7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

December 30, 2025

A simple crypto profit calculator that just subtracts your buy price from your sell price isn't telling you the whole story. In the real world, your true profit is almost always lower once you factor in the unavoidable costs of trading, like network fees and slippage, which can quietly eat away at your gains.

On the surface, calculating your crypto profit seems straightforward. You buy a token, the price goes up, and you sell for more than you paid. Simple, right? But if you’re actually active in DeFi, you know that this formula is dangerously misleading and gives you a false sense of your real performance.

The concept of Profit and Loss (PnL) is the bedrock of any serious trading strategy. However, the surface-level math—sell price minus buy price—completely ignores the small deductions that silently chip away at your returns. It’s like running a business: revenue is great, but net profit is what actually matters.

For every transaction you make on-chain, there's a trail of costs that don't show up in the headline price. These aren't just minor details; they are fundamental parts of your real financial outcome. Failing to account for them is one of the biggest and most common mistakes I see new traders make.

A proper crypto profit calculator must go deeper and track several critical variables.

Relying on a basic "buy low, sell high" calculation gives you a vanity metric. It feels good to look at, but it doesn't reflect the actual cash you can take out. Your true PnL is the full financial story of your trading journey, warts and all, including every fee and unexpected cost along the way.

Mastering these details is the first step toward tracking your performance accurately. It’s what separates rough guesswork from the kind of profitable precision you see in top-performing wallets.

By understanding the true anatomy of a trade, you start building a real framework for success. Before we get into more advanced analysis, it’s crucial to nail down the basics.

This table breaks down the essential components that influence your final crypto profit and loss calculation. Think of these as the non-negotiable inputs for any accurate PnL assessment.

Getting these factors right is foundational. Once you have a firm grip on them, you can move on to calculating your returns with true precision.

To really know how you're doing, you need to get the basics right. We'll start with the most common trade you'll ever make: buying a single crypto asset like Ethereum, holding it for a bit, and then selling it. This simple transaction is the foundation for everything else.

The core formula is pretty straightforward and is the engine behind any good crypto profit calculator.

(Sale Price - Purchase Price) - Total Fees = Realized Profit

This little equation tells you your realized profit—the actual cash you've pocketed from a finished trade. It’s the single most important number for keeping score of your wins and losses.

Let's walk through a practical example. Say you buy 1 ETH for $3,000. The exchange charges a $15 fee for the purchase. A few months later, you sell that ETH for $3,500, incurring a selling fee of $17.50.

Here’s the step-by-step calculation:

$3,000 (ETH Price) + $15 (Buy Fee) = $3,015$3,500 (Sale Price) - $17.50 (Sell Fee) = $3,482.50$3,482.50 (Net Proceeds) - $3,015 (Total Cost) = $467.50At first glance, it looks like a clean $500 profit. But once you factor in those pesky fees, your actual take-home is $467.50. It might not seem like much here, but trust me, those fees add up fast over dozens or hundreds of trades.

Hardly anyone just buys once. A much more common strategy is dollar-cost averaging (DCA)—buying bits of an asset over time to iron out the price swings. When you do this, you can't just pick one purchase price to figure out your profit. You need to calculate your average cost basis.

Let's imagine you've been buying a token called XYZ:

To find your average cost, add up the total amount spent and divide it by the total number of tokens acquired.

100 + 150 + 50 = 300 XYZ$100 + $180 + $45 = $325$325 / 300 = ~$1.083Now, if you sell 200 of those XYZ tokens for $1.50 each, your profit calculation starts from that $1.083 average cost, not any of the individual buy prices. This gives you a consistent, accurate way to track PnL for assets you stack over time. For a deeper dive, you can learn more about how to calculate crypto profit in our detailed guide.

Last but not least, you absolutely have to know the difference between gains you've locked in and gains that are just on paper. This is non-negotiable for smart portfolio management and, especially, for tax season.

Getting this concept is critical. I’ve seen way too many traders get hit with a massive tax bill from realized gains, even when their total portfolio value had dropped since they sold. Any decent crypto profit calculator will track both metrics separately to give you a clear picture of your tax liability and your portfolio's real-time value.

Once you move past simple buy-and-sell trades, the basic profit formulas just don't cut it anymore. In the wild west of DeFi, your trades often involve multiple steps, leverage, or yield-generating moves that can muddy the waters. This is where you need a much sharper pencil to figure out your true performance.

DeFi requires a level of tracking that serious on-chain analysts live by. Simple PnL calculations get messy fast when you’re dealing with multi-step swaps, leveraged positions, or rewards from staking and airdrops. Let's break down how to handle these more complex situations so you're never flying blind.

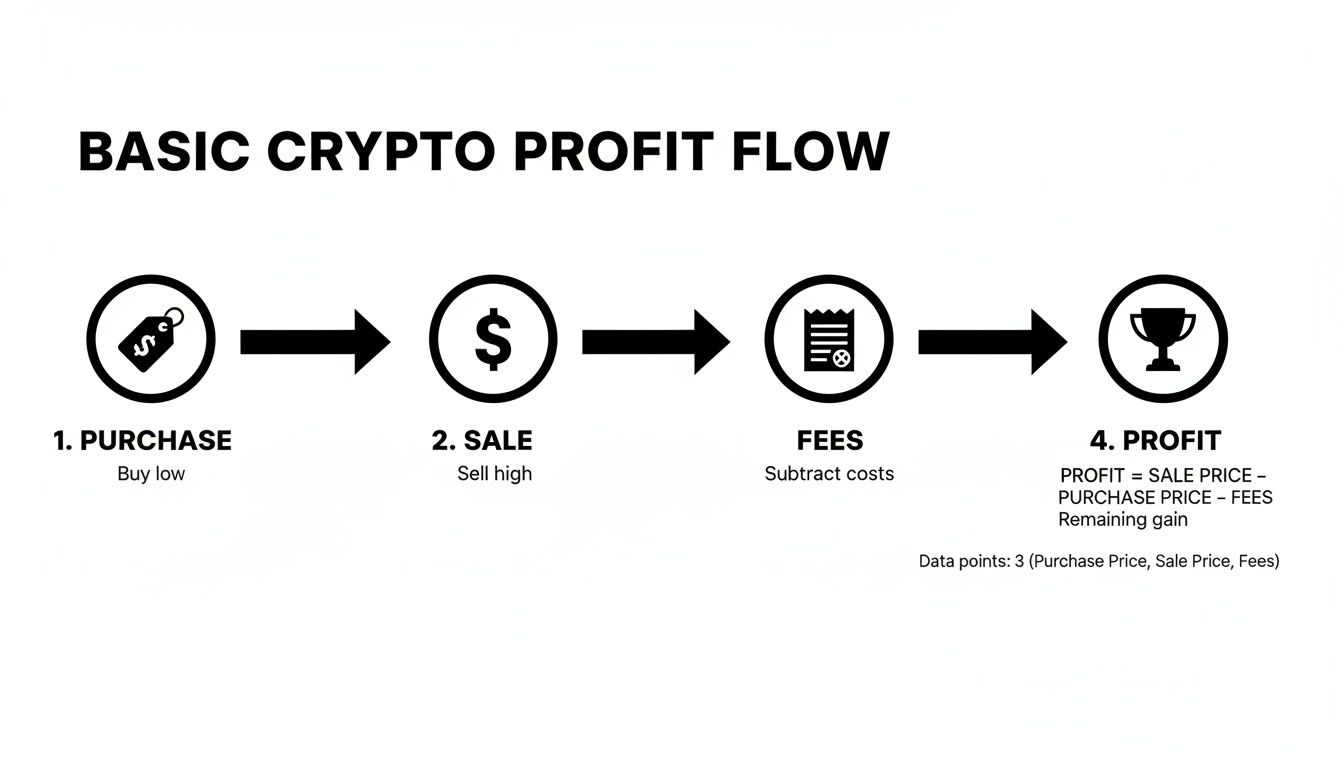

This flowchart maps out the basic journey of a crypto investment, from the initial buy to the final profit, highlighting the critical step of subtracting fees.

As you can see, fees are an unavoidable part of the game, and they directly chip away at the profit you actually pocket.

A typical DeFi trade isn't a clean USD-to-token purchase. More often than not, you're doing a multi-hop swap—maybe trading ETH for WETH, then immediately flipping that WETH for a hot new memecoin. Each one of those "hops" is a taxable event that racks up its own fees and slippage, changing your final cost basis.

Let's walk through a realistic example:

Your real cost basis for that bag of MEMECOIN isn't just the initial $3,000. It's the total amount you spent to get there: $3,020 (WETH cost) + $35 (gas) + $15 (slippage) = $3,070. If you forget to track these extra costs, you'll get a nasty surprise when you sell, thinking your profit was bigger than it actually was.

Everyone knows leverage magnifies gains and losses. But what many traders forget is the sneaky cost that bleeds your position dry: funding rates. These are small, regular payments swapped between long and short positions to keep the futures contract price tethered to the spot price.

Say you open a $10,000 long on BTC with 10x leverage, putting up $1,000 of your own capital. The price jumps 5%, so your position is now worth $10,500. On paper, your gross profit is $500.

Not so fast. You held this position for three days, and the funding rate was 0.01% every eight hours (a pretty standard rate).

Your net profit isn't $500. It’s $500 - $9 = $491 (and that's before trading fees). While $9 seems small here, negative funding on a crowded trade can drain hundreds or thousands from a position over weeks, easily turning a winner into a loser.

Any serious crypto profit calculation has to factor in these recurring costs. Ignoring funding rates is like ignoring interest payments on a loan—it gives you a completely false sense of your financial health.

Staking rewards and airdrops are great, but they come with tax strings attached that you absolutely have to track. When you receive these tokens, they are usually treated as ordinary income, based on their fair market value on the day you claim them.

This means their initial cost basis is not zero.

Let’s make this crystal clear:

Forgetting to record that initial income event and establish a proper cost basis is an incredibly common mistake. It leads to messed-up profit calculations and major headaches when it's time to report your taxes. Meticulous tracking is the only way to stay sane and profitable in DeFi.

A profitable trade on paper can easily flip to a loss in the real world if you ignore the hidden costs that constantly chip away at your returns. These "profit killers"—fees, slippage, and taxes—aren't just minor details. They're fundamental variables every serious trader has to account for.

Without tracking them, your profit calculations are just wishful thinking.

Too many traders celebrate a win the second they see green on the screen, only to find the final number that hits their bank account is always lower. Understanding and anticipating these costs is what separates consistently profitable traders from those who are perpetually surprised by their shrunken PnL.

Fees are the most obvious profit drain, but they're still often underestimated. They come in different forms, each hitting your bottom line.

Here’s a breakdown of common fees to watch for:

Slippage is the gap between the price you thought you were getting and the price you actually got. It's a particularly nasty profit killer when you're trading low-liquidity altcoins or during a crazy market swing.

Imagine you hit "sell" on a token priced at $1.00. By the time your order processes a few seconds later, the best available price might have dropped to $0.98. On a $5,000 trade, that 2% slippage instantly costs you $100. A proper crypto profit calculator has to let you input your actual execution price, not just the number you saw when you clicked the button.

Slippage is the silent tax on speed and liquidity. The less liquid an asset is, and the faster the market is moving, the more you should expect to pay for the privilege of executing your trade.

Taxes are, without a doubt, the single largest expense you'll face as a profitable trader. How much you owe comes down to your holding period, which sorts your profits into either short-term or long-term gains. This one distinction can make a massive difference to your net profit.

The crypto tax software world has exploded to tackle this exact problem. Specialized platforms now exist to organize thousands of transactions and plug directly into software like TurboTax. For short-term traders, the tax hit is significant—profits from assets held less than a year are taxed at your ordinary income rate, which can be anywhere from 10% to 37% in the U.S.

In contrast, long-term capital gains rates are much friendlier, typically ranging from 0% to 20%. This creates a huge incentive to think strategically about when you take profit.

Let's see how this plays out with a simple $1,000 profit. We'll assume you're in the 24% income tax bracket.

Just by holding on for two more months, Trader B keeps an extra $90.

This simple example proves that when you take profits is a critical strategic decision. A smart crypto profit calculator doesn't just show you gross profit; it helps you model these tax scenarios so you can make smarter decisions about when to sell. Ignoring these details is a recipe for leaving a huge chunk of your hard-earned gains for the taxman.

Let's be honest: manual spreadsheets are a terrible way to track your crypto profits. They're time-consuming, prone to errors, and just don't scale when your trades climb into the hundreds or thousands. This is where automation stops being a luxury and becomes a genuine competitive advantage, moving you from tedious data entry to strategic action.

It's time to put all the theory we've discussed into practice and get your profit tracking on autopilot. Modern crypto profit calculator tools have come a long way, connecting directly to your wallets to give you real-time valuations and a constant pulse on your unrealized gains. While many of us started out doing these calculations by hand, it gets impossibly complex as a portfolio grows.

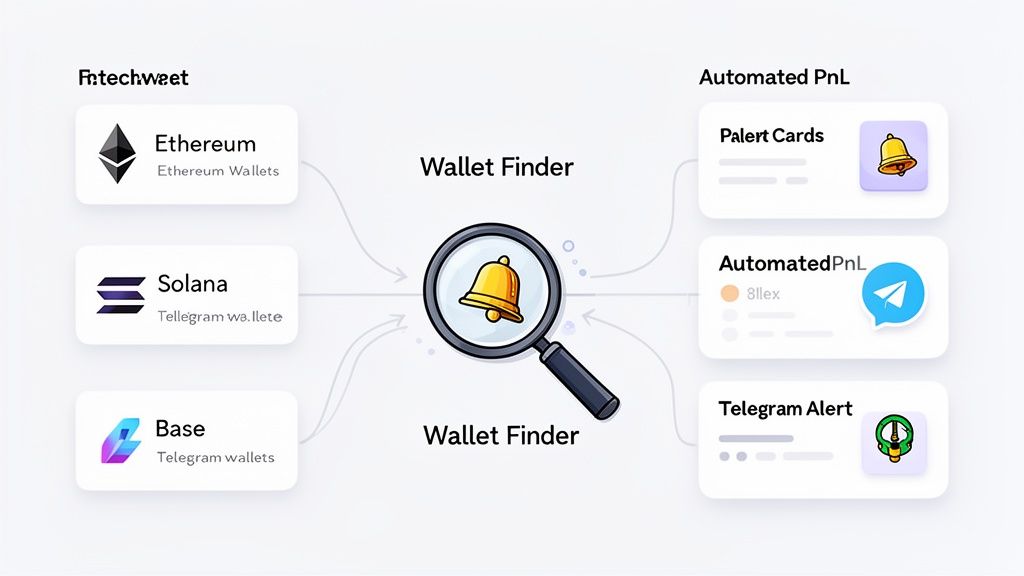

Wallet Finder.ai hooks directly into your wallets on major chains like Ethereum, Solana, and Base to automatically crunch the numbers on your realized and unrealized PnL. This live ledger saves you countless hours and, more importantly, prevents the costly mistakes that creep in with manual tracking.

But its real magic is in what it lets you do beyond your own portfolio. The "Discover Wallets" feature is your on-chain window into the playbooks of top traders. You can find hyper-profitable wallets and then zoom in on their entire history—every buy, every sell, and the exact net profit that resulted.

This is the kind of high-level view you get from the dashboard, showing you the performance metrics of wallets you’re tracking.

You can quickly analyze PnL, win rates, and recent activity, giving you a crystal-clear picture of what the "smart money" is actually doing.

Seeing what works is one thing, but actually acting on it is what matters. The goal here is practical application. By analyzing the best performers, you learn what profitable trading really looks like on-chain.

You're not just getting data; you're getting a repeatable blueprint for success. By seeing the complete PnL of a top trader, you understand their risk management, position sizing, and timing.

Wallet Finder.ai bridges the gap between insight and action with its alerts. Once you’ve pinpointed wallets with impressive track records, you can set up instant Telegram notifications for every move they make.

Key Actions You Can Automate:

This transforms noisy on-chain data into a powerful trading edge. Instead of just reacting to market headlines, you can start making moves based on the proven strategies of traders who are consistently ahead of the curve.

Ultimately, the goal of any tool like this is to help you make better, more profitable decisions. Manually calculating your PnL is a defensive move—it's about keeping your books straight. Automating it with on-chain intelligence is an offensive strategy designed to find new alpha.

Imagine this workflow:

This process takes the boring concept of a crypto profit calculator and turns it into a dynamic tool for generating alpha. It’s about using technology not just to track your past performance with perfect accuracy, but to actively shape your future profitability. For those looking to fully optimize their setup, checking out the best crypto portfolio tracker options can reveal even more ways to stay ahead.

Even with the best tools, crunching the numbers on your crypto profits can get tricky. Let's walk through some of the most common questions that trip up traders, from beginners to seasoned pros.

Think of this as your rapid-fire guide to the nuances. Getting these details right isn't just for bragging rights—it’s crucial for knowing your true performance and staying compliant.

This is easily the most important concept to get your head around in trading.

Realized profit is cold, hard cash (or crypto) in your wallet. It’s the gain you lock in by actually selling an asset. You bought 1 ETH for $3,000 and sold it for $3,500? You have a $500 realized profit (minus fees, of course). This is the number that matters for taxes because it’s an official taxable event.

Unrealized profit, on the other hand, is just paper gains. Say that same ETH is now worth $3,800, but you’re still holding it. You have an $800 unrealized profit. It's potential money, but it can shrink or vanish with the next market dip. You don't owe a cent of tax on it until the moment you sell.

A core function of any good crypto profit calculator is to track both of these metrics separately. This gives you a complete view of your portfolio's health: what you've earned and what you could potentially earn.

This is a massive blind spot for a lot of traders, especially in DeFi. When you swap one crypto for another, the tax authorities see it as two separate events: selling one asset and immediately buying another.

Here's how it breaks down with a real-world example:

Forgetting to track this two-step process is one of the easiest ways to mess up your profit calculations and end up with a nasty surprise come tax time.

Absolutely. A solid crypto profit calculator is your best friend when tax season rolls around. While it won’t file your returns for you, it does all the painful prep work your accountant or tax software needs.

Here's how it makes tax season less of a nightmare:

For anyone active in DeFi, this kind of automation isn't just a nice-to-have; it's essential for staying compliant and avoiding costly mistakes.

Ready to stop guessing and start tracking your PnL with precision? Wallet Finder.ai automates the entire process, giving you a real-time view of your performance and the actionable intelligence to mirror the strategies of top traders. Discover your true profitability and find your next winning trade at https://www.walletfinder.ai.