Smart Contract Platforms: A Trader's Guide

Discover the best smart contract platforms for DeFi trading. Our guide compares Ethereum, Solana, Base, and L2s to improve your on-chain analysis and strategy.

February 19, 2026

Wallet Finder

February 19, 2026

Smart contract platforms are the bedrock of decentralized finance (DeFi). They're the blockchains where dApps get built and smart contracts execute. For a trader, the choice of platform creates a fundamental trade-off: some chains, like Ethereum, prioritize security and decentralization, which usually means higher fees. Others, like Solana, are built for raw speed and low costs. These two philosophies create entirely different playgrounds for trading.

If you're a DeFi trader or an on-chain analyst, the smart contract platform you're on isn't just tech—it's your trading floor. It’s the arena where every swap, yield farm, and arbitrage opportunity plays out. The DNA of each platform, from Ethereum and Solana to Layer 2s like Base, directly molds market dynamics and, ultimately, your PnL.

Understanding these differences is non-negotiable. A platform's architecture dictates its transaction speed, cost, and security, creating distinct advantages for specific trading styles. Here’s a quick breakdown of what this means for you:

At its heart, a smart contract platform is a decentralized computer running code that powers everything from DEXs to lending protocols. How that platform reaches agreement on transactions—its consensus mechanism—has a direct line to your wallet.

A platform's finality—the moment a transaction becomes irreversible—is a make-or-break factor for traders. Fast finality slashes the risk of your trade getting rolled back during market volatility, which is absolutely critical for anyone running arbitrage bots or high-frequency strategies.

The rules of the game are set by a few key traits:

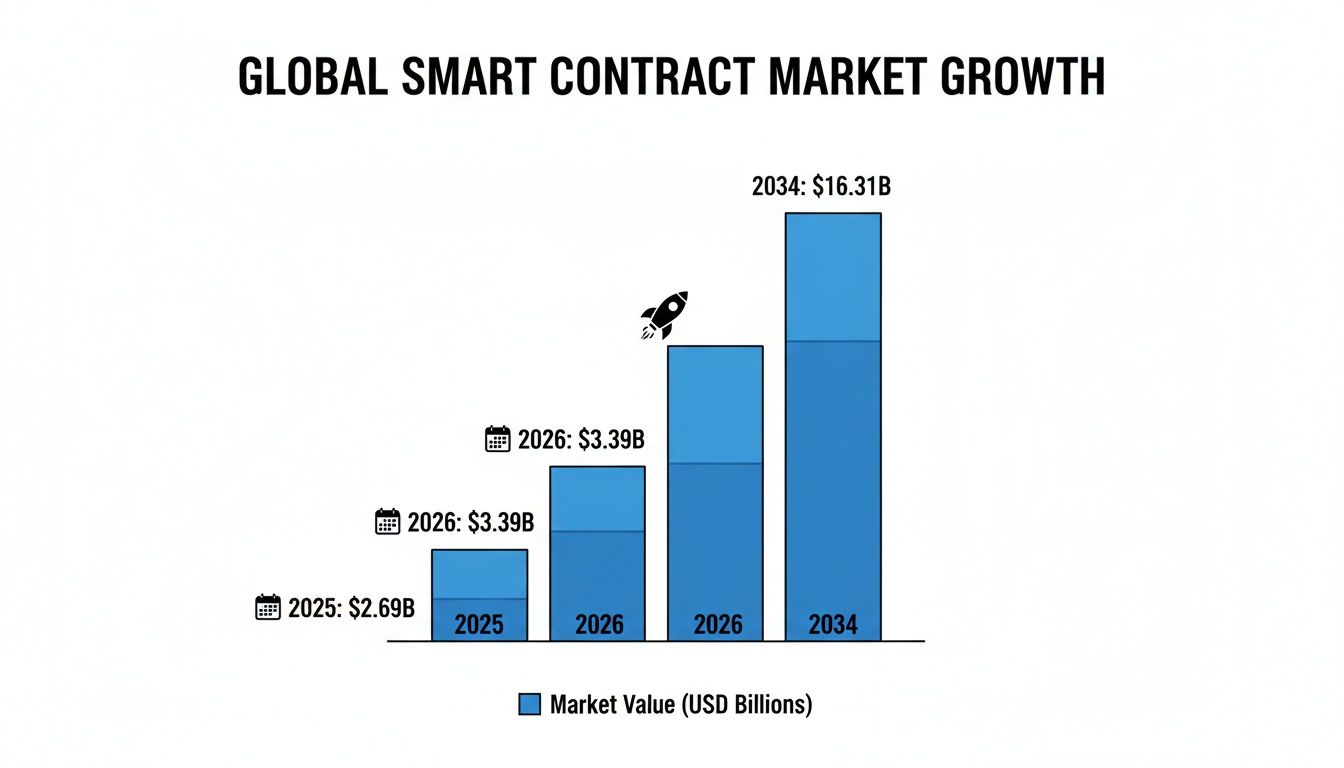

The economic gravity of these platforms is undeniable. The global smart contracts market is on a tear, valued at USD 2.69 billion in 2025 and projected to rocket to USD 16.31 billion by 2034. This growth means a firehose of new capital, protocols, and trading opportunities is pointed right at us. Discover more insights about the smart contracts market growth on fortunebusinessinsights.com. For traders, that translates to deeper liquidity and more complex markets to master. Picking the right platform is the first move you make to capitalize on it.

Choosing a smart contract platform is like a race car driver picking a car for a specific track. You wouldn't bring a car built for the tight corners of Monaco to the long, fast straights of Monza. The blockchain you choose dictates your strategy, affecting everything from execution speed to the fees that chip away at your profits.

To make the right call, you must look past the marketing noise and get into the core mechanics of each chain. The architectural decisions made by developers—whether a chain is monolithic or modular—have a direct impact on real-world performance. This is where you find your edge.

This section breaks down the dominant platforms today, focusing on the technical guts that matter for active DeFi traders. We'll compare Ethereum, the hardened veteran; Solana, the high-speed upstart; and the crucial Ethereum Layer 2s like Arbitrum, Optimism, and Base that are changing the game.

Blockchains generally come in two flavors: monolithic or modular. A monolithic chain like Solana handles everything—execution, settlement, consensus, and data—on a single, highly optimized layer. The goal is pure, unadulterated speed.

A modular design, best seen in Ethereum and its Layer 2 ecosystem, splits up the jobs. Ethereum acts as the secure settlement layer, while Layer 2 solutions like Arbitrum and Optimism handle the heavy lifting of transaction execution much more cheaply. This approach aims for massive scale without compromising decentralization. You can dive deeper into this in our complete Ethereum Layer 2 guide for traders.

Consensus mechanisms also create huge performance differences:

For traders, the takeaway is straightforward: Monolithic chains like Solana often deliver faster finality and dirt-cheap fees, making them a playground for high-frequency strategies. Modular systems built on Ethereum offer battle-tested security, which is what you want when you're parking large amounts of capital for the long haul.

Don't get fooled by theoretical "transactions per second" (TPS) numbers. What really counts is how a platform performs under pressure and what you actually pay in fees. This is where the differences become stark.

Ethereum mainnet prioritizes security, chugging along at 15-30 TPS with fees that can skyrocket to hundreds of dollars during congestion. This makes it a no-go for most retail trading but perfect for large, infrequent moves where security is non-negotiable.

This is the problem that Layer 2s and alternative Layer 1s fix. Solana routinely handles over 2,000 TPS, with fees that are fractions of a penny. Layer 2s like Arbitrum and Base also blow Ethereum mainnet out of the water on speed, with fees usually under $0.10.

The market for these platforms is exploding, projected to grow from $2.69 billion in 2025 to over $16.31 billion by 2034.

This massive influx of capital will only increase the pressure on these networks, making their ability to scale cheaply more critical than ever.

The Ethereum Virtual Machine (EVM) is the operating system for smart contracts where most of DeFi lives. Whether a platform is compatible with the EVM is one of its most critical features for both developers and traders.

EVM-compatible chains like Avalanche, BNB Chain, Arbitrum, Optimism, and Base can run code originally written for Ethereum without major changes. The benefits here are massive. You can use familiar wallets like MetaMask, developers can easily port their dApps to new networks, and liquidity can move between ecosystems with less friction. This shared standard creates a powerful network effect.

Solana is the odd one out—it's not EVM-compatible. It uses a completely different programming model and requires its own set of wallets, like Phantom. While this unlocks unique performance gains, it also means a steeper learning curve for users and a more siloed ecosystem.

The table below provides a side-by-side analysis of the key technical specs that directly impact trading performance, security, and user experience across the dominant blockchains. Think of it as the spec sheet for your trading engine.

These numbers aren't just trivia; they dictate the kinds of strategies that are viable on each platform. High fees on Ethereum make micro-transactions impossible, while Solana's low costs open the door to high-frequency arbitrage and scalping. Understanding these differences is fundamental to finding your trading advantage.

A platform's specs tell you how fast the car can go, but its on-chain ecosystem tells you where the race is actually happening. Tech is only half the story. The real action—and the real money—is in the ecosystem of protocols, liquidity, and communities built on top of these chains. It's where opportunities are born, live, and die.

A healthy ecosystem is a direct signal of profit potential. A chain with deep liquidity, a ton of dApps, and an active developer community is a rich hunting ground. A technically superior chain that’s a ghost town offers little more than a quiet place to lose money.

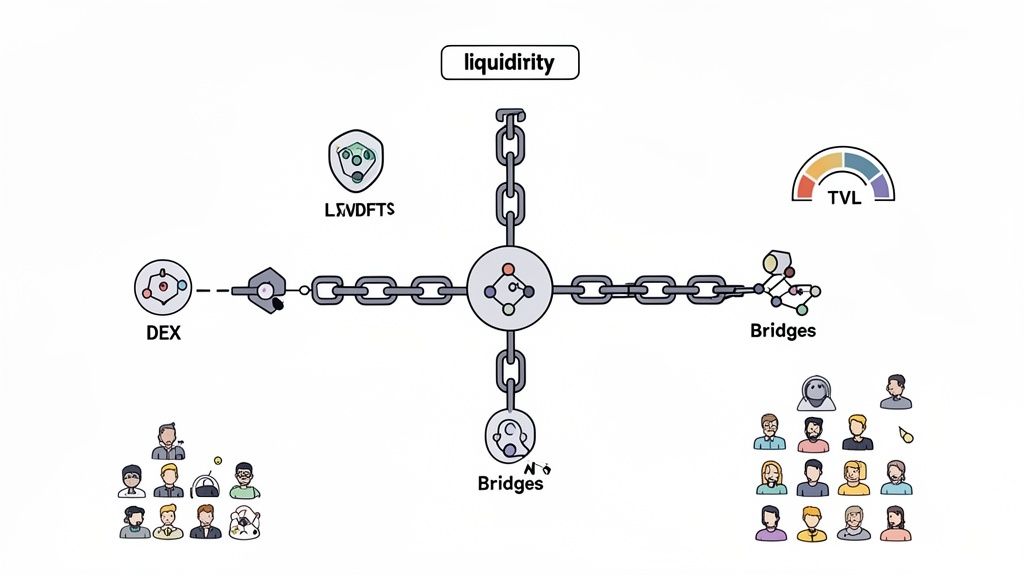

To see past the hype, look at the hard data. The go-to metric for an ecosystem's size is Total Value Locked (TVL)—the total value of assets deposited in a platform's DeFi protocols. It’s a direct measure of user trust and capital commitment.

A high and growing TVL usually points to a healthy, active ecosystem. Ethereum’s TVL often sits above $50 billion, cementing its status as the institutional-grade settlement layer. Meanwhile, new L2s like Base can see their TVL explode in months, signaling a massive rush of retail and degen activity that traders can ride.

Don't just look at the raw TVL number. Smart traders watch the TVL-to-market cap ratio. A low ratio could mean a platform's token is undervalued compared to the economic activity on its chain, flagging a potential investment.

Beyond TVL, a few other key metrics give you the full picture:

The vibe of a platform’s ecosystem dictates which trading strategies work best. Each chain attracts a different flavor of capital and risk. Knowing this is crucial for matching your strategy to the right playground.

Ethereum mainnet is the home of blue-chip DeFi. Protocols like Aave, Uniswap, and Lido are deeply embedded, managing billions in assets. The high gas fees act as a natural barrier, making it the preferred field for large, deliberate trades and long-term holds where security is everything.

On the other hand, low-fee platforms like Solana and Base are magnets for degen plays and high-frequency trading. These chains are perfect for:

This difference explains why a trader you're tracking on Wallet Finder.ai might keep their core ETH and stablecoin bags on Ethereum but run a high-speed memecoin strategy from a different wallet on Base. It’s a calculated decision based on what each platform does best.

Liquidity is the lifeblood of any trading ecosystem. Deep liquidity means you can execute huge trades with minimal slippage—the annoying difference between the price you expected and the price you got. Thin liquidity can turn a winning trade into a loser before it even confirms.

A platform’s bridging infrastructure is a critical part of its liquidity. Bridges are the highways that let assets flow between blockchains. A chain with secure, fast, and cheap native bridges will naturally attract more capital because users know they can move their funds without massive fees or risk.

When you’re sizing up a platform’s ecosystem, here’s what to look for:

Looking at these ecosystem factors gives you the story behind the numbers. It helps you understand why a smart money wallet is moving capital to a certain chain and empowers you to get ahead of market moves instead of just reacting to them.

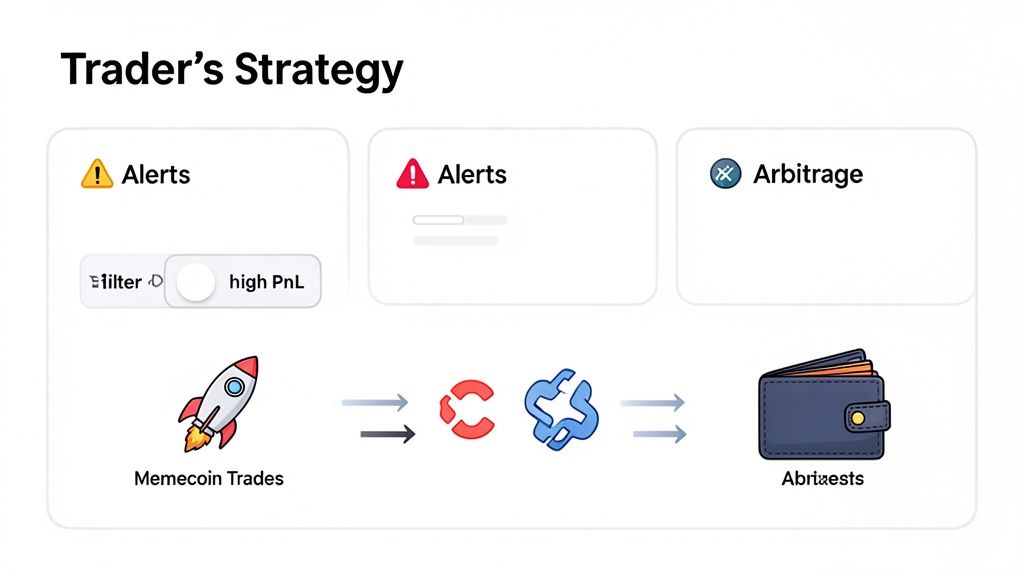

Knowing the tech specs of a smart contract platform is one thing; turning that knowledge into profit is another. A strategy that crushes it on a low-fee chain like Base would get slaughtered by gas fees on Ethereum. You have to match your playbook to the field you're playing on.

This section lays out concrete, actionable strategies for today's most popular chains. We’ll show you exactly what to do and how to use a tool like Wallet Finder.ai to find an edge and execute with precision.

Chains like Solana and Base are built for one thing: speed. With transaction fees that are often less than a penny and near-instant finality, they are the perfect hunting grounds for strategies that depend on quick execution and high trade volume.

Memecoin trading is the classic example. The game is about getting into new token launches before the crowd arrives and getting out before the inevitable dump. Your only real advantage is speed. High-frequency arbitrage also thrives here, as bots can exploit tiny price differences across DEXs without fees eating into profits.

The name of the game on high-speed chains is volume over value. You aren't hunting for one massive score. You're aiming for dozens, or even hundreds, of small, fast wins that compound over time.

To pull this off, you need to find the smart money that moves first. This is where a tool like Wallet Finder.ai becomes your secret weapon.

On these fast-paced chains, your mission is to pinpoint wallets that consistently get into new tokens early and flip them for a profit. Here’s a practical blueprint:

When you switch over to platforms like Ethereum and Arbitrum, the entire game changes. High gas fees on Ethereum and moderate fees on Arbitrum make high-frequency trading a losing proposition. Here, the focus shifts to identifying undervalued blue-chip assets and tracking seasoned DeFi farmers.

The real opportunities lie in finding savvy operators who know how to rotate capital between protocols to maximize yield or spot an established token right before a narrative shift sends its price soaring. Your strategy here is less about speed and more about patience and conviction.

To find these "DeFi Whales," you need a different filtering strategy.

By tailoring your discovery and alert settings in Wallet Finder.ai to the specific character of each chain, you can turn raw on-chain data into a targeted, actionable trading plan. This method allows you to systematically find and replicate the success of top traders, no matter which ecosystem they call home.

Let's be real: making money in DeFi is only half the battle. Keeping it is the other, much harder half. The shiny new chain with 1,000% APYs often hides serious risks, from protocol exploits to shaky cross-chain bridges. One vulnerability can evaporate your profits in a flash.

Crypto history is a graveyard of expensive lessons. Every major platform has had its trial-by-fire security incident that tested its design and resilience. These aren't just cautionary tales; they're valuable case studies on what can go wrong.

A platform's security is more than just its smart contracts—it's the entire ecosystem, especially the bridges connecting it to other chains. Cross-chain bridges have consistently been the weakest link, accounting for a massive slice of all stolen DeFi funds.

For traders hopping between chains, knowing how to move capital safely is a critical skill.

Bridges are the highways that let you move assets like USDC or ETH from one blockchain to another. Unfortunately, they are also a favorite playground for hackers. It's crucial to understand that not all bridges are built the same.

When you see a top wallet on Wallet Finder.ai moving a huge sum, pay attention to how they're doing it. Are they sticking to a battle-tested native bridge or gambling on a newer third-party option? That choice tells you a lot about their approach to risk.

Before you bridge any serious capital, run through this quick security check. This simple habit can be the difference between a successful trade and a total loss. To really get a handle on these risks, our complete guide on smart contract security is a must-read.

By treating every cross-chain transfer with a healthy dose of skepticism, you can sidestep some of the biggest landmines in DeFi. Analyzing the security of the smart contract platforms you trade on isn't just a box to check—it's fundamental to protecting your capital.

Jumping into the world of smart contract platforms can feel overwhelming. Here are clear, straightforward answers to some of the most common questions DeFi traders ask.

If you're just getting started, you want a platform with low transaction fees and a solid community. This is where Layer 2 chains like Base and Optimism really shine.

They are both EVM-compatible, so your MetaMask wallet will work right out of the box. The real win is the low gas fees. You can experiment with small trades, learn the ropes of different DeFi protocols, and even make a few mistakes without it costing you a fortune. While Solana also has super-low fees, it’s not EVM-compatible, meaning you'll need a different wallet (like Phantom) and a bit of a learning curve if you're used to the Ethereum world.

EVM (Ethereum Virtual Machine) compatibility is a game-changer for traders. It means a blockchain can run smart contracts designed for Ethereum, which creates a much smoother, more connected experience. For you, this translates into some real, practical benefits:

The EVM standard has created a massive, interconnected web of blockchains. For a trader, that means more liquidity to tap into, more opportunities to find, and way less of a headache when moving capital around.

It's easy to get swept up in the hype of a new chain, but you need to approach them with skepticism. Keep an eye out for these major red flags:

The fastest way to find the smart money on any blockchain is to use a specialized tool like Wallet Finder.ai. It lets you cut through the noise and zero in on wallets that are consistently making profitable moves.

Here's a simple process:

Ready to stop guessing and start tracking the smart money? Wallet Finder.ai gives you the on-chain intelligence to discover profitable wallets, get real-time trade alerts, and replicate winning strategies on the smart contract platforms that matter. Find your edge and start your 7-day trial today at https://www.walletfinder.ai.