How to transfer Coinbase to Coinbase Wallet

How to transfer coinbase to coinbase wallet: Learn safe steps, networks, fees, and troubleshooting for a smooth transfer.

February 21, 2026

Wallet Finder

February 21, 2026

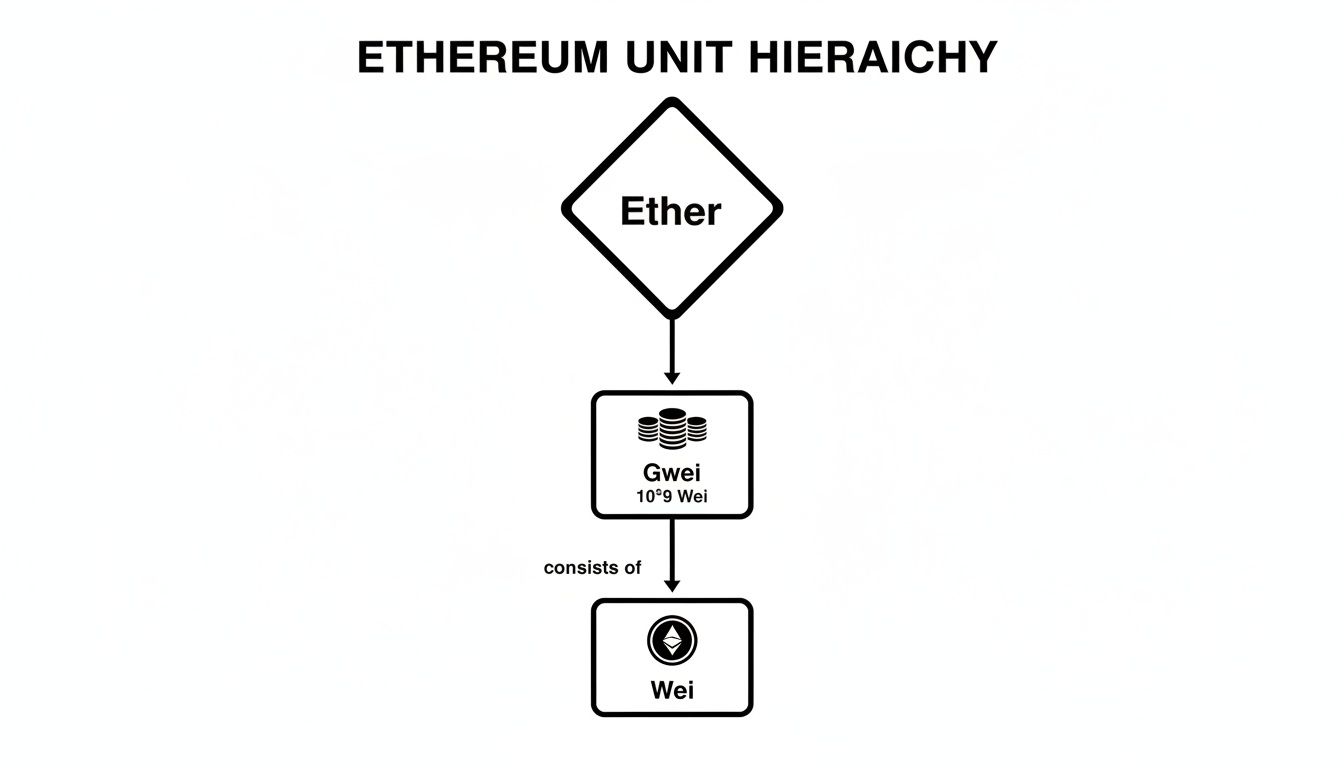

Here’s the simple version: 1 Ether is equal to 1,000,000,000 Gwei.

Think of it like this: Gwei is to Ether what cents are to a dollar. It’s just a smaller, more convenient unit for pricing things on the Ethereum network.

If you’ve ever sent a token or used a DeFi app, you’ve seen transaction costs, or “gas fees,” shown in Gwei. But why not just use Ether? It all comes down to making tiny costs easy for people to read and work with.

Trying to express gas fees in tiny slivers of ETH, like 0.000000001 ETH, would be a headache and an easy way to make a mistake. So, to keep the numbers sensible, the Ethereum network uses a hierarchy of units. This system works well for both the computers running the network and the humans using it.

The smallest possible unit of Ether is called a Wei. From there, the units get bigger, but Gwei is the one you’ll run into most often in your day-to-day crypto activities.

To really nail it down: 1 ETH is exactly 1,000,000,000 Gwei. This system makes understanding transaction fees intuitive. If you want to dig deeper into what makes up a gas fee, check out our in-depth guide on Ethereum gas fees.

This diagram gives you a great visual of how Ethereum's main units relate to one another.

The image makes it clear: Ether is the big one, while Gwei and Wei are the smaller pieces used to calculate exact transaction costs with precision.

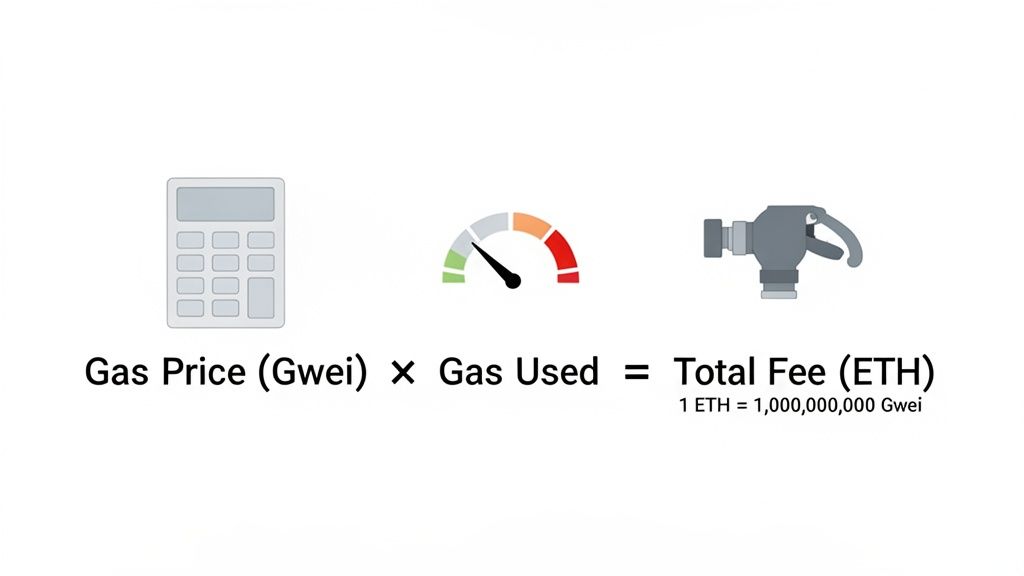

Turning an abstract gas price in Gwei into a real-dollar cost is a must-have skill for anyone transacting on Ethereum. It’s the difference between guessing and knowing exactly what you'll pay before you click confirm.

Thankfully, the calculation is simple once you get the hang of it. It all boils down to one core formula.

Total Transaction Fee (in ETH) = Gas Units Used × Gas Price (in Gwei)

Let's quickly unpack those two pieces:

Let's walk through a real-world scenario. Imagine you're about to make a token swap, and your wallet estimates it will use 150,000 gas units.

150,000 gas × 20 Gwei = 3,000,000 Gwei.3,000,000 / 1,000,000,000 = 0.003 ETH.0.003 ETH × $3,500 = $10.50.Mastering this quick calculation is vital for traders who need to know if a potential trade is profitable after factoring in network fees. For a closer look at converting these fees to fiat, check out our guide on how Gwei translates to USD.

Knowing the formula is one thing, but seeing how Gwei plays out in the wild is what really helps you make better decisions on-chain. The cost of any transaction can swing wildly depending on how congested the Ethereum network is at that exact moment.

A quiet Sunday morning might see gas prices dip as low as 15 Gwei, but a hyped-up NFT mint on a Tuesday afternoon could easily send them soaring to 60 Gwei or even higher. This volatility hits your bottom line directly. The goal is to build an intuition for what these numbers actually mean in dollars and cents.

Let's break down how different gas prices affect the cost of a few common actions. It’s eye-opening to see how a jump in Gwei completely changes the math. We'll use an ETH price of $3,500 for these examples.

As you can see, a simple transfer stays relatively cheap. But for a DeFi trader, that jump from 15 to 60 Gwei is a huge deal, potentially turning a profitable trade into a losing one. You can learn more about how these Gwei to Ether conversions are calculated on CoinMarketCap.

The ability to quickly do this mental math is a key skill for any serious on-chain user. Seeing a "50 Gwei" gas quote should instantly trigger a warning bell, prompting you to double-check if the trade still makes sense. This fast assessment is what helps you avoid overpaying and protects your capital.

Gas prices on Ethereum boil down to one simple concept: supply and demand. The supply is the finite space in each new block, which can only process a certain number of transactions. The demand comes from every single person trying to cram their transaction into that next block.

When more people want in than there's room for, they have to compete by bidding up the gas price. Think of it like a packed highway during rush hour. There's only so much road (block space), but way too many cars (transactions). Only the drivers willing to pay a higher toll (gas fee) get to use the express lane.

Certain on-chain events can trigger a massive, sudden flood of activity, sending gas prices through the roof. These are the moments every trader has to watch out for.

Key triggers include:

A classic example was the UNI token airdrop in September 2020, which caused average gas prices to spike over 500 Gwei. While the market has cooled since then, with recent average gas prices hovering much lower, it shows how fast the situation can change. You can dive deeper into historical trends in The Ethereum Gas Report.

For a trader, understanding these triggers is critical. A high gas price isn't just an inconvenience; it can flip a winning trade into a net loss. Timing your transactions is as important as picking the right asset.

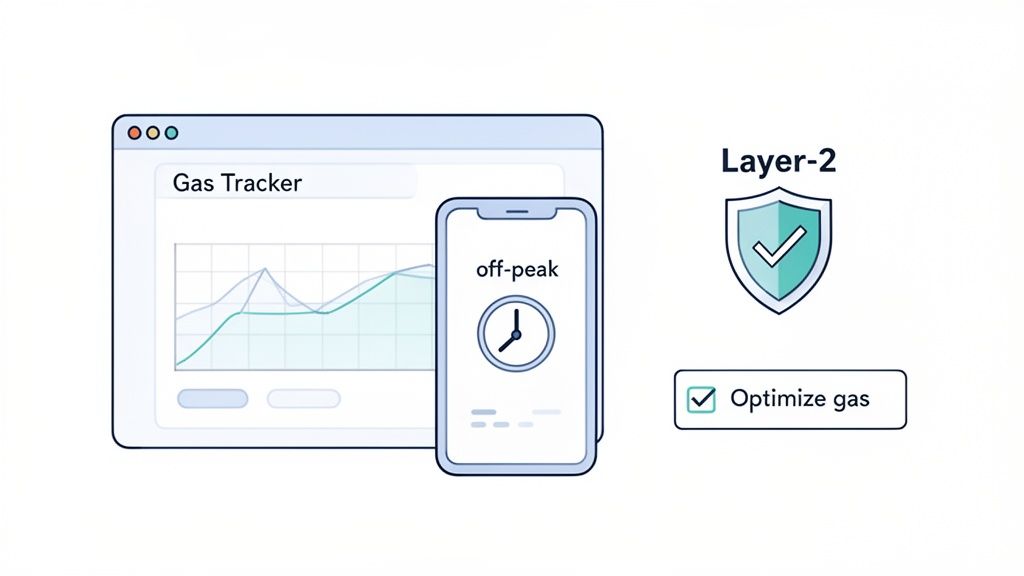

Actively managing your gas fees is one of the easiest ways to protect your profits. Instead of blindly accepting the default fee, use a handful of simple tools and strategies to get your transactions confirmed for a fraction of the cost.

The first habit every on-chain trader needs is using a real-time gas tracker. Websites like the Etherscan Gas Tracker or Blocknative's Gas Estimator are indispensable. They show you the live Gwei prices for slow, average, and fast confirmations.

Here are three powerful ways to cut your transaction costs:

Time Your Transactions: The Ethereum network has predictable ebbs and flows. Demand—and Gwei prices—tend to dip during weekends and late-night hours in U.S. and European time zones. If a transaction isn’t urgent, waiting for these quiet periods can cut your costs in half.

Use Advanced Wallet Settings: Get comfortable with your wallet's "advanced" gas settings. Manually setting your "Max Priority Fee" (the tip for the validator) and "Max Fee" (the absolute most you'll pay) gives you total control, preventing you from overpaying when the network is volatile.

Move to Layer-2 Networks: For regular traders, this is the ultimate solution. Blockchains like Arbitrum and Optimism process transactions off the main Ethereum chain, meaning their gas fees are drastically lower—often just pennies. For a deep dive, check our guide on gas fee optimization comparing Layer-1 vs Layer-2.

A quick pre-flight checklist before every transaction—glance at a gas tracker, consider the time of day, and tweak your wallet settings—is a powerful habit. It turns a reactive expense into a managed cost, ensuring you execute every trade at the best possible price.

Getting the hang of Ethereum means wrapping your head around its lingo. Even after you’ve nailed the gwei to ether conversion, a few practical questions always pop up. This section gives you straight answers to clear up the most common points of confusion.

There’s no single answer—a “good” gas fee is a moving target. On a quiet Sunday morning, 10-20 Gwei might be enough. During a hyped-up NFT mint, that price could shoot past 100 Gwei. A "good" fee is whatever it takes to get your transaction included in an upcoming block without overpaying. Your best bet is to always check a real-time gas tracker before you hit confirm.

The best strategy is to match your gas fee to your urgency. If a transaction isn't time-sensitive, picking the "slow" option on a gas tracker can save you a surprising amount of money over time.

Oh, absolutely. Setting your gas fee too low is a classic mistake, especially when the network is slammed. When you do this, your transaction can get "stuck" in a pending state for hours or even days. Validators always prioritize transactions that pay them more, so yours just keeps getting pushed to the back of the line. Luckily, most modern wallets have a "speed up" or "cancel" button that lets you fix a stuck transaction by resubmitting it with a more competitive gas fee.

While Wei is the smallest possible unit of Ether, using it for gas fees would be a nightmare. A simple gas price of 20 Gwei is the same as 20,000,000,000 Wei. Imagine trying to type that out every time—it would be confusing and incredibly easy to make a typo. Gwei hits the sweet spot for user experience. It’s small enough to be precise but keeps the numbers we actually deal with in a simple, readable range. It's a unit chosen purely for clarity and ease of use.

Stop guessing and start winning. Wallet Finder.ai gives you the tools to track the smartest traders on-chain, copy their strategies, and get real-time alerts on their every move. Discover profitable wallets today with Wallet Finder.ai.