Calculating Crypto Profit: A Guide for Traders

Master calculating crypto profit in DeFi with our guide. We cover cost basis, gas fees, staking rewards, and tools for accurate P&L tracking.

February 13, 2026

Wallet Finder

February 10, 2026

At its core, a crypto trading pair tells you how much one cryptocurrency is worth in terms of another. Take the classic example, BTC/USD. This pair shows you exactly how many U.S. dollars you need to buy one Bitcoin. Mastering this simple relationship is the first step to making any trade.

Think of swapping money at an airport currency exchange. The board shows a rate like USD/EUR, telling you the price relationship between dollars and euros. A crypto trading pair is the exact same concept, just on a crypto exchange—whether it's a massive centralized platform or a scrappy decentralized one.

Every single trading pair is made of two parts: the base currency and the quote currency.

The first currency listed in any pair is always the base currency. This is the asset you actually want to buy or sell.

The second currency is the quote currency. You can think of this as the "price tag"—it's what you use to measure the value of the base currency.

Key Takeaway: In the ETH/USDT pair, Ethereum (ETH) is the base, and Tether (USDT) is the quote. If the price is 3,500, it means you need 3,500 USDT to buy 1 ETH.

This simple structure creates a universal language for trading. The price you see is never static; it’s constantly moving based on supply and demand dynamics in the market's order book. To make this crystal clear, here’s a quick-reference table breaking down the anatomy of a trading pair.

Once you’ve got this down, you’re ready to dig into the different types of pairs you'll encounter in the wild.

Just like a mechanic has different wrenches for different bolts, traders lean on different types of crypto trading pairs to get the job done. Each category comes with its own set of advantages and risks, making your choice of pair a genuine strategic decision. Your choice directly shapes your market exposure and how easily you can move money. Let’s break down the main types.

Think of these as the main bridges connecting the traditional financial world with the crypto ecosystem. They link a cryptocurrency directly to a government-backed currency, like the U.S. Dollar (USD) or the Euro (EUR).

For anyone navigating the wild price swings of the crypto market, these pairs are a lifesaver. A stablecoin is a type of crypto designed to hold a steady value, usually by being pegged 1-to-1 to a fiat currency like the U.S. dollar.

Stablecoin pairs are your volatility buffer. They let you stay liquid and ready to trade 24/7, sidestepping the delays and banking headaches that come with converting back to fiat.

Also known as crypto-to-crypto pairs, this is where you trade one cryptocurrency directly for another—no fiat or stablecoins involved. This is the heartland of altcoin speculation.

This category includes less common pairs, often involving new or low-cap altcoins. They are typically found on decentralized exchanges (DEXs) or smaller centralized platforms.

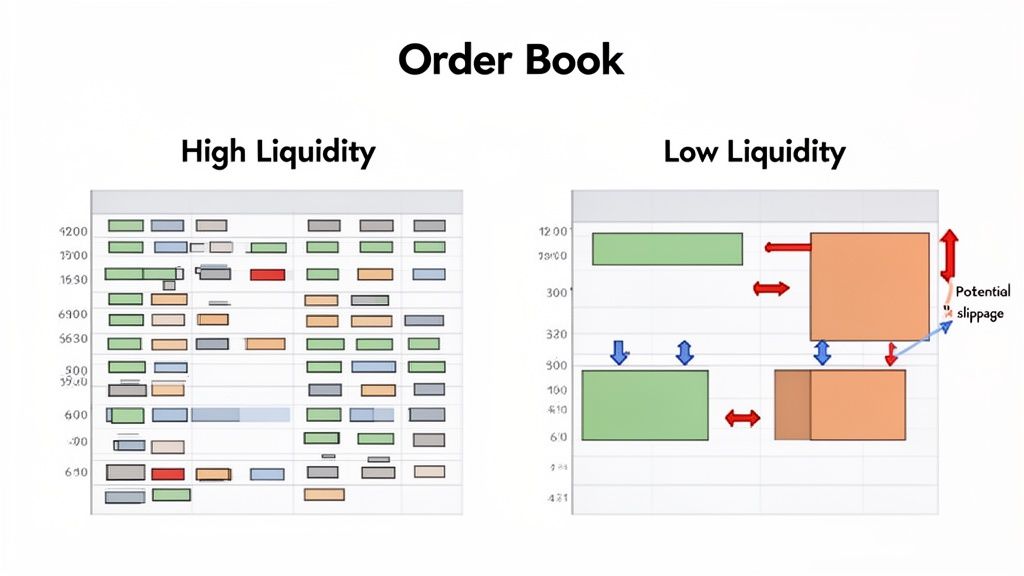

Ever placed a trade and watched in horror as the price you got was way worse than the price you clicked? That’s the painful lesson of poor liquidity. To avoid these hidden costs, you need to understand the engine room of any crypto trading pair: the order book.

Think of the order book as a live, digital marketplace for a specific pair. On one side, you have all the buy orders (bids). On the other, you have all the sell orders (asks). This tug-of-war between buyers and sellers is what sets the current market price.

In simple terms, liquidity is a measure of how easily you can buy or sell something without tanking its price. High liquidity means the marketplace is buzzing with activity. This is what you want as a trader, for a few key reasons:

On the flip side, a pair with low liquidity is a quiet market with wide, costly spreads and sharp price swings. This is where you encounter the silent profit killer known as slippage.

Slippage Explained: Slippage is the difference between the price you clicked and the price you actually got. In illiquid markets, a large order can "eat through" the best-priced orders, forcing you to accept worse prices to fill your entire position.

Getting a handle on these mechanics is crucial because they directly impact your profit and loss. Here's a breakdown of the costs you need to manage:

Even on major exchanges, liquidity can dry up. For example, combined spot and derivatives volumes recently dropped 26.4% to $5.79 trillion, marking the lowest activity since October. You can find more insights on trading volumes over at CoinDesk.

And if you’re looking at decentralized alternatives, you might find our guide on crypto liquidity pools helpful. Ultimately, your choice of a trading pair isn't just a bet on the market—it's a calculated decision about managing your costs.

Picking the right crypto trading pair isn't a preliminary step—it's the foundation of your trading strategy. Different pairs have their own personalities. Making sure their traits align with your trading style can be the difference between winning and losing.

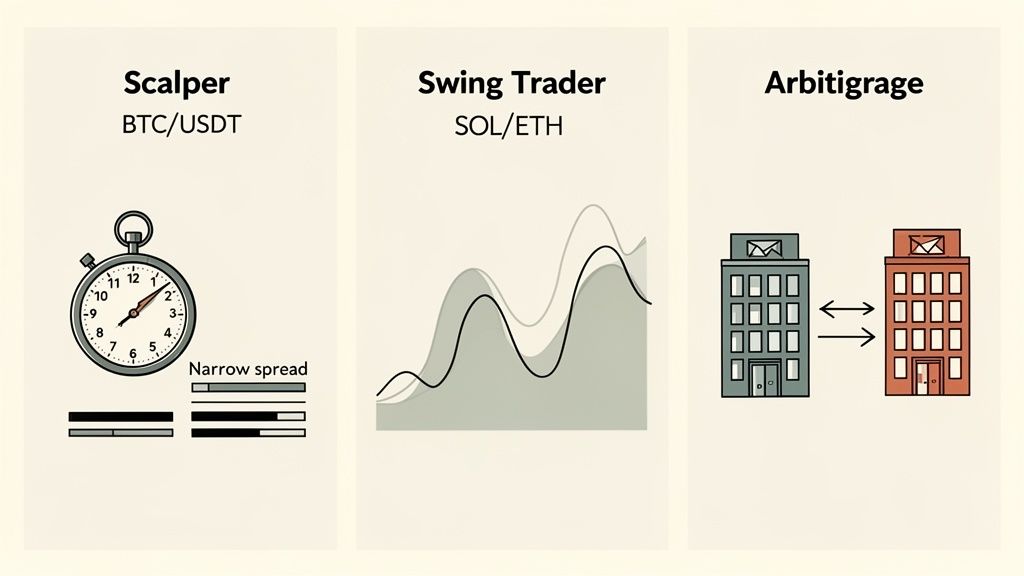

Put simply, a high-frequency scalper and a patient swing trader should almost never be looking at the same pairs. The pair you choose is the environment you're trading in.

Scalpers and day traders live in the fast lane. They jump in and out of the market to capture tiny, rapid price moves. For this high-octane style, two things are non-negotiable: high liquidity and tight spreads.

Trying to scalp a low-liquidity altcoin is a classic rookie mistake. The wide spread will kill your profits, and slippage can flip a winning trade into a loser in a heartbeat.

Swing traders play a longer game, holding positions for days, weeks, or even months to ride bigger market waves. For them, transaction costs are less of a concern. Their holy grail is volatility.

Just look at the history of BTC/USD to see these cycles in action. After topping out near $20,000 in December 2017, it plummeted to around $3,100 just a year later—a staggering 85% drop. Digging into historical data like this gives traders a serious edge. You can find data on platforms like CoinMarketCap.

Arbitrage traders are the detectives of the crypto world. They hunt for small price differences for the exact same asset on different exchanges. The game is simple: buy a crypto pair where it's cheap and instantly sell it on another exchange where it's priced higher.

As you can see, your strategy really does dictate the pair you should be trading. Here’s a quick reference table to help you match your approach to the right market.

Choosing a pair that fits your strategy's needs gives you an immediate advantage, setting you up to execute your plan in the most favorable conditions possible.

Knowing the theory is one thing, but building a repeatable process to find winning trades is what separates the pros from the rest. This is where on-chain data and modern tools change the game. They give you a lens to see what the market is really doing before the price action hits a chart.

The goal is to stop guessing and start making decisions backed by hard data. Using a platform like Wallet Finder.ai, you can translate raw blockchain activity into signals you can trade on by tracking the moves of highly profitable "smart money" traders.

First, you have to cut through the noise. The crypto market is massive. CoinDesk Data, for example, covers over 300,000 trading pairs across 10,000+ coins. Trying to track this manually is a fool's errand. This is why analytical tools are crucial. You can find market data on sites like Kaggle.

To find a pair with breakout potential, start by filtering for specific on-chain signals.

This initial filtering takes you from thousands of possibilities down to a handful showing signs of life. For a deeper dive, check out our guide on on-chain data analysis.

Once you have a short list, the next move is to figure out who is trading them. A powerful technique is to analyze the wallets that are consistently profitable with a specific crypto trading pair. This takes you beyond the token and focuses on the trader's skill.

The screenshot below from Wallet Finder.ai’s "Discover Tokens" view shows exactly this, ranking tokens by metrics like recent smart money inflows and PnL.

This dashboard immediately flags tokens that top-performing wallets are trading, giving you a direct signal of where experienced traders see an opportunity. By digging into these wallets, you can see their precise entry points, exit points, and overall win rate for that pair—basically, a blueprint of a successful strategy.

Pro Tip: Don't just look at a wallet's total profit. Analyze their win rate and average holding period for a specific pair. A wallet with a 90% win rate on SOL/USDT trades held for less than a day tells a very different story than one with a 50% win rate on long-term holds.

The final step is to put your monitoring on autopilot. Instead of being glued to your screen, set up real-time alerts that trigger based on the on-chain events you care about.

Create alerts for specific actions like these:

By combining smart filtering, deep wallet analysis, and automated alerts, you build a real system for discovering high-opportunity pairs. It’s a data-driven approach that helps you get ahead of market trends.

Even when you've got the basics down, a few questions always seem to pop up. Let's tackle some of the most common ones to give you that extra bit of confidence.

If you're just starting out, your best bet is almost always a pair with high liquidity and a track record of relative stability. This points you directly toward the major pairs, like BTC/USDT or ETH/USDT.

Why these? Because they have incredibly deep order books. That means you can place trades and have them execute reliably with minimal slippage—a costly trap that trips up many newcomers. Since they're the most traded pairs in the world, there's a ton of news and analysis available, making it far easier to learn the ropes without the insane price swings you see with smaller altcoins.

Liquidity is everything. It's the lifeblood of a trading pair, and it directly impacts price stability and how much you pay to trade. A highly liquid pair has a tight spread (the tiny gap between the buy and sell prices), which makes trading efficient and cheap.

On the flip side, an illiquid pair is a minefield. It'll have a wide spread and is prone to massive price swings from just one or two large trades. This makes it incredibly risky and expensive to trade. Low liquidity is like a hidden tax—you pay more to get in, pay more to get out, and the price can be pushed around way too easily.

Key Insight: A pair's liquidity is a direct signal of its risk. Low liquidity hits you with wider spreads and higher slippage, silently eating away at any potential profits before you even see them.

The whole process of finding good pairs can be boiled down to a simple workflow: filter the noise, zero in on what looks promising, and set alerts so you don't miss the action.

This flowchart visualizes that exact process—using tools to filter the market for signals, identifying specific pairs and wallets driving the action, and then setting alerts to jump on opportunities in real time.

On centralized exchanges like Binance or Coinbase, the short answer is no. They control the menu and decide which pairs get listed. But when you step into the world of decentralized finance (DeFi), the game changes completely.

On decentralized exchanges (DEXs) like Uniswap or SushiSwap, anyone can create a new liquidity pool for any two ERC-20 tokens. By doing this, you're essentially creating a brand-new, tradable market for that pair. It's an advanced move, though, requiring you to provide capital (liquidity) and understand the inherent risks, like impermanent loss.

Every crypto exchange has its own business strategy, listing criteria, and target audience. This fragmentation is precisely why you might find a hot new altcoin on one exchange but not another.

This exact setup is what creates arbitrage opportunities. A sharp trader can spot price differences for the same token across different exchanges and pocket the difference by buying low on one and selling high on another.

Stop guessing and start tracking the smart money. With Wallet Finder.ai, you can discover top-performing wallets, see their complete trading history, and set real-time alerts to copy their moves before the market catches on. Find your next winning trade today.