How to transfer Coinbase to Coinbase Wallet

How to transfer coinbase to coinbase wallet: Learn safe steps, networks, fees, and troubleshooting for a smooth transfer.

February 21, 2026

Wallet Finder

February 17, 2026

Think back to the simple, physical tokens you might've used for a parking meter or a laundromat. Each one bought you access to a specific service, right? Now, imagine that same concept, but supercharged for the digital age.

We're going to use the coin meter token as a powerful analogy to really get a handle on what utility-focused assets in DeFi are all about.

The idea of a token granting access is nothing new. In fact, its roots go way back, decades before anyone even dreamed up a blockchain. Understanding this history gives you a surprisingly solid framework for seeing the real value in modern digital assets.

Those early tokens were dead simple, single-purpose tools. A metal disc for a parking meter or a plastic coin for a washing machine did the exact same thing: they represented pre-paid access to a service. This core concept—a token for a utility—is the direct ancestor of countless cryptocurrencies you see being traded today. The only real difference is the tech that powers them.

Back in the mid-20th century, physical coin meter tokens were a small but revolutionary part of urban life. The iconic U.S. parking meter tokens first appeared in the 1930s, and by 1950, over 1.5 million meters were installed, pulling in revenue equal to about $1.2 billion today.

That little token economy has an echo in today's DeFi world. We've just swapped metal for on-chain tokens like stablecoins, which recently hit an insane $4 trillion in volume—that's up 83% year-over-year. You can read more about the growth of stablecoin usage to see just how fast things are moving.

Just like you could "read the meter" to see how much it was used, today's on-chain analysis lets traders see exactly which digital tokens are getting real traction.

This guide will show you how to:

This article bridges the gap between a simple, old-school concept and the modern, actionable trading strategies you need today. By the end, you'll be able to turn complex on-chain data into your own unique trading edge.

We're going to start with the basics, moving from fundamental checks to advanced techniques for mirroring the moves of top traders. Get ready to shift your approach from pure speculation to sharp, data-driven decision-making.

"Coin meter token" isn't a term you'll see listed on major exchanges, but it’s a killer mental model for understanding a specific kind of digital asset. Think of it as a quick way to describe any token built with a clear, measurable job to do beyond just pure speculation.

Unlike a memecoin that rides on pure hype or a governance token that gives you voting rights, a coin meter token is a workhorse. Its main job is to unlock access, measure usage, or act as the gasoline for a decentralized application (dApp). This means its value is directly linked to how useful it is inside its own little economy.

Under the hood, every one of these tokens runs on a smart contract. This isn't some dusty legal document; it’s a piece of code that lives on the blockchain and executes itself automatically. This code lays down the law for the token—how many can ever exist, what you can do with it, and how it moves from one wallet to another.

These on-chain mechanics are what give the token its real function. For example, a token might be the only way to pay for transaction fees on a certain network, unlock special features in a DeFi protocol, or serve as the in-game currency for a blockchain game. The smart contract is the blueprint for the token's entire life. If you want to dive deeper into vetting these functions, our guide on how to identify DeFi tokens is a great place to start.

A token's utility is its purpose. A token without a clear, functional purpose is like a car key without a car—it might look interesting, but it doesn't actually do anything. On-chain analysis lets you check if the key truly fits a working engine.

This idea of using tokens for access actually has some pretty cool historical roots. Think about the rise of coin-operated laundromats from the 1940s to the 1970s, which created a massive, local token economy. By 1960, more than 30,000 laundromats in the U.S. were issuing tens of millions of their own unique tokens every year.

Fast forward to today, and you see the same concept playing out on a global scale. The number of crypto users has skyrocketed to 861 million, and stablecoin volume alone has hit $4 trillion just this year. The principle is the same—a token for a specific machine—but the scale and technology have changed dramatically.

The table comparing historical and digital tokens highlights transparency as a key advantage of blockchain-based assets. One specific transparency benefit that competitors almost never discuss is token velocity, which is arguably the single most revealing metric for distinguishing a utility token with genuine adoption from one that is held purely for speculation with no underlying usage.

Token velocity is calculated by dividing the total transaction volume of a token over a given period by its average circulating supply during that same period. The result tells you how many times the average token changes hands in that timeframe. A high velocity means tokens are being actively used and circulating. A low velocity means they are sitting in wallets, either being hoarded speculatively or not being used at all.

For a physical coin meter token analogy: imagine a parking token that gets used dozens of times per day as drivers pay, get change, and reuse tokens versus one that sits in a jar in someone's glove compartment for six months. The first token is genuinely functioning as intended. The second is being held in anticipation of future use, or worse, purely as a collectible with no actual economic activity behind it.

The specific velocity ranges that distinguish healthy utility token behavior from speculative accumulation vary by token type. Gas tokens and fee tokens that power network transactions, like the native tokens of high-activity Layer 2 networks, typically show velocities of 5 to 20 on a 30-day basis, meaning the average token changes hands 5 to 20 times per month. This reflects constant turnover from users paying transaction fees, receiving fees as validators, and selling into markets. Protocol access tokens, like those required to use a specific DeFi service, typically show velocities of 0.5 to 3, reflecting moderate turnover where tokens cycle through users as they access the protocol but are not trading hands constantly.

Extremely low velocity on a token that claims to be a utility asset, below 0.1 on a 30-day basis, is a warning signal that the claimed utility is not generating actual on-chain usage. Either the protocol has almost no real users or the token's connection to the protocol's activity is weaker than the team's marketing suggests.

The inputs for a rough velocity calculation are available on any major block explorer or DeFi analytics platform. Pull the token's 30-day transfer volume in dollar terms from Dune Analytics or Token Terminal, then divide it by the token's current market cap (which approximates the total value of circulating supply). The result is your annualized velocity approximation. A token with $10 million in monthly transfer volume and a $50 million market cap has a monthly velocity of 0.2, meaning the average token turns over roughly 2.4 times per year. Compare this number against the protocol's claimed daily active user count. If the velocity is very low but the team claims tens of thousands of daily active users, the disconnect is worth investigating before you invest.

The table below breaks down the shift from a physical, localized token to a global, transparent digital one. While the core idea of "a token for a service" remains, the underlying technology couldn't be more different.

AttributeHistorical Coin Meter TokenModern Digital TokenIssuance & ControlCentralized by a single company or cityDecentralized, issued via a smart contractTransparencyOpaque, no public ledger of transactionsFully transparent on a public blockchainSecurityVulnerable to physical counterfeitingSecured by cryptographic principlesTransferabilityLimited to physical exchangeInstantly transferable globally 24/7VerifiabilityManual inspection, difficult to verifyInstantly verifiable on-chain with block explorers

This evolution from a simple metal disc to a cryptographically secure asset on a global ledger highlights the power of blockchain. The core utility is familiar, but the trust, transparency, and accessibility are on a completely different level.

In DeFi, you don't have to trust—you can verify. The blockchain itself gives you all the evidence you need to tell if a project is the real deal or just smoke and mirrors. Before you even think about investing, doing your on-chain homework is non-negotiable. This is how you move past the social media hype and start using the same verification toolkit the pros rely on.

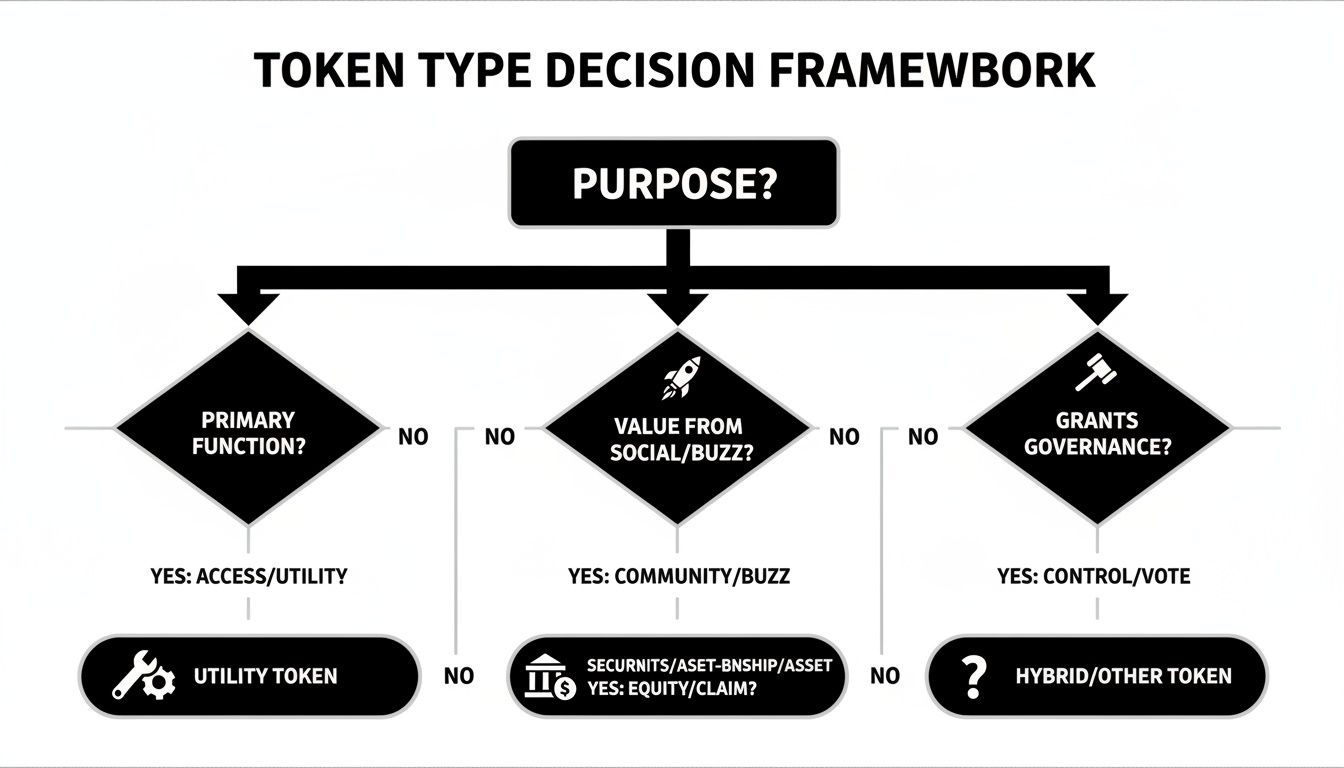

First things first, you need to know what kind of token you're actually looking at. Not every token is created equal, and its core function completely changes how you should analyze its potential. This framework breaks down the common token types by what they're built to do.

As you can see, tokens are usually designed for one of three things: granting access, driving community hype, or giving holders control over the project's future. Figuring out which bucket a coin meter token fits into is your starting point for a real on-chain investigation.

The absolute most important on-chain check you can do is to confirm the smart contract is verified. An unverified contract is a massive, flashing red flag. It means the code is a black box, and you have no idea what it's programmed to do.

Actionable Checklist: Contract Verification

mint(), pause(), or blacklist() which could give developers malicious control.A verified contract lets you scan for nasty surprises. Malicious functions—like the power to freeze trading, blacklist wallets, or mint an infinite number of new tokens—are hallmarks of scam projects. If you can't see the code, you have to assume the worst.

Next up: who actually owns the token? A healthy project will have its tokens spread out across a wide base of holders. This is crucial because it means no single person or group has enough power to crash the price by dumping their entire bag on the market.

Block explorers have a "Holders" tab that breaks this down for you, listing every wallet and the percentage of the total supply it owns. Keep an eye out for these warning signs:

Digging into these distribution patterns is a core part of what experts call crypto on-chain analysis. It gives you a clear, data-backed picture of the risks baked into the token's supply.

The classic "rug pull"—where developers drain every last cent of value from a project—is only possible if they control the liquidity pool (LP). A legitimate team will lock their LP tokens in a separate smart contract for a fixed amount of time, proving to everyone that they can't just run away with the money.

You can check for a liquidity lock using a dedicated platform that scans the blockchain for this data. A lock lasting at least six months to a year shows a real commitment from the team. If there's no lock, or a very short one, consider it a critical warning. This one step is your best defense against the most common scam in DeFi.

The article's smart contract verification section correctly identifies the importance of checking the contract on a block explorer. What it does not address is one of the most financially damaging mistakes retail traders make when applying this advice: verifying the wrong contract because they found the right token name on the wrong chain or in the wrong version.

When a legitimate utility token gains attention, fraudulent actors deploy copycat contracts on the same or different chains with identical or near-identical names and ticker symbols. They then seed these contracts with small amounts of liquidity on DEXes and promote them through social media channels targeting traders who heard about the legitimate token and searched for it. A trader who searches for a token by name on DexScreener or Uniswap and finds multiple results with similar names will often pick the wrong one, especially when the fraudulent version has been artificially pumped to show attractive recent price action.

The multi-chain version of this problem is more subtle. Legitimate projects frequently deploy token contracts on multiple chains simultaneously, Ethereum, Arbitrum, Base, and BNB Chain being the most common combination. Each deployment is a separate smart contract address. If a project's official documentation lists only one contract address and you find a second one with the same token name on a different chain, the second contract may be a legitimate bridge-wrapped version or it may be a fraudulent copycat. The distinction matters enormously because wrapped tokens carry bridge risk in addition to the underlying token risk, while fraudulent copycats carry the additional risk of complete loss.

The reliable verification sequence for any token you are considering buying takes three steps. First, identify the official contract address from the project's own website, their verified Twitter/X account, or their pinned Discord announcement, not from DexScreener, CoinGecko, or any search result. Search results and aggregators can be gamed by fraudulent projects paying for listings or by users submitting incorrect information. The project team's own controlled channels are the only authoritative source for the correct contract address.

Second, verify that address on the appropriate block explorer before buying. Do not rely on a DEX interface showing you the token logo and name. Logos and names are metadata that anyone can copy. The contract address is the only unique identifier. Copy the address from the project's official source and paste it into Etherscan or the relevant chain's explorer directly.

Third, for any token claiming to exist on multiple chains, look for explicit bridge documentation from the project. Legitimate multi-chain deployments are documented with the specific bridge contract addresses used to move tokens between chains. If a team has deployed on Ethereum and Arbitrum but their documentation does not explain the bridging mechanism and list the bridge contract addresses, one of those deployments may not be from the team. LayerZero and Wormhole are the most commonly used legitimate bridging protocols, and their bridge contracts are publicly documented. A token that claims to exist on multiple chains but cannot point to a recognized bridging protocol is a significant red flag.

The additional check that catches impersonation contracts specifically is the deployer wallet history on the block explorer. Every contract has a deployer address, the wallet that originally published it to the blockchain. If the legitimate project's known wallet addresses are publicly documented (teams that are serious about transparency usually post these), compare the deployer of the contract you are evaluating against the known team wallets. A contract deployed from an unrelated wallet with no prior project activity has not been deployed by the team, regardless of the name or ticker it displays.

A technically perfect smart contract and a locked liquidity pool are great, but they don't guarantee a token will actually go anywhere. A project also needs real market momentum—that mix of social hype and financial energy that pushes a token from a "good idea" into a profitable trade. Learning to spot this momentum is how you connect the dots between on-chain safety and real-world viability.

Think of it this way: on-chain analysis is like popping the hood of a car. You're checking to make sure the engine is sound and won't fall apart. Market momentum analysis, on the other hand, is checking the fuel gauge and listening to the crowd of people trying to buy it. You need both before you get behind the wheel.

To really get a feel for the market's pulse on a coin meter token, you have to look past the price chart. When you combine a few key metrics, a much clearer picture of a token's health and potential starts to emerge.

Just as crucial as spotting the green flags is learning to recognize the warning signs that pop up right before a token's price nosedives. Ignoring these is probably the fastest way to get wrecked in DeFi.

Vending machine tokens from the 1920s give us a baseline for scalable token ecosystems, a concept now magnified by blockchain. The crypto market recently surpassed $4 trillion, with Bitcoin claiming $2 trillion and stablecoins exceeding a $300 billion supply—a 16% jump after regulatory approvals. This explosive growth underscores the importance of tracking smart money on platforms like Wallet Finder.ai, especially as the APAC region's crypto market grew 69% YoY to $2.36 trillion. You can read the full research on crypto sector growth for more details.

Tread very carefully if you see any of these signs:

The red flags section correctly flags large token sales from team wallets as a danger signal. What it does not explain is that for most legitimate utility token projects, these selling events are not random. They follow a predetermined schedule documented at launch called the token unlock schedule, and this schedule creates predictable selling pressure events that you can plan around rather than be blindsided by.

When a project launches a token, the founders, early investors, and team members typically receive large allocations that cannot be sold immediately. Instead, these allocations are vested, meaning they are released gradually over a period of 12 to 48 months according to a schedule. Most vesting schedules include a cliff, a period of complete lock-up before any tokens are released at all, followed by a linear or monthly release of the remaining allocation.

A typical structure for early investors might be a 6-month cliff followed by 18 months of linear vesting. This means that at the 6-month mark after token launch, a large block of early investor tokens becomes tradeable simultaneously. The cliff unlock is the most dangerous event because it represents the maximum concentrated selling pressure from holders who received tokens at the lowest prices and therefore have the highest potential profit margins on their sales. An early investor who received tokens at a $0.01 average cost during a seed round has an enormous incentive to sell at least a portion of their allocation the moment the cliff unlock releases their tokens, regardless of the current market conditions.

The dollar-value impact of an unlock event relative to the token's normal trading volume tells you how disruptive that event is likely to be. If $5 million worth of tokens are scheduled to unlock in a month where the token averages $500,000 in daily trading volume, that single unlock represents 10 days of normal selling capacity entering the market in a concentrated window. Unless new buying demand enters simultaneously, basic supply and demand mechanics suggest the price will face meaningful downward pressure.

Token Terminal, Vesting.finance, and Cryptorank.io all track vesting schedules for major utility token projects and display upcoming unlock events with approximate dollar values based on current prices. For any token you are holding or considering, pull up the upcoming unlock calendar and note the date and size of the next major cliff or linear release event.

The calculation for assessing impact is: divide the dollar value of tokens unlocking by the token's average daily volume over the prior 30 days. The resulting number is the number of trading days' worth of sell pressure entering the market from that single event. An unlock representing fewer than 2 days of average volume is unlikely to cause sustained price disruption. An unlock representing more than 10 days of volume warrants serious caution, particularly if the recipients are early investors rather than long-term team members with continued alignment to the project.

The practical position management approach around major unlock events is reducing position size in the two to three weeks before the cliff date and re-evaluating after the initial post-unlock selling has been absorbed. The price pattern around large cliff unlocks is relatively consistent: selling pressure increases as the date approaches from holders who anticipate the event, the price often hits a local low around the unlock date itself as the newly liquid tokens enter the market, and then stabilizes or recovers as the selling from the newly unlocked holders subsides and the market recalibrates. Buying into that post-cliff low, for tokens with strong underlying protocol activity, is one of the more reliable entry patterns available for utility token traders.

Okay, so we've established what the Coin Meter token is and checked its vital signs on-chain and off-chain. Now for the fun part: seeing what the sharpest traders are actually doing about it. This is where we move from theory to action, and it's how you can gain a real edge.

The image above gives you a peek into Wallet Finder.ai. It's designed to cut through the noise of the blockchain and show you exactly who's buying, who's selling, and when. Seeing these moves in real-time transforms raw transaction data from a confusing mess into a clear trading signal.

First things first, you need to find the "smart money." This isn't about picking random wallets and hoping for the best. It’s about methodically identifying traders who consistently crush the market. The Discover Wallets feature on Wallet Finder.ai is built for exactly this. It lets you filter wallets by performance metrics that actually prove they know what they're doing.

This turns on-chain analysis from a blind search into a targeted hunt. You can sort and filter by things like:

For example, you could set a filter for wallets that have pulled in over $100,000 in profit in the last 30 days with a win rate higher than 75%. Just like that, you’ve filtered out 99% of the noise and are left with a curated list of elite traders.

Once you’ve found a few wallets that look promising, you don’t want to lose track of them. The next step is to bundle them into a custom watchlist. Think of this as creating your own private trading group where you get to look over the shoulders of proven pros. A watchlist pulls all their activity into one clean, real-time feed.

This is worlds better than trying to track wallets one-by-one on a block explorer. You’ll never miss a key move again. Inside your watchlist, every single buy, sell, and token swap they make appears as it happens. This gives you a front-row seat to their strategy, whether they're trading a coin meter token or jumping on the next big narrative.

Your watchlist is basically an intelligence briefing. You're not just seeing what they trade, but when they trade it. In DeFi, that timing is often the only thing separating a monster gain from a painful loss.

In a market that moves at the speed of light, information from an hour ago might as well be from last year. This is why getting instant alerts is non-negotiable. It’s what turns your passive watchlist into an active trading weapon.

You can set up alerts to ping you the second a wallet on your list makes a move.

Here are a few killer alert setups:

This setup puts you in a position to mirror their trades almost instantly, acting on the same information they have. It effectively closes the gap between you and the full-time pros, giving you a chance to catch momentum before the rest of the market even knows what's happening.

We’ve covered a lot of ground, starting with a simple coin meter and ending with a professional-grade trading workflow. If there’s one thing to take away, it's that real, sustainable success in DeFi trading is a blend of three key things: solid on-chain research, sharp market analysis, and the right tools for the job.

By bringing these skills together, you can finally step off the hype rollercoaster. You learn how to actually verify a token's legitimacy, size up its market momentum, and then—crucially—confirm your instincts by watching what the top traders are doing. This is the difference between a wild guess and a calculated risk.

Platforms like Wallet Finder.ai give you a serious advantage. They provide a clear window into what the most profitable wallets are buying and selling in real-time. This isn’t just random data; it’s actionable intelligence that closes the gap between your research and your final decision to trade.

Now, it’s your turn to put this into practice. It's time to stop chasing pumps and start building a strategy backed by on-chain evidence and the moves of proven winners.

Diving into the world of token analysis and smart money tracking always brings up a few questions. Let's tackle some of the most common ones to help you sharpen your trading strategy and make better sense of on-chain data. Getting these concepts down is what separates the real opportunities from all the market noise.

So, how do you know if you're tracking a genuinely skilled trader or just someone who got lucky on a single memecoin pump? The answer, in one word, is consistency. A truly smart wallet shows a repeatable strategy that works over time, not just one lottery-ticket win.

Look for these dead giveaways of real skill:

A single massive win is just an outlier. A clear pattern of profitable trades? That's a signal worth paying attention to.

When it comes to mirroring trades for a new coin meter token, what are the real dangers? Following smart money can be an incredibly powerful edge, but it’s definitely not a risk-free game. The biggest risk is slippage, especially on tokens with low liquidity. This means you could end up paying a much higher price than the trader you're copying.

Another huge one is getting front-run by bots that spot your transaction in the mempool and jump in ahead of you.

The golden rule here is simple: never invest more than you are truly willing to lose. Even if you're following the best wallet in the world, you have to do your own on-chain homework. Their risk tolerance is not your risk tolerance.

Is it actually possible for tools like Wallet Finder.ai to help you get into tokens before they hit the mainstream? Yes, absolutely. This is precisely what the platform is built for. The secret is to focus on early smart money movements.

Instead of waiting for a token to pop up on crypto Twitter or big news sites, you can use filters to find brand-new token pairs that are quietly attracting capital from proven, profitable wallets. By setting up real-time alerts for these specific wallets, you get a notification the second they make their first move. This gives you a massive head start on the rest of the market.

Token burns are one of the most frequently misunderstood mechanisms in utility token economics, and the way they affect long-term value depends almost entirely on whether the burns are funded by genuine protocol revenue or manufactured through tokenomics that simply reduce supply without creating corresponding demand.

A revenue-funded burn works as follows: the protocol collects fees from users for using its service, uses a portion of those fees to buy tokens on the open market, and then permanently destroys them by sending them to an unspendable address (the zero address on Ethereum). This mechanism directly connects protocol usage to token value: more users generate more fees, more fees fund more buybacks, more buybacks reduce circulating supply, and reduced supply with stable or growing demand produces upward price pressure. BNB on the BNB Chain uses this model, burning tokens quarterly based on trading volume on Binance.

A tokenomics-driven burn simply destroys tokens from the initial supply allocation according to a predetermined schedule, regardless of protocol activity. This reduces supply mechanically but creates no new demand to absorb the reduced supply. Tokens that implement burns this way frequently decline in price despite technically deflationary supply mechanics, because deflation without demand growth does not translate to value creation.

To evaluate whether a burn mechanism is meaningful, find the protocol's burn transaction history on the block explorer and compare the dollar value of tokens burned over the prior 90 days to the protocol's reported fee revenue for the same period. If the burn amount represents a meaningful percentage of revenue, say 20% to 50%, the mechanism has real economic substance. If the burns are tiny relative to revenue or not connected to revenue at all, they are primarily marketing.

The distinction matters both legally and practically, and getting it wrong can expose you to assets you cannot legally trade in your jurisdiction and that may be subject to regulatory enforcement actions that create sudden liquidity risk.

A utility token provides access to a specific product or service within a blockchain ecosystem. Its value derives from the demand for that service, not from the expectation of profit through the efforts of others. The parking meter token analogy throughout this article illustrates utility: you buy the token to use the service, not to profit from the token appreciating in value. Regulatory guidance in most jurisdictions, including the framework informally applied by the SEC in the United States, treats genuine utility tokens as non-securities if they meet specific criteria around decentralization and functional utility.

A security token is an investment contract where the buyer expects to profit primarily from the efforts of a third party, the issuing team or protocol developers. The legal test in the US is the Howey Test, derived from a 1946 Supreme Court case. If a token offering involves an investment of money in a common enterprise with an expectation of profits predominantly from the efforts of others, it is likely a security regardless of what the issuing team calls it. Securities must be registered with the SEC or qualify for an exemption, and trading unregistered securities can expose both issuers and, in some cases, platforms facilitating trading to regulatory enforcement.

The practical trading implication is token delistings. When the SEC has named a specific token as a security in an enforcement action, centralized exchanges operating in the US are legally obligated to delist it or face enforcement themselves. Tokens named in the SEC's 2023 cases against Coinbase and Binance, including SOL, ADA, MATIC, FIL, and SAND, experienced immediate price drops and liquidity reduction when those enforcement actions became public. Utility token traders should monitor SEC enforcement actions and be aware that tokens trading on DEXes may not face delisting risk from regulatory action the way exchange-listed tokens do.

Position sizing in utility token trading should not be uniform across all tokens regardless of their on-chain risk profile. The on-chain metrics discussed throughout this article directly translate into specific position sizing adjustments that reflect the actual risk you are taking.

The baseline framework ties maximum position size to a combination of liquidity depth and holder concentration. For any token where a single exit of your intended position size would move the price by more than 1% based on the visible order book depth or liquidity pool size, your position is too large for that token's current liquidity. This is not an arbitrary rule: positions that are large relative to liquidity cannot be exited cleanly if the thesis reverses, and the inability to exit cleanly during a price decline can turn a manageable loss into a catastrophic one.

A practical scaling approach: for tokens with locked liquidity, verified contracts, holder concentration below 30% in the top 10 wallets, and positive protocol revenue metrics, a position of up to 5% of your portfolio per token is defensible. For tokens that pass contract verification and liquidity lock checks but have concerning holder concentration (30% to 50% in top 10 wallets) or limited revenue history, reduce the maximum to 2% to 3%. For tokens with any major red flag, meaning unlocked liquidity, unverified contracts, or concentration above 50% in top 10 wallets, treat any position as a speculative bet and cap it at 0.5% to 1% of portfolio regardless of the potential upside the opportunity appears to offer. The asymmetry between missing a 10x and losing 100% of a position strongly favors conservative sizing on high-risk tokens.

Ready to stop guessing and start making data-driven moves? Wallet Finder.ai gives you the toolkit to find top-performing wallets, get real-time alerts, and act on smart money signals before everyone else catches on. Start your 7-day free trial today.