Your Guide to American Coin Crypto Trading

Unlock the American coin crypto market. This guide shows you how to analyze tokens, follow smart money, and use on-chain data for smarter trading decisions.

February 23, 2026

Wallet Finder

January 9, 2026

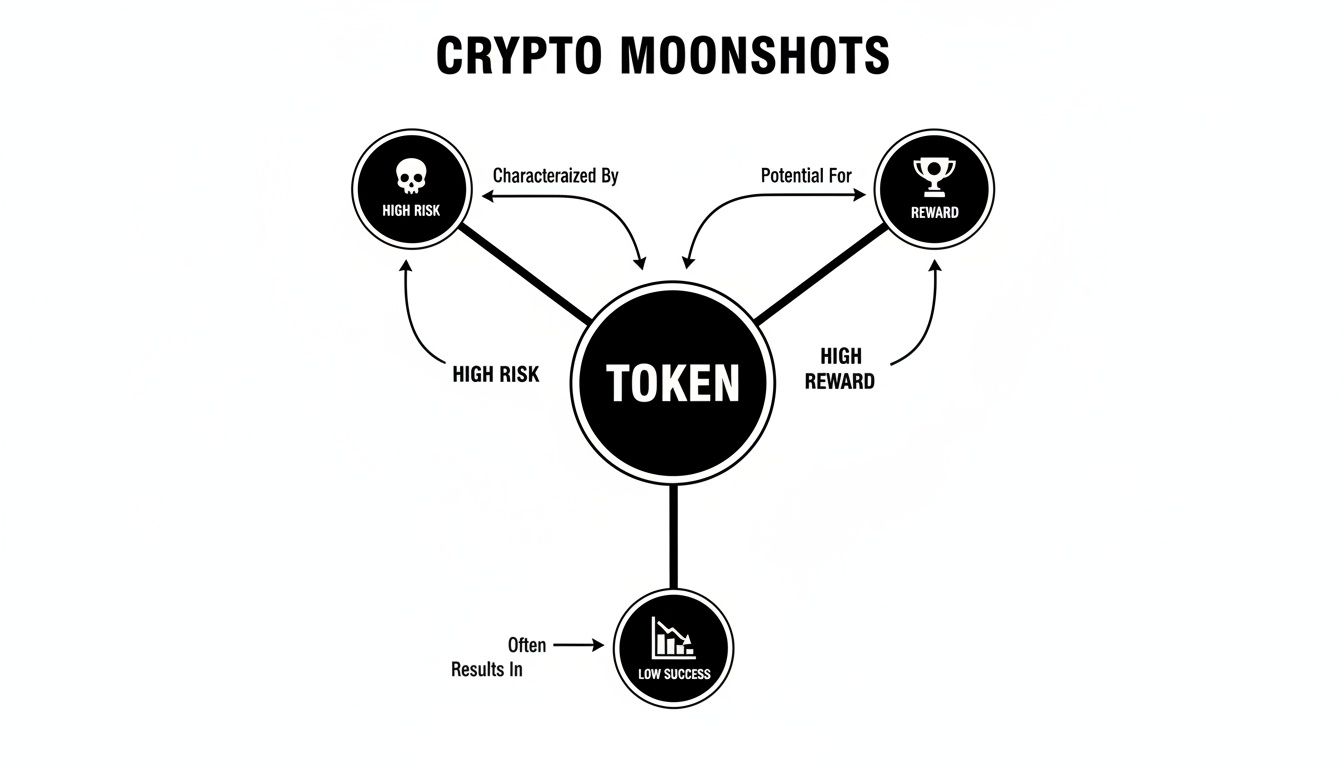

In the wild world of crypto and finance, you'll hear the term "moonshot" thrown around a lot. It describes a high-risk, high-reward investment with the potential for explosive, almost unbelievable returns. We're not talking about a small gain here; this is about a project or an asset that could deliver 100x or even 1,000x growth, completely changing the value of a portfolio practically overnight.

To really get what a "moonshot" is, we need to look past the trading charts and go back to where it all started. The term wasn't born in a trading pit but from one of humanity's greatest achievements: the Apollo 11 mission.

It all began on May 25, 1961, when President John F. Kennedy set a seemingly impossible goal: land a man on the Moon before the decade was out. At the time, NASA had a grand total of just 15 minutes of human spaceflight experience. This was an audacious plan, packed with risk and requiring immense resources, yet they pulled it off just eight years later. You can learn more about this ambitious goal and its legacy on how we define moonshots today.

That historical context is everything. Just like the space race, a financial moonshot is defined by three key ingredients.

This whole idea is a close cousin to the popular crypto phrase "to the moon," which you can dive into in our guide on the meaning of to the moon. It’s all about that shared hope in the community that a token’s price will soar to astronomical heights.

A moonshot isn’t about making a 10% profit. It's about pursuing a 100x return that redefines what’s possible, accepting that the journey is perilous and success is never guaranteed.

Ultimately, a moonshot is more than a lucky lottery ticket. It’s a calculated chase for a breakthrough opportunity. For traders, this means finding those rare projects with the right mix of innovation, timing, and market potential—all while knowing that for every single success story, there are countless failures left behind.

In the world of DeFi, the idea of a "moonshot" isn't just some abstract dream—it's a very real trading strategy. For traders, it means actively hunting for tokens that have the potential for explosive, portfolio-changing returns. We're not talking about a modest 10% gain here. The goal is to find the next 10x, 100x, or even 1,000x monster.

This high-stakes game completely flips the script on risk and reward. Traditional investing is all about slow and steady growth, but moonshot hunting is different. It’s built on the understanding that most of these bets will probably go to zero. The core belief is that a single massive win can be so huge it makes all the previous losses look like pocket change.

This is exactly why traders turn to specialized tools like Wallet Finder. They’re not just staring at charts all day. They're digging deep, looking for the digital breadcrumbs left by savvy early investors who seem to have a sixth sense for finding these gems before they take off.

Let's be real: you have to go into this with your eyes wide open. The crypto market is a graveyard of projects that promised the world but fizzled out on the launchpad. The stats are brutal—the vast majority of new tokens fail spectacularly.

So why bother? Because we’ve seen it happen before. The term "moonshot coin" became crypto slang for a reason. During the 2021 bull run, for example, we saw a wave of DeFi tokens and memecoins pull off insane 50x–100x gains right after listing. This happened even while most other new tokens were bleeding out, losing over 90% of their value within a year or so.

For a copy trader, finding a moonshot means sifting through thousands of wallets to find the tiny fraction—often less than 1–5%—that actually deliver those mind-blowing returns. If you want to go deeper into how the term evolved, there's a good primer on the meaning of moonshots in crypto on gate.com.

The goal is not to win every bet. The goal is to find one winner so powerful that the losses from other attempts become statistically irrelevant.

This kind of environment makes early detection and solid research absolutely critical. By studying past winners, traders can start to see patterns and on-chain signals that just might point to the next breakout star.

Every market cycle gives us a few legendary stories that keep the dream alive. Think about the people who got into projects when they were completely unknown and watched them become household names. It wasn't always blind luck. Many of those wins came from spotting early on-chain clues, like a sudden flood of smart money or a rapidly growing army of holders.

These iconic successes give us a blueprint. When you break down their journeys, you can build a checklist of what to look for:

These case studies prove that while finding a moonshot is tough, it’s not impossible. They pave the way for a more methodical hunt, where data-driven tools can help us spot similar patterns today and turn a wild guess into a structured strategy.

If you want to find a moonshot, you have to look where most people aren't. While Twitter storms and Telegram hype can certainly move markets, the real alpha—the earliest, most reliable clues—is almost always buried deep within the blockchain's data.

By zeroing in on a few key crypto on-chain analysis metrics, you can start to see momentum building long before it hits the mainstream. This is about ignoring the noise and focusing on the digital breadcrumbs left by the earliest investors and the project's budding community. The goal here is to spot genuine accumulation and growing interest right from the source.

The most powerful early signal is often the quiet accumulation by smart money wallets. These aren't just any wallets; they're addresses with a proven history of getting into high-performing assets before anyone else. When you see several of these seasoned traders start buying up a new, obscure token, it's a huge tell that something is brewing under the surface.

They don't typically drop a huge bag at once. Instead, their initial buys are often small and methodical to avoid setting off alarms. But a clear pattern of consistent buying across several top-performing wallets strongly suggests they see massive upside potential. Think of it as the on-chain equivalent of insiders loading up on company stock right before a game-changing announcement.

Beyond watching what smart money is doing, several other on-chain metrics can help paint a full picture of a token's potential. Each indicator tells a different part of the story, from the health of its community to the stability of its market.

You're really looking for patterns to emerge. A rising holder count is one thing, but when you see that combined with growing liquidity and a healthy token distribution, the signal becomes much, much stronger.

To make sense of it all, here's a breakdown of the on-chain metrics that matter most. Learning to read these signals gives you a solid framework for making decisions based on data, not just FOMO.

By keeping an eye on these indicators, you can move beyond speculation and start identifying projects with real, verifiable on-chain momentum.

Theory is great, but seeing how it plays out in the real world is what really clicks for a trader. To truly get a feel for what moonshot potential looks like, we need to rewind the tape and look at tokens that went from zero to hero, delivering life-changing returns. By picking apart these past successes, we can draw a straight line from the on-chain indicators we've been talking about to actual, explosive market moves.

Think of these case studies as blueprints, not just stories. They show us exactly how specific data points—like smart money piling in or a sudden spike in liquidity—were the early warning signs of a rocket getting ready for launch. Let's dig into two different scenarios to see how these signals showed up on the chain.

Imagine a new DeFi protocol, let’s call it "Project Atlas," that launches without much buzz. For weeks, its token, $ATLAS, just crabs sideways, doing nothing. But anyone who was digging into the on-chain data would have seen the writing on the wall long before the price chart went vertical.

Here’s what they would have noticed:

Put these signals together—smart money getting in early, a rapidly growing user base, and a fat liquidity pool—and you have the perfect recipe for the 50x explosion that followed over the next six weeks.

Memecoins are a whole different beast—way more volatile and driven by hype—but they often leave behind the same kind of on-chain clues. Let's cook up a fictional example, "DogeRocket" ($DROCKET), that took the market by storm.

Unlike a project with real utility, the main engine here was pure social momentum. Still, for anyone bothering to look, the on-chain data was telling a very clear story.

The most explosive moonshots often begin with the quietest signals. By the time the hype is deafening on social media, the initial, most profitable entry points are long gone. The real opportunity lies in spotting the on-chain whispers before they become a roar.

The wild ride of $DROCKET can be broken down into a few key phases, all visible on-chain before the massive pump.

In this scenario, the ridiculously fast growth in the holder count was the neon sign. It showed that the memecoin's story was catching on like wildfire. Traders who were tracking this metric would have seen the momentum building long before it hit escape velocity, allowing them to ride the wave to gains that topped 100x for the earliest believers.

The pull of a 100x return is intoxicating, but let's be clear: the road to a crypto moonshot is paved with blown-up accounts. For every token that goes vertical, thousands of others flatline, taking all the invested capital down with them.

If you want to hunt for these gems, understanding and managing this insane level of risk isn't just important—it's the only thing that matters.

Without a solid plan, you’re not investing. You're just gambling with extra steps. This space is a minefield of scams designed to prey on the exact FOMO that moonshots generate. We’re talking about rug pulls, where dev teams vanish with the liquidity, and honeypots that happily let you buy a token but mysteriously never let you sell. The threats are real and constant.

Even legitimate projects are not safe havens. The extreme volatility of these micro-cap coins can vaporize your entire position in minutes. A single large holder deciding to sell or a sudden shift in market chatter can cause a 90% price crash before you can even blink. This is exactly why a risk management strategy isn’t optional; it's your lifeline.

To make it in this high-stakes game, you have to shift from a gambler's mindset to a strategist's. It all starts by accepting a hard truth: most of your moonshot bets are going to fail. That’s okay. The whole point is to make sure your winners are big enough to cover all the losers and still leave a hefty profit.

Here is an actionable checklist to build your survival framework:

Chasing a moonshot without a plan is like navigating an asteroid field blindfolded. A structured strategy, disciplined execution, and a healthy respect for risk are your only true navigational tools.

So, what separates a pure gambler from a strategic trader in this arena? It all comes down to their process. A gambler runs on hope, hype, and a prayer. A strategist runs on data, discipline, and a plan. Understanding the true meaning of moonshot trading means embracing the risk, but a strategist actively works to control it.

The table below breaks down the key differences.

When it's all said and done, a successful moonshot hunter is a master of risk management first and a token picker second. They know that protecting their capital is the only way to stay in the game long enough to actually catch one of those life-changing wins.

Alright, let's put all this theory into practice. An on-chain intelligence tool like Wallet Finder is where the rubber meets the road, letting you actively hunt for the next crypto moonshot. This isn't about blind luck; it's about following the breadcrumbs left by the most successful traders in the game.

The whole process starts with a mental shift. Instead of chasing tokens, you start by hunting for the "smart money"—traders who have a knack for getting into projects early and banking huge returns. Our guide on how to track crypto wallets is a great place to start if this concept is new to you.

Your main goal is simple: find out what these top-tier traders are buying before everyone else piles in. Here’s a straightforward workflow you can use inside Wallet Finder to get started right away.

Below is a peek at the Wallet Finder dashboard, where you can see top-performing wallets at a glance.

This view lets you quickly sort by crucial metrics like total PnL and win rate, making it dead simple to find the most consistently profitable traders to follow. By keeping tabs on their new buys, you give yourself a massive head start.

Let's tackle some of the most common questions traders have when they start hunting for crypto moonshots. Getting these fundamentals down is key to navigating this wild, high-reward corner of the market.

This is a big one. Most seasoned traders I know stick to a pretty strict rule: only allocate a tiny slice of your portfolio, usually around 1-5%, to high-risk plays like moonshots.

Think of it as your "speculation" bucket. This approach lets you take a swing at those massive potential gains from a 100x winner without blowing up your entire account if (and when) a few of them go to zero. The exact number really comes down to your personal risk tolerance, but small is almost always the right answer here.

Not at all, though it's easy to see why people think that. While a ton of memecoins are launched with moonshot ambitions, the terms aren't the same.

A moonshot is any crypto asset—utility token, new Layer 1, DeFi protocol, you name it—that has the potential for explosive, outsized returns. A memecoin, on the other hand, is a type of moonshot that gets its value almost entirely from community hype and viral trends, not from any real-world utility.

The core idea of a "moonshot" is all about the sheer scale of ambition and potential return. It’s the hunt for a 100x gain, whether the project is built on memes or groundbreaking tech.

There’s no magic number here. Some memecoins, fueled by a perfect storm of social media hype, can go parabolic in just a few days or weeks. It can be a dizzying, fast-paced ride.

On the flip side, a project with genuine technology might take months or even years to build its product, gain traction, and see its token value reflect that progress. For these, patience is everything. No matter the timeline, keeping a close eye on on-chain data is your best bet for tracking momentum and seeing what the smart money is doing.

Ready to stop guessing and start tracking the smart money? Wallet Finder.ai gives you the on-chain intelligence to spot the next moonshot before it takes off. Start your 7-day trial today and follow the wallets that win.