7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 10, 2026

Before investing in a new token, your first move should be a rug checker crypto tool. These are automated scanners that analyze a token's smart contract and instantly flag common red flags used in scams.

These scams, known as rug pulls, are when a project's team suddenly vanishes, taking all investor money with them. It's a massive problem that has cost investors billions.

The world of Decentralized Finance (DeFi) is full of incredible opportunities, but it's also a minefield of scams. The most frequent threat you'll face is the rug pull, an exit scam where developers drain the liquidity pool, making the token worthless overnight while they disappear with the funds.

This isn't just a small-time issue. In 2024 alone, illicit crypto activities have already hit around $40.9 billion, and rug pulls are a huge piece of that pie. Scammers are masters at exploiting the hype and fast-paced nature of the market, especially in certain corners of crypto.

You’ll find that these scams pop up more frequently in specific environments. Scammers love to target:

In this wild, unregulated space, the usual financial safety nets just don't exist. There's no bank to call, no central authority to reverse a fraudulent transaction. Once your funds are gone, they are almost certainly gone for good.

In crypto, every transaction is final. That's why personal responsibility is everything. Unlike traditional finance, you can't just call customer service if you get scammed. Proactive due diligence isn't just a suggestion; it's non-negotiable.

This is precisely why having a systematic rug checker crypto workflow isn't just a good idea—it's a critical survival tool for anyone investing in DeFi. Think about it: you wouldn't buy a house without getting it inspected, right? So why would you invest in a token without thoroughly vetting its on-chain health?

By learning to spot the tell-tale signs—from unlocked liquidity to sneaky functions hidden in the smart contract—you can shield your capital from the most common and devastating scams out there. This guide provides an actionable checklist to do just that.

So, you've found a new token that looks promising. Before you even think about connecting your wallet, your very first move should be to run its contract address through an automated rug checker crypto tool. Think of these platforms as a quick background check, designed to sniff out the most obvious and dangerous red flags in just a few seconds. They're an essential filter for immediately weeding out the most blatant scams.

These tools take complicated on-chain data and translate it into a simple score or a report you can actually understand. They’ll look at things like the smart contract code, how the tokens are distributed, and, most importantly, the status of the project's liquidity. It’s a high-level overview that tells you if a token is even worth a second look.

When you paste a contract address into a checker, you’ll get a dashboard packed with different metrics. A high score looks good, but the real value comes from understanding what each individual piece means. Here are the three areas you must scrutinize:

A "honeypot" is a particularly nasty trap where the smart contract lets you buy in but has hidden functions that prevent you from ever selling. Automated checkers are fantastic at spotting these, saving you from an investment you can never cash out.

Getting a handle on these metrics is your first step toward building a solid defense. For a deeper dive into different scam types, check out our guide on crypto scam checkers.

While an automated rug checker crypto tool is an indispensable part of your toolkit, its score is a starting point, not the final word. A low score is a crystal-clear sign to walk away. No questions asked.

However, a high score doesn't automatically mean a project is safe. It just means it passed the most basic checks. Canny scammers are getting better at tricking these systems to appear legitimate. Use these tools to quickly filter out the junk. The projects that get a passing grade are the ones that might be worthy of a deeper, manual investigation—which is exactly what we'll cover next.

Here's a quick reference table to help you spot immediate warning signs when analyzing a new token with an automated tool. If you see any of these, especially the critical ones, it's time to be extremely cautious.

These indicators are your early warning system. Paying attention to them will save you a lot of time, money, and heartache in the long run.

Automated tools are your first line of defense, a quick filter for the most blatant scams. But if you're serious about protecting your capital, you have to learn to look under the hood yourself. A passing score from a rug checker crypto tool is an invitation to start your real due diligence, not a final green light.

This is the point where you shift from being a passive investor to an active analyst. It means jumping into a blockchain explorer and verifying the facts with your own eyes. You’ll be looking directly at the on-chain data—the permanent, unchangeable record of every move a project has made.

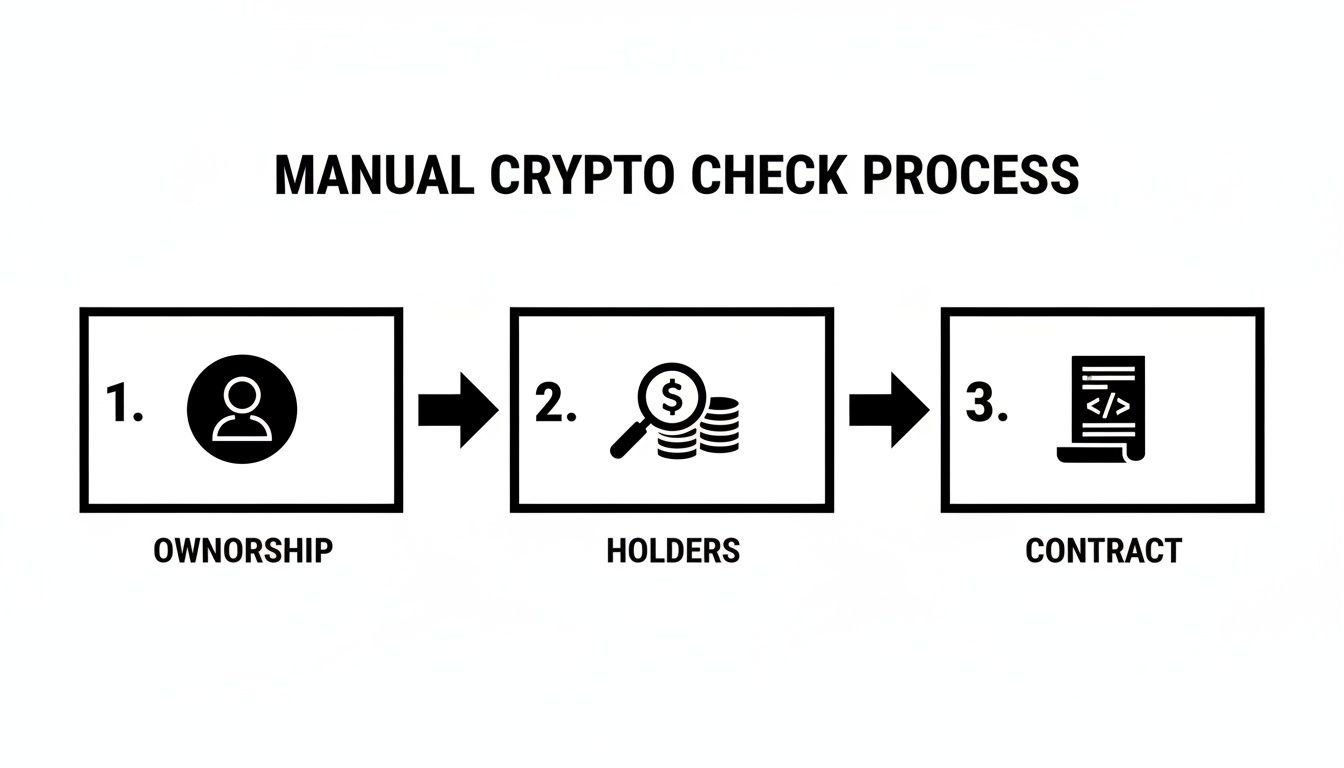

Follow these steps to manually verify a token's safety:

Confirm Contract Ownership is Renounced:

owner() function.0x000...000 (the "zero address").Analyze Token Holder Distribution:

Verify Liquidity is Locked:

If you're new to this, learning what a blockchain explorer is is the perfect place to start.

Instead of constantly being on the defense, a more powerful strategy is to stop chasing random tokens and start tracking the wallets of proven, profitable traders.

This changes the game completely. You’re no longer just running a rug checker crypto scan on some coin you saw on X. You’re tapping into the due diligence already done by experts with real skin in the game. By following the smart money, you instantly cut through the noise and hype that lures so many investors into bad situations.

The process starts with leveraging on-chain analysis to find wallets that consistently avoid rug pulls and generate profits. Tools like Wallet Finder.ai are built specifically for this, letting you filter millions of wallets to find the true alpha.

Look for wallets with these key traits:

Once you’ve found these high-performing wallets, you can start digging into their behavior. What kind of projects are they buying? How early do they get in, and just as importantly, when do they cash out? This insight is worth more than a thousand influencer posts.

The flowchart below shows the kind of manual checking process many of these pros use themselves.

This workflow isn't just for you; it’s what the experts you’re tracking are likely doing to protect their own capital.

Okay, so you've found the wallets. The real edge comes from acting on their moves the moment they happen. In crypto, minutes can be the difference between getting in early and becoming someone else's exit liquidity.

By setting up automated alerts for your tracked wallets, you transform their on-chain activity into your personal alpha. You get an instant notification the moment they make a move, allowing you to investigate and potentially mirror their trade before the rest of the market catches on.

This proactive system lets you piggyback on the instincts and research of seasoned traders. Of course, you still need to do your own final checks—never invest blindly. But now, you're starting from a pool of pre-vetted opportunities instead of a sea of scams.

Theory and tools are great, but nothing drives the lesson home like seeing a scam unfold. When you dissect actual rug pulls, you can see the exact red flags that were waving from day one and understand how a solid due diligence process could have saved investors from disaster.

These aren't just stories; they're practical applications of the rug checker crypto framework.

The Squid Game Token (SQUID) was a masterclass in exploiting global hype. Riding the coattails of the hit Netflix show, the token’s price exploded by over 230,000% in less than a week.

But for anyone who looked past the soaring price chart, the red flags were screaming for attention:

The collapse was swift. The anonymous devs drained the liquidity pool and vanished with an estimated $3.38 million. The token’s price flatlined to zero in minutes. A simple check on a block explorer would have revealed the selling restrictions. Understanding the full meaning of a rug pull is your first line of defense against these tactics.

AnubisDAO was a more sophisticated rug pull that played on investor trust, raising nearly $60 million in ETH during its token sale. The fatal flaw? The entire treasury was held in a single wallet controlled by one person. Just 20 hours after the sale kicked off, all of it was gone.

This case is a brutal reminder of why you must check for multisignature (multisig) wallets and timelocks on project funds. A multisig setup would have required several team members to sign off on the transaction, making a one-person heist impossible.

The AnubisDAO rug proves a vital lesson: trust is not a strategy. No matter how polished a project seems, if its entire treasury is in the hands of one person with zero safeguards, you're always just one click away from total loss. The crypto space has seen devastating losses, with DeFi projects alone driving nearly $6 billion in damages in early 2025, a startling 6,500% year-over-year increase. You can read more about these shocking rug pull statistics on CoinLaw.io.

Even with the best workflow, you’re bound to run into situations where a rug checker crypto tool gives you mixed signals. Learning to navigate these gray areas is what will sharpen your instincts and make you a much smarter investor.

Let's walk through some of the most common questions that pop up during the due diligence process.

A great score from an automated checker is a good sign, but it is not a guarantee of safety. Think of it as a bouncer at a club.

Sophisticated scammers can sometimes game these tools, so you must always perform your own manual digging.

What happens when your analysis is a mix of good and bad? Maybe the liquidity is locked for a year (awesome!), but the top ten wallets hold 60% of the supply (yikes!). It's all about weighing the severity of the risks.

When you're faced with conflicting data, always err on the side of caution. One critical flaw is enough to sink the entire ship. It’s far better to miss out on one potential moonshot than to knowingly walk into a scam.

And the scams are getting more sophisticated. The crypto crime wave peaked in 2025, with projected losses hitting a staggering $17 billion—a huge leap from $9.9 billion in 2024. A lot of this is being fueled by AI-powered scams. You can get the full rundown in the 2026 crypto scams report. This is exactly why you can't afford to overlook even a single red flag.

Good news: you don't need to be a developer to spot the most common contract shenanigans. Head to the "Contract" tab on the token's explorer page.

mint, blacklist, setTax, or freeze.Diving into rug checkers can bring up a lot of questions. Here are quick answers to some of the most common ones we hear.

Hopefully, that clears up some of the fog. The more you practice, the faster you'll get at spotting these issues.

Ready to move from defense to offense? Wallet Finder.ai empowers you to track and mirror the strategies of proven, profitable traders. Stop guessing and start following the smart money. Discover top-performing wallets with Wallet Finder.ai today.