Crypto Future Profit Calculator: A Guide

Use our crypto future profit calculator to accurately forecast leveraged gains. Learn to account for fees and risks to make smarter, data-driven trades.

January 28, 2026

Wallet Finder

January 28, 2026

Feeling like you're trading blind, basing decisions on hype instead of hard numbers? Let's fix that. Forget guesswork. This guide provides a systematic way to calculate potential crypto profits, turning abstract market swings into tangible figures you can act on. This isn't about finding a magic tool; it's about mastering the method behind any good crypto future profit calculator.

This structured approach is crucial in a market defined by both extreme volatility and massive opportunity. To give you some perspective, the crypto market's transaction value shot up from $910.3 million in 2021 and is projected to hit a mind-boggling $6.16 trillion by 2026. Some analysts even see it reaching $20.01 trillion by 2031. With that much capital in play, the trading possibilities are endless.

Plugging numbers into a random online calculator is easy, but most miss the most critical component: realistic data. An effective profit calculation hinges on the quality of your inputs. To make your calculations actionable, you must define these key variables:

This guide will show you how to source these variables intelligently. By analyzing what successful traders are actually doing, you can fill your calculations with data grounded in reality, not just wishful thinking. For a deeper dive into the basics, our guide on how to calculate crypto profit is a great place to start.

Key Takeaway: A "crypto future profit calculator" isn't a piece of software—it's a strategic process. Your success ultimately comes down to the quality of your inputs. This is precisely why basing your numbers on the proven strategies of top wallets, a core feature of platforms like Wallet Finder.ai, is such a game-changer.

Before you can realistically forecast a trade's outcome, you must master the basic math. Forget the complex jargon; Profit and Loss (PnL) calculations are simple. They are the engine behind any crypto future profit calculator, whether you're using a spreadsheet or a sophisticated platform.

The goal isn't just to memorize a formula but to build an intuition for how it works. That gut feeling for a trade's potential is what separates consistently profitable traders from those who are just getting lucky. Let's break down the two main formulas you'll live by.

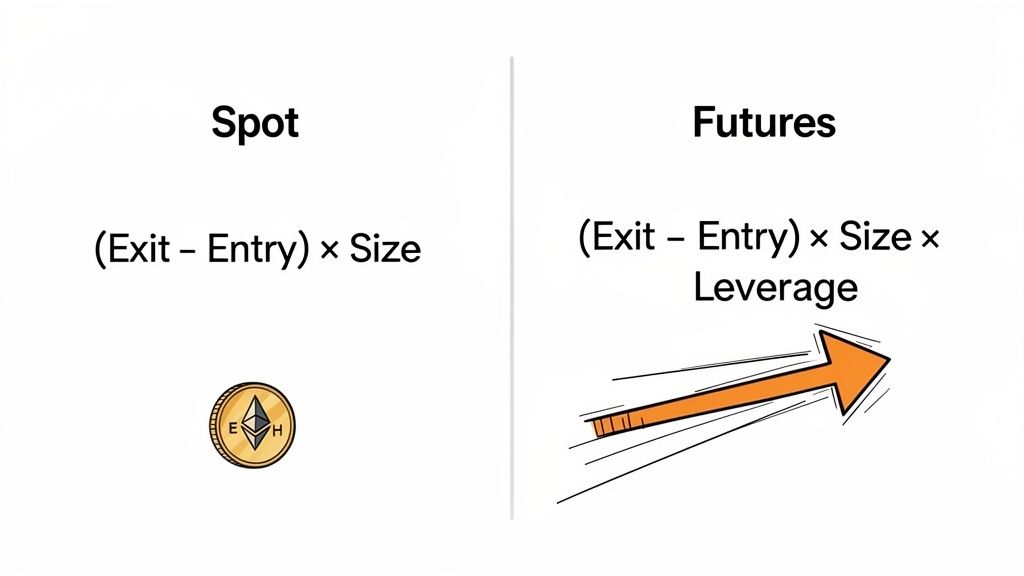

When you buy and hold a coin on the spot market, the math is straightforward. You're calculating how much the price changed and multiplying it by the amount of the asset you own.

Formula: PnL = (Exit Price - Entry Price) * Position Size

Actionable Example:

($3,300 - $3,000) * 1 = $300 profit (gross profit before fees).This visual gives you a quick side-by-side of how spot and futures PnL compare.

You can see right away how adding leverage completely changes the game, which is exactly what we'll get into next.

Futures introduce leverage, a powerful way to gain more market exposure without putting up the full capital. Because of this, the PnL formula gets one critical addition.

Formula: PnL = (Exit Price - Entry Price) * Position Size * Leverage

Actionable Example:

Let's use the same ETH trade, but with leverage. Instead of buying 1 ETH for $3,000 on spot, you open a futures position.

When the price moves from $3,000 to $3,300 (a $300 jump), the PnL calculation becomes:

($3,300 - $3,000) * 1 * 10 = $3,000 profitThe Power of Leverage: The difference is staggering. The spot trade netted a 10% return on your $3,000 capital. The 10x leveraged trade, on the other hand, delivered a 1,000% return on your tiny $300 margin. This amplification is what makes futures so appealing, but remember—it cuts both ways and magnifies losses just as easily.

Getting these two formulas locked in is the absolute first step. If you want to dive deeper into tracking your portfolio's overall health, our guide on profit and loss analysis has more detail. Once these concepts click, you'll have a solid foundation for forecasting what your trades could actually look like.

The gross profit you see after a winning trade is exciting, but it’s not what hits your account balance. The real measure of success is your net profit. To calculate it, you must account for the small, relentless costs that quietly erode your gains. Ignoring these is like filling a leaky bucket; you'll lose more than you realize. These details can be the difference between a profitable strategy and a losing one.

The most obvious costs are trading fees. Every exchange charges these for each transaction.

Slippage is another critical cost, especially in volatile markets. It's the difference between the price you expected and the price your trade actually executed at. During a sudden pump, your buy order might fill at a higher price than you clicked, digging into your potential profit.

If you trade perpetual futures, funding rates are a constant you can't ignore. These are small payments made between long and short positions to keep the futures price anchored to the spot price. If you're long and the funding rate is positive, you pay a fee to shorts, typically every eight hours. A single payment might seem tiny, but these add up significantly if you hold a position for days. I’ve seen trades that were profitable on paper turn into losers because of high funding rates. To get a deeper understanding, check out our complete guide on crypto funding rates.

A savvy trader knows their break-even point isn't just their entry price—it's their entry price plus all associated costs. Always calculate these expenses beforehand to set realistic profit targets.

As you can see, even on a small trade, these costs add up. Imagine this effect scaled over hundreds of trades with larger position sizes. It becomes clear why accounting for every cent is non-negotiable.

The formulas are the easy part. A crypto profit calculator is only as good as the numbers you feed it, and this is where most traders fail. Pulling entry and exit targets out of thin air is a surefire way to get wrecked. Instead of guessing, ground your forecasts in the real-world performance of proven traders.

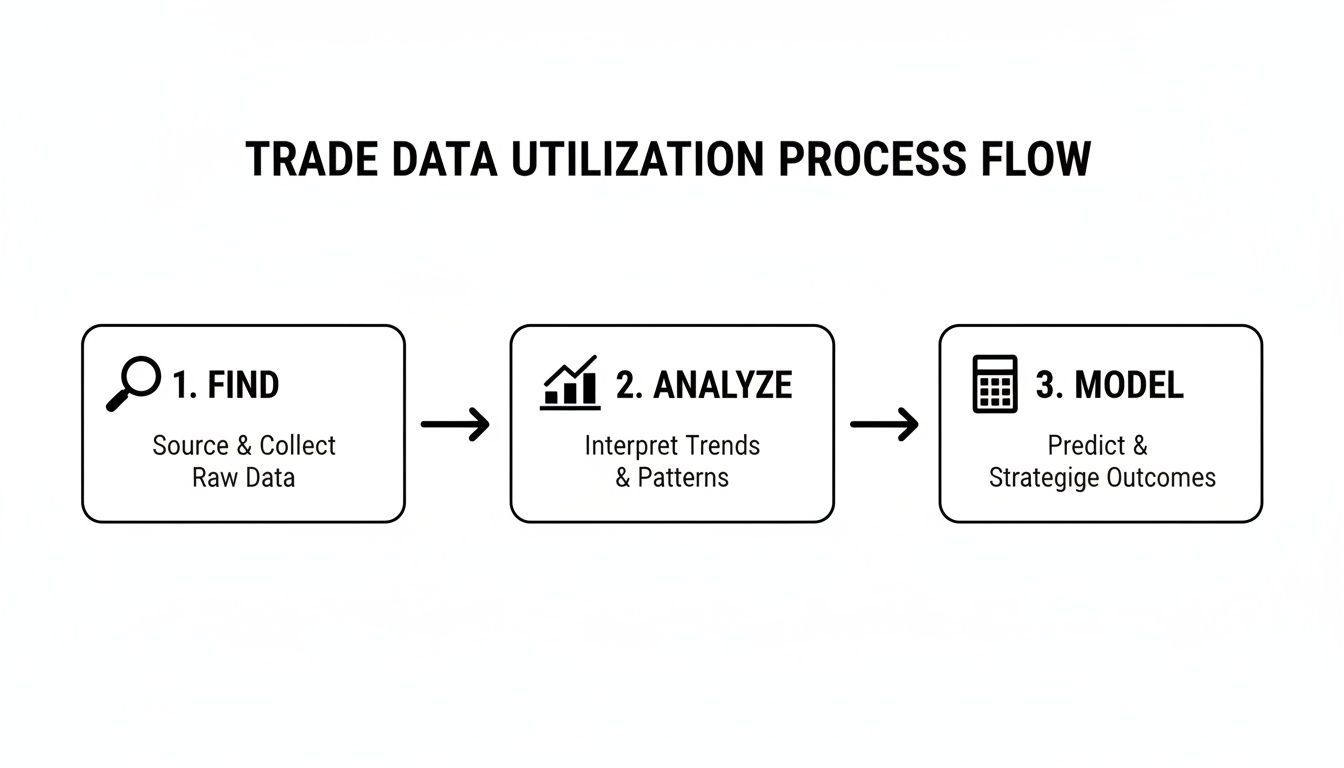

Here is a step-by-step actionable plan:

First, you need to find a "smart money" wallet that's consistently profitable on the asset you're watching. This is exactly what platforms like Wallet Finder.ai were built for. You can filter traders by total profit, win rate, or the specific tokens they trade.

Actionable Example: Say you're bullish on a Solana memecoin, $WIF. Instead of just aping in, you use Wallet Finder to find wallets with a high PnL and a solid track record trading $WIF.

Once you have a promising wallet, go deep. The real gold is in the individual trades. Your mission is to understand their strategy. Pull up their last 5-10 winning trades on that token and look for patterns:

By gathering this data, you're building a realistic trading model based on demonstrated success.

Pro Tip: Look for consistency above all else. A wallet with one lucky, massive win and a sea of small losses isn't a great model. What you want is a wallet showing a steady stream of repeatable, moderately-sized wins. That signals a replicable strategy, not a lottery ticket.

Now you have high-quality, data-driven inputs for your calculator. Let's say your deep dive on the top $WIF trader revealed a clear pattern:

Armed with this intel, you can run a calculation that actually means something.

Let's plug these data-backed numbers into the PnL formulas we covered earlier.

This process turns your calculator from a math tool into a potent trade-planning system. You're no longer asking, "What if the price goes up?" Instead, you're asking, "What would my PnL look like if I could execute with the precision of a top trader?" This is the shift from gambling to strategic, data-backed trading.

A crypto profit calculator showing massive potential gain is only looking at one side of the coin. Without a plan for when things go wrong, you're not trading—you're gambling. This is where you build a robust plan to protect your capital from emotional decisions.

The cornerstone of this professional approach is disciplined risk management. A golden rule many traders live by is the 1% rule: never risk more than 1% of your total trading capital on a single trade. If you have a $10,000 portfolio, your maximum loss on any position is just $100. This is the secret to staying in the game.

This simple process flow is a great mental model for how to use on-chain data to find, analyze, and map out your trades before risking real capital.

This highlights the structured approach: first, find smart money wallets, then analyze their strategies, and finally, model potential outcomes with a calculator.

Once you've defined your maximum acceptable dollar loss ($100 in our case), you can determine your perfect position size. The trick is to work backward from your stop-loss—the price where you'll automatically exit to cut your losses.

Let's imagine you want to go long on ETH at $3,500 and set your stop-loss at $3,450. The distance to your stop is $50 per ETH. To calculate your position size, you divide your max risk by that distance:

$100 / $50 = 2 ETH

Just like that, your position size is perfectly aligned with your risk tolerance. This forces you to think defensively first.

With your position size locked in, you can now use your calculator for scenario planning.

You need to ask specific questions and calculate the answers for each scenario:

($3,700 - $3,500) * 2 ETH = $400 profit.($3,450 - $3,500) * 2 ETH = -$100 loss.This analysis is critical, especially in fast-moving markets. For instance, the Asia-Pacific region is set to become the fastest-growing crypto market, projected to expand at a 29.24% CAGR and lead revenue generation by 2031. For traders using tools like Wallet Finder.ai, this growth means a constant stream of new, sophisticated "smart money" wallets to analyze. You can discover more insights about global crypto market growth on mordorintelligence.com.

By pre-calculating both your potential profit and your pre-defined loss, you remove emotion from the equation. The trade becomes a simple execution of a well-defined plan.

Here are some of the most common questions from traders trying to map out their potential profits and risks.

Hands down, your entry and exit prices. Everything else is secondary.

Your entire profit and loss scenario pivots on these two figures. If they're based on wishful thinking, your calculations will be useless. This is where a tool like Wallet Finder.ai becomes so valuable—it lets you see the actual entry and exit points of traders with a proven track record, giving you a much more realistic, data-driven starting point.

Leverage is a powerful tool, but it's also a double-edged sword that can wipe you out in minutes. It magnifies losses just as aggressively as gains.

With 10x leverage, a tiny 5% price move against you instantly translates to a 50% loss of your capital. A 10% move against you? That's a 100% loss. You're liquidated. This is why you must model the downside with a calculator and always use a stop-loss when trading futures.

A trader who only calculates potential profit is just gambling. True professionals calculate their risk first to make sure they live to trade another day.

Absolutely. The math for PnL is the same for Bitcoin or a new memecoin. The difference isn't in the formula but in the inputs you use.

For highly volatile assets, you must be realistic about a few things:

When projecting profits on these, tighten your stop-losses and be more conservative with your profit targets.

For 99% of traders, tracking your performance in a stable currency like USD is the only way to go. It gives you the clearest, most honest picture of your performance.

When you calculate in the crypto you're trading, its own price volatility can distort your results. Did you make a great trade, or did the coin's price just pump? Tallying everything in USD shows you the real fiat value you've gained or lost, making it much easier to track your growth.

Ready to stop guessing and start building your trade plans with real-world data? Wallet Finder.ai shows you exactly how the top wallets are positioning themselves.

Grab a free 7-day trial and see what a difference on-chain intelligence can make.