Calculating Crypto Profit: A Guide for Traders

Master calculating crypto profit in DeFi with our guide. We cover cost basis, gas fees, staking rewards, and tools for accurate P&L tracking.

February 13, 2026

Wallet Finder

February 12, 2026

The ORN coin price is a key indicator for a dynamic altcoin in the fast-paced DeFi sector. Its value is driven by a mix of broad market sentiment, trading volume, and developments within the Orion Protocol ecosystem. This guide provides actionable insights into understanding and navigating its market.

To evaluate ORN's potential, you must first understand its current market position. Core metrics act as the vital signs of the project, offering a real-time snapshot of investor interest, liquidity, and overall valuation. These figures are the foundation of any solid analysis for both new and experienced traders, telling a clear story of supply and demand.

To put the ORN coin price into perspective, this table summarizes the most important real-time and historical data. Use this as a quick reference for its current market standing.

These numbers provide a solid baseline for understanding where ORN fits in the broader market and help you make more informed trading decisions.

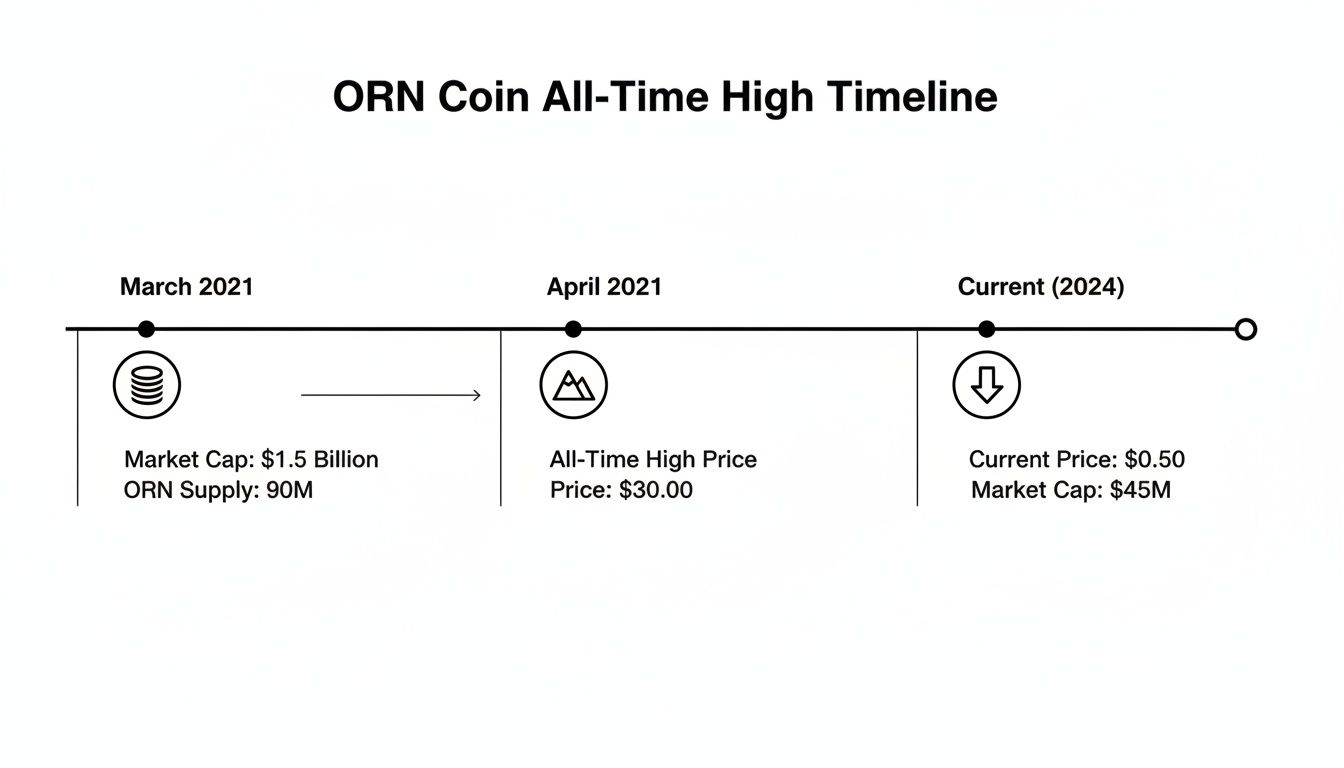

ORN's story is deeply tied to the 2021 DeFi bull market, a period of explosive growth. It was during this time that ORN hit its all-time high of $29.25 on March 22, 2021. This peak was fueled by immense excitement for liquidity aggregators—platforms promising to simplify trading across countless exchanges. Understanding a token's history is crucial for anticipating its future behavior. For a deeper dive, you can explore ORN's historical performance on Bybit.

To truly understand the ORN coin price today, you must examine its past. Every crypto chart tells a story of market hype, technological promises, and the volatile swings of the broader market. Orion Protocol's journey is a classic crypto tale of massive peaks and steep corrections, offering valuable clues about its behavior.

The token's most significant moment came during the 2021 bull run, the height of the DeFi summer craze. Investors were eager to fund projects that claimed to solve market fragmentation. Orion, with its compelling vision of aggregating liquidity from all exchanges into a single terminal, was perfectly positioned.

This market optimism propelled ORN to its all-time high of $29.25 on March 22, 2021. This surge was driven by a powerful narrative: DeFi was the future, and Orion was a key player. Early believers who recognized its potential were rewarded with incredible gains as its market cap soared.

However, crypto markets are cyclical. The brutal bear market that followed the 2021 peak brought nearly every asset, including ORN, down from its highs.

This chart clearly illustrates the key moments in ORN's history, showing its market cap growth and that unforgettable all-time high.

The chart shows a dramatic climb followed by a long correction, a pattern familiar to those who traded altcoins during that period.

Analyzing these price swings is more than a history lesson; it reveals the token's sensitivity to market sentiment and hype cycles. Understanding these patterns is essential for navigating its future movements.

By studying ORN's past performance, traders can identify potential support and resistance levels rooted in historical price action, providing a more informed context for making future decisions.

This historical context isn't just about memorizing old numbers. It's about understanding the market psychology that drove those highs and lows. To get the full story, combine this price analysis with a solid understanding of the project's technology. For a deeper dive, check out our guide on The Orion Protocol. Combining price history with project fundamentals gives you a much sharper picture of where ORN might be headed.

A historical chart tells you what happened, but understanding why gives you an edge. The ORN coin price is a direct reflection of the health, demand, and buzz surrounding the Orion Protocol. Two major forces are at play: fundamental drivers (the project's real-world value) and on-chain metrics (what users are doing with their tokens).

Think of fundamentals as the engine—the tech, partnerships, and roadmap. On-chain data is the dashboard, showing real-time stats. You need to monitor both.

Orion Protocol is a liquidity aggregator built to solve fragmented liquidity. It pools liquidity from multiple exchanges into a single terminal, creating tangible demand for the ORN token. Here’s a breakdown of actionable fundamental drivers:

The big takeaway here is that ORN's value is chained to the success of its ecosystem. As the protocol gets more use and attracts a bigger crowd, the intrinsic demand for the token is built to follow right along with it.

While fundamentals offer a long-term view, on-chain data provides insight into short-term market psychology. Here are key metrics to watch:

Once you understand the forces moving the ORN coin price, the next step is acquiring it. This guide will walk you through the process securely and simply.

First, choose an exchange. ORN is available on both centralized exchanges (CEXs) like Kraken and decentralized exchanges (DEXs). CEXs are often more beginner-friendly, while DEXs offer self-custody. If you want to learn more, our guide on what a DEX does explains the differences.

While platforms vary, the core process for buying ORN is similar across most centralized exchanges. Here’s a simple, five-step breakdown:

Always, always double-check wallet addresses before sending funds. And turn on two-factor authentication (2FA) for your exchange account. It's an essential layer of security that can save you from a world of headache by blocking unauthorized access to your hard-earned assets.

In the volatile crypto market, separating signal from noise is crucial, especially for the ORN coin price. To gain an advantage, you need a data-driven edge. This is where tracking "smart money" becomes invaluable.

![]()

Smart money refers to the wallets of traders who are consistently and provably profitable. By observing their on-chain actions, you can gain insight into potential market moves. Imagine receiving an alert the moment a top-performing trader starts accumulating ORN—that’s a game-changer.

The first step is to find these influential wallets. The goal isn't just to find the biggest accounts, but the smartest ones. Tools like Wallet Finder.ai are designed to help you identify wallets with a proven track record of successful trades in ORN and similar tokens.

Here’s a checklist for vetting smart money wallets:

Once you've identified promising wallets, add them to a watchlist. This creates a curated, high-signal feed of activity from traders you trust.

Think of it like this: by focusing on the actions of proven winners, you're essentially looking at the market through an expert's eyes. You get to see opportunities based on the conviction of traders who've already put in the hours of research.

Watching wallets is just the beginning. The key is to turn their movements into an actionable strategy. Set up real-time alerts through a platform like Wallet Finder.ai to be notified instantly when a tracked wallet buys, sells, or swaps ORN.

The goal is to spot patterns. Do they buy after a significant dip? Do they sell after a specific gain? Understanding their entry and exit timing provides a blueprint you can adapt. For a deeper dive, learn more about using a smart money tracker.

By using these tools, you can move from reacting to the ORN coin price to anticipating its next move, making decisions based on data, not just guesswork.

Predicting the exact future of any crypto asset is impossible. Instead, focus on the real-world forces that could influence the ORN coin price. Knowing which signals to watch is key. Orion Protocol's journey is filled with both significant opportunities and challenges. Its success depends on executing its vision in a competitive market.

A positive future for ORN hinges on wider adoption and a DeFi sector resurgence. If the Orion Terminal captures a meaningful share of trading volume, demand for its token will follow.

Here is a list of potential bullish catalysts:

A crucial metric to keep an eye on is the Total Value Locked (TVL) on the protocol. A steady climb in TVL is a huge vote of confidence from users, signaling growing trust and platform health—often a precursor to a positive price move.

Conversely, several risks could hinder the ORN coin price. The crypto landscape is highly competitive, with Orion facing off against other aggregators and large, established exchanges.

Furthermore, ORN's fate is tied to market sentiment. A prolonged bear market reduces overall trading activity, impacting Orion's fee generation and the value proposition of holding ORN. As a smaller altcoin, it is inherently more volatile and susceptible to significant price swings.

This volatility is evident in its recent performance. ORN experienced a -37.42% decline over the last 30 days, yet within that same period, it posted a 24.36% 1-month ROI and 18.46% weekly gains. This high-risk, high-reward nature is critical to understand. You can explore more data on ORN's market fluctuations on Blockchain.com. When considering ORN long-term, you must weigh its innovative potential against these tangible risks.

To conclude, let's address some of the most frequent questions about ORN and its price. These clear, direct answers will help solidify your understanding of the asset.

The ORN token is the core utility token of the Orion Protocol ecosystem. Its value is directly linked to the platform's functionality and success.

Yes. Like any low-cap altcoin, ORN carries a higher risk profile than established assets like Bitcoin or Ethereum. However, this risk is accompanied by the potential for higher returns. Its long-term value is entirely dependent on the adoption and success of the Orion Protocol.

A bullish outlook for ORN relies on Orion's ability to attract significant trading volume and innovate within the competitive liquidity aggregation space. Before investing long-term, carefully assess the project's roadmap, real-world traction, and the broader DeFi market against your personal risk tolerance.

For a coin as volatile as ORN, timing is everything. This is where smart money tracking becomes a game-changer. It shows you when the pros are making their moves, giving you an edge so you're not just trading on a hunch.

Tools like Wallet Finder.ai offer a significant advantage. Instead of guessing market direction, you can monitor the wallets of traders with a proven record of success.

You can set up real-time alerts for when these 'smart money' wallets buy or sell ORN. This enables you to see potential market moves before they happen by mirroring the strategies of top traders. In a fast-moving, lower-liquidity market like ORN's, where professionals often lead trends, such insight is invaluable.

Stop guessing and start making data-driven decisions. With Wallet Finder.ai, you can track the smart money moving the ORN market and get real-time alerts on their trades. Discover the strategies of top-performing wallets and gain an edge in your trading today. Start your free trial at https://www.walletfinder.ai.