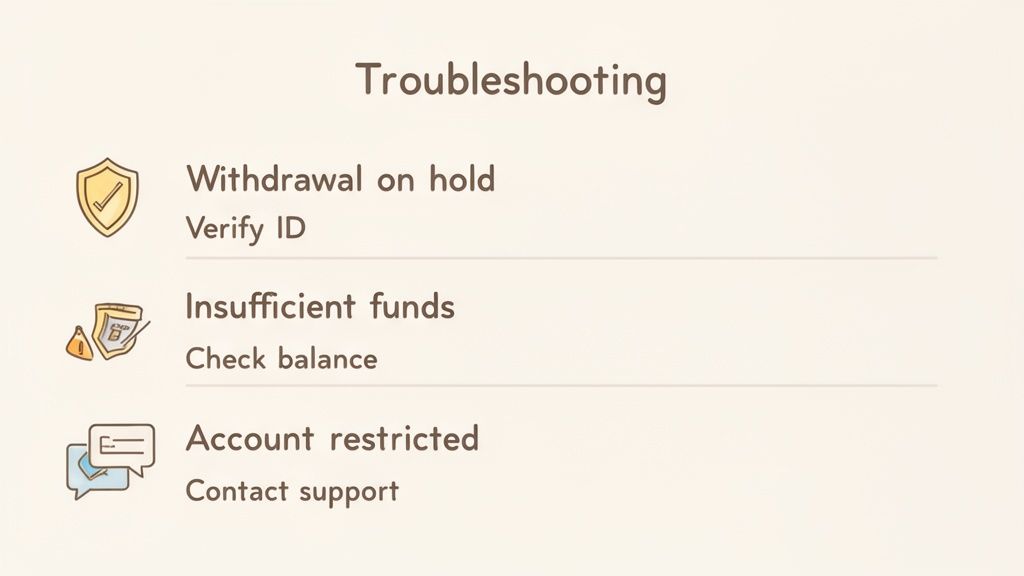

So you followed the steps, hit "Withdraw," and... nothing. Or worse, an error message pops up. It’s a frustrating moment, especially when you need access to your money, but don't panic.

Most withdrawal issues on Coinbase are common and have simple fixes. More often than not, the problem isn't a deep technical glitch but a routine security measure or a verification step you might have overlooked. Let's walk through the usual suspects so you can get things moving.

The most frequent culprit is a withdrawal hold, usually triggered after a recent deposit from an ACH bank transfer. To combat fraud, Coinbase temporarily freezes those funds for 3-7 days to make absolutely sure the deposit clears your bank before letting the cash leave their platform.

If you find your withdrawal is on hold:

Another common blocker is a full-blown account restriction. This is a bit more serious and is typically triggered by security flags or incomplete identity verification. Make sure your KYC information is current and that you have a solid two-factor authentication method enabled to keep your account in good standing.

A sudden surge in withdrawal blocks can even be a macro market signal. During the 2022 'crypto winter,' for instance, Coinbase users pulled out over $10 billion as Bitcoin's price tanked. Daily withdrawal volume hit a record $1.2 billion on a single day, a classic sign of mass retail capitulation that can sometimes signal a market bottom. You can dig into more of this kind of data with Coinbase's institutional market reports.

Seeing an "insufficient funds" error when your balance looks healthy is confusing, to say the least. This almost always means the funds you're trying to withdraw are already spoken for—either locked in an open trade order or still under that pesky deposit hold we just talked about.

To sort this out:

Finally, you might run into a payment method error. This just means your linked bank account or card information is out of date or needs to be re-authorized.

When it's time to take profits and move your money out of Coinbase, a few common questions always seem to surface, especially when things don't go exactly as planned.

This section cuts through the confusion and tackles the most frequent roadblocks people hit during the withdrawal process. From frustrating fund holds to figuring out the fastest exit route, these answers should clear things up.

The number one reason for a delay is a security hold. If you recently funded your account using an ACH bank transfer, Coinbase will place a temporary hold on those funds, which typically lasts 3-7 days.

This isn't a glitch—it's a standard security measure. Coinbase needs to make sure your deposit fully clears the bank before letting that cash leave the platform. It’s a simple but effective way they prevent fraud.

A key thing to remember is that your "total balance" and your "available to withdraw" balance are two different things. The available balance is the only amount you can actually cash out right now, as it doesn't include funds that are on hold or tied up in open trades.

For pure speed, nothing beats their "Instant Card Cashout." When you withdraw to a linked Visa or Mastercard debit card, the funds usually hit your bank account in less than 30 minutes.

Of course, that convenience comes at a price—a higher fee, usually around 1.5%.

PayPal withdrawals are another solid, speedy option. They are often free on Coinbase's end and can land in your account within a few hours. This makes them a fantastic balance of speed and cost. Withdrawal features are a big deal when picking an exchange, which is something we dig into in our comparison of Kraken or Coinbase.

No, you can't send cryptocurrencies like Bitcoin or Ethereum straight from Coinbase to a traditional bank account. Banks operate in fiat currencies (like USD, EUR, GBP), and they aren't set up to handle digital assets directly.

To cash out, you have to follow this two-step process:

This sell-then-withdraw flow is fundamental to how you get money out of Coinbase and pretty much every other centralized exchange out there.

Cashing out itself does not trigger an audit, but specific patterns around cash-outs increase audit risk in ways worth understanding before you execute a large withdrawal.

The IRS receives your 1099-DA from Coinbase and matches it against your tax return automatically through their document matching system. If your return does not include a Schedule D reporting the sale that generated the proceeds on your 1099-DA, the system flags it as a discrepancy. This discrepancy does not automatically cause an audit, but it does generate an IRS CP2000 notice, which is a proposed adjustment to your tax liability based on the unreported income. CP2000 notices require a response within 60 days and often result in additional taxes, penalties, and interest even without a formal audit.

The pattern that most commonly triggers a full examination rather than just a notice is large cash-outs combined with no corresponding income on your tax return. If you cash out $150,000 from Coinbase, report $30,000 in W-2 income, and file a return that does not include the crypto sale proceeds, the income discrepancy is significant enough to flag for review. This is not unique to crypto and applies to any large unreported proceeds.

The practical protection is filing a complete and accurate Schedule D and Form 8949 that accounts for every sale generating proceeds shown on your 1099-DA. Crypto tax software handles this automatically when you import your Coinbase transaction history. The audit risk from a properly reported large cash-out is no higher than from any other properly reported large transaction.

This question became much more urgent after the FTX collapse in November 2022, when millions of users learned that assets on centralized exchanges can be at risk in bankruptcy proceedings. Coinbase's situation differs from FTX's in specific structural ways that are worth understanding, though the risk is not zero.

Coinbase is a publicly traded company (COIN on Nasdaq) subject to SEC reporting requirements and mandatory financial disclosures. Its financial statements are audited and publicly available, unlike FTX's opaque internal structure. More importantly for cash-out timing, Coinbase disclosed in its 2022 annual report and subsequent filings that in a bankruptcy scenario, customer crypto assets could be treated as assets of the bankruptcy estate rather than being returned to customers first. This disclosure caused significant concern and was later clarified by Coinbase to indicate they do not commingle customer assets with company assets, but the legal ambiguity around crypto asset treatment in bankruptcy remains unsettled in US law.

The practical risk mitigation is straightforward: do not leave more funds on Coinbase than you need for active trading. Cash out profits promptly rather than using Coinbase as a long-term storage account. For holdings above approximately $10,000 that you do not intend to trade in the near term, transfer to a self-custody wallet where the assets are outside any exchange's control entirely. This is not a prediction that Coinbase will fail but a basic counterparty risk management practice appropriate for any centralized exchange.

Yes, with specific caveats that catch many travelers off guard. Coinbase's platform is accessible from most countries, but the available withdrawal methods and supported currencies differ significantly by country, and using Coinbase from a foreign IP address can trigger security holds that temporarily block withdrawals.

The security hold issue is the most immediately disruptive. Coinbase's fraud detection system flags login activity from unusual locations as potentially compromised. A first-time login from a foreign country while traveling can result in a temporary withdrawal hold while Coinbase's system verifies the activity. The hold duration varies from a few hours to 24 hours depending on your account history. Preventing it requires either enabling a trusted device on your account before traveling or proactively notifying Coinbase support of your travel plans before departure.

The currency and method limitations matter for the cash-out destination. If you are traveling and need local currency urgently, withdrawing USD from Coinbase to a US bank account and then using a low-FX-fee card like Charles Schwab's debit card (which reimburses all foreign ATM fees) or a Wise card to access the funds locally is more cost-effective than attempting to withdraw in local currency through Coinbase's international options. Coinbase supports local currency withdrawals in the UK, EU, Canada, and Australia through SEPA, Faster Payments, and other regional systems, but the FX spread applies as described in the FX section above. For short trips where the need is temporary liquidity rather than a permanent cash-out, the card-access workflow is both faster and cheaper than initiating a new international bank withdrawal.

At Wallet Finder.ai, we turn complex on-chain data into clear, actionable signals. Discover top-performing wallets, get real-time trade alerts, and mirror the strategies of professional traders to stay ahead of the market. Start your free 7-day trial today!