Calculating Crypto Profit: A Guide for Traders

Master calculating crypto profit in DeFi with our guide. We cover cost basis, gas fees, staking rewards, and tools for accurate P&L tracking.

February 13, 2026

Wallet Finder

November 11, 2025

At its core, a decentralized exchange (DEX) is a peer-to-peer marketplace where you trade crypto directly from your own wallet. No middlemen, no company accounts, no handing over your funds.

Think of it like a digital farmers' market. You show up with your own cash (your crypto wallet) and deal directly with the vendors (automated smart contracts), keeping complete control over your funds the entire time. This setup opens the door to permissionless trading for anyone with a wallet and an internet connection.

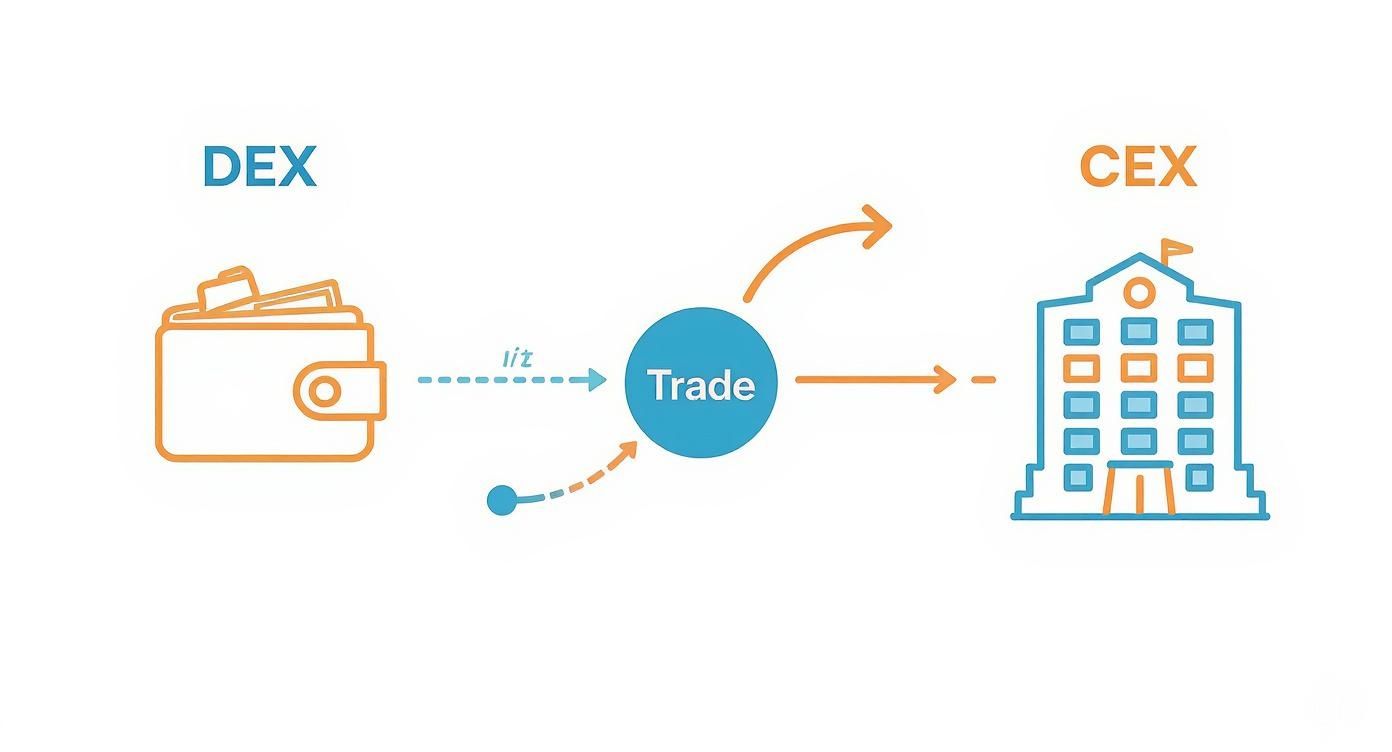

To really get what makes a DEX tick, it’s useful to stack it up against a centralized exchange (CEX) like Coinbase or Binance. On a CEX, you deposit your funds into an account the company controls. They’re the custodian, holding your crypto and matching buyers with sellers behind the curtain. You’re trusting them to keep your assets safe and execute trades fairly.

A DEX flips that model on its head. Instead of depositing anything, you just connect your personal crypto wallet to the platform. You never give up control of your private keys, which means you always control your assets. This principle of self-custody is the single biggest difference and a huge draw for traders.

And it's not a niche concept anymore. DEXs now process an average daily trading volume of $4.93 billion. Some projections even suggest the total yearly volume could hit $3.48 trillion.

This peer-to-peer magic is powered by two main technologies:

We'll break down these "engines" in more detail later. For now, the key takeaway is that DEXs use on-chain smart contracts to automate trading, cutting out the need for a central company to run the show. For a deeper dive, check out our complete guide on decentralized crypto exchanges.

To make the distinction crystal clear, it helps to see the practical differences side-by-side. The table below breaks down how trading on a DEX compares to a CEX.

Ultimately, the choice between a DEX and a CEX comes down to what you value most as a trader: the control and privacy of a DEX, or the convenience and user experience of a CEX.

To really get what a DEX does, you have to look under the hood at the two main "engines" that make trades happen. These systems are what set the prices, match up buyers and sellers, and ultimately define your entire trading experience. While they both get you to the same place—swapping assets without a middleman—they go about it in completely different ways.

Most modern DEXs run on an Automated Market Maker (AMM) system. Don't think of an AMM as a traditional marketplace with buyers and sellers haggling over prices. Instead, picture an automated robot banker that's always ready to trade with you, 24/7. This "robot" doesn't need to find another person to take the other side of your trade; it just uses a giant pool of tokens to fill your order instantly.

This infographic gives you a quick visual breakdown of the difference between a DEX, where you trade directly from your wallet with these automated systems, and a CEX, which holds your funds to manage its own book of trades.

The big takeaway here is that a DEX is all about user control and direct interaction with smart contracts. A CEX, on the other hand, operates more like a traditional bank, holding your assets to facilitate trades on its internal ledger.

So where does this "robot banker" get its tokens? From liquidity pools. These are just big piles of tokens supplied by other users, who we call liquidity providers. They deposit pairs of assets (like ETH and USDC) into a smart contract, and in return, they earn a small fee from every single trade that uses their funds. It's a bit like earning interest, but from trading fees instead of loans.

But how does the AMM figure out what price to quote you? It all comes down to a simple but elegant mathematical formula, most often the constant product formula (x * y = k).

When you want to buy Token A, you put Token B into the pool. The smart contract then does the math to figure out exactly how much of Token A it can give you back while keeping 'k' constant. This automatic pricing is the magic that makes instant swaps possible without waiting for someone to match your order. Uniswap on Ethereum is the poster child for an AMM-based DEX.

The second engine is the Order Book model, which looks a lot more like something you'd see at the New York Stock Exchange. This system simply keeps a running list of all the open buy and sell orders at different price points.

An order book directly matches a buyer who wants to purchase ETH at $3,000 with a seller who is willing to sell it at that exact price. The DEX is just the venue where these two people find each other.

This model gives traders much more precise control. You can place limit orders, stop-losses, and use other advanced strategies you can't with a basic AMM. The catch? It needs a ton of transaction speed to constantly manage and match thousands of orders without getting bogged down. That's why order book DEXs are pretty rare on slower blockchains like Ethereum but have thrived on high-speed networks.

Platforms on Solana, like Raydium, often use an order book model. They can handle the firehose of transactions needed to match orders in real-time, giving you a trading experience that feels much closer to a big centralized exchange. Ultimately, your choice of DEX often comes down to this: do you prefer the instant, "always-on" liquidity of an AMM, or the precision and control of an order book?

Alright, so we've covered the mechanics, but what does using a decentralized exchange actually feel like? Think of it as a playground for your digital assets. It all comes down to three main activities: trading, earning, and participating in the wider world of decentralized finance (DeFi).

Before you can jump in, you’ll need a self-custody wallet, which is basically your passport to the DeFi ecosystem. If you're new to this, it's worth taking a moment to understand what a DeFi wallet is and how to pick the right one for you.

Got your wallet set up and connected? Great. Let's walk through what you can actually do on a DEX.

The most common reason people visit a DEX is to perform a swap. This is just a fancy word for trading one cryptocurrency for another—like swapping your ETH for USDC, or SOL for BONK. The whole process is designed to be dead simple and happens almost instantly.

Here’s your step-by-step guide to making a swap:

Ever wanted to be the "house" instead of just another trader? That’s what providing liquidity is all about. You’re essentially acting like a mini-bank by depositing a pair of tokens into a liquidity pool. Other traders then use your deposited funds to execute their swaps.

By doing this, you're helping the DEX run smoothly. And for your trouble, you earn a cut of the trading fees every time someone trades using that pool. When you deposit your assets, the DEX gives you special LP (Liquidity Provider) tokens.

Think of LP tokens as your claim ticket or receipt. They represent your share of the pool and are used to track how much you’ve contributed. When you want your money back, you just "cash in" these LP tokens to reclaim your original assets, plus all the fees you’ve earned along the way.

This whole system is the engine that powers AMM-based DEXs. Without everyday users stepping up to provide liquidity, there’d be no assets available for anyone else to trade.

Yield farming takes liquidity providing and kicks it up a notch. It’s a strategy for squeezing even more earnings out of your assets by putting your LP tokens to work. Instead of just letting them sit there, you can "stake" them in a separate smart contract, often called a "farm."

In return for locking up your LP tokens, the protocol rewards you with even more tokens—usually its own native governance token. This creates a really compelling incentive loop:

This technique lets you generate multiple income streams from a single pot of capital, which is why it's one of the most popular (and, admittedly, higher-risk) activities in all of DeFi.

To really get a feel for what a DEX does, you have to see them in action. Different platforms on different blockchains solve the trading puzzle in their own unique ways, and the DEX you choose is often tied to the ecosystem you want to operate in. Think of this less as a list and more as a practical tour of how these decentralized exchanges actually work.

As the original smart contract blockchain, Ethereum is home to the most established and liquid DEXs in the game. The undisputed king here is Uniswap. While it didn't invent the Automated Market Maker (AMM) model, it perfected it and made it a global standard. Uniswap's simple elegance became the blueprint for thousands of other DEXs, relying entirely on liquidity pools and the constant product formula (x*y=k) to make trades happen.

Another huge player on Ethereum is Sushi (originally SushiSwap), which famously started as a "fork" of Uniswap's code. While it uses the same core AMM technology, Sushi quickly evolved, adding features like yield farming and lending to build out a more complete DeFi hub. Both platforms are cornerstones of the Ethereum ecosystem.

The Solana blockchain was built from the ground up for speed, and that performance unlocks different kinds of DEX designs. Platforms here can handle a massive number of transactions per second for pennies, making them perfect for the order book model—something that feels much more like a traditional stock exchange.

A prime example is Raydium. It cleverly combines an AMM with a central limit order book, which it actually shares with another Solana DEX, Serum. This hybrid approach lets traders place precise limit orders while still tapping into the deep liquidity of its pools. For anyone coming from a centralized exchange, Raydium offers a familiar experience on a fully decentralized backbone.

Beyond just swapping tokens, DEXs have also exploded into the derivatives market, especially for perpetual futures. In a recent quarter, the trading volume for these instruments on DEXs skyrocketed to $898 billion. A derivatives DEX called Hyperliquid was responsible for an incredible $653 billion of that volume, capturing about 73% of the market share. This trend shows just how much demand there is for complex financial products that give users total control. You can find more data on DEX market trends at CoinLaw.io.

To help you see these differences side-by-side, we've put together a quick breakdown of these popular platforms.

This table offers a snapshot of leading decentralized exchanges, highlighting their underlying technology and what makes each one stand out.

As you can see, the "best" DEX often depends entirely on the blockchain you're using and what kind of trading experience you're looking for.

Trading on a DEX gives you incredible freedom and access, but that autonomy comes with unique risks you won't find on centralized platforms. Being a successful DeFi trader isn't just about finding the next big token; it's about understanding and managing the potential pitfalls that come with the territory.

Let's walk through the most common hazards so you can navigate the decentralized world with confidence.

When you provide liquidity to an automated market maker (AMM), you deposit a pair of assets. Impermanent loss is what happens when the price of your deposited tokens changes compared to when you first put them in the pool.

Think of it like a seesaw. If one token’s price shoots up while the other stays flat, the AMM protocol automatically rebalances your holdings to keep the pool's value ratio intact. This rebalancing can leave you with less total value than if you had simply held onto the assets in your own wallet.

Impermanent loss isn't a "real" loss until you pull your liquidity out. But if you ignore it, major price swings can easily wipe out all the trading fees you've earned—and then some.

Getting a handle on this risk is absolutely crucial for anyone looking to provide liquidity profitably. For a deeper dive, you can learn how to calculate impermanent loss and see the numbers for yourself.

Every DEX is built on smart contracts—self-executing code that handles every swap, deposit, and withdrawal. If there's a bug, an exploit, or any kind of vulnerability in that code, hackers could potentially drain the entire protocol of its funds.

This isn't just a theoretical risk. Over $2 billion was lost to DeFi hacks in 2023 alone, with many targeting weaknesses in smart contracts. Here’s a checklist to stay safe:

Two other risks, slippage and front-running, can quietly eat away at your profits if you aren't paying attention.

Slippage is the difference between the price you expect when you click "swap" and the price your trade actually executes at. This usually happens in pools with low liquidity or during wild market volatility. Most DEXs let you set a maximum slippage tolerance (like 0.5% or 1%) to protect you from getting a terrible price.

Front-running is far more malicious. Bots, often called MEV (Maximal Extractable Value) bots, constantly scan the network for pending transactions. If they see you're about to make a large buy, they can jump in front of you with their own buy order, push the price up slightly, and then immediately sell to you at that inflated price. They pocket the difference, and you're left overpaying.

Here’s how you can defend yourself:

After diving into the unique risks of decentralized trading, one big question remains: why do millions of traders pick DEXs over the more familiar, centralized platforms? It really boils down to a handful of powerful benefits that get to the very heart of the DeFi movement.

The biggest reason by far is true asset ownership. When you trade on a DEX, you’re doing it directly from your own self-custody wallet. This core principle of "not your keys, not your crypto" is the foundation everything else is built on.

Beyond just holding your own keys, DEXs open up a massive universe of tokens that you simply can’t find anywhere else. New projects often launch on a DEX months or even years before they’re ever considered for a listing on a major centralized exchange.

Finally, privacy is a huge draw. DEXs are key for traders who want to maintain their anonymity. This is a massive plus in regions with restrictive financial rules or for anyone who just believes their financial life is their own business.

The proof is in the numbers. The global decentralized finance (DeFi) market, which DEXs are a huge part of, was valued at $26.94 billion and is on track to hit $231.19 billion by 2030. That's a clear signal of the surging demand for these private, user-controlled systems. You can dig into the full DeFi market report from Grand View Research for a deeper look.

For many, the ability to trade without submitting sensitive personal documents (a process known as KYC, or "Know Your Customer") is not just a preference—it's a core philosophical reason for choosing DeFi over the legacy financial system. It represents a return to personal sovereignty over one's financial life.

These powerful advantages—self-custody, permissionless access, and privacy—are the engine driving the massive shift toward decentralized exchanges. They offer a powerful alternative for traders who put control and freedom above everything else.

Ready to turn on-chain data into your next winning trade? Wallet Finder.ai helps you discover and mirror the strategies of top-performing crypto wallets in real-time. Start your 7-day trial and gain the edge you need to stay ahead of the market. Find your next move at https://www.walletfinder.ai.