7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 17, 2026

If you’ve spent any time in crypto circles, you've heard it. Shouted in Telegram groups, plastered across X (formerly Twitter), and chanted like a mantra on Reddit. "To the moon!" It's the ultimate rallying cry, a pure shot of hopium that means one thing: an asset's price is about to go on a parabolic, gravity-defying tear.

It’s more than just a phrase; it's an expression of pure, unadulterated optimism and the raw hype that fuels so much of the market.

Think of "to the moon" as the digital equivalent of a crowd roaring at a sports game. It's all about building energy, excitement, and a powerful sense of "we're all in this together" among investors. It signals that a community is fired up and ready for a wild ride.

You’ll see this phrase thrown around most often with memecoins and other super-volatile tokens where the power of the crowd can literally move markets. For a trader, hearing "to the moon" is a double-edged sword. On one hand, it’s a flashing neon sign that social momentum is building, which could ignite a massive price surge.

On the other hand? It can be a massive trap. This exact language is the calling card of coordinated "pump-and-dump" schemes. Organizers whip up a frenzy to lure in unsuspecting buyers, only to dump their own bags at the peak, leaving everyone else holding worthless tokens.

This is why you have to look past the hype. As decentralized finance keeps growing—with research pointing to its expanding dominance by 2025—telling the difference between a genuine groundswell and manufactured hype is a survival skill. You can learn more about the future of DeFi and its growth to get a sense of where things are headed.

To help you out, we’re going to break down where this phrase came from, the risks that come with it, and—most importantly—how to use on-chain data to see if a "moonshot" has real fuel in the tank or is just hot air.

When you see the rockets flying on social media, it's easy to get swept up in the excitement. But for a smart trader, it’s a signal to start digging deeper. This table breaks down what the phrase implies and when you should be skeptical.

ComponentMeaning for TradersPotential Red FlagCommunity HypeA strong, engaged community is forming around the asset, which could drive demand.The hype appears out of nowhere and is driven by anonymous, bot-like accounts.Price ExpectationTraders are anticipating a rapid, exponential price increase—not just a slow climb.The price has already pumped 100x and new buyers are being urged to "get in before it's too late."Speculative InterestThe asset is likely highly volatile and driven by social sentiment rather than fundamentals.There's no clear use case, whitepaper, or credible team—only memes and price predictions.

Ultimately, "to the moon" is a call to pay attention, not a guaranteed ticket to riches. Use it as your cue to open up your analytics tools and verify what's really happening on-chain.

The phrase "to the moon" wasn't cooked up in some corporate marketing meeting. It was born in the wild, chaotic forums of the internet, bubbling up from the early days of the Dogecoin community on Reddit. Back then, it was just a fun, hopeful cheer for the meme-inspired crypto's success.

But its real launch into the mainstream happened during the GameStop (GME) saga in early 2021. Retail traders, gathering on the subreddit r/wallstreetbets, made "to the moon" their battle cry. It became the anthem of a movement, a way for everyday people to push back against the big hedge funds that were betting on the company to fail.

For these traders, "to the moon" meant so much more than just a price target. It was a powerful mix of community hope, defiance against the financial establishment, and the exhilarating dream of hitting it big.

You can see the raw energy in discussions from that time. Forums like r/wallstreetbets were a perfect storm of memes, intense chatter, and shared financial goals that fueled an incredible wave of coordinated buying.

This blend of humor and serious financial ambition is exactly what gives the phrase its punch.

After GameStop, the phrase was permanently stamped into the internet's DNA. It was a natural fit for the crypto world, where volatility is the name of the game, and it was quickly adopted by communities rallying around new tokens and especially memecoins.

Understanding this backstory is key for any trader today. When you see "to the moon" plastered across social media, it's not just noise. It's a signal that signifies:

This is why the slogan can kick off such intense market momentum. It's also why you have to approach it with a clear head and solid data, not just pure emotion.

Every guide about "to the moon" treats social sentiment as a binary input: hype is either present or absent, and you either trust it or you don't. The more useful question is a timing one. Social chatter about a token and actual price movement are not simultaneous events, and the lead/lag relationship between them is measurable, inconsistent across asset types, and directly actionable once you understand it.

Research on crypto social sentiment, including studies documented by blockchain analytics firm Santiment, consistently shows that for large-cap assets like Bitcoin and Ethereum, social sentiment volume is more often a lagging indicator than a leading one. Price moves first, then social media responds. When Bitcoin breaks through a major resistance level, the "to the moon" posts surge within hours. Traders who interpret that surge as a signal to buy are reacting to a move that has already happened, entering at or near the local top of the sentiment-driven run.

For mid-cap and small-cap altcoins, the relationship inverts. Organic social sentiment, meaning genuine discussion from real users rather than coordinated bot activity, tends to lead price by 12 to 72 hours in assets where the market cap is small enough that retail buying from sentiment-driven traders actually moves price. A token with a $5 million market cap that sees a 400% spike in social mentions without a corresponding price spike is often sitting at the beginning of its move rather than the end of it, because the community is building before market participants have processed the signal.

The practical implication is that "to the moon" language on a large-cap Bitcoin or Ethereum post is nearly useless as a forward-looking signal. It tells you the asset already moved. The same language appearing on a micro-cap token that has not yet price-responded to the sentiment is a materially different situation. Distinguishing between these two scenarios requires checking whether price has already moved to validate the sentiment, which takes five seconds on any charting tool.

One of the most reliable and counterintuitive applications of sentiment data comes from extreme sentiment peaks. When social volume and positive sentiment on a specific token reach their statistical maximum, meaning the "to the moon" volume is higher than it has ever been, the price is typically very close to a local top rather than the beginning of a sustained run. This is because the maximum sentiment peak represents the moment when everyone who is going to buy based on hype has already bought. The marginal buyer who would have entered on the excitement does not exist anymore, because all of them are already in. With no new hype-driven buyers available, selling pressure from profit-takers starts to dominate.

Santiment's social volume metric tracks the number of unique social media posts mentioning a specific token across Twitter, Reddit, and Telegram. Historical data shows that tokens experiencing all-time high social volume readings frequently see price corrections of 20% to 40% within the following 48 to 72 hours. Maximum hype almost never predicts sustained continuation. The smart money interpretation of a "to the moon" frenzy at an all-time high social volume reading is not excitement but a signal to tighten stops and consider scaling out of positions.

That "to the moon" feeling can spark some serious FOMO (Fear Of Missing Out). It's a powerful psychological trigger, and it's responsible for a lot of impulsive, high-risk trades. But jumping on a token just because of social media hype is a dangerous game that often ends in disaster.

The raw emotion behind the phrase makes it the perfect bait for scammers. It’s almost always the battle cry for pump-and-dump schemes, where a group of insiders artificially inflates a token's price. They'll flood Twitter, Telegram, and Discord with rocket emojis and insane price predictions to lure in waves of unsuspecting buyers.

Once the price has skyrocketed, the organizers dump their huge bags on the market. The value crashes in an instant, leaving everyone who bought into the hype holding nearly worthless tokens.

It's easy to mistake a coordinated social media campaign for genuine, organic momentum. An army of bots or a handful of paid influencers can suddenly start shilling a token, creating the illusion that a massive community is forming around it.

This is exactly why a smart trader hears "to the moon" and doesn't see a buy signal—they see an urgent warning to start digging deeper.

The critical takeaway is to treat the phrase as a starting pistol for your due diligence, not as a green light to invest. Genuine opportunities are backed by data, not just emotional appeals and memes.

A sudden, aggressive marketing push with zero real project development to back it up is a colossal red flag. These campaigns prey on the universal hope for quick, life-changing money, but the reality is often devastating. Many of these schemes are just slickly packaged exit scams. You can learn more about these risks in our detailed guide on the meaning of a rug pull in crypto.

Ultimately, protecting your capital comes down to one thing: learning to tell the difference between authentic community growth and manufactured hype. Before you ever put money on the line, ask yourself: Is this excitement supported by real on-chain activity, or is it just a lot of noise?

The "to the moon" cycle is almost always amplified by influencer promotion, and the influencer side of this equation is far less understood than the market manipulation side. Most traders know that following influencer calls blindly is dangerous. Far fewer know the legal framework governing what influencers can and cannot do, which enforcement actions have actually produced consequences, and what the realistic financial exposure looks like for both promoters and the people who follow their calls.

The Securities and Exchange Commission began pursuing crypto influencer cases seriously around 2022, with the legal theory that promoting tokens qualifying as securities without disclosing compensation constitutes illegal market manipulation under Section 17(b) of the Securities Act of 1933, which prohibits touting securities for compensation without disclosure.

The enforcement cases that resulted in actual charges illustrate where the legal line sits. In 2022, the SEC charged eight individuals including Kim Kardashian for promoting the EthereumMax (EMAX) token on Instagram without disclosing she was paid $250,000 for the post. Kardashian settled for $1.26 million, which included the promotion fee, disgorgement of profits, a financial penalty, and a three-year ban on promoting crypto securities. Separately, Floyd Mayweather and DJ Khaled paid combined settlements of over $760,000 for undisclosed promotion of Centra Tech, a token that turned out to be a fraud.

The cases that resulted in criminal rather than civil charges involved more active participation. John McAfee was indicted by the DOJ in 2021 for a scheme where he and associates accumulated tokens before publicly promoting them, then dumped their holdings after the price rose. This is the textbook pump-and-dump structure with influencer amplification and it meets the criminal threshold under wire fraud and securities fraud statutes.

The legal accountability runs almost entirely toward promoters, not buyers. A trader who loses money after following an influencer's "to the moon" call has essentially no legal recourse against that influencer unless they can prove active fraud rather than undisclosed promotion. Civil litigation from buyers against influencers has produced almost no successful recoveries at the individual level because damages are difficult to attribute to any specific statement.

The additional complication is that most crypto tokens are not classified as securities, which means the SEC framework does not apply and there is no regulatory requirement to disclose promotional compensation. For tokens in this category, which covers most memecoins and utility tokens not structured as investment contracts, influencer promotion without disclosure is entirely legal regardless of how damaging it is to buyers. This legal gap is why the memecoin "to the moon" ecosystem operates with essentially no accountability for influencer-driven pumps on non-security tokens. Any influencer post promoting a specific token without a clear statement of their position size and whether they received compensation should be treated as a promotional asset rather than a signal.

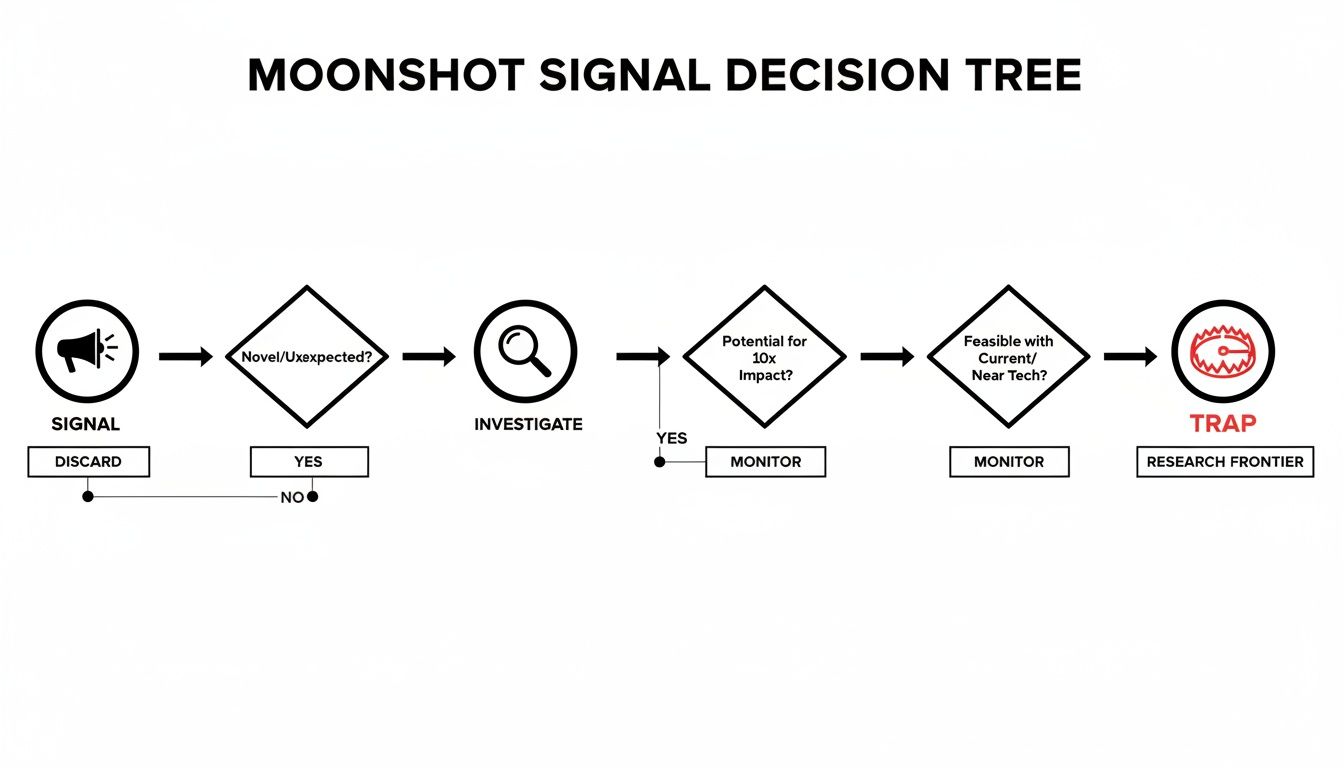

When a token starts trending and the "to the moon" chants echo across social media, it's easy to get swept up in the hype. But for a smart trader, that's not a buy signal—it's a trigger for due diligence. Instead of chasing hashtags and rocket emojis, you need to ground your decisions in on-chain data.

On-chain data is the blockchain's permanent, unchangeable record of every single transaction. It tells you what's really happening with a token, not just what influencers want you to believe.

Think of social hype as smoke; on-chain data is the fire. You need to see a real fire before you run towards it. This means digging for cold, hard evidence that real money—and real conviction—is behind the noise.

The key takeaway is simple: a moonshot signal should always kick off an investigation, not an immediate buy order. This is how you avoid getting burned by a pump-and-dump scheme.

Use this checklist to systematically validate the hype you see online. If a token fails to meet these criteria, proceed with extreme caution.

Signal TypeSocial Hype Indicator (Low Confidence)On-Chain Data Indicator (High Confidence)Community GrowthThousands of new Twitter followers overnightA steady, organic increase in unique wallet addresses holding the token.Trading ActivityA few influencers posting "Just aped in!" screenshotsSignificant and consistent buy orders from "smart money" wallets with a history of profitable trades.Token OwnershipClaims of a "strong community" and "diamond hands"A healthy holder distribution where the top 10 wallets hold less than 50% of the supply.Market SentimentA flood of rocket emojis and "WAGMI" postsRising net flow into the token, with more buys than sells from established wallets.

By prioritizing the high-confidence indicators on the right, you dramatically reduce your risk and trade based on substance, not sentiment. For a more detailed breakdown of these techniques, check out our complete guide on how to use crypto on-chain data.

The goal is to find alignment between social sentiment and on-chain reality. When a token’s story is backed by a growing holder base, smart money inflows, and healthy trading volume, the phrase "to the moon" starts to feel less like a gamble and more like a data-supported opportunity.

Talk is cheap. It’s one thing to understand the theory, but seeing how "to the moon" plays out in the wild is where the real lessons are. Some tokens have become legendary, delivering on the hype and creating fortunes along the way.

When we look back at these explosive runs, we can often find the breadcrumbs—verifiable on-chain data that hinted at their moonshot potential long before everyone else caught on.

Two of the best examples are Shiba Inu (SHIB) and PEPE. Both started as obscure memecoins that most people dismissed, yet they captured the market's imagination and went on incredible rallies. For traders who looked past the social media noise and dug into the data, the early signals were there.

With both SHIB and PEPE, the blockchain told a story that was far more convincing than any tweet. Before the prices went vertical, specific indicators painted a picture of genuine, growing interest—a stark contrast to the usual pump-and-dump schemes.

Here’s what the smart money was seeing:

This kind of on-chain activity is what separates a project with real potential from a flash in the pan. To dive deeper into these dynamics, check out our guide on what moonshot crypto is.

Of course, for every success story, there are countless tokens that generated massive hype only to crash to zero. In almost every one of those cases, the on-chain signals we just talked about were nowhere to be found.

Instead, you’d see a high concentration of tokens in just a few wallets and a holder count that flatlined after the initial pump. The hype was loud, but the blockchain was silent.

The lesson is clear: doing your own research is non-negotiable. A token’s on-chain footprint tells the real story, offering a layer of truth that social media sentiment just can’t match.

As the global crypto wallet market is projected to grow substantially in 2025, the tools for this kind of research are becoming better and more accessible. You can read more about the expanding crypto wallet market on Fortunebusinessinsights.com.

Let's be real, diving into crypto trading feels like learning a new language. This section will break down some of the most common questions traders have about slang like "to the moon," so you can trade with more clarity and less confusion.

"To the moon" calls on social media are extremely unreliable if you take them at face value. Think of them as a flare in the dark—a signal to start digging for yourself, not a green light to throw your money in.

The hard truth is that the vast majority of these calls are just noise, designed to whip up fake excitement for pump-and-dump schemes. Always, always verify the hype with actual on-chain data before you even think about making a move.

A pump-and-dump is when a group manufactures a sudden, massive price spike based on nothing but social media hype. There's no real project value, no fundamentals—just hot air. This is a world away from genuine growth, which is always backed by solid on-chain metrics.

Genuine growth looks like a steady increase in unique wallet holders, sustained trading volume, and visible development from the project's team. A pump-and-dump has none of that. It's all about creating FOMO before the insiders cash out, leaving everyone else holding the bag as the price crashes to zero.

Your best defense against FOMO is having a rock-solid trading plan before you invest a single dollar. This is what separates calculated trading from emotional gambling in a red-hot market.

Your plan needs to clearly define three things:

By following your own rules, you sidestep the emotional traps laid by all the "to the moon" hype. Never invest more than you're truly comfortable losing, especially with the highly speculative tokens where this slang is most common.

It has been measured, and the results are more nuanced than either "sentiment predicts price" or "sentiment is meaningless." Research using Twitter sentiment data from 2017 to 2022 found statistically significant correlations between sentiment spikes and price movements for Bitcoin, but with an important caveat: the correlation was strongest over 1 to 3 day windows and worked in both directions. Positive sentiment spikes predicted price increases over the following 24 to 72 hours at rates better than random, but negative sentiment reversals after a positive spike were also predictive of corrections. The signal was real but weak enough that trading on it alone, without additional confirmation, produced marginal returns before transaction costs and essentially zero after them.

For small-cap altcoins and memecoins, the predictive relationship is shorter and noisier. The window where sentiment leads price is typically under 12 hours, meaning by the time you identify the signal, process it, and execute a trade, a meaningful portion of the move has already occurred. The traders capturing value from sentiment signals in this market are running automated tools that identify and execute in seconds, not retail traders manually monitoring social media. This is the uncomfortable reality behind every "I spotted the hype early" success story: the person often got lucky with timing rather than genuinely outrunning the signal processing speed of algorithmic competitors.

This is a behavioral finance question as much as a market structure one, and the answer involves two documented cognitive mechanisms: the availability heuristic and variable ratio reinforcement, the same psychological mechanic that makes slot machines compelling.

The availability heuristic causes people to estimate the probability of outcomes based on how easily examples come to mind. In crypto communities, the examples retold most frequently and with the most emotional intensity are the wins: the person who bought SHIB at launch and made 100x, the early Dogecoin holder who turned $1,000 into $400,000. Losses are forgotten or minimized in the retelling, while wins spread virally. This creates a systematically distorted mental model of how often "to the moon" calls actually deliver, because the evidence reaching most community members is heavily filtered toward successes.

Variable ratio reinforcement is the mechanism by which unpredictable rewards create stronger behavioral repetition than predictable ones. "To the moon" tokens that occasionally produce enormous returns, even at a 2% rate, create the same reinforcement dynamic as a slot machine. The 98% of losses are processed as "the ones that didn't work out," while the 2% of wins are treated as proof that the strategy is valid. The behavioral pattern repeats because occasional unpredictable wins reinforce it more powerfully than consistent small losses extinguish it. Understanding this mechanism does not make you immune to it, but naming it helps you audit your own decision-making when you notice yourself dismissing a string of losses as bad luck while attributing wins to research quality.

Yes, and the differences are structural rather than just cultural. The same phrase means something mechanically different when applied to an S&P 500 stock versus a newly launched memecoin, and understanding those differences helps calibrate appropriate skepticism in each context.

In traditional equity markets, a stock going "to the moon" faces structural friction that does not exist in crypto. Circuit breakers halt trading when a stock moves more than 7%, 13%, or 20% in a session, preventing the 99% single-day collapses that are routine in crypto pump-and-dump schemes. Market makers are required to maintain orderly markets and cannot simply withdraw liquidity. Short sellers can borrow shares and bet against overextended prices, creating a natural dampening force on runaway upward moves. Regulatory oversight of pump-and-dump schemes in equities is more established and consistently enforced than in crypto, with Regulation M and market manipulation statutes carrying decades of enforcement history.

In crypto, none of these friction mechanisms apply in the same way. There are no circuit breakers on most DEXes. Liquidity providers can withdraw instantly. Short selling infrastructure exists but is thinner than in equities. Regulatory enforcement is inconsistent and jurisdictionally fragmented. The result is that "to the moon" in crypto describes a genuinely different risk environment from the same phrase applied to stocks, with higher upside potential, faster collapse timelines, less regulatory protection, and no structural mechanisms to slow a crash once it starts. The human psychology underneath is identical in both markets. The mechanics that constrain or amplify that psychology are worlds apart.

Stop gambling on hype and start trading with data. Wallet Finder.ai surfaces the on-chain signals that matter, helping you spot real opportunities before they go mainstream. Discover the tokens and wallets smart money is buying right now at https://www.walletfinder.ai.