7 Best Meme Coin Trading Tools for 2026

Discover the 7 best meme coins trading platforms and tools for 2026. Get actionable insights, find winning wallets, and trade smarter on CEXs and DEXs.

February 20, 2026

Wallet Finder

February 3, 2026

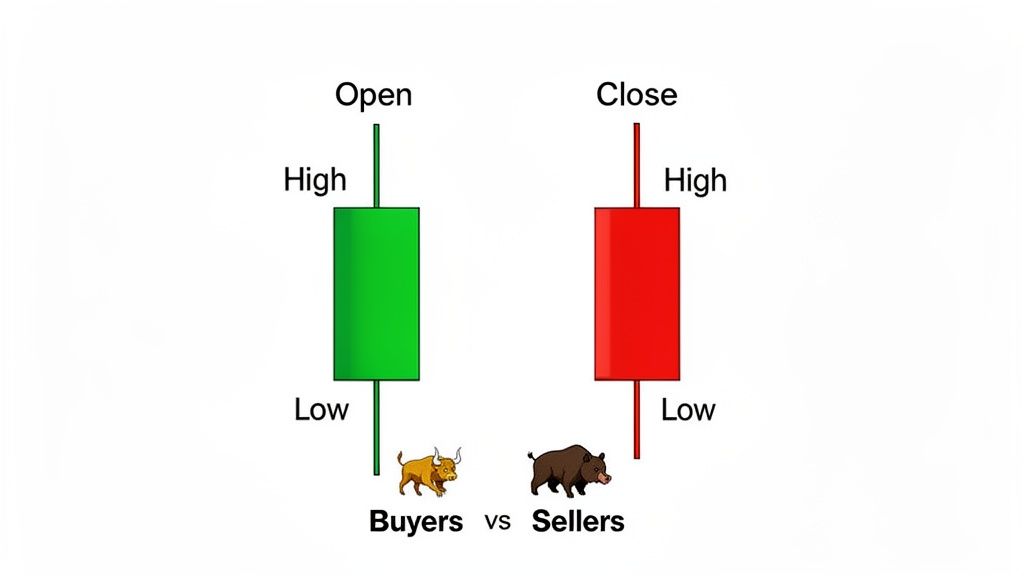

Think of a crypto candlestick chart as a visual story. Instead of a simple line showing price, each "candle" gives you a rich, detailed summary of the battle between buyers and sellers over a specific timeframe. It's an essential tool for any trader who wants to understand market sentiment at a glance.

Each candlestick is like a snapshot from a battlefield. Over a set period—a minute, an hour, a day—buyers (the bulls) and sellers (the bears) are in a constant tug-of-war, pushing the price of a crypto asset up or down. The candle that forms tells you who won that battle, how intense the fight was, and who’s got momentum on their side.

Getting a feel for this narrative is the first real step toward making smarter, more informed trading decisions.

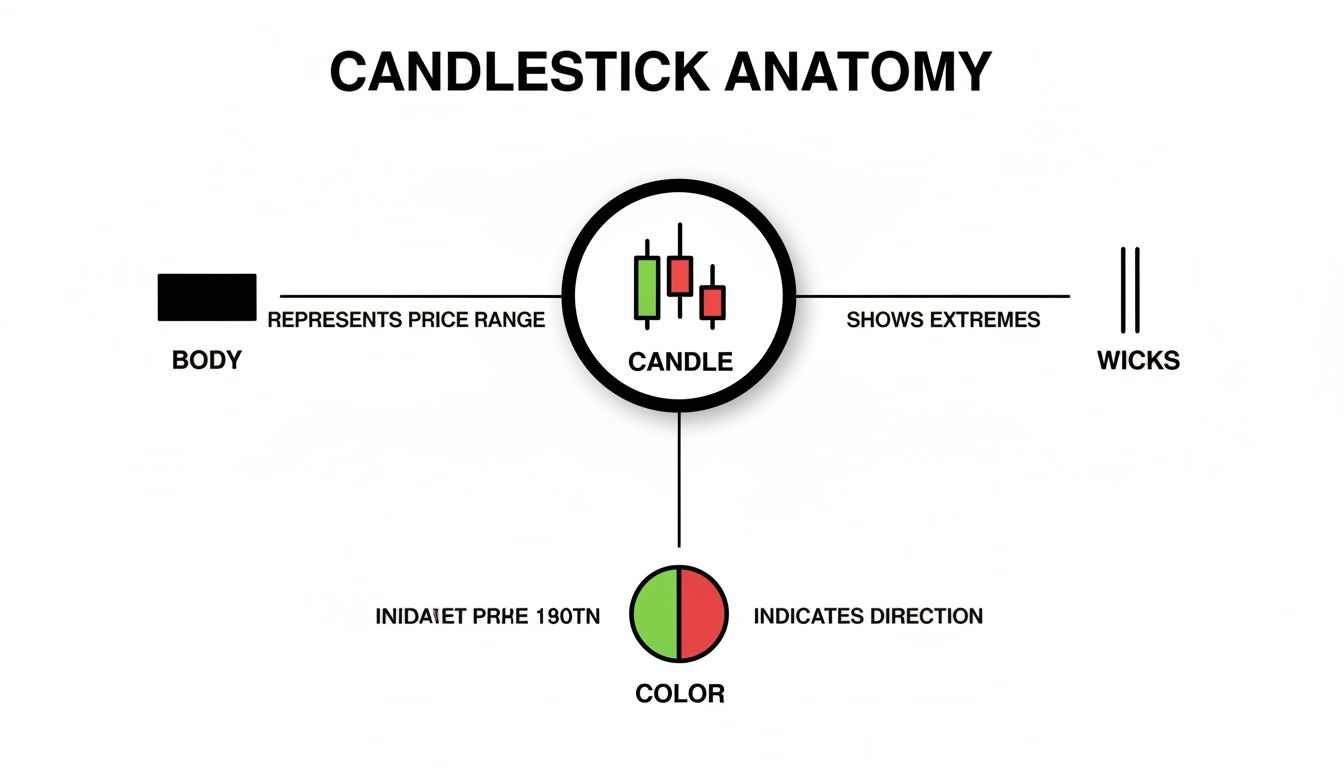

Every candlestick, no matter how simple or complex it looks, is made of two main parts: the body and the wicks. The way these two elements interact paints a quick, visual picture of what the market was up to.

The heart of the candlestick is its body—that thick, rectangular part. The body shows you the opening and closing prices for that period. A green body means the closing price was higher than the opening price, signaling a victory for the buyers. On the flip side, a red body tells you the closing price was lower than the open, a clear win for the sellers.

Sticking out from the top and bottom of the body are the thin lines, often called wicks or shadows. The upper wick marks the highest price the asset hit during that timeframe, while the lower wick shows the lowest price. Long wicks are a dead giveaway for volatility and indecision, showing that the price traveled a long way from where it started and finished.

This simple breakdown is the foundation for everything that follows.

As you can see, the body, wicks, and color come together to tell a complete story about price movement. To build on these basics, be sure to check out our complete guide on how to read crypto charts for a much deeper dive.

Here’s a quick reference table to keep the core components straight. Think of it as your cheat sheet for decoding any candle you see on a chart.

Once you’ve got these four pieces down, you're ready to start spotting patterns and understanding the bigger picture of market psychology.

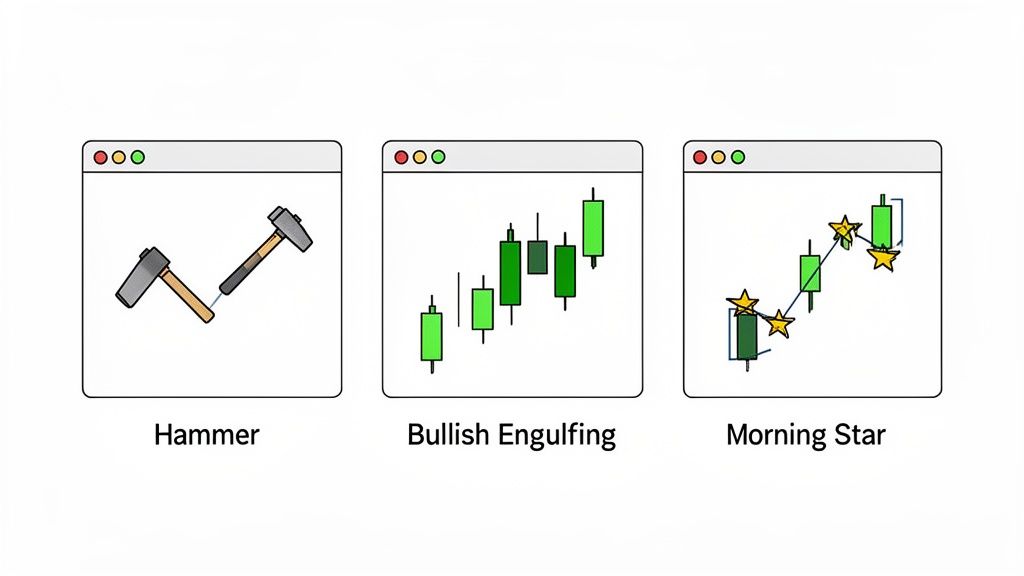

While individual candles give you a snapshot, it's the patterns they form together that really tell the story. Bullish patterns are specific shapes that pop up on a chart, suggesting sellers are running out of steam and buyers are about to take the wheel. Spotting them can signal a potential turnaround from a downtrend to an uptrend.

Think of these patterns less as random shapes and more as a visual record of market psychology. They capture those critical moments where indecision gives way to conviction, and buying pressure finally overwhelms selling pressure. For a crypto trader, seeing these formations early can make all the difference in timing your entries.

And this isn't just wishful thinking. Research on major stock indices found that bullish reversal patterns could generate an average return of 1.31% over a 10-day period following a downtrend. You can dive deeper into the statistical backing of candlestick patterns if you want to see the numbers for yourself.

The Hammer is one of the easiest bullish patterns to spot. You'll see it during a downtrend, and it looks just like its name implies: a small candle body up top with a long lower wick that's at least twice the size of the body. You’ll see little to no upper wick.

This single candle tells a dramatic story. Within one trading session, sellers managed to push the price way down, creating that long lower shadow. But then, the buyers stormed back in, driving the price all the way back up to close near where it opened.

Key Takeaway: The Hammer shows us that even though the bears tried to drag the price down, the bulls fought back hard and rejected those lower prices. This kind of seller exhaustion is often the first hint that a price reversal is coming.

The Bullish Engulfing pattern is a two-candle powerhouse that signals a major shift in who's in control. It appears at the bottom of a downtrend and plays out like this:

This pattern is a clear and decisive takeover by the buyers. The sellers were in charge for the first candle, but the second one shows buyers stepping in with enough force to not just wipe out the previous day's losses but also push the price much higher. The bigger the green candle, the stronger the buying pressure.

The Morning Star is a three-candle pattern that signals hope after a downturn, kind of like the morning star appearing just before the sun rises. This formation takes three sessions to play out at the bottom of a downtrend.

This sequence shows sellers losing their grip, a moment of doubt where the trend stalls, and then a final confirmation that buyers have taken over. It’s a classic sign that the downtrend has lost its mojo and a new uptrend could be starting.

Now for the other side of the coin. Just as bullish patterns can signal a great time to jump in, bearish patterns are your flashing red lights. They’re the market’s way of telling you that the party might be winding down and the sellers are starting to take over the dance floor.

Spotting these formations is a huge part of smart risk management. It can mean the difference between locking in your profits and watching them evaporate as the market turns against you. Think of them as the footprints of a power struggle where the buyers are losing steam, paving the way for a reversal or at least a significant correction.

Don't let the name fool you; this one's all about context. The Hanging Man is a single-candle pattern that looks exactly like a bullish Hammer—small body up top, long wick down below. The critical difference? It shows up at the top of an uptrend, and that completely flips its meaning.

Here’s the story it tells: The market was moving up, but during this session, sellers flexed their muscles and shoved the price way down. While the bulls managed to claw it back up by the close, that initial plunge—the long lower wick—is a serious crack in their armor. It's a sign of rising doubt and the first hint that sellers are testing the waters.

If the Hanging Man is a quiet warning, the Bearish Engulfing pattern is a loud alarm bell. This is a powerful two-candle formation that screams reversal. It shows up at the peak of an uptrend and plays out like this:

This is a dramatic plot twist. One moment, the bulls are in control. The next, sellers have stormed the castle, not just erasing the previous day's gains but pushing the price even lower. It’s an unmistakable signal that the balance of power has shifted firmly to the bears.

Key Insight: A Bearish Engulfing pattern is one of the most trusted reversal signals out there. Its credibility gets a major boost when it appears after a long run-up and is backed by a spike in trading volume, which confirms the sellers mean business.

The Evening Star is a bit more subtle, telling its story over three candles. It signals a reversal that’s more of a gradual slowdown than a sudden slam on the brakes, but it's just as important.

Here’s how it unfolds:

This sequence perfectly captures the peak of excitement, the moment of uncertainty, and the final, decisive bearish takeover.

Data-driven traders often look for patterns with a proven track record. For example, the Head and Shoulders pattern, another major reversal indicator, has historically shown an 82% success rate in calling major trend changes. To dive deeper, you can find more about powerful reversal chart patterns at altfins.com.

Here’s a quick look at some of the most reliable reversal patterns that crypto traders keep an eye on.

Understanding which patterns have historically performed well can give you an edge. While no signal is foolproof, prioritizing formations with higher success rates can significantly improve your odds.

This table isn't an exhaustive list, but it highlights some of the heavy hitters. Focusing on these high-probability setups helps filter out the noise and allows you to act with more confidence when a clear signal appears on the chart.

A candlestick pattern isn't some universal truth. Its meaning can flip entirely depending on the timeframe you're looking at. A Bullish Engulfing pattern on a 5-minute chart? That might just be a small, temporary bounce. But see that same pattern on a weekly chart, and you could be looking at a massive trend reversal that plays out over months.

In crypto, context is king.

This is where Multiple Time Frame Analysis (MTFA) becomes your secret weapon. Think of it like a military operation: you use a satellite for the big picture, a drone for a closer look at the battlefield, and boots on the ground with a magnifying glass for the final move. Each view gives you a crucial piece of intel, and together, they paint a complete picture.

MTFA simply means looking at the same crypto asset across at least three different timeframes to validate a trade idea. This layered strategy helps you cut through the market noise and dramatically stack the odds in your favor.

Here’s how you can put it into practice:

Imagine spotting a perfect Hammer on the 4-hour chart. If it’s forming right on a major support level you identified on the daily chart, while the weekly chart is screaming "bull market," that's an A+ setup. That same Hammer appearing in the middle of nowhere, against the primary trend? It's probably a trap.

Trader's Edge: The number one rule is to never fight the high-timeframe trend. A beautiful bullish pattern on a 1-hour chart is far more likely to get crushed if the weekly chart is in a heavy downtrend.

We all know crypto is volatile. That's both the opportunity and the danger. Wild price swings can print all sorts of false signals, like long, scary wicks caused by a flash crash on a low-liquidity exchange or a sudden news event.

So, how do you tell a real signal from all that noise? The answer is volume.

A textbook candlestick pattern that appears on a massive spike in trading volume is the real deal. It shows genuine conviction—thousands of traders are putting their money behind that move. Without that volume confirmation, even the most picture-perfect pattern could be nothing more than a manipulation play designed to lure you in.

To really get this down, you need to understand how to use crypto volume analysis to confirm your trades and avoid those costly mistakes.

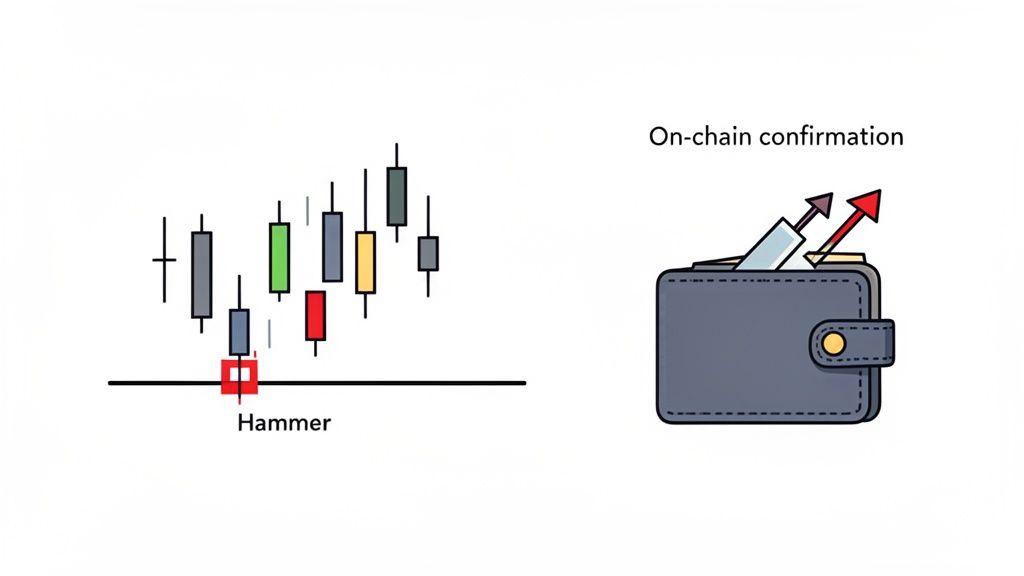

Getting good at technical analysis with candlestick charts is a huge step forward for any crypto trader. But if you want a real edge, you have to look past the chart and see what’s actually happening on the blockchain. This is where the magic happens—when you combine price action with on-chain data, you stop guessing and start building a data-driven strategy.

Think about it like this: you spot a perfect Hammer pattern forming on a token's daily chart, right at a critical support level. Classic bullish reversal signal. Now, what if you got an alert at that exact moment showing that several top-performing wallets—the "smart money"—just started buying up that same token in huge amounts?

That powerful combination is what traders call confluence. It’s the moment when two completely independent forms of analysis point to the exact same outcome. That’s not just a signal; that’s a high-conviction reason to act.

Price charts tell you what is happening. On-chain data pulls back the curtain to show you who is making it happen and why. Is that a retail panic sell, or are seasoned whales simply buying the dip? That context is everything.

With on-chain analysis tools, you can follow the money. You can see how funds are flowing, watch what influential wallets are doing, and spot accumulation trends before the price fully reacts. Layering this intelligence over your candlestick analysis lets you filter out the noise and focus only on the strongest setups. For a deeper dive, check out our guide on crypto on-chain analysis.

The Ultimate Edge: Spotting a bullish candlestick pattern is a great start. But seeing that same pattern confirmed by a $2 million inflow from a historically profitable wallet? That’s the kind of signal that can completely change your trading game.

For instance, platforms that track smart money give you a direct window into their recent moves and overall performance.

A dashboard like this one from Wallet Finder.ai shows you the top-performing wallets, their profits, and win rates, so you can see exactly what successful traders are doing in real time.

You don’t need to be a data scientist to integrate on-chain intelligence. It’s a straightforward process that just adds a layer of proof to the patterns you’re already spotting.

Here’s a simple, step-by-step approach:

Once you get the hang of the basics, you'll inevitably run into new questions when applying candlestick analysis to the wild, fast-moving crypto markets. This section tackles the most common queries traders have, giving you clear, straightforward answers to help you trade with more confidence.

We'll dig into how reliable patterns really are in such a volatile space, which timeframes make the most sense, and why trying to trade with candlesticks alone is a recipe for disaster. Think of this as the practical knowledge you need to handle the common hurdles.

Candlestick patterns are basically pictures of market psychology. Since crypto is driven heavily by emotion, these patterns are incredibly relevant. But—and this is a big but—their reliability isn't a given. It all comes down to context.

A pattern's predictive power shoots up when it forms under the right conditions. For instance, a bullish pattern at a major support level that has held up in the past is far more meaningful than one appearing in the middle of nowhere. It tells you a real battle between buyers and sellers is happening at a critical point.

Confirmation is everything. The most powerful signals are the ones that come with a big spike in trading volume. That volume is your proof that there's real conviction and money behind the move.

Pro Tip: Never, ever trade a candlestick pattern in a vacuum. Real reliability comes from confluence—when a candle pattern lines up with other signals. Maybe a bullish engulfing pattern appears right as the RSI hits "oversold," or on-chain data shows smart money wallets are suddenly buying. This layering approach cuts through the noise and gives you a much stronger reason to pull the trigger.

There’s no magic "best" timeframe for looking at a crypto candlestick chart. The right one is 100% tied to your personal trading style and goals. Each timeframe tells a completely different part of the market’s story.

The smartest approach is to blend them using Multiple Time Frame Analysis (MTFA). Start with a high timeframe (like the weekly) to get the big-picture trend. Then, drop down to a medium timeframe (daily) to mark out key support and resistance zones. Finally, use a lower timeframe (like the 4-hour) to pinpoint your exact entry. It gives you the full story, from the plot down to the fine print.

While you technically could, relying only on candlestick patterns is like trying to navigate a new city with just one street sign—you're missing almost all of the context. It’s an unnecessarily risky strategy that ignores tons of other critical market data.

For a much safer and more reliable strategy, think of candlestick analysis as just one tool in your toolbox. The best traders always look for confirmation from several different, unrelated sources before they put any real capital on the line.

Here’s a simple checklist to run through:

When you have a clean candlestick pattern, confirming technicals, high volume, and smart money piling in? That's when your odds of a successful trade go way, way up.

Stop guessing and start trading with data-backed conviction. Wallet Finder.ai gives you the on-chain intelligence to confirm your candlestick signals by tracking what the most profitable traders are doing in real time. Discover smart money moves and elevate your strategy with a free 7-day trial.