7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 14, 2026

The term moon shot gets thrown around a lot, but what does it actually mean? At its core, it’s a high-stakes bet on an ambitious, almost audacious, project that has a slim chance of success but promises a world-changing payoff if it works.

In the wild world of crypto, a moonshot is a low-market-cap token with the potential for truly explosive returns. We’re not talking about a simple 2x or 3x gain; we're talking about the kind of investment that could multiply by 10x, 50x, or even 100x. Think of it as the crypto equivalent of finding a tiny, unknown startup and betting it becomes the next Amazon.

The idea of a "moon shot" didn't start in crypto—its origins are far more historic. The phrase was born from the sheer audacity of NASA's Apollo 11 mission, which on July 20, 1969, did what many considered impossible: it put humans on the moon.

This monumental achievement, a culmination of work from 400,000 people and costing what would be $283 billion today, became the ultimate symbol for any project that shoots for the stars. You can read more about this incredible history and its parallels in crypto on osl.com.

That same spirit of aiming for the unattainable was a perfect fit for cryptocurrency. In this space, a moonshot isn’t about exploring the cosmos but about exploring the high-risk, high-reward frontier of finance.

Not every new token is a moonshot. These projects have a very specific DNA that sets them apart from giants like Bitcoin or Ethereum. Their defining feature is the potential for astronomical gains, which is always balanced by an equally massive risk.

A crypto moonshot is less about buying into a proven asset and more about betting on pure, unbridled potential. It’s an educated gamble that a tiny, overlooked project is about to capture the market's imagination and explode in value.

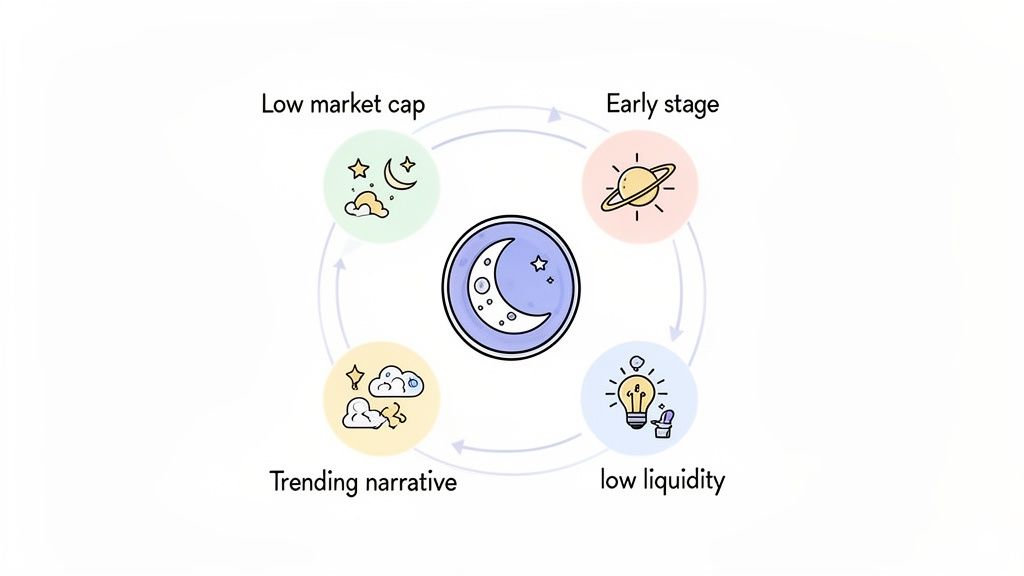

To really get what a moon shot is in practice, you need to understand its key traits. To help with that, here’s a quick breakdown of what makes a moonshot tick.

This table sums up the core attributes of a crypto moonshot. Think of it as a field guide for spotting these high-risk, high-reward opportunities in the wild.

Understanding these characteristics is the first step. It helps you frame your expectations and recognize that you're not just investing—you're speculating on what could be.

So, what really makes a crypto project a moonshot? It's more than just a buzzword. Think of it like a garage startup in the tech world—tiny, raw, and holding a lottery ticket for massive success if it catches fire. These aren’t your established blue-chips; they're the hungry newcomers playing on the absolute edge of the market.

A true crypto moonshot almost always starts with a ridiculously low market cap. While everyone has their own number, many serious hunters won’t even look at a project over $10 million. That tiny valuation is the secret sauce. A coin going from $1 million to $100 million is a 100x gain—something a giant like Bitcoin physically can't do anymore.

Market cap is just the starting point. Several other factors need to line up to create that perfect storm for a token to take off. These elements feed off each other, creating a powerful loop that sucks in attention and, more importantly, capital.

Here is a list of the core ingredients that fuel moonshot potential:

The anatomy of a moonshot is a delicate balance of a tiny market cap, a compelling story that taps into current trends, and just enough scarcity to make new investment create dramatic price action.

In today's market, moonshots are typically these low-cap gems—often under $50 million, and ideally below $10 million. They're perfectly positioned for viral pumps because they have a story to tell. These are the coins that have a real shot at 10x to 100x gains, completely blowing past the slow-and-steady growth of major assets.

Just look at the recent explosion in the Solana ecosystem. A huge part of that was fueled by the memecoin craze and new apps that made trading them easier and safer. This frenzy helped drive SOL up by 174% and pushed daily trading volumes past $7.4 billion. It's a perfect example of how a hot narrative can create incredible momentum. You can read more about the Solana ecosystem's explosive growth on MEXC.

This blend of a low entry point and a captivating story creates a flywheel effect. The first believers kick off the initial pump, social media screams the story from the rooftops, and then the fear of missing out (FOMO) drags in waves of new buyers, launching the token into orbit.

Knowing what a moonshot looks like is one thing, but actually finding the next one before it takes off is a whole different ball game. To go from watching on the sidelines to actively hunting, you need to think like a detective. Your best evidence? On-chain data—the transparent, real-time log of every single transaction on the blockchain.

This data gives you the raw, unfiltered truth about what’s happening with a token long before the hype makes it to the masses. Instead of chasing rumors or getting swayed by social media noise, on-chain analysis lets you see the actual digital footprints of investors. It’s all about spotting patterns that whisper a token might be coiling up for a massive move.

Think of these metrics as your moonshot detection toolkit. One signal on its own might not be a big deal, but when you see a few of them pop up at the same time, it’s a huge clue that something is brewing.

Here are the critical on-chain signals that often show up right before a major price pump:

The secret to on-chain hunting is simple: follow the money and the crowd before they become obvious. When you see a surge in volume, holders, and liquidity all at once, you might just be witnessing the ignition sequence of a genuine moonshot.

These data points paint a much clearer picture than a price chart ever could. Learning to read them is a game-changing skill. If you want to go deeper, our guide on on-chain data analysis covers more advanced techniques.

You don’t need to be a data scientist to spot these signals; you just need the right tools and a straightforward process. The goal is to set up alerts or regularly scan for tokens that check these boxes, so you can build a watchlist of promising contenders and catch the wave early.

Here’s an actionable checklist to get you started on your hunt:

On-chain data gives you a raw, unfiltered look at the market, but let's be honest—it's a firehose of information. Sifting through it all is overwhelming. A much more direct path to finding the next potential moon shot is to follow the digital breadcrumbs left by the most successful traders out there.

This strategy is all about tracking what the pros call smart money.

It’s not about guessing. It's about finding wallets with a proven track record of killing it in the market. These are the traders who consistently get into projects before they start trending, know exactly when to take profits, and maintain an incredible win rate over hundreds or even thousands of trades.

By watching what they do, you're essentially getting a high-quality signal for where the market might be heading next.

A "smart money" wallet isn't just some address that got lucky on a single memecoin pump. We're talking about an address that shows consistent, repeatable success backed by cold, hard data. Analytics platforms are your best friend here, helping you cut through the noise by filtering for key metrics that separate the sharks from the fish.

When you're vetting a wallet to follow, keep an eye out for these specific traits:

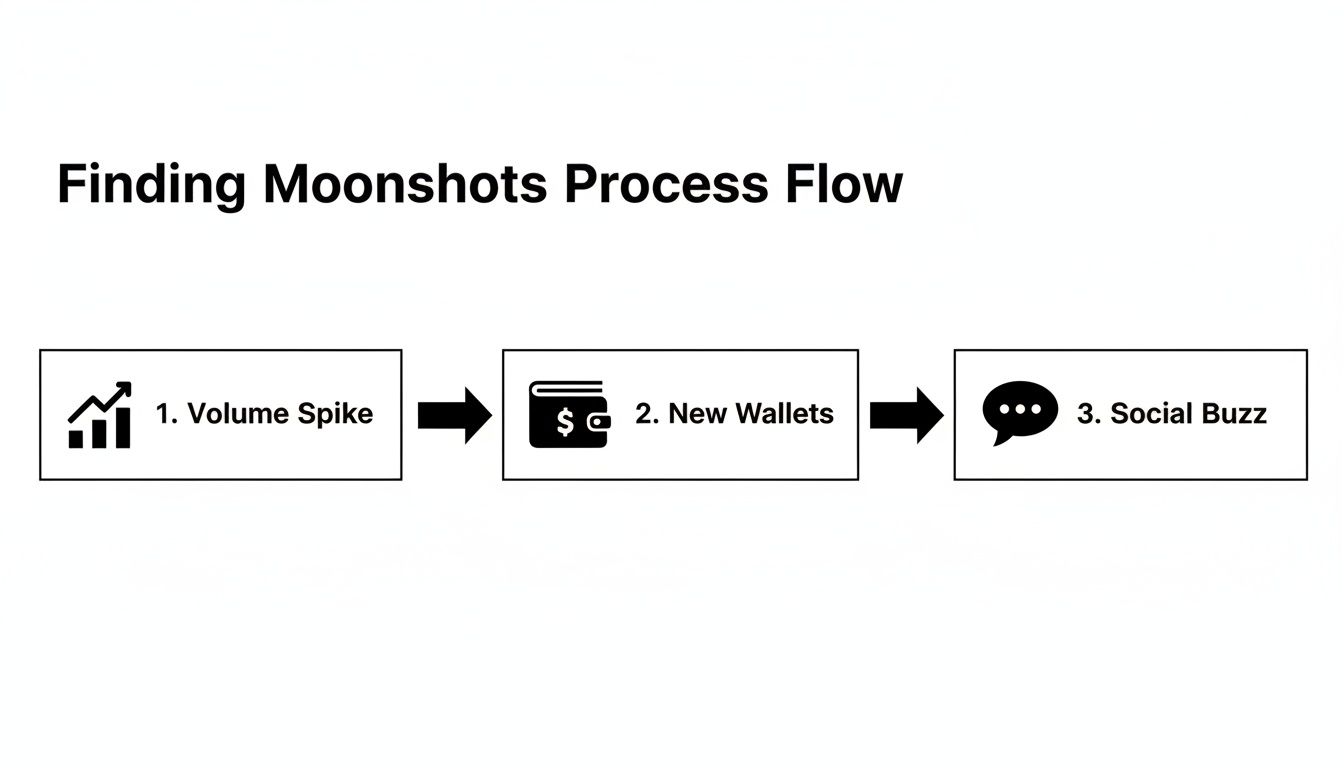

This infographic breaks down a simple process for spotting promising tokens, which often mirrors the first steps a smart money trader takes.

As you can see, a sudden spike in trading volume, a jump in new holders, and growing social chatter are often the sparks that light the fuse.

Once you’ve found a handful of top-performing wallets, the game becomes about analyzing their patterns and setting up alerts. This practice, often called copy trading, lets you mirror the moves of elite traders. But it's not about blindly following every move—that’s a recipe for disaster.

Instead, you use their actions as a powerful starting point for your own research.

Following smart money turns the chaotic noise of the crypto market into a clear, actionable signal. It’s about leveraging the expertise of proven winners to gain a significant competitive advantage.

Many traders use specialized tools to get real-time notifications when a wallet they're tracking makes a move, like buying a new token or selling a position. This gives them a chance to react quickly and investigate the opportunity for themselves. If this sounds like something you want to set up, our guide on using a smart money tracker will walk you through building a professional workflow.

To get started, it helps to know which metrics really matter when you're sizing up a wallet on an analytics platform. The table below breaks down the key performance indicators that will help you separate the true pros from the pretenders.

Focusing on these numbers helps you cut out the distractions and zero in on the wallets making truly smart, data-driven decisions. It's one of the most powerful edges you can get in your hunt for the next crypto moonshot.

While the dream of a 100x return is intoxicating, let's be crystal clear: stepping into the world of moonshot investing is like walking through a minefield. The brutal reality behind the moon shot meaning is that for every explosive success story you see on Twitter, there are thousands of projects that go straight to zero.

This isn't a game for the faint of heart. The odds are stacked against you from the very beginning. The hard truth is that an overwhelming majority of these speculative tokens don't just underperform—they completely collapse. The fantasy of life-changing wealth often ends with a portfolio balance of zero, and understanding this isn't just a suggestion; it's the first rule of survival.

The statistics are grim. Over 90% of speculative tokens fail, often within just a few weeks of launching. Scams are everywhere, with rug pulls draining billions from the market—a huge chunk of which are meme coins, where crashes exceeding 99% are almost a rite of passage.

But then there are the outliers. These are what keep the dream alive. PEPE's mind-blowing 7,166x rise from its lows or BONK's 10,000x surge didn't just create fortunes overnight; they fueled massive ecosystem growth. You can explore more data on how to find these outliers at ATAS.net.

To avoid becoming another statistic, you have to approach every potential moonshot with a healthy dose of skepticism and a rigorous research process. Never, ever invest based on hype alone. Use this checklist to vet projects and hopefully filter out the most obvious disasters waiting to happen.

Protecting your capital is your number one job. The potential for massive gains should never overshadow the need for meticulous due diligence. A single overlooked red flag can be the difference between a calculated risk and a guaranteed loss.

Even with the best research in the world, moonshots are still gambles. That's where proper portfolio management comes in. Think of it as your seatbelt—it's there to protect you from catastrophic losses when a bet inevitably goes wrong.

First, it's absolutely essential to understand what a rug pull is and how to spot its warning signs before it's too late.

Here are a few non-negotiable rules for managing your exposure:

Diving into the world of high-risk, high-reward crypto is bound to stir up some questions. It's one thing to get the gist of what a "moon shot" is, but actually putting that knowledge to work can feel like a huge leap. Let's tackle some of the most common queries head-on to help you navigate this volatile corner of the market with a bit more clarity.

This is easily the most important question you need to answer for yourself before clicking "buy." The golden rule here is non-negotiable: only invest an amount you are completely willing to lose. Seriously. Consider that money gone the second you make the trade.

A good rule of thumb is to dedicate no more than 2-5% of your entire crypto portfolio to these kinds of bets. This approach ring-fences the vast majority of your capital from the brutal losses that are common in this space, while still giving you a ticket to the moonshot lottery. And it should go without saying, but never, ever use money you need for rent, groceries, or any other essential expense.

Great question. While people often throw these terms around interchangeably, there's a subtle but crucial distinction. Both are ridiculously speculative, but a genuine moonshot candidate should have at least a few fundamental threads holding it together—even if they're thin.

Think of it this way: a moonshot is a high-risk tech startup operating out of a garage. A shitcoin is a lottery ticket you found on the street—and the drawing was last week. Your due diligence is what helps you spot the difference.

A huge part of understanding the moon shot meaning is recognizing this key difference. While the risk is off the charts for both, a true moonshot offers that tiny sliver of plausible potential that separates it from projects built on nothing but hot air.

You won't spot these super-early tokens on big exchanges like Coinbase or Binance. Moonshots live and breathe on decentralized exchanges (DEXs). The DEX you'll need depends entirely on which blockchain the token was launched on.

Here’s a quick cheat sheet for the most popular ecosystems:

To trade on these platforms, you'll need a self-custody wallet like MetaMask or Phantom. This type of wallet gives you 100% control over your funds, which is essential for interacting with DEXs. If you're new to this side of crypto, expect a bit of a learning curve, but mastering it is a core skill for hunting those early-stage gems.

Ready to stop guessing and start tracking the smart money? Wallet Finder.ai gives you the tools to discover profitable wallets, find promising tokens, and get real-time alerts on winning trade strategies. Turn on-chain data into your competitive edge.