7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 17, 2026

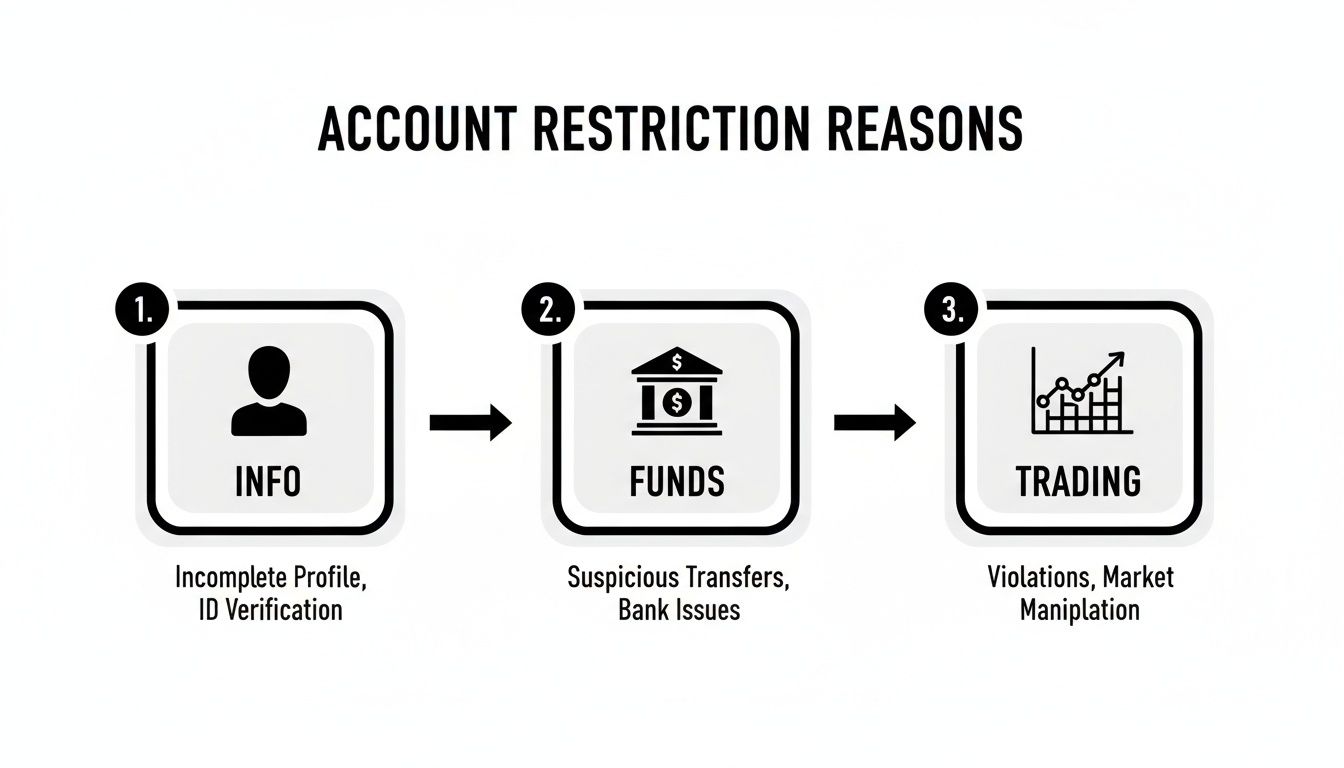

Seeing the "Robinhood account restricted" message can freeze you in your tracks. It means your ability to trade, deposit, or withdraw funds is on a temporary hold. This can be due to a simple failed bank transfer, a trading violation, or a routine identity check. Pinpointing the why is your first step. After that, you can take targeted action by submitting the right documents or waiting out a required suspension to get your account back.

There’s nothing worse than seeing a market opportunity slip by because your account is suddenly frozen. It’s frustrating, and it cuts you off from managing your own portfolio. But these restrictions rarely happen out of the blue; they're almost always triggered by specific issues with your account, your funding, or your trading activity.

Getting to the bottom of it is key. If you can figure out the likely cause, you can get a head start on fixing it, often before you even need to talk to customer support.

Most of the time, the culprit behind a Robinhood account restricted notice is a simple administrative hiccup or a funding issue. These are usually the easiest problems to fix, but they can definitely catch you by surprise.

Keep in mind, a restriction isn't an accusation. More often than not, it's a security measure or just a response to a simple mistake, like a typo in a bank account number.

Most guides treat a failed bank transfer as a simple inconvenience, a deposit that bounces, a brief hold, and then normal service once you pay the balance. The actual downstream consequences of a reversed ACH on Robinhood are considerably more serious and affect your financial life well beyond your Robinhood account.

When a deposit reverses, Robinhood immediately suspends instant buying power on all future deposits. This means the next deposit you make, even if it goes through perfectly, will not be available for trading until the funds fully settle, which takes four to five business days. For a trader used to instant access to deposited capital, this operational restriction can last for months before Robinhood's system reinstates instant buying power, and the exact duration varies by account history.

The more significant consequence is what happens if you used that instant buying power to purchase securities before the reversal hit. You now have a debit balance: you hold securities that were purchased with funds that don't exist in your account. Robinhood will attempt to collect the owed amount from your linked bank account again. If that second collection attempt also fails, they may liquidate positions in your account to cover the debt without requiring your authorization to do so, a right granted to them explicitly in their customer agreement.

The financial reporting consequence is the least-discussed and most damaging part. Robinhood reports debit balances and failed payment activity to Early Warning Services (EWS) and ChexSystems, the two consumer reporting agencies that banks and brokerages use to screen new account applications. A negative EWS or ChexSystems report is not on your Equifax or Experian credit report, so your credit score is unaffected, but it can result in being declined for new bank accounts and brokerage accounts at other institutions for up to five years. Users who've had an unresolved Robinhood debit balance have reported being unable to open accounts at TD Ameritrade, Fidelity, and Charles Schwab due to the ChexSystems flag, even years after paying the original balance.

The resolution sequence when you have a debit balance matters enormously. Pay the negative balance directly through Robinhood's in-app payment option rather than waiting for them to initiate a new ACH pull. Once the balance is cleared, explicitly request from Robinhood support a letter confirming the account is paid and in good standing, then submit that letter to ChexSystems directly as a dispute to have the negative record updated. ChexSystems is required by the Fair Credit Reporting Act to investigate disputes within 30 days. Without this active dispute process, a paid debit balance may remain as a negative record on your ChexSystems file for the full five-year retention period even after the Robinhood account is fully resolved.

The more serious restrictions come from breaking specific trading rules set by financial regulators. These aren't about your personal details; they’re all about how you trade.

Sometimes, restrictions can stem from bigger issues on Robinhood's end. Between 2018 and 2022, for example, many users got locked out of their crypto accounts. The platform ended up in a $3.9 million settlement because it was preventing users from moving their crypto to their own personal wallets, trapping them in the Robinhood ecosystem. This was a massive headache for traders trying to get out of volatile coins like Dogecoin, which at one point made up over 60% of Robinhood’s Q2 2021 crypto trading volume. You can read more about the crypto company settlement on oag.ca.gov.

That "Robinhood account restricted" notification can definitely make your heart skip a beat. The first instinct for many is to panic, but trust me, a methodical approach will get you back in the game much faster than firing off a dozen frustrated emails.

Here is a step-by-step action plan:

As you can see, the root cause is often something straightforward like a funding issue or an outdated profile detail. This is why it’s so important to keep your personal information and linked bank accounts up to date.

Once you know the why, you can start on the how. Many restrictions simply require you to prove you are who you say you are. Having these documents ready to go will slash your resolution time.

Here is a checklist of commonly requested documents:

Pro Tip: I keep digital copies of these documents in a secure folder on my phone. When a platform asks for verification, I can upload them in seconds instead of digging through a file cabinet.

When you reach out to Robinhood support, precision is your best friend. A vague message like "my account is locked" just creates more back-and-forth. You want to give them everything they need to solve your problem in the very first message.

Here’s a simple template I've used that gets straight to the point:

This approach immediately shows the support agent that you've done your part. It helps them pinpoint your issue and start the review process right away, instead of sending you a canned response asking for more information.

While many account freezes are just simple administrative hiccups, some restrictions come from a much more serious place: financial regulations. When your Robinhood account is restricted for compliance reasons, you've likely bumped up against some complex rules from authorities like the Securities and Exchange Commission (SEC).

These aren't just Robinhood's internal policies. They're federal laws that every brokerage has to enforce. Getting on the wrong side of these can lead to a much longer and more complicated restriction than a simple ID verification issue.

One of the sneakiest triggers for an account restriction is a violation of Regulation SHO. This is a dense rulebook governing short selling, including the critical requirement for brokers to locate and deliver shares to close out short positions. When that system fails, it causes headaches for the whole market—and can get individual traders caught in the crossfire.

Robinhood's own business model has created some major compliance issues. Between May 2019 and December 2023, the platform was found to be in violation of Regulation SHO. The SEC found major failures in closing out short positions, marking orders correctly, and locating shares. You can dive into the SEC's findings on Robinhood's violations to see the full picture.

It was a huge deal. The investigation ended with a staggering $45 million SEC penalty in 2025. Robinhood Securities paid $33.5 million and Robinhood Financial paid $11.5 million, which shows you just how seriously regulators take this stuff.

So, why does this matter to you? Because when a brokerage has systemic failures like this, individual accounts can get swept up in the mess. Your account might get frozen during an internal audit or if your trading activity is somehow linked to these bigger compliance problems.

Every article about Pattern Day Trader restrictions on Robinhood tells you the $25,000 rule. None of them tell you about the one-time PDT reset that Robinhood offers, the specific conditions under which it works, or the margin account strategy that technically avoids PDT status while creating a different set of risks that most retail traders are not prepared to manage.

Robinhood allows each account holder exactly one PDT flag removal over the account's lifetime. When you request this reset, Robinhood removes the PDT designation from your account and restores full day trading access as if the flag never occurred. The critical restriction is that the reset is applied to your account's lifetime, not to a calendar year or trading period. Use it in your first year of trading and it's gone permanently; there is no second chance regardless of how many years you continue using the platform.

The reset request must be made through Robinhood support and not through any in-app self-service tool. The processing time is typically two to three business days. The reset is only granted if your account balance at the time of the request is below $25,000. If your account has grown to $25,001 or more, you're classified as a PDT-eligible account by regulation and the reset becomes moot because your balance already permits unlimited day trades. Timing the reset request correctly means making it as soon as you realize you've been flagged and before you've had any chance to build your balance above the threshold.

The margin account alternative is structurally misunderstood by most traders who encounter it as a PDT workaround. A margin account does not exempt you from PDT rules. PDT rules apply to all accounts, margin or cash, with less than $25,000. What a margin account changes is the settlement timeline, not the PDT classification. Trades in a margin account settle immediately in terms of buying power because the broker extends credit, whereas in a cash account trades settle in two business days. This settlement difference means cash account holders must also comply with Good Faith Violation rules in addition to PDT rules, while margin account holders only deal with PDT. The practical upshot is that switching to a margin account doesn't give you more day trades; it just removes the second layer of restriction around unsettled fund usage.

Where margin accounts genuinely create more problems than they solve for restricted account holders: if your account is already under a restriction review when you switch account types, the switch itself can trigger an additional compliance review because account type changes require updated account documentation and re-evaluation of your trading permissions. A restriction that was two days from resolution can reset to a full review cycle when you change account type in the middle of it. The correct sequencing is to fully resolve any existing restriction before making any changes to account type, deposit method, or trading permissions.

It's not all about short selling, though. Regulatory rules also cover things like anti-money laundering (AML) and Know Your Customer (KYC) requirements, which are all about preventing financial crime.

A sudden, unusually large deposit or a weird pattern of transactions that doesn't match your history could easily trigger an AML review. That means a temporary account freeze while Robinhood’s team investigates what’s going on. Staying aware of these rules is key, as you can see in our guide on how crypto regulation impacts market reactions; many of the same principles apply. The more you know, the better you can trade without accidentally tripping a compliance wire.

There's nothing more frustrating than having your Robinhood account restricted and hearing nothing but crickets from support. You've sent your documents, you've waited, and you're stuck in a loop of automated replies—or worse, total silence. When this happens, it's time to stop waiting and start pushing.

Your first move should be to follow up with more direct language. Ditch the polite, passive "any update?" emails. Instead, send a new message that clearly references your original support ticket number. Give them a quick, clean summary of the problem, the date you first reached out, and everything you've done so far. This builds a clear paper trail.

If a full week passes with no real response, it’s time to try hitting them from different angles. Robinhood's support is notoriously siloed, and sometimes getting your case in front of a new set of eyes on a different platform is all it takes to get things moving.

Here is a tiered escalation plan:

TierActionPlatformGoal1Firm Follow-UpEmailReference ticket number, state financial impact.2Public PostX (Twitter)Tag @AskRobinhood, include ticket number.3Request CallbackIn-App RequestSpeak to a human agent directly.

Anytime you do make contact, document everything. Note the agent's name, the date and time, and a summary of the conversation. You’ll want this information handy if things don't get resolved.

Let's say you've tried all of that and you're still stuck. Your next step is to go over their heads and contact the regulators. This is a serious move, but it's your right as an investor.

The two main players you'll want to contact are FINRA and the SEC.

Filing a formal complaint has a way of getting a brokerage's immediate attention. It pulls your case out of the regular customer service queue and lands it on the desk of the compliance department—the people who are legally required to respond.

To make your complaint stick, you need to lay out a clear, factual case. Gather all your documentation: every email, every screenshot, and all your notes from any calls. Build a simple timeline of events, starting from the day your account was restricted to your very last attempt to contact support. A well-organized complaint gives regulators the evidence they need to fight for you.

Dealing with a Robinhood account restricted notice is a massive headache. While getting your access back is the top priority, the real victory is making sure it never happens again. The good news is that prevention usually boils down to just a few core habits: staying on top of your funding, understanding the trading rules, and keeping your account details accurate.

Think of it like basic car maintenance—a little proactive care goes a long way in preventing a major breakdown.

The article's escalation section correctly identifies FINRA and the SEC as formal complaint channels. There is a layer underneath that discussion that dramatically affects your practical options if you've suffered real financial losses during your restriction period: Robinhood's mandatory arbitration clause, which you agreed to when you opened your account and which most users discover only when they try to pursue legal action.

Robinhood's customer agreement requires that virtually all disputes between you and Robinhood be resolved through FINRA arbitration rather than litigation in court. This clause has been upheld by federal courts in cases involving Robinhood, including claims stemming from the January 2021 GameStop trading restriction, where Robinhood disabled buy buttons for GME, AMC, and other meme stocks while millions of users had open positions. Class action lawsuits were filed and then largely dismissed or rerouted to arbitration because of this clause. The practical effect is that you cannot join a class action and you cannot sue Robinhood in state or federal court for most account restriction claims.

FINRA arbitration is not free and not simple. Filing fees range from $50 to $1,800 depending on the amount of the claim, with the higher fees applying to claims above $100,000. Arbitrator fees during the hearing are typically split between parties and can run $300 to $600 per hour per arbitrator, with most panels consisting of three arbitrators. A disputed matter that goes to a full hearing can cost the claimant $5,000 to $15,000 in fees and attorney costs on top of whatever financial loss triggered the claim. This cost structure makes FINRA arbitration economically viable only for claims above approximately $25,000 in direct damages.

For losses under $25,000 during a restriction period, your most effective channels remain the FINRA complaint process (separate from arbitration, essentially a complaint investigation where FINRA investigates the brokerage rather than adjudicating your specific claim) and the SEC's investor complaint system. These are free, generate regulatory pressure on Robinhood, and have produced enforcement actions against the company in documented cases. They don't directly recover your money but they do create documented records and force regulatory attention.

For losses above $25,000 that you believe are directly attributable to an improper restriction, the FINRA arbitration process becomes worth evaluating with a securities attorney. Most securities attorneys handle FINRA arbitration on a contingency basis, meaning no upfront cost to you, with fees taken from the recovery if successful. A free initial consultation with a FINRA arbitration specialist is the appropriate first step when evaluating whether your case meets the threshold that makes arbitration economically sensible.

The CFPB remains a viable parallel channel because Robinhood's cash management and debit card products fall under consumer financial protection law in addition to securities regulation. A restriction affecting a Robinhood Cash Management account or Robinhood debit card has CFPB jurisdiction in addition to FINRA jurisdiction, which gives you an additional federal regulator to involve who operates independently of the securities framework.

More often than not, the most common restrictions are also the easiest to prevent. They typically pop up from simple oversights with a linked bank account or out-of-date personal info.

Here is a quick preventative checklist:

A good rule of thumb is to peek at your profile and linked accounts every six months. This quick five-minute check can solve problems before Robinhood’s automated systems even have a chance to flag them.

Beyond the basic account hygiene, your actual trading behavior is the next area that gets scrutinized. Claiming you didn't know the rules won't help much when you're staring down a 90-day trading ban.

Here’s a quick-reference table to keep you on the right side of the rules:

Trading RuleHow to Avoid a ViolationPattern Day Trader (PDT)If your account value is under $25,000, don't make more than three day trades in a five-business-day window. Keep a simple count in a notes app to be safe.Good Faith Violation (GFV)Only trade with cash that has fully settled. After you sell a stock, wait the required two business days for the funds to clear before using that money to buy and then sell another security.Margin CallsBe extremely careful when trading on margin. You have to keep a close watch on your portfolio's value to ensure it doesn’t dip below the required maintenance level.

Getting comfortable with different order types can also be a lifesaver. For instance, knowing how to properly set up certain orders can prevent you from accidentally using unsettled funds or taking on too much leverage. You can learn more about Robinhood limit orders to see how they give you more control over your trades.

When that Robinhood account restricted notice pops up, it’s natural for your mind to start racing. The uncertainty is the worst part, especially with your money tied up. Let's cut through the noise and get direct answers to the questions I hear most often from traders in this exact spot.

Honestly, the timeline is all over the map. For something simple, like a request to re-verify your ID, you could be back up and running within 24-48 hours once you’ve sent them what they need.

But more tangled issues will take longer. Things like reversed bank transfers, potential fraud flags, or trading violations (hello, Pattern Day Trader rule) trigger a much deeper review. That can stretch the process out to several business days, and in some cases, even weeks. Your best move is to jump on any request for information from Robinhood immediately. The faster and more accurately you reply, the less time you'll spend on the sidelines.

This is the big one, and the answer truly depends on why you were restricted. For many of the more common, minor issues, Robinhood will put your account into a "liquidate-only" status. This is a silver lining. It means you can still close out your existing positions and pull out any cash that has settled. That gives you a crucial bit of control to manage your risk even if you can't open any new trades.

However, if the restriction is for something more serious—like suspected unauthorized activity on your account or a major compliance breach—they might freeze everything. And I mean everything. Selling stocks, withdrawing funds, all of it gets put on ice until their investigation is wrapped up.

Almost never. Don't expect a heads-up. Most restrictions are triggered by automated systems that react instantly to specific events. The second your account registers that fourth day trade in a five-day window, the Pattern Day Trader restriction is applied automatically. There's no warning shot.

It’s the same with a failed bank transfer—that triggers an immediate hold. You usually find out you're restricted when you go to place a trade or an alert flashes in the app. An email or in-app message explaining the reason typically follows pretty quickly after the fact.

A Robinhood restriction itself does not affect your Equifax, Experian, or TransUnion credit score because Robinhood does not report account status to the major consumer credit bureaus. However, a restriction that results from a negative debit balance can affect your financial life through a different reporting system that is just as consequential in practice.

As covered earlier in this guide, debit balances and failed payment activity get reported to ChexSystems and Early Warning Services, the consumer reporting agencies used by banks and brokerages for account screening. A ChexSystems record doesn't touch your credit score but it can prevent you from opening accounts at other financial institutions for up to five years. If you've recently had a restriction stemming from a reversed ACH, check your ChexSystems report immediately by requesting it free at ChexSystems.com (you're entitled to one free report per year under the FCRA). If there's a Robinhood entry and the underlying balance has been paid, dispute it directly to have it updated or removed.

For restrictions that proceed to Robinhood closing your account and pursuing the debt through a collections agency, the collections account can appear on your standard credit report and does affect your credit score. This scenario is relatively rare but occurs when users ignore debit balances for extended periods. The moment you see a restriction stemming from a failed deposit, treat the balance as an urgent financial obligation exactly the way you would treat a bounced check at a bank, because the downstream consequences are functionally equivalent.

These are two distinct account states with meaningfully different implications for what you can and cannot do.

Restricted trading means specific functions are disabled while others remain active. The most common version is a liquidate-only status, where you can close existing positions and withdraw settled cash but cannot open new positions or deposit additional funds. This status is typically applied for minor violations like a single Good Faith Violation or a small debit balance, and it allows you to continue managing risk on your existing portfolio even while the underlying issue is being resolved. A PDT restriction falls into this category: you're restricted from day trading specifically but can still make swing trades that you hold overnight.

A full account freeze is the more severe state, where buying, selling, depositing, and withdrawing are all suspended simultaneously. This typically accompanies a serious compliance investigation, suspected fraud, identity verification failure, or a legal hold placed on the account by a court or regulatory body. During a full freeze, your positions are held in place and you have no ability to manage risk. This is the scenario where time urgency is highest, because market movements during a freeze directly affect your portfolio value with no ability to hedge or exit.

The distinction matters for your escalation approach. A liquidate-only restriction can often be resolved through standard support channels on the original timeline because the situation is stable: you can manage your existing positions while the review proceeds. A full account freeze warrants faster escalation, including same-day follow-up with support and earlier invocation of formal complaint channels, because every day of frozen status creates real financial exposure you cannot mitigate.

In most cases no, but there are specific circumstances where it can create obstacles at other brokerages.

A standard temporary restriction that resolves normally leaves no external record. Once your Robinhood account is back to full access, there is nothing in any external reporting system that indicates you were temporarily restricted. Other brokerages evaluating a new account application have no way to see your Robinhood account status history.

The exceptions involve two scenarios. First, if your Robinhood restriction resulted in a debit balance that was reported to ChexSystems (as described in the credit score FAQ above), other brokerages that use ChexSystems screening will see that record when you apply. This is the most common pathway for a Robinhood restriction to affect account openings elsewhere, and it affects some institutions more than others. Online brokerages like Fidelity and Charles Schwab use ChexSystems. Traditional banks are even more likely to decline based on negative ChexSystems records. Crypto-native platforms that don't operate as traditional broker-dealers typically don't use ChexSystems at all.

Second, if your Robinhood account was closed for a terms of service violation rather than simply restricted, the account closure itself may appear in industry databases that some brokerages review during onboarding. The specific database used varies by institution and isn't always disclosed during the application process, so if you're declined for a new brokerage account after a Robinhood closure, ask the declining institution specifically which consumer reporting agency or industry database triggered the decline. That tells you exactly which record to dispute.

Ready to stop guessing and start learning from the best? Wallet Finder.ai gives you the tools to track the trades of top-performing crypto wallets, see their strategies in real time, and act on proven signals. Start your 7-day trial today and turn on-chain data into your competitive advantage.