Master Crypto Transaction Tracking

Master crypto transaction tracking with our guide. Learn how to trace digital assets on the blockchain for security, compliance, and research.

December 24, 2025

Wallet Finder

December 25, 2025

Decentralized crypto wallets are your personal, digital vaults, giving you complete and sole control over your cryptocurrencies. Unlike keeping funds on an exchange, these wallets make you your own bank in the truest sense—only you can access your assets.

In the world of digital assets, knowing who holds the keys is everything. It's the one thing that separates actual ownership from a simple IOU. This is the entire philosophy behind decentralized crypto wallets, which you'll often hear called non-custodial wallets.

Think of it like this: a decentralized wallet is like having a physical safe in your home where you are the only person on earth who knows the combination. You have absolute control. On the flip side, using a centralized exchange is more like depositing your money into a bank's vault. The bank holds it for you, and you're trusting them to hand it over when you ask.

So, how does this all work? It comes down to two critical pieces of information: the private key and the seed phrase.

There's a popular saying in crypto: "not your keys, not your coins." A decentralized wallet is the practical application of this idea, giving you total sovereignty over your digital wealth and a direct line to the blockchain.

This level of control isn't just about locking down your assets; it's about freedom. A decentralized wallet is your passport to the entire Web3 ecosystem. It’s what allows you to connect to decentralized finance (DeFi) platforms, lend out your assets, trade on decentralized exchanges (DEXs), and buy or sell NFTs—all without needing permission from some central company.

To dig a bit deeper, check out our guide on what a Web3 wallet is and how it works as your gateway to the decentralized web.

The growing appetite for this kind of control is undeniable. The crypto wallet market is expected to balloon to USD 98.57 billion by 2034, growing at an incredible compound annual rate of 26.7%. This signals a massive shift as more people wake up to the benefits of managing their own assets. You can read the full research about these market projections to see where the trend is headed.

Not all crypto wallets are built the same. The biggest difference boils down to a single, critical question: who holds your keys?

This one detail changes everything—your level of control, your security, and your freedom. Getting this concept right is the most important first step you can take in your DeFi journey.

Think of a custodial wallet like your regular bank account. A third party, usually a crypto exchange like Coinbase or Binance, holds onto your private keys for you.

This setup is all about convenience. If you forget your password, you can probably reset it. The interface is often clean and simple, making it easy for beginners to get started. But that ease of use comes with a major trade-off: you're giving up control. You're trusting that company to keep your funds safe and give you access whenever you ask for it.

A non-custodial wallet is the complete opposite. It’s like a personal vault where you, and only you, have the key. This is the true, decentralized form of a crypto wallet.

With a non-custodial wallet, you have exclusive control over your private keys and, by extension, your funds. No one can freeze your account, block a transaction, or lose your assets in a company hack. This is the very heart of the crypto ethos: "not your keys, not your coins."

While it puts all the responsibility for security on your shoulders, it also opens up the entire world of Web3. You can connect and interact directly with any decentralized application (dApp) you want, without needing anyone's permission.

To make the choice clearer, it helps to see the different wallet types side-by-side. Each model has its own strengths and weaknesses, designed for different types of users—from long-term holders to active DeFi traders.

There's a clear pattern here. As you gain more control and security, you usually sacrifice a bit of convenience. A hardware wallet, for example, offers incredible security by keeping your keys completely offline, but it's not very practical for making quick, frequent trades like a software-based non-custodial wallet is.

Ultimately, your choice depends on your goals and how much risk you're willing to manage yourself.

The core principle of decentralized crypto wallets is that true ownership is non-negotiable. By holding your own keys, you eliminate counterparty risk and gain unrestricted access to the open financial system.

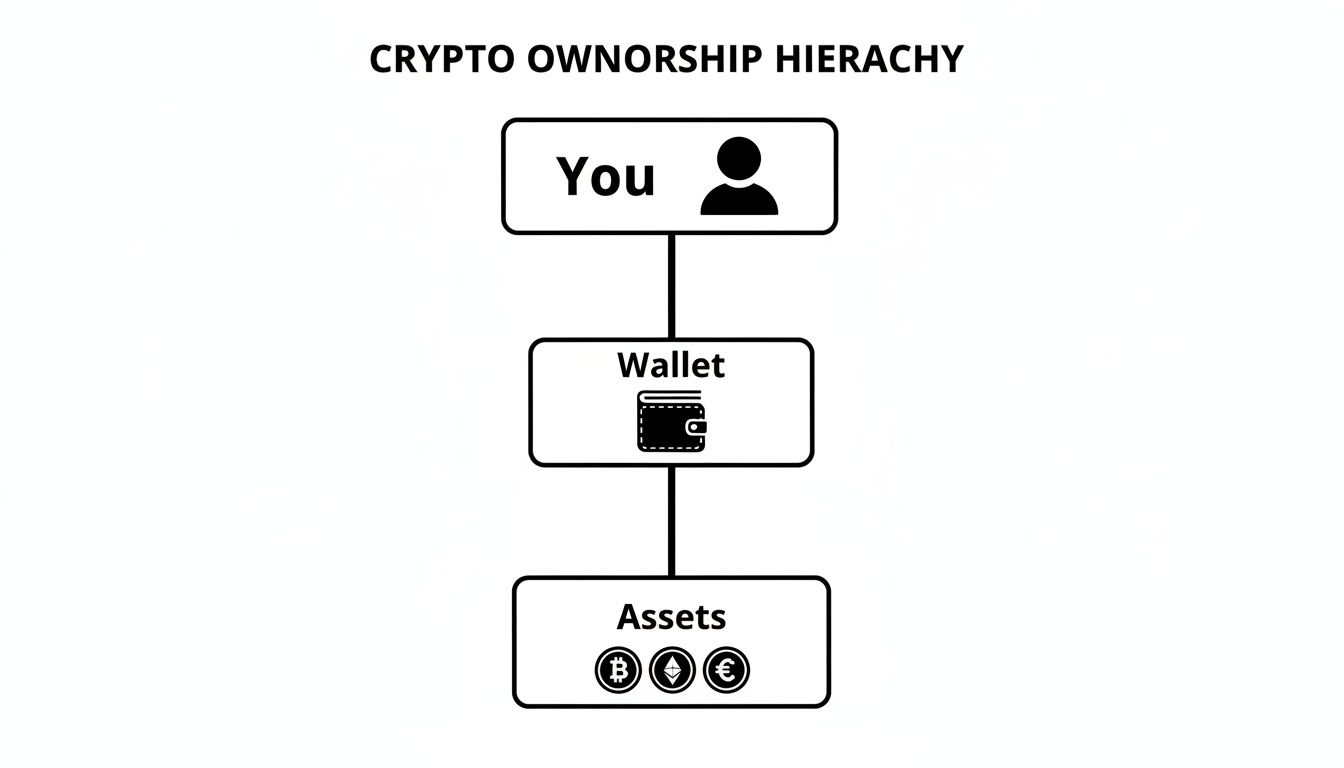

The relationship between you, your wallet, and your assets is a simple but powerful one. A non-custodial setup puts you firmly in charge, as this diagram shows.

The key takeaway is the direct line of control. In a decentralized world, there are no middlemen between you and your assets. Your wallet is just the tool you use to manage what is already yours on the blockchain.

For absolute beginners, a custodial wallet can be a fine place to start. But for anyone serious about copy trading, DeFi, and owning their assets, a non-custodial wallet is non-negotiable.

A decentralized wallet is much more than a digital piggy bank; think of it as your passport to the entire Web3 world. While holding your assets is its most basic job, the real magic happens when it interacts directly with decentralized applications (dApps) on the blockchain. This is what lets you trade, lend, earn, and explore.

Connecting your wallet to a dApp is like showing your ID to get into a secure venue. The dApp asks to see your public wallet address to verify you on the blockchain, but it never sees your private keys. It's a simple, read-only handshake that lets the app see your public balances and get transactions ready for your approval.

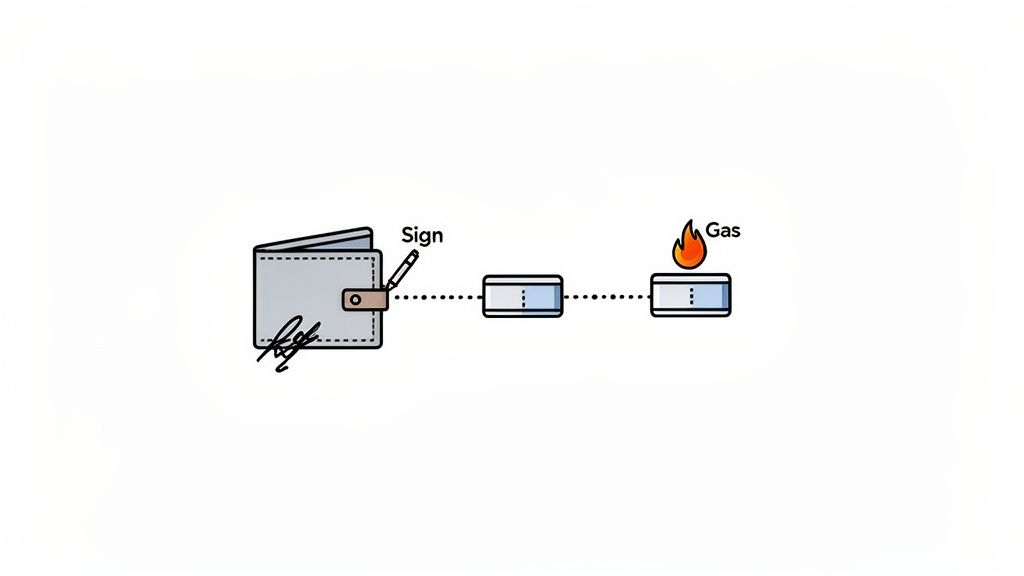

Let's say you're connected and want to do something, like swapping one token for another on a decentralized exchange (DEX). The dApp will prompt you to sign the transaction. This is the single most important step in the whole process.

Signing a transaction is the digital version of putting your legally binding signature on a contract. By signing, you use your private key to cryptographically approve a very specific action. Your wallet will always pop up with a summary of what you're about to do—what you're sending, where it's going, and any associated fees—before you hit "confirm."

This digital signature is undeniable proof that you, and only you, authorized the transaction. It’s the core security feature that guarantees no one else can touch your funds, making your decentralized wallet a true self-custody powerhouse.

You'll repeat this signing process for every single on-chain action, whether you're listing an NFT for sale or casting a vote in a DAO.

Nothing on the blockchain happens for free. For network validators (or miners) to process your signed request, they need to be paid for their work. This payment is called a gas fee.

Think of gas as the fuel for your car—no gas, no go. Gas fees aren't fixed; they fluctuate based on how busy the network is. The more people trying to make transactions, the higher the fee will be. Your wallet will always give you an estimate of this fee before you finalize anything.

Once you approve the transaction and pay the gas, it gets broadcasted to the entire network. Here’s a quick rundown of what happens next:

This isn't just happening in a vacuum; it’s part of a huge global network. On-chain activity shows some fascinating regional trends that directly affect how wallets behave. For instance, recent data from Chainalysis revealed that the Asia-Pacific region's on-chain value received shot up by 69% year-over-year, hitting a massive USD 2.36 trillion. This kind of boom directly impacts transaction volumes and the gas fees everyone experiences. If you're interested in moving assets between chains, our guide on how to swap crypto across different chains breaks it down with practical steps.

The freedom of decentralized crypto wallets comes with a heavy dose of responsibility. This isn't like traditional banking where you can just hit a "forgot password" button or call a support line if things go wrong. In this world, you are the bank. You're the only one in charge of your assets, which is why a security-first mindset isn’t just a good idea—it's absolutely critical.

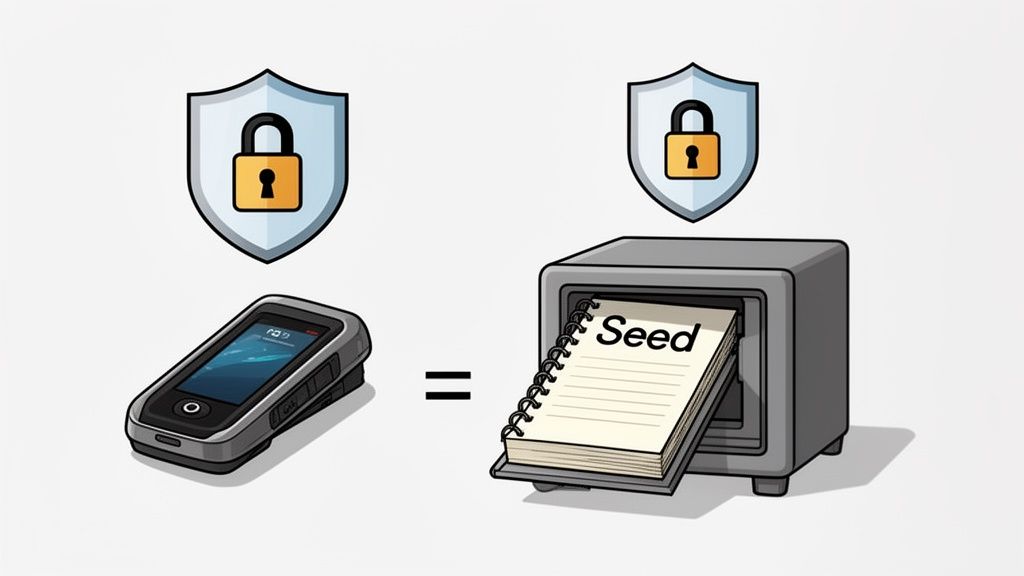

This responsibility begins and ends with your seed phrase, the master key to your entire digital vault. If you lose it or someone else gets their hands on it, your funds are gone. Forever.

Think of your seed phrase as the most valuable secret you'll ever own. The number one, non-negotiable rule is to never, ever store it digitally. That means no screenshots, no notes app on your phone, no emailing it to yourself, and definitely no saving it to a cloud drive. Storing it online is like leaving the key to your safe under the doormat for any hacker to find.

Instead, go old-school with these offline methods:

Protecting your seed phrase is the bedrock of self-custody. It is the one thing standing between you and the permanent loss of your assets. Treat it with the seriousness it deserves.

Scammers are always cooking up new tricks to get you to hand over your private keys or seed phrase. They often use social engineering, creating a fake sense of urgency or a too-good-to-be-true opportunity to pressure you into acting before you can think.

Stay sharp and watch out for these red flags:

One of the sneakiest threats out there involves tricking you into signing a malicious transaction or giving a contract unlimited "token approval." When you use a dApp, you often give it permission to spend your tokens. If you accidentally grant an unlimited spending allowance to a bad actor, they can pull all of that specific token out of your wallet whenever they want.

Here’s how to protect yourself:

For a more systematic way of thinking about this, you can use a detailed checklist for assessing wallet risks to go through your security setup step by step.

Ultimately, your strongest defense is a layered one. A great setup is pairing a secure software wallet for your daily DeFi activity with a hardware wallet for your long-term holdings. This keeps your private keys completely offline, even when you're signing transactions, creating a nearly impenetrable barrier against online threats.

If you’re a long-term HODLer, a hardware wallet tucked away in cold storage makes perfect sense. But for active DeFi traders and on-chain analysts, the game is entirely different. Your wallet isn’t just a digital vault; it’s the cockpit you use to navigate the wild, fast-paced world of DEXs, lending protocols, and hyped token launches.

For you, needs are immediate, and actions are frequent. Your wallet choice can genuinely make or break your profitability. The right one becomes a natural extension of your trading strategy, cutting out the friction so you can act decisively. It needs to be fast, powerful, and most importantly, completely in your control. This is exactly where software-based, non-custodial wallets come into their own, hitting that sweet spot between security and the accessibility needed for daily on-chain action.

Not all non-custodial wallets are built the same, especially when you’re looking at them through a trader’s eyes. To get an edge, you need a tool built for speed and flexibility. When you're sizing up your options, these features are non-negotiable.

Beyond these essentials, look for wallets that offer next-level features like transaction simulations. These let you preview the outcome of a complex trade before you commit real funds and pay gas. Some of the more advanced wallets even bake in MEV (Maximal Extractable Value) protection to shield your trades from front-running bots looking to pick your pocket.

The ideal trading wallet isn't just a container for your keys; it's an active interface that empowers you to execute strategies with precision and speed. It should feel less like a bank vault and more like a finely tuned trading terminal.

The beautiful thing about public blockchains is their transparency. Every single transaction is a data point available for anyone to see, creating a rich tapestry of market activity that smart traders can decode. This is where on-chain analytics tools like Wallet Finder.ai become absolute game-changers.

Think of these platforms as financial intelligence agencies for the blockchain. They sift through millions of transactions to pinpoint the "smart money"—wallets belonging to highly profitable traders, VCs, or market makers. By keeping tabs on these wallets, you can uncover incredibly powerful insights into their game plan.

On-chain analytics tools let you:

This workflow turns public blockchain data into a powerful, actionable advantage. You discover a winning strategy on an analytics platform, then use your secure, feature-rich decentralized wallet to put that strategy into action with your own capital.

The demand for this kind of on-chain alpha is exploding. Recent findings from Andreessen Horowitz highlight this shift, noting that crypto mobile wallet users hit all-time highs in 2025, jumping 20% year-over-year. The report also points out that nearly one-fifth of all spot trading volume now happens on decentralized exchanges. This is a fundamental change that makes direct wallet-to-protocol trading—and the analytics that support it—more critical than ever. You can dive into more insights in the State of Crypto 2025 report.

Jumping into the world of decentralized wallets can bring up a lot of questions. As you start taking full control over your own crypto, it's totally normal to wonder about the "what ifs" and how everything really works. This section is here to give you clear, straight-up answers to the stuff we hear most often, helping you get comfortable and confident with self-custody.

Think of this as your cheat sheet for understanding both the responsibilities and the incredible freedom that comes with being your own bank.

Losing your seed phrase is like losing the one and only key to a vault full of cash. It's a big deal. Because decentralized wallets are non-custodial, there's no company, no support desk, and no central authority that can help you get it back. Your seed phrase is the master key to everything—all your private keys, and by extension, all your assets on the blockchain.

This is why protecting that phrase is your number one job. You absolutely have to store it offline, somewhere safe from things like fire, water damage, or theft. Never, ever share it with anyone or type it into a website, no matter how legit it might seem.

Treat your seed phrase with the same caution you'd use for physical gold bars. If it's lost or someone else gets their hands on it, access to your funds is gone for good. There is no recovery process.

Yep, absolutely. Your seed phrase is designed to be portable. You can use it to restore your exact wallet on any new or extra device, bringing over all your assets and transaction history. This works perfectly whether you're switching to a new phone, adding your wallet as a browser extension on your laptop, or even importing it into a hardware wallet for an extra layer of security.

The process is usually pretty simple. You just download the wallet software on the new device and look for an "Import" or "Restore" option instead of creating a new wallet. From there, you'll enter your 12 or 24-word seed phrase, and the software will regenerate your private keys and sync up with the blockchain to show all your assets. While this is a fantastic backup feature, it also highlights just how critical it is to keep that phrase secret. Anyone who finds it can clone your wallet from anywhere in the world and drain your funds.

This is a really common misconception. Decentralized crypto wallets aren't anonymous; they're pseudonymous. What that means is your real-world identity—your name, address, etc.—isn't automatically tied to your wallet address. However, every single transaction you make is public and permanently stamped onto the blockchain for anyone to see.

Think of your wallet address like a pen name. You can operate under this pseudonym without giving away your true identity. The catch is, if that pen name ever gets linked to your real identity, your entire on-chain history can be traced right back to you.

So, how does that link happen? Usually through interactions with centralized services:

So, while you get way more privacy than with a traditional bank account, these wallets don't offer complete, untraceable anonymity.

On-chain analytics tools are basically super-powered search engines for the blockchain. They constantly scan, index, and make sense of the mountains of public data recorded on chains like Ethereum, Solana, and Base. Since every transaction, swap, and NFT mint is on a public ledger, these platforms can put together a complete picture of any wallet's activity.

These tools don't need your private keys or any special access because they're only looking at public information. They're just reading the digital receipts that are open for everyone to see.

By crunching all this data, analytics platforms can uncover some incredibly powerful insights, like:

This is what lets you spot winning strategies and find top-performing traders to learn from—all without anyone's security being compromised. It’s all about turning transparent, public data into smart intel for your own trades.

Ready to turn on-chain data into your competitive advantage? Wallet Finder.ai helps you discover the most profitable traders and mirror their strategies in real time. Start your 7-day trial today and trade smarter, not harder.

"I've tried the beta version of Walletfinder.ai extensively and I was blown away by how you can filter through the data, and the massive profitable wallets available in the filter presets, unbelievably valuable for any trader or copy trader. This is unfair advantage."

.avif)

Pablo Massa

Experienced DeFi Trader