Crypto Future Profit Calculator: A Guide

Use our crypto future profit calculator to accurately forecast leveraged gains. Learn to account for fees and risks to make smarter, data-driven trades.

January 28, 2026

Wallet Finder

January 26, 2026

The SafeMoon V2 (SFM) price chart isn't for the faint of heart. It’s notoriously volatile, driven by a complex set of internal rules rather than the usual market pressures. In fact, its history includes a jaw-dropping price collapse of over 99.95% from its peak, a clear signal that your standard trading playbook won’t cut it here.

If you want to understand the SafeMoon V2 price, you have to look beyond the typical charts. SFM was never meant to be a conventional cryptocurrency. It was built with unique tokenomics that directly shape its value with every single transaction. Because of this, on-chain data tells a much richer story than a simple price graph ever could.

Traditional market analysis just doesn't work here. It completely misses the core mechanics hard-coded into the SFM smart contract. To make any sense of the price swings, you have to get your hands dirty and look at the data generated by the blockchain itself.

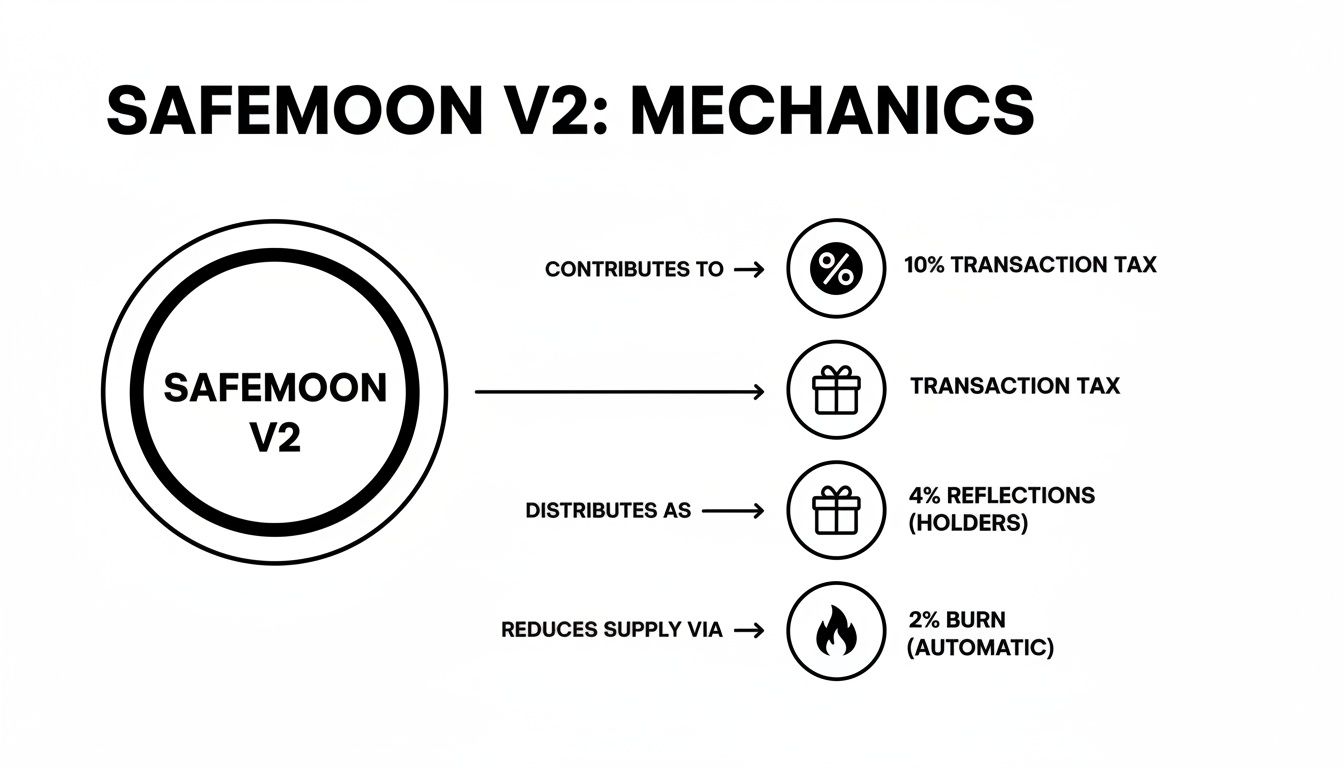

At its core, SafeMoon V2 runs on three key mechanisms that create its own little economic ecosystem:

These features mean the real drivers of the safemoon price v2 are trading volume, how long people hold, and how quickly the supply is shrinking.

For traders, this is a game-changer. Watching metrics like the burn rate and the growth in new wallets gives you a much clearer picture of market sentiment than just looking at the price. A rising burn rate means more activity, while reflections show you how rewards are being distributed across the network.

Think of this guide as your practical playbook for moving beyond pure speculation. Instead of just guessing, you'll learn how to use on-chain data to make decisions with confidence. We’ll dig into how tools like Wallet Finder.ai uncover these hidden signals, helping you spot market shifts before they happen.

The token's wild history makes it a fascinating case study. After hitting an all-time high of $0.007232 on January 4, 2022, the price cratered, wiping out fortunes and highlighting the extreme risks in the altcoin space. You can explore the full history of SafeMoon V2 price movements on CoinMarketCap.

If you want to get a real handle on the SafeMoon price v2, you can't just stare at the price chart all day. You have to go deeper—into the on-chain data. The token’s value is directly wired into its unique mechanics, which act like a built-in economic engine humming away on the blockchain.

Every single transaction leaves a footprint. Learning how to read these signals gives you a massive advantage over traders who only react to price wiggles.

Unlike your typical crypto asset, SFM's price is heavily shaped by three core functions: a transaction tax, automatic rewards for holders (known as reflections), and a continuous token burn. Together, these create a transparent ecosystem where you can see exactly what's happening. A sudden spike in the daily burn rate isn't just a random number; it's a flashing sign of rising trading volume, which often comes right before a big price move.

This diagram breaks down exactly how each transaction fuels the SafeMoon V2 ecosystem.

As you can see, that transaction tax is the engine driving everything, from rewarding holders to shrinking the total supply through the burn.

SFM’s tokenomics aren't just clever features; they're powerful market signals you can actually read. When you learn how to analyze them, they give you incredible insights into what holders are thinking and the overall health of the network. This shifts your approach from just reacting to price changes to actively anticipating them based on real, fundamental activity.

Here's an actionable checklist of the most important metrics to keep an eye on:

Let's break down these on-chain signals and how you can use them in a more structured way.

Keeping an eye on these metrics is like having a live health report for the entire SFM ecosystem. This is the real foundation of data-driven trading in DeFi.

Some of the most predictable and dramatic price shifts are kicked off by whales—wallets holding enormous stacks of SFM. A single large buy or sell order from a whale can move the entire market. By tracking what these influential wallets are doing, you can spot potential price swings before they actually happen.

Whale activity gives you the context that charts alone can't provide. Is a major whale quietly accumulating more tokens? That could signal confidence in a future price increase. Are several large wallets suddenly moving their SFM to an exchange? That’s often a precursor to a big sell-off.

Watching these moves is like having an early warning system. It gives you precious time to position yourself ahead of the herd instead of getting swept away in the aftermath. If you're looking to really level up your strategy, our guide to crypto on-chain analysis breaks down exactly how to interpret these critical blockchain activities.

If on-chain data is your long-range weather forecast for the SafeMoon V2 ecosystem, then price charts are your real-time GPS. They give you the tactical view, helping you navigate the market’s current mood swings. When you combine the two, you get a powerful, layered perspective on the safemoon price v2 that most people miss.

For an asset as volatile as SFM, throwing a bunch of standard indicators at the chart can spit out a lot of false signals. It's just noise. But a couple of them work surprisingly well if you know what you’re looking for. The trick is to never trust just one indicator; always look for confirmation between your chart and the on-chain signals we've already covered.

The Relative Strength Index (RSI) is a classic for a reason. It’s a momentum indicator that tells you how fast and how hard the price is moving, scored on a simple scale from 0 to 100. For SFM, it's brilliant at spotting when the market is getting a little too greedy or a little too scared.

Here’s a quick-reference guide for reading it:

The most powerful RSI signal for the SafeMoon price v2 is divergence. If the price chart shows a new high but the RSI chart shows a lower high, that’s a bearish divergence. It's a huge red flag that the upward momentum is fading. On the flip side, if the price hits a new low but the RSI makes a higher low, that’s a bullish divergence—a strong hint that a bottom might be forming.

Next up are Bollinger Bands, which are perfect for visualizing SFM's legendary volatility. You have three lines: a middle line (just a simple moving average) and two outer bands that expand and contract based on how wild the price action is.

When looking at the SFM price, keep an eye out for these two patterns:

The real power comes from layering these tools. Imagine the RSI is showing SFM is oversold (below 30) at the exact same time the price touches the lower Bollinger Band. That’s a much stronger signal for a potential buy than either indicator would be on its own.

Now, cross-reference that with on-chain data, like seeing the burn rate suddenly pick up. You're no longer just guessing; you're building an evidence-based strategy.

Dipping your toes into decentralized exchanges (DEXs) like PancakeSwap to grab some SafeMoon V2 can be exciting, but you need to go in with a security-first mindset. Unlike the big centralized exchanges, on a DEX, you're the one in control—which also means you're your own head of security. Getting this right is everything if you want to protect your funds from common scams and technical headaches.

First, here's a step-by-step checklist to prepare:

With your wallet funded, it's time to connect to a DEX like PancakeSwap. This next part is where the most critical security check happens. Don't skip it.

Here’s the single most important step before you swap for SFM: verify you are using the correct smart contract address. This is non-negotiable. Scammers are notorious for creating counterfeit tokens with the same name and logo to fool investors. If you interact with the wrong contract, your funds are gone. Poof.

To stay safe, only get the official SFM contract address from a trusted source like CoinMarketCap or the official SafeMoon website. Never, ever trust an address someone sends you on social media or in a random chat group.

Once you have the legit address, paste it into the token import field on PancakeSwap. This move guarantees you're trading the real SafeMoon V2 token. For a deeper dive into moving assets across different blockchains securely, check out our guide on how to chain swap crypto.

Okay, you've got the right token selected. Now you need to adjust your slippage tolerance. Slippage is just the potential price wiggle that can happen between the moment you hit "swap" and when the transaction is actually confirmed on the blockchain. Because SFM has that built-in 10% transaction tax, your slippage has to be set high enough to cover it.

A typical slippage of 1-2% will just cause your transaction to fail. For SFM, you need to crank it up to 12% or even a bit higher.

This covers two things:

Nailing the slippage is essential for a successful swap. If you set it too low, the transaction will fail, but you'll still lose the gas fees you paid. By following these two simple steps—verifying the contract and setting the right slippage—you can buy SafeMoon V2 confidently and safely.

Technical indicators and on-chain metrics give you a powerful view into the market, but the pros add another layer to their strategy: they track smart money. This means finding and watching the wallets of highly profitable traders who consistently beat the market. When you see what they're doing, you get early clues about potential shifts in the safemoon price v2 long before they show up on the charts.

This entire strategy flips trading from reactive to proactive. Instead of just reacting to price candles, you start anticipating them by watching what the most successful players are doing right now. It’s like getting a peek at the playbook of the market's top performers.

First thing's first: you have to find these "winning" wallets. Trying to manually sift through thousands of transactions on a block explorer is a surefire way to get lost. This is where specialized tools like Wallet Finder.ai are a game-changer, letting you filter for wallets based on their actual performance.

You can zero in on traders who have a proven track record with SFM by looking for a few key traits:

The screenshot below from Wallet Finder.ai shows how you can easily filter wallets to find those with the highest gains, giving you a ready-made list of top performers to dig into.

This data-first approach helps you cut through the noise and focus only on the wallets whose actions have historically come before major price moves.

Once you've got a handful of interesting wallets, the real fun begins. Dive into their transaction history to figure out how they trade. Are they accumulating SFM slowly over time, or do they make huge, decisive buys right before a pump? Do they dump everything at once or take profits in stages on the way up?

By studying their entry and exit points, you start to see patterns. These patterns are pure gold because they can reveal sophisticated strategies that are completely invisible if you're only looking at charts.

The final, and most powerful, step is to set up real-time alerts. Modern wallet-tracking tools can send you an instant notification the moment a wallet you’re watching makes a move.

Actionable Alert Setup:

This method gives you a powerful leading indicator. For instance, when you see three or four of your top-watched wallets all start buying SFM within a few hours of each other, that's a very strong signal that they expect the price to go up.

To get a better handle on this advanced technique, check out our deep dive into how wallet accumulation predicts token price moves.

Even with a solid game plan, SFM's unique mechanics can trip up even experienced traders. Let's clear up a few of the most common points of confusion. Getting these answers straight is key to building the confidence you need to trade effectively.

Think of this as reinforcing what we've already covered, making sure you have the complete picture before you make your next move.

Anyone looking at a historical SafeMoon chart for the first time gets a shock. You see this massive, vertical price jump between V1 and V2 and assume something incredible happened. But that wasn't a market rally; it was a planned token consolidation.

During the migration from V1 to V2, the developers initiated a 1000:1 consolidation. What that means is for every 1,000 old V1 tokens you held, you received just 1 new V2 token.

Of course, to make sure nobody lost money in the process, the price of each V2 token was simultaneously made 1,000 times higher.

For example, if you were holding 10 million V1 tokens that were worth $100, the swap would have left you with 10,000 V2 tokens, also worth exactly $100. Your bag's total value didn't change an inch at the moment of migration.

So, why do it? The team's stated reasons for this structural change were to:

The key thing to remember is this was a structural change, not a sudden, organic price explosion.

The 10% transaction tax is the heart of the entire SafeMoon ecosystem, and it touches every single thing you do with your SFM. Buying, selling, or even just moving tokens from one of your wallets to another—it all gets hit with the tax, deducted right from the transaction total.

This tax is what powers SafeMoon's tokenomics. It's not just a fee; it's the fuel that gets split up to run the whole machine:

For a trader, the bottom line is this: you're starting every trade 10% in the hole. When you go to swap on a DEX like PancakeSwap, you have to account for this. You'll need to set your slippage tolerance to at least 12% to make sure the transaction goes through. That covers the 10% tax and gives you a 2% cushion for any price swings that happen while your trade is confirming on the blockchain.

No, it is no longer possible to swap SafeMoon V1 tokens for V2. The official migration window established by the development team has been closed for a long time.

There was a specific process and a generous timeframe for holders to make the switch. Once that window closed, the V1 smart contract was effectively shut down and its liquidity was removed.

Any V1 tokens that were not swapped are now, for all practical purposes, without value in the SafeMoon ecosystem. They cannot be officially converted to SFM V2. Be extremely wary of anyone—or any third-party website—claiming they can still perform the swap for you. These are scams, 100% of the time, designed to drain your wallet. The V1 token is defunct; there is no legitimate way to exchange it.

Ready to stop guessing and start tracking the smart money in DeFi? Wallet Finder.ai gives you the tools to discover profitable wallets, analyze their strategies, and get real-time alerts on their trades. Find your edge and trade with confidence. Start your 7-day trial at Wallet Finder.ai.